QuantPartners: Morning Note 10/14/22 - $SPX

U.K. Finance Minister Sacked & News Conference With PM Truss at 9:00 A.M. EDT. Stocks Higher With Wide Overnight Range.

Overnight Summary: The S&P 500 closed Thursday at 3669.91 (higher by 2.60%) from Wednesday at 3577.03 (lower by -0.33%). The overnight high of 3715.50 was hit at 11:50 p.m. EDT. The low was hit at 3660.25 at 5:50 a.m. EDT, a range of 55 points high to low which is below the recent range of 45. At 7:10 a.m. EDT, the S&P 500 was up +13.75 points which is +0.37%.

Breaking News: Kroger (KR) to buy Albertsons (ACI) for $34.10. Was rumored yesterday. Will face Antitrust issues and the rise in interest rates could impact the deal. (CNBC)

Earnings Out After The Close:

Beats: WAFD +0.16.

Capital Raises:

IPOs Priced or News:

RGG: Withdraws IPO.

New SPACs launched/News:

StoneBridge Acquisition Corporation (APAC) extends the time available to the Company to consummate its initial business combination from October 20, 2022 to January 20, 2023.

OceanTech Acquisitions I Corp. (OTEC) Announces Termination of Merger Agreement with Captura Biopharma, Inc.

Pine Island Acquisition Corp. (PIPP) Announces It Will Redeem Its Public Shares and Will Not Consummate an Initial Business Combination.

Secondaries Priced:

NVOS: Announces Pricing of $2.0 Million Public Offering.

Common Stock filings/Notes:

SDIG: Filed Form S-1.. 10,000,000 Shares.

SMIT: Filed Form S-1 Common Stock Offering.

Direct Offering:

VJET: Completes $ 4.4 Million Registered Direct Offering.

Mixed Shelf Offerings:

GTBP: Filed Form S-3.. $150 Million Mixed Shelf.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close:

After Hours:

Trading Up: RETA +6%, RWT +6%, WLK +6%.

Trading Down: TVTX -6%.

News Since The Close:

JPMorgan CEO warns higher inflation could push U.S. rates above 4.5%. (Reuters)

Alcoa (AA) lobbying White House to block U.S. imports of Russian aluminum. (YahooFinance)

Kroger (KR) and Albertsons (ACI) in Deal Talks to Create Supermarket Powerhouse. (WSJ)

United Airlines (UAL) nears order for over 100 BA widebody jets - (Bloomberg)

Elon Musk under federal investigation for conduct related to Twitter (TWTR) deal, company says - (Bloomberg)

Bank of American:

BofA's Bull & Bear Indicator Remains at "Max Bearish" for 4th Consecutive Week.

BofA Strategists See More Pain In Store Before Stocks Reach Low.

Nutanix (NTNX) exploring sale after receiving takeover interest. (WSJ)

Oceaneering Intl's (OII) Subsea Robotics segment won multiple contracts during Q3, totaling an anticipated $300 million.

Exchange/Listing/Company Reorg and Personnel News:

Westlake (WLK) Set to Join S&P MidCap 400; MillerKnoll (MLKN) to Join S&P SmallCap 600.

Aspiration (IPVF) Announces Olivia Albrecht as CEO.

Berkshire Hills Bancorp's (BHLB) CFO resigned to pursue other career interest.

Beyond Meat (BYND) CFO Philip Hardin stepping down, names Lubi Kutua CFO

Broadmark Realty (BRMK) CFO David Schneider to resign from his position.

Jim Umpleby to Continue as Caterpillar (CAT) Chairman & CEO.

Hudbay Minerals (HBM) appoints Eugene Lei as CFO.

Invivyd (IVVD) Appoints Fred Driscoll as Interim Chief Financial Officer and Announces Resource Reallocation to Maximize Integrated Discovery Platform.

Coca-Cola FEMSA (KOF) CEO to retire at year end.

Laboratory Corp (LH) names Google Cloud exec Kirsten Kliphouse to its board.

Rubicon Technologies (RBT) Announces Leadership Transition.

Smart Power Corp. (CREG) Regains Compliance with NASDAQ.

SciPlay (SCPL) announces appointment of Jim Bombassei as EVP, CFO and Secretary.

Buyback Announcements or News: None of note.

Stock Splits or News:

GEHI trading r/s price.

Dividends Announcements or News:

Agree Realty Declares (ADC) Increased Monthly Common Dividend.

Albertsons Companies (ACI) Announces Special Dividend in Connection with Signing of Merger Agreement.

Avient (AVNT) increases its quarterly dividend by 4.2% to $0.2475 per share.

Mcdonald's (MCD) Raises Quarterly Cash Dividend By 10% to $1.52 per share.

Northwest Natural (NWN) increases its quarterly dividend 0.5% to $0.485 per share.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 -6, Dow Jones +9, NASDAQ -50, and Russell 2000 -1. (as of 8:07 a.m. EDT). Europe higher and Asia higher. VIX Futures are at 31.59 from 31.57 yesterday morning and the VIX closed at 33.54 from 33.63 yesterday. Gold and Silver lower with Copper higher. WTI Crude Oil and Brent Oil Futures lower with Natural Gas lower. $ is higher vs Euro, higher vs Pound and higher vs Yen. US 10-year Treasury sees yields at 3.887% from 3.89% yesterday. Bitcoin is at $19,725.00 from $18179.50 yesterday morning and is higher by 1.89% this morning.

Sector Action:

Daily Positive Sectors: All - but on top is Energy, Financials, Technology, Utilities, Basic Materials, Industrials of note.

High inflation....higher markets. Got it? OK. That was some pretty wide swings from bottom to top as stocks revered early gap down prints to finish firmly in the green. As a first, the down was down 500 points and up 800 points in a single trading day. Party on Garth! You have to squint to see the value lines below. They got compressed due to the wide trading range established through the day.

Click here for a video explanation of Erlanger Value Lines.

Upcoming Earnings Of Note: (sorted by market cap, highest to lowest with most visible names)

Friday After the Close: None of note.

Monday Before the Open: BAC, SCHW, XRAY of note.

Earnings of Note This Morning:

Beats: UNH +0.35, JPM +0.27, WFC +0.21, PNC 0.09,, PNC +0.09, C +0.05, FRC +0.03.

Flat: UBS.

Misses: MS (0.04).

Guidance:

Positive Guidance: INMD of note.

Negative Guidance: BYND, PNC of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: WLK +5%, BBIO +5%, RWT +4%.

Gap Down: BYND -7%, TVTX -5%.

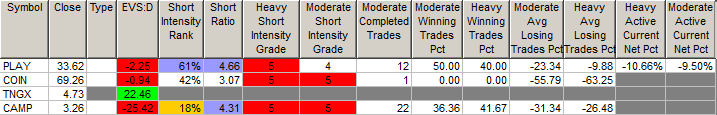

Insider Action: No stock sees Insider buying with dumb short selling. No stock sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Stocks Making The Biggest Moves: (CNBC)

5 things to know before the stock market opens Friday. (CNBC)

Five Things You Need to Know to Start Your Day. (Bloomberg)

Bloomberg Lead Story: U.K. Finance Minister Kwarteng's Job in doubt as Truss Prepares Tax U-Turn. (Bloomberg)

Bloomberg Most Read Story: Kroger (KR) wants to merge with Albertson's (ACI) to create Supermarket Giant. (Bloomberg)

J.P. Morgan (JPM) tops estimates. (CNBC)

Wells Fargo (WFC) profits fall as loan loss reserves rise, shares higher. (CNBC)

Morgan Stanley (MS) misses on top and bottom lines. (Reuters)

United Airlines (UAL) to purchase 100 wide body jets. (Bloomberg)

Beyond Meat (BYND) COO Doug Ramsey arrested for biting a man's nose proving that man cannot live by plant alone. (CNBC)

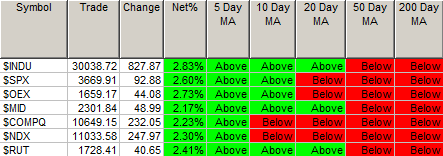

Moving Average Update:

Boom goes the dynamite. Score jumps to 42% just like that.

Geopolitical:

President’s Public Schedule:

The President departs Los Angeles, California en route Santa Monica Airport Landing Zone, 4:10 p.m. EDT

The President departs Santa Monica Airport Landing Zone, 4:30 p.m. EDT

The President arrives in Orange County, California, 5:00 p.m. EDT

The President delivers remarks on lowering costs for American families, 6:10 p.m. EDT

The President departs Orange County, California, 7:20 p.m. EDT

The President arrives in Portland, Oregon, 9:30 p.m. EDT

The President participates in a grassroots volunteer event with the Oregon Democrats, 10:10 p.m. EDT

Economic:

September Retail Sales is due out at 8:30 a.m. EDT and expected to come in at 0.2% from 0.3%.

Import and Export Prices 8:30 a.m. EDT

The University of Michigan Consumer Sentiment (Prelim) - is due out at 10:00 a.m. EDT and estimates are for 58.6 from 58.60.

Business Inventories 10:00 a.m. EDT

Consumer Sentiment 10:00 a.m. EDT

Baker Hughes Rig Count 1:00 p.m. EDT

Federal Reserve / Treasury Speakers:

Federal Reserve Kansas City President Esther George Speaks 10:00 a.m. EDT

Federal Research Board of Governors Lisa D. Cook 10:30 a.m. EDT (new member as of 05/23/22)

M&A Activity:

Enliven Therapeutics and Imara (IMRA) Announce Merger Agreement.

Lincoln Electric (LECO) Signs Definitive Agreement to Acquire Fori Automation, Inc.

Meeting & Conferences of Note:

Sellside Conferences:

Deutsche Bank Detroit Auto Show Conference 2022

Previously posted and ongoing conferences:

Nantucket Conference

SVB Digital Health Innovators & Disrupters

Company Meetings: AGFY

Investor/Analyst Day/Calls: BIOC, BFRI, OCUP

Company Event:

Biocept, Inc. (BIOC) Neuro-oncology Webinar featuring CNSide.

Industry Meetings:

CSN Cyprus ICT Shipping Conference 2022

European College of Neuropsychopharmacology (ECNP) 35th Congress 2022 (10/15/22-10/18/22)

World Lottery Summit 2022 (10/16/22-10/20/22)

CHEST Annual Meeting 2022 (10/16/22-10/19/22)

AAPS PharmSci 360 Virtual 2022 (10/16/22-10/19/22)

Previously posted and ongoing conferences:

Joint School of Nanoscience and Nanoengineering (JSNN) NanoImpacts 2022: Semiconductor Synthetic Biology and Beyond (10/13/22-10/15/22)

National Academy of Sports Medicine (NASM) Optima Conference 2022 (10/13/22-10/15/22)

The Battery Safety Summit 2022 (10/12/22-10/14/22)

North American Spine Society (NASS) 2022 (10/12/22-10/15/22)

51st Child Neurology Society (CNS) Annual Meeting (10/12/22-10/15/22)

Immuno-Oncology Summit (10/12/22-10/14/22)

World Vaccine Congress Europe 2022 (10/11/22-10/14/22)

Top Tier Sell-side Upgrades & Downgrades: