QuantPartners: Morning Note - 06/26/23:

The Weekend After Russian Insurrection, How Will Stocks Trade?

Overnight Summary: The S&P 500 closed Friday at 4348.33 lower by -0.77%. Thursday at 4381.89 higher by 0.37%. Overnight ranges saw the high hit at 4402.25z at 11:20 p.m. EDT while the low was high at 4375.75 at 4:55 a.m. EDT. The range overnight was 27 points. The 10-day average of the overnight range is at 20.40 from 19.20. This morning's range is high for a second day in a row. The average for May was 21.63. Currently, the S&P 500 is lower by -6.50 points and is lower by -0.15% at 7:00 a.m. EDT.

Earnings Out After The Close: None of note

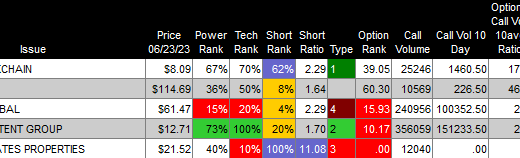

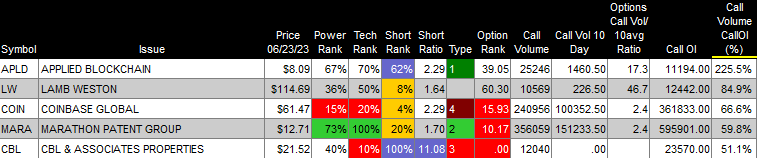

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Capital Raises:

IPOs Priced or News:

Beauty shopping platform Oddity Tech (ODD) files for IPO. (MarketWatch)

Sagimet Biosciences (SGMT) gives going public a second chance under new CEO. (MarketWatch)

Common Stock filings/Notes:

CBAY: Filed Form S-3ASR.. 4,642,857 Shares Common Stock.

FEMY: Filed Form S-1.. 3,388,525 Shares Common Stock.

FOXO: Filed Form S-1.. Up to 19,312,823 Shares of Class A Common Stock.

INPX: Filed Form S-1.. 150,000,000 Shares of Common Stock Issuable Upon Exercise of Warrants.

SQL: Filed Form S-1.. $75,000,000 Common Stock.

TTNP: Filed Form S-1.. Common Stock.

VNRX: Announces Exercise of Over-Allotment Option by Underwriters.

Selling Shareholders of note:

NN: Filed Form S-3.. 25,925,927 Shares of Common Stock by selling shareholders issuable upon exercise of Warrants 25,925,927 Warrants to Purchase Common Stock.

PRST: Filed Form S-1.. 7,260,500 Shares of Common Stock by the Selling Security holders.

Private Placement of Public Entity (PIPE):

HGTY: Raises $105 Million in Capital from Strategic Investors.

RCI: Commences Exchange Offer for Notes Issued in Connection with Prior Private Offering.

Mixed Shelf Offerings:

ALTO: Filed Form S-3.. $100 Million Mixed Shelf.

AGEN: Filed Form S-3ASR.. Mixed Shelf.

AMTB: Filed Form S-3.. $300 Million Mixed Shelf.

BRDS: Filed Form S-3.. $25 Million Mixed Shelf.

CMCO: Filed Form S-3ASR.. Mixed Shelf.

DMRC: Filed Form S-3.. $100 Million Mixed Shelf.

DTSS: Filed Form S-3.. $90,583,574 Mixed Shelf.

ELVN: Filed Form S-3.. $400 Million Mixed Shelf.

OMQS: Filed Form S-3.. $50 Million Mixed Shelf.

Debt/Credit Filing and Notes:

AWK: Announces Proposed Private Placement of $900 Million of Exchangeable Senior Notes.

HUT: Announces US$50 Million Credit Facility.

ORTX: Announces Second Closing of Strategic Financing, Resulting in $34 Million of Additional Capital.

TDW: Pricing of $250 Million Senior Unsecured Bond Issue.

Convertible Offering & Notes Filed:

INVO: Filed Form S-1.. Up to 6,241,493 Shares of Restricted Common Stock and Common Stock Issuable Upon Exercise of Certain Convertible Debentures and Common Stock Purchase Warrants.

PACB: Announces a Private Convertible Exchange Transaction of $441 Million Principal Amount of 1.375% Convertible Senior Notes due 2030.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close and Over the Week:

Weekly Wrap Up: Best and Worst performing large cap stocks:

Trading Up: CASA 22.7%, LPSN 20.4%, QUOT 15.7%, CSTE 12.5%, SIEN 12.3%, GRPN 12.2%, BIG 12.1%, EBS 10.5%, ABEO 10.2%, CAR 9.7%, LOVE 9.7%, EGRX 9.6%, ARCO 9.4%, PDCO 9.4%, INGN 9.3%, MTLS 9.3%, CMTL 9.0%.

Trading Down: QURE -40.8%, VAPO -24.6%, TSE -19.8%, CURO -19.5%, FNKO -18.3%, CGC -17.9%, TPIC -17.9%, FIXX -17.4%, NVAX -16.7%, INSG -16.5%, AXDX -16.5%, CYRX -16.3%, IRBT -15.0%, COHR -14.9%, GDS -14.8%, CVNA -14.8%.

News Items After the Close:

Amazon (AMZN) delays virtual care service’s unveiling after senators raised privacy concerns. (Politico)

IBM nears deal to buy software company Apptio for $5 billion. (MarketWatch)

Mercury Systems (MRCY) stock tanks 10% as company’s sale falls through, interim CEO named. (MarketWatch)

Goldman Sachs (GS) Begins Cutting About 125 Managing Directors.

JPM Cuts 40 Dealmakers in North America Amid Global Cull.

Elon Musk’s SpaceX eyeing $150 billion valuation. (MarketWatch)

Huntington Ingalls (HII) awarded a $274 million incentive and $119 million modification to previously awarded US Navy contracts.

TotalEnergies SE (TTE) and Aramco award contracts for $11 billion Amiral Project.

News Items Over the Weekend:

The Score - Stocks that Defined the Week: RIVN, BABA, FDX, AMZN, DRI, OSTK (WSJ)

This week in Bidenomics: The campaign pitch begins. (YahooFinance)

What’s next for markets after aborted Wagner mutiny leaves Russia’s Putin weakened. (MarketWatch)

Barron's:

Positive View: SAM, DO , NE, SDRL, RIG, VAL, CDRE, NSC, UNP, CNR, CP, CSX, URI, DE, ETN, PWR, JCI of note.

Cautious View: None of note.

Mixed View: None of note.

Erlanger Type 1 Short Squeezes and Type 4 Long Squeezes reporting earnings this week:

Exchange/Listing/Company Reorg and Personnel News:

Final Russell Reconstitution: Click here.

Aehr Test Systems (AEHR) Joins Russell 3000® Index.

BlackSky Technology (BKSY) Added to Russell 3000® Index.

Dragonfly Energy (DFLI) Joins the Russell 2000® Index.

ICON plc (ICLR) Set to Join Russell 3000® Index.

J.Jill, Inc. (JILL) Added to the Russell 3000® Index.

Li-ion Power Storage Innovator (XPON), Expion360, Joins Russell Microcap(R) Index.

LSI Industries (LYTS) to Join the Russell 3000® Index.

Mayville Engineering Company (MEC) to Join Russell 3000® Index.

Ranger Energy Services (RNGR) to Join the Russell 3000® Index.

Reviva Pharmaceuticals (RVPH) to be Added to Russell Microcap® Index.

Rockwell Medical (RMTI) Added to Russell Microcap Index.

Semler Scientific (SMLR) to Join the Russell 2000® and 3000® Indexes.

Super Group (SGHC) Joins the Russell 2000® Index.

XOMA Added to the Russell 2000® and Russell 3000® Indexes.

Heron Therapeutics (HRTX) Announces Appointment of Ira Duarte as Chief Financial Officer.

iMedia Brands (IMBI) Announces Receipt of Second Nasdaq Non Compliance Notice.

Mercury (MRCY) CEO Mark Aslett to resign. (See News After the Close)

Mirati Therapeutics (MRTX) Appoints Industry Veteran Carol Gallagher, Pharm.D. as New Independent Director.

NaaS Technology Inc. (NAAS) Announces Board Change.

Papa John's (PZZA) appoints Ravi Thanawala As Chief Financial Officer.

Solarwinds (SWI) Current & Former Executives Got SEC Wells Notices.

Sotera Health (SHC) Announces Jon Lyons as New Senior Vice President and Chief Financial Officer.

Buyback Announcements or News:

CNH Industrial (CNHI) Completion of fourth $50 million tranche of $300 million Buyback Program.

Genesco (GCO) Announces $50 Million Increase to Its Share Repurchase Authorization.

Stock Splits or News:

SKLZ trading r/s price.

Dividends Announcements or News: None of note.

What’s Happening This Morning: Futures value reflects the change with fair value.

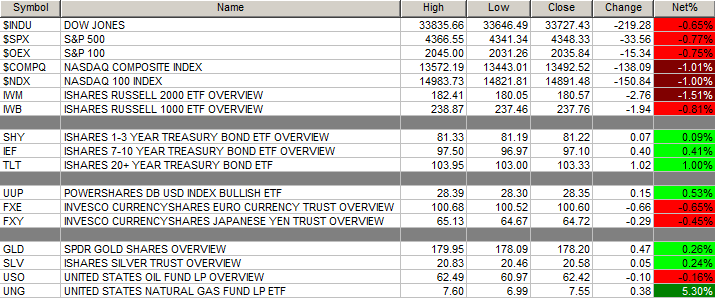

S&P 500 -2, Dow Jones -1, NASDAQ -17, and Russell 2000 -4. (as of 7:56 a.m. EDT). Asia is lower ex the Kospi and Europe is lower ex the CAC. VIX Futures are at 16.10 from 15.97 Friday. Gold, Silver and Copper higher this morning. WTI Crude Oil and Brent Crude Oil higher with Natural Gas higher as well yesterday. US 10-year Treasury sees yields at 3.686% from 3.737% Friday. The U.S. Dollar is lower versus the Euro, higher versus the Pound and lower against the Yen. Bitcoin is at $30,316 from $30,100 yesterday, lower by -0.26%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: None of note.

Daily Negative Sectors: Utilities, Consumer Cyclical, Real Estate, Energy, Technology, Basic Materials of note.

One Month Winners: Consumer Cyclical, Technology, Industrials of note.

Three Month Winners: Technology, Consumer Cyclical, Communication Services of note.

Six Month Winners: Technology, Communication Services, Consumer Cyclical of note.

Twelve Month Winners: Technology, Industrials, Consumer Cyclical of note.

Year to Date Winners: Technology, Communication Services, Consumer Cyclical of note.

U.S. stocks fell Friday to end the week in the red, snapping winning streaks for the major indexes. The tech-heavy Nasdaq Composite lost 1% and the S&P 500 fell 0.8%. The Dow Jones Industrial Average dropped 219 points, or 0.6%. All three indexes posted losses for the week, ending eight straight weeks of gains for the Nasdaq and a five-week streak of gains for the S&P 500. (WSJ - edited by QPI)

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Monday After the Close: None of note.

Tuesday Before the Open:

Earnings of Note This Morning:

Still to Report: CCL of note.

Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: BMEA +28%, LCID +8%, MLTX +8%, ETNB +7%, IPHA +6%, LXRX +5%, LL +4%, ESPR +4% of note.

Gap Down: MRCY -9%, SUPN -5% of note.

Insider Action: ENV, VST, AREN sees Insider buying with dumb short selling. SOL sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Stocks Making The Biggest Moves Premarket: TSLA, MRNA, GOOGL, PACW, LCID (CNBC)

5 things to know before the stock market opens. (CNBC)

Five Things You Need to Know to Start Your Day. (Bloomberg)

Bloomberg Lead Story: Putin Faces Historic Threat to Absolute Grip on Power in Russia. (Bloomberg)

Bloomberg Most Shared Story: Goldman Sachs is cutting about 125 Managing Directors Globally. (Bloomberg)

Bonds Rally as economic threats hits risk appetite: Market Wrap. (Bloomberg)

OPEC+ says that oil demand to rise to 110 million barrels a day by 2045, an increase of 23%. IEA disagrees. (CNBC)

China's economic gloom worsens with weak consumer spending data. (Bloomberg)

Russian Mercenary Chief Prigozhin is a "dead man walking", Eurasia Group's Ian Bremmer says. (CNBC)

FibroGen (FGEN) ends late stage trial of idiopathic pulmonary fibrosis, cuts costs to extend cash runway to 2026. (MarketWatch)

Pfizer (PFE) to advance Danuglipron as treatment for obesity and diabetes towards late stage trial and end trial of Lotiglipron. (MarketWatch)

Shortage of Cancer drugs is hurting outcome for Cancer patients in U.S. (NYT)

Next iteration of Ozempic and Wegovy, made by Novo-Nordisk (NVO) will be in pill form over just an injectable. (NYT)

Moving Average Update:

Score settles the end of the week at 54%.

Geopolitical:

President’s Public Schedule:

The President and The Vice President kick off the next phase of Administration’s Investing in America tour with a significant high-speed internet infrastructure announcement here at the White House; The Secretary of Commerce participates, 11:45 a.m. EDT

The President and The Vice President have lunch, 12:30 p.m. EDT

The President receives the Presidential Daily Briefing, 2:00 p.m. EDT

Press Briefing by Press Secretary Karine Jean-Pierre, 2:00 p.m. EDT

Economic:

Dallas Fed Mfg Activity 10:30 a.m. EDT

Federal Reserve / Treasury Speakers: None of note.

M&A Activity:

LL Flooring (LL) Board of Directors Unanimously Rejects Unsolicited Proposal from Cabinets To Go, Subsidiary of F9 Brands, Inc.

Meeting & Conferences of Note:

Sellside Conferences:

Bank of America AgTech Panel 2023

HC Wainwright 4th Annual Neuropsychiatry Conference 2023

UBS Healthcare Services Conference 2023 (06/26/23-06/28/23)

Raymond James Insurance Conference

Wells Fargo Private MedTech Symposium

Previously posted and ongoing conferences:

TD Cowen 2nd Annual Tools/Dx Revolution 2023. (06/25/23-06/28/23)

Top Shareholder Meetings: ATHM, BIDU, BZ

Investor/Analyst Day/Calls: IOVA, LMNR, RXO

Company Event:

Snowflake (SNOW) Summit 2023 (06/26/23-06/29/23)

Industry Meetings:

Association for Professionals in Infection Control and Epidemiology, Inc. (APIC) Annual Conference and Exposition 2023 (06/26/23-06/28/23)

Hospitality Industry Technology Exposition & Conference (HITEC) 2023 (06/26/23-06/29/23)

Infinity 365 Conference 2023 (06/26/23-06/28/23)

The Global Beauty and Fashion Tech Forum 2023

Collision Conference

Previously posted and ongoing conferences:

ADA (American Diabetes Association) 83rd Scientific Sessions 2023 (06/23/23-06/26/23)

European Society of Hypertension Annual Meeting 2023 (06/23/23-06/26/23)

Society for Nuclear Medicine & Molecular Imaging SNMMI Annual Meeting 2023 (06/24/23-06/27/23)

31st Congress of the International Society on Thrombosis and Haemostasis (ISTH) 2023 (06/24/23-06/28/23)

Drug Information Association (DIA) Global Annual Meeting 2023 (06/25/23-06/29/23)

HFMA Annual Conference 2023 (06/25/23-06/28/23)

American Society for Metabolic and Bariatric Surgery (ASMBS) Annual Meeting 2023 (06/25/23-06/29/23)

Top Tier Sell-side Upgrades & Downgrades: