QuantPartners: Morning Note - 06/22/23 - BOE Raises Rates by 50bps

The Bank of England Raises Rates by 50 Basis Points. Stocks Lower

Overnight Summary: The S&P 500 closed Wednesday at 4365.69 lower by -0.52% from Tuesday at 4388.71 lower by -0.47%. Overnight ranges saw the high hit at 4413.50 around 8:20 p.m. EDT while the low was high at 4393.75 at 3:20 a.m. EDT. The range overnight was 20 points. The 10-day average of the overnight range is at 17.40 from 16.80. The average for May was 21.63. Currently, the S&P 500 is lower by -10.25 points and is lower by -0.22% at 7:00 a.m. EDT.

Surprise Headline This Morning: The Bank of England is out with its latest rate announcement prior to the opening of the stock market in the U.S and raised by 50 basis points. (CNBC)

Earnings Out After The Wednesday Close:

Beats: KBH +0.61, SCS +0.08 of note

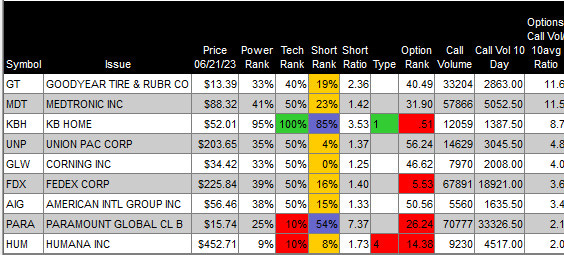

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Capital Raises:

Secondaries Priced:

ALVR prices 20 million shares at $3.75 a share.

GPOR prices 1.3 million shares at $95 a share.

Notes Priced of note:

WKC priced $300 million of the aggregate principal amount of 3.25% Convertible Senior Notes due 2028.

Common Stock filings/Notes:

ALVR files a $75 million public offering.

IGMS files for a $100 million offering and a concurrent private placement.

NXPL files S-3 for 3,428,571 common shares.

Selling Shareholders of note:

GPOR files for 1,350,000 shares of common stock offering by selling shareholders.

DM files for 444,793 shares of common stock by selling shareholders.

Mixed Shelf Offerings:

MFIN files a $100 million mixed shelf offering.

KRTX files a mixed shelf offering.

Convertible Offering & Notes Filed: CRNC files a $190 million convertible notes offering. Priced this morning at 1.50%.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close:

After Hours:

Trading Up: AAOI +13.8%, KURA +3% of note.

Trading Down: CDMO -21%, ALVR -19.10%, GPOR -9.3% of note.

News After The Close:

Apple (AAPL) releases developer software tools for Apple Vision Pro. (Press Release)

KB Home (KBH) beats and raises guidance. (MarketWatch)

Steelcase (SCS) beats on earnings, revenues and raises guidance. (MarketWatch)

Applied Optoelectronics (AAOI) enters into a supply agreement with Microsoft for design and assembly services.

Lockheed Martin (LMT) to continue working with U.S. on maintenance and development of F-35 as well as engine upgrade.

Raytheon Technologies (RTX) awarded $294 million U.S. Navy contract modification.

Mosaic (MOS) sees potash sales near high end and phosphate sales near the low end.

Intel (INTC) to restructure the manufacturing business. (Reuters)

Elliott Associates seeks to oust NRG Energy (NRG) CEO. (WSJ)

Federal Reserve Atlanta President Raphael Bostic wants to hold rates steady for the rest of the year. (Yahoo Finance)

Exchange/Listing/Company Reorg and Personnel News:

Turtle Beach (HEAR) names Cris Kerin as interim CEO.

Integra (IART) names Lea Daniels Knight as EVO and CFO as of 6/28.

W&T Offshore (WTI) names Sameer Parasnis to EVP and CFO effective 7/3.

Buyback Announcements or News:

Insider Sales of note after the close NVDA CRNX.

Logitech (LOGI) approves new three-year buyback of up to $1.0 billion.

Stock Splits or News: None of note.

Dividends Announcements or News: None of note.

S&P 500 -8.94, Dow Jones -57, NASDAQ -44.95, and Russell 2000 -2.71. (as of 7:55 a.m. EDT). Asia lower ex the Kospi and Europe is lower. VIX Futures are at 16.40 from 16.45 yesterday. Gold and Silver lower with Copper higher yesterday. WTI Crude Oil and Brent Crude Oil lower with Natural Gas higher yesterday. US 10-year Treasury sees yields at 3.76% from 3.75% yesterday. The U.S. Dollar is lower versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $30,22o from $28,821 yesterday, higher by 0.49%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Energy, Utilities and Industrials of note.

Daily Negative Sectors: Basic Materials, Energy, Real Estate and Utilities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close: SWBI of note.

Friday Before the Open: APOG KMX of note.

Earnings of Note This Morning:

Beats: GMS +0.21 FDS +0.18 CMC +0.18 ACN +0.18 DRI +0.04 of note.

Guidance:

Positive Guidance: SCS KBH of note.

Negative Guidance: CDMO of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: AAOI +10.2%, MRNS +4.3%, KURA +4%, OSG +3.8%, XEL +3%, COLD +2.9%, MDGL +2.9%, EPAC +2.8%, GVA +2.7%, GMS +2.5% of note.

Gap Down: ALVR -23.5%, CDMO -17.4%, GPOR -10.1%, ASTL -9%, IGMS -4%, CRNC -3.7%, ERAS -2.1% of note.

Insider Action: No names see Insider buying with dumb short selling. FREE is heavily shorted with no history. RMBL sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Stocks making the biggest moves before the bell: TSLA DRI BUD AA KBH SPR (CNBC)

Five Things You Need to Know to Start Your Day. (Bloomberg)

Five Things To Know Before the Stock Market Opens Today. (CNBC)

Bloomberg Lead Story: Powell Defies DC Critics and Makes Case For Why Rates Must Rise. (Bloomberg)

Bloomberg Most Shared Story: Short Bets on U.S. Stocks Hit $1 Trillion, Most Since April 2022. (Bloomberg)

Stocks Slump As Hawkish Central Banks Sap Spirits: Market Wrap. (Bloomberg)

The Bank of England is out with its latest rate announcement prior to the opening of the stock market in the U.S and raised by 50 basis points. (CNBC)

The Swiss National Bank hiked by 25 basis points this morning. (CNBC)

Turkey Central Bank hikes rates to 15% to fight 40% inflation. (CNBC)

Overstock (OSTK) to buy intellectual property and digital assets of Bed, Bath & Beyond. (CNBC)

Micron (MU) to build a new assembly plant in Gujarat, India.

Applied Materials (AMAT) to build a collaborative engineering center in Bangalore, India.

Ocado, British online grocer, jumps 40% on speculation that Amazon (AMZN) will purchase the company. (CNBC)

Moving Average Update:

Wednesday saw three indexes break their 10-day moving average from two. Now 77% from 80% of the moving averages are positive.

Geopolitical:

President’s Public Schedule:

The president receives the Daily Briefing at 9:00 a.m. EDT.

President Biden, First Lady, Vice President and Second Gentleman greet Indian Prime Minister Modi at 10:00 a.m. EDT.

President Biden and Prime Minister Modi hold bilateral talks at 10:45 a.m. EDT.

President Biden and Prime Minister Modi deliver remarks and take questions from the press at 12:45 p.m. EDT.

President Biden and The First Lady host a state dinner for Indian Prime Minister Modi at 8:45 p.m. EDT.

Economic:

May Existing Home Sales are due out at 10:00 a.m. EDT and is expected to remain at 4.28 million.

May Leading Indicators are due out at 10:00 a.m. EDT and is expected to come in at -0.8% from -0.6%.

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Weekly EIA Natural Gas Inventories are due out at 10:30 a.m. EDT.

Weekly Crude Oil Inventories are due out at 11:00 a.m. EDT.

Federal Reserve/Treasury Speakers: Federal Reserve Chairman Powell concludes two days of Humphrey Hawkins Testimony on The Hill as he appears before the Senate. Federal Reserve Governor Christopher Waller spoke at 4:00 a.m. EDT. Federal Reserve Governor Michelle Bowman speaks at 9:55 a.m. EDT. Federal Reserve Richmond President Thomas Barkin speaks at 4:30 p.m. EDT.

M&A Activity:

Talaris Therapeutics (TALS) and Tourmaline Bio to merge with shareholders of Talaris receiving $3.43 a share and new symbol TRML.

Meeting & Conferences of Note:

Sellside Conferences:

Roth MKM London Conference

Cantor Brain Week One

Capital One Spatial Biology and Proteomics

IDEAS Investor Conference

JPM Securities Mid Year MedTech Forum

JP Morgan Mexico Opportunities Conference

JP Morgan Energy, Power and Renewables Conference

Maxim Healthcare Conference

Singular Research Summer Solstice Conference

Stephens Summer Bank Bash

Top Shareholder Meetings: KR NVDA PVH

Investor/Analyst Day/Calls: AI FSLY IOT MDB NRG

Industry Meetings:

Mining Investment Event of the North

Federal Reserve Bank of Cleveland Policy Summit

NYSE Access Day Healthcare & Technology

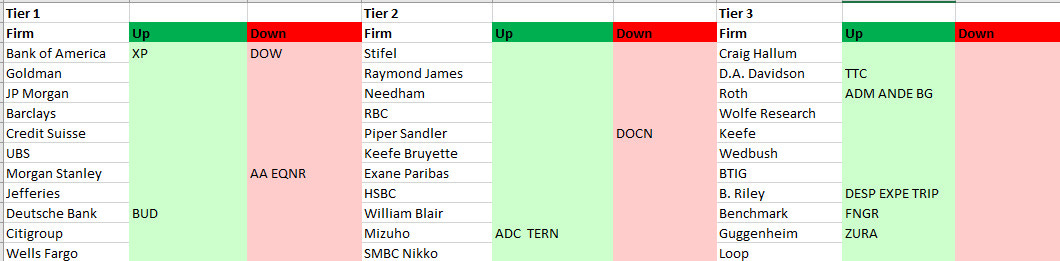

Top Tier Sell-side Upgrades & Downgrades: