QuantPartners: Morning Note - 05/02/23 $SPX

Stocks Down Slightly, Another Narrow Overnight Range. FOMC Begins Meeting Today.

Overnight Summary: The S&P 500 closed Monday at 4167.87 lower by -0.04% from Friday at 4169.48 higher by 0.83%. The overnight high of 4191.50 was hit at 3:10 a.m. EDT. The low was hit at 4175.75 at 6:10 a.m. EDT, a range of ~15 points high to low which is well below the recent range of 45. At 7:20 a.m. EDT, the current price was 4181.50 which is -0.10% and -4.25 points. The overnight session was again amazingly narrow. Two sessions in a row.

Earnings Out After The Close:

Beats: MSTR +30.41, CAR +4.37, MED +1.27, TEX +0.56, CF +0.31, MSA +0.31, AL +0.30, WWD +0.30, MGM +0.28, SBAC +0.22, HOLX +0.18, TMDX +0.17, FLS +0.14, SYK +0.13, LEG +0.13, SFM +0.13, VNOM +0.12, NXPI +0.10, AXNX +0.10, ANET +0.09, SON +0.08, FWRD +0.07, ADUS +0.06, VRNS +0.05, KMT +0.05, VRTX +0.05, FMC +0.03, SCI +0.02, ZI +0.02, CHGG +0.01, INST +0.01, LSCC +0.01, PDM +0.01, FCPT +0.01 of note.

Flat: AMKR +0.00, BRX +0.00, INVH +0.00 of note.

Misses: RE (1.23), CACC (0.62), PLOW (0.42), FANG (0.42), RMBS (0.39), CYH (0.27), RIG (0.16), CNO (0.10), VICI (0.08), SYM (0.06), JJSF (0.03), AMRC (0.03), NSA (0.03), OGS (0.02), VNO (0.02) of note.

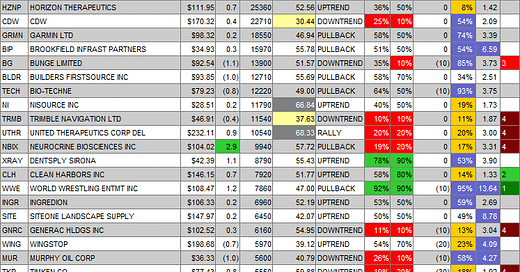

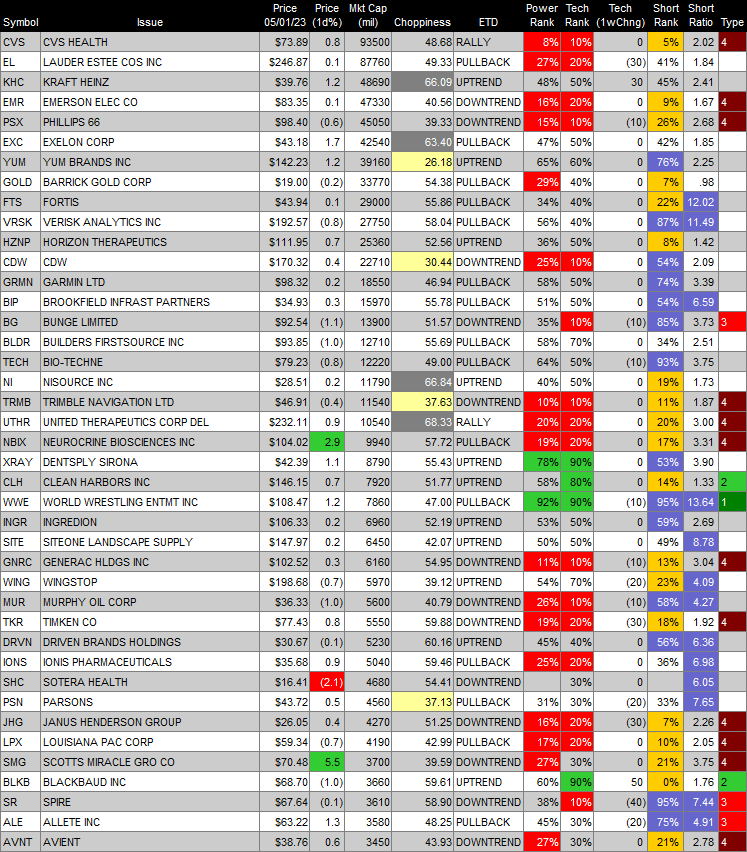

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Capital Raises:

IPOs Priced or News: None of note.

New SPACs launched/News:

GODN: Pricing of $60 Million Initial Public Offering .. 6M Units $10.

Common Stock filings/Notes:

AFL: Filed Form S-3ASR.. 52,300,000 shares of common stock

BBLG: Filed Form S-1.. Filed Form S-1.. Common Stock Offering

BLTE: Filed Form F-3.. Up to $300,000,000 of American Depositary Shares

BXRX: Closing of $4 Million Public Offering

DMS: Filed Form S-3.. 49,206,264 Shares of Class A Common Stock

HCDI: Filed Form S-1.. Common Stock Offering

RCON: Filed Form F-1.. 10,002,500 Class A Ordinary Shares underlying Warrants

SABS: Filed Form S-3.. Up to 300,000 Shares of Common Stock Issuable Upon Exercise of Warrants

Mixed Shelf Offerings:

BTTR: Filed Form S-3.. $55,000,000 Mixed Shelf.

MLTX: Filed Form S-3.. $500,000,000 Mixed Shelf.

SAVA: Filed Form S-3ASR.. Mixed Shelf.

SNDA: Filed Form S-3.. $150Million Mixed Shelf.

TMUS: Filed Form S-3ASR.. Mixed Shelf and Debt Securities.

Debt/Credit Filing and Notes:

CMS: Prices Upsized Offering of $700 Million of 3.375% Convertible Senior Notes Due 2028.

DXCM: Announces Proposed Offering of $1.0 Billion of Convertible Senior Notes.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close:

After Hours:

Trading Up: WWD +16%, BB +8%, SFM +7%, STAG +7%, SIBN +6%, FLS +6%, ZI +5%, TEX +5%, NXPI +4%, CHEF +4% of note.

Trading Down: CHGG -32%, TVTX -25%, ETWO -17%, CYH -13%, ANET -7%, MED -7%, CACC -7%, CNO -6%, AXNX -6%, SYK -5%, SGRY -4% of note.

News After The Close:

Stocks making the biggest moves after hours: MGM, ANET, SYK, FANG, NXPI, RE (CNBC)

The Air Has Come Out of the Dollar. (WSJ)

Woodward (WWD) stock jumps more than 15% on quarterly beat, raised guidance. (MarketWatch)

IBM CEO: Will Pause Hiring For Roles That AI Could Do - Could Replace 7,800 Jobs With AI.

Morgan Stanley (MS) Is Rumoured To Be Planning 3,000 Employee Cutbacks Due To A Deal Drought.

President Joe Biden called Speaker Kevin McCarthy Monday, asking him to meet about the looming debt-limit deadline. Biden is also calling other top congressional leaders. Biden is expected to convene a meeting of Big Four leaders.” The meeting date is May 9th. (@PunchbowlNews)

Treasury Secretary Janet Yellen Repeats Call For Congress To Raise Debt Limit after the close.

White House Considers Two Key Nominations at the Fed. (NewYorkTimes)

Exchange/Listing/Company Reorg and Personnel News:

ADS-TEC Energy GmbH (ADSE) to delay filing 20-F.

Soluna (SLNH) Board of Directors Unanimously Votes John Belizaire as CEO of Soluna Holdings.

Stag Industrial (STAG) To Replace Axon Enterprise In S&P Midcap 400. Axon Enterprise (AXON) will replace First Republic Bank (FRC) in the S&P 500

SunPower (SPWR) Announces Chief Operating Officer.

Buyback Announcements or News:

CVLT: Board of Directors approved an increase of the share repurchase program so that $250.0 million was available.

Stock Splits or News: None of note.

Dividends Announcements or News:

AGCO Announced $5.00 Per Share Special Variable Dividend And Raised Quarterly Dividend 21%.

Sunoco LP (SUN) increases quarterly distribution by 2% to $0.8420 per unit.

Enact Holdings (ACT) increases quarterly cash dividend 14% to $0.16 per share, up $0.02.

Northern Oil & Gas (NOG) increases quarterly dividend $0.03 to $0.37 per share.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 -, Dow Jones -, NASDAQ -, and Russell 2000 -. (as of 7:59 a.m. EDT). Asia higher ex ASX 200 and Europe lower ex the FTSE. VIX Futures are at 18.80 from 18.47 yesterday. Gold higher with Silver and Copper lower. WTI Crude Oil and Brent Crude Oil lower with Natural Gas lower. US 10-year Treasury sees yields at 3.53% from 3.458% yesterday. The U.S. Dollar is higher versus the Euro, higher versus the Pound and lower against the Yen. Bitcoin is at $28,064 from $28,531 yesterday, higher by 0.50%.

Sector Action:

Daily Positive Sectors: Healthcare, Industrials of note.

Daily Negative Sectors: Energy, Real Estate, Consumer Cyclical, Basic Materials, Financial of note.

U.S. stocks finished the first day of May lower, giving up earlier gains, as investors monitored the health of regional banks and kept the Federal Reserve’s rate decision on Wednesday in focus. The real story was the move in rates higher as the 10 year moved from 3.45% to 3.59%. The Dow Jones Industrial Average shed about 46 points, or 0.1%, ending near 34,051. The S&P 500 index was fractionally lower near 4,167, while the Nasdaq Composite Index ended off 0.1%. (WSJ - edited by QPI)

Click here for a video explanation of Erlanger Value Lines.

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before the Open:

Earnings of Note This Morning:

Beats: LNG +15.45, CQP +2.22, CMI +0.85, AGCO +0.80, IT +0.78, NPO +0.69, MDC +0.54, MPC +0.49, TREE +0.36, AER +0.31, TAP +0.28, ZBH +0.25, MAR +0.25, PFE +0.24, ABC +0.20, SUN +0.18, IDXX +0.17, STNG +0.16, GPK +0.14, CVLT +0.11, ESAB +0.11, QSR +0.11, TRTN +0.10, ETRN +0.10, HRMY +0.10, ETN +0.10, AME +0.08, MPLX +0.08, TROW +0.06, RGEN +0.05, BP +0.04, INMD +0.04, ADT +0.04, HWM +0.04, DD +0.04, BR +0.02, ZBRA +0.02, TRI +0.02, EPD +0.01, MD +0.01 of note.

Flat: DEA +0.00, PINC +0.00, SAGE +0.00 of note.

Misses: CIGI (0.55), DORM (0.38), INCY (0.37), UBER (0.23), RYTM (0.21), TRN (0.18), AQUA (0.14), LDOS (0.12), LGIH (0.11), PJT (0.11), DTM (0.09), SEE (0.03) of note.

Still to Report: ECL , EXPD , FELE , FSS , IPGP , ITW , NNN , NSIT , PEG , PIPR , PRFT , SYY of note.

Guidance:

Positive Guidance: ON, SBAC, AXNX, SFM, HOLX, WWD, SYK, ZI, TMDX, NXPI, FLS, TEX, KMT, INST, OTTR, GPK, ETN, ZBH, ABC, AME, MAR, HWM, AGCO of note.

Negative Guidance: AMKR, VRNS, CHGG, AMRC, MED, ETWO, FMC, ZBRA, PINC, INMD, TREE, CIGI of note.

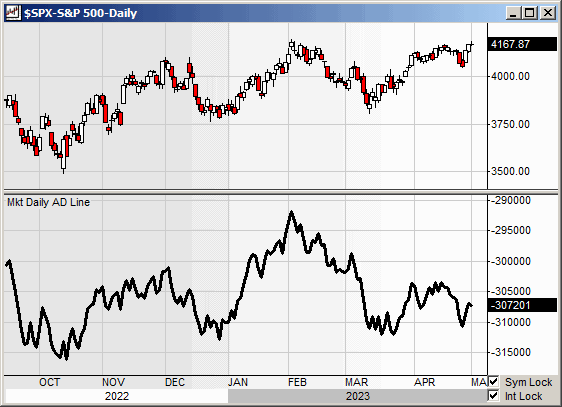

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: WWD +16%, SIBN +10%, SFM +10%, UBER +8%, HSBC +6%, FLS +5%, PDM +5%, NXPI +4%, TEX +4%, AER +4% of note.

Gap Down: CHGG -43%, ETWO -24%, TREE -20%, CYH -13%, ANET -9%, CACC -7%, CNO -6%, ZBRA -6%, BP -5%, DD -5%, SCI -4% of note.

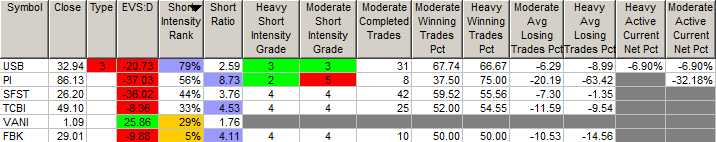

Insider Action: USB sees Insider buying with dumb short selling. No stock sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

5 things to know before the stock market opens. (CNBC)

5 Things You Need to Know to Start Your Day. (Bloomberg)

Bloomberg Lead Story: Morgan Stanley Plans 3,000 More Job Cuts As Dealmaking Slumps. (Bloomberg)

Bloomberg Second Most Shared Story: IBM to Pause Hiring For Jobs That AI Could Do. (Bloomberg)

Stocks Wobble On Amped Up Policy Tightening Bets: Market Wrap. (Bloomberg)

More than 20,000 Russians have been killed in the Russia-Ukraine War since December. (FT)

Australia hikes interest rates unexpectedly by 25 basis points, hints at more tightening. (CNBC)

Tesla raises prices slightly of Model 3 and Model Y in China and U.S. (Bloomberg)

First Republic sale fills bankers with relief and worry. (Bloomberg)

Masimo (MASI) trade secret case against Apple (AAPL) ends in a mistrial. (Reuters)

Airbus (EADSY) new longer range jet is running over a year behind schedule. (Bloomberg)

Marriott (MAR) beat estimates and raised guidance. (MarketWatch)

Moving Average Update:

Score remains at 85%.

Geopolitical:

President’s Public Schedule:

The President receives the Presidential Daily Briefing, 12:00 p.m. EDT

Press Briefing by Press Secretary Karine Jean-Pierre, 1:00 p.m. EDT

Economic:

Redbook Sales 8:55 a.m. EDT

March Factory Orders are due out at 10:00 a.m. EDT and are expected to improve to 1.4% from -0.7%.

JOLTS 10:00 a.m. EDT

API Crude Oil Data 4:30 p.m. EDT

Federal Reserve / Treasury Speakers:

FOMC Meeting Begins.

M&A Activity:

Ametek (AME) announces the acquisition of Bison Gear & Engineering Corp.

Chefs' Warehouse (CHEF) acquires Hardie’s Fresh Foods and Greenleaf Produce & Specialty Foods; financial terms were not disclosed.

3D Systems (DDD) to acquire Wematter, a Swedish 3D printer manufacturer.

Meeting & Conferences of Note:

Sellside Conferences:

H.C. Wainwright BioConnect

Aegis Capital Virtual Conference

Previously posted and ongoing conferences:

Taglich Brothers Investment Conference (05/01/23-05/02/23)

Company Meetings: APCX, AXP, BAX, BMY, EVRG, NE, MGM, MT, TRP, TX

Investor/Analyst Day/Calls: ALLE, MPTI, RVPH, VEEV, VNRX

Company Event:

TriNet (TNET) Second Annual Small Business Week Virtual Summit 2023. (05/01/23-05/04/23)

Industry Meetings:

Space Tech Expo (05/02/23-05/04/23)

Competitive Carriers Association (CCA) Mobile Carriers Show 2023 (05/02/23-05/04/23)

Wellness Real Estate & Communities Symposium

Previously posted and ongoing conferences:

The American Society of Neuroradiology 2023 (ASNR23) Annual Meeting (04/29/23-05/03/23)

Milken Institute Global Conference 2023 (04/30/23-05/03/23)

4th Symposium on Infectious Diseases in the Immunocompromised Host (04/30/23-05/02/23)

APPA Engineering & Operations Conference (04/30/23-05/03/23)

SpineWeek (05/01/23-05/05/23)

Waste Expo (05/01/23-05/04/23)

Stifel Investor Summit at Waste Expo (05/01/23-05/02/23)

Digital Insurance Summit 2023 (05/01/23-05/02/23)

Advanced Clean Transportation (ACT) Expo 2023 (05/01/23-05/04/23)

Advanced Semiconductor Manufacturing Conference (ASMC) 2023 (05/01/23-05/04/23)

Offshore Technology Conference (OTC) 2023 (05/01/23-05/04/23)

Keystone Symposia on Type 2 Diabetes: Understanding its Early Drivers and the Road to Therapeutics (05/01/23-05/04/23)

Channel Partners Conference & Expo 2023 [Communications] (05/01/23-05/04/23)

Top Tier Sell-side Upgrades & Downgrades: