QuantPartners: Morning Note - 04/20/23 $SPX

Stocks Lower For A Second Morning As Overnight Selling Picks Up. Lots of Fedspeak Today.

Overnight Summary: The S&P 500 closed Wednesday lower by -0.01% at 4154.52 from Tuesday higher by 0.09% at 4154.27. The overnight high of 4178.75 was hit at 4:05 p.m. EDT. The low was hit at 4144.25 at 4:50 a.m. EDT, a range of ~34 points high to low which is below the recent range of 45 but has been rising. At 7:10 a.m. EDT, the current price was 4150.75 which is -0.66% and -27.75 points. The biggest drop hit again around 2:00 a.m. EDT as it fell by 25 points to 4:50 a.m. EDT.

Earnings Out After The Close:

Beats: LRCX +0.46, STLD +0.42, RLI +0.40, WTFC +0.27, SLG +0.13, IBM +0.12, NBHC +0.10, FFIV +0.10, LVS +0.08, CNS +0.08, LBRT +0.07, EFX +0.06, CALX +0.05, CCI +0.02, FNB +0.01, FR +0.01, KMI +0.01 of note.

Flat: BDN, REXR, TSLA of note.

Misses: DFS (0.33), AA (0.23), ZION (0.21) of note.

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Capital Raises:

IPOs Priced or News: None of note.

New SPACs launched/News:

Integral Acquisition Corporation 1 (INTE) Files Definitive Proxy Statement for Stockholder Meeting Seeking Extension.

Secondaries Priced: None of note.

Notes Priced of note: None of note.

Common Stock filings/Notes:

IMRX: Filed Foprm 424B5.. 2,727,273 Shares Class A Common Stock

VMAR: To raise approximately $1.6 million

Direct Offering:

ATHX: Closing of $3.7 Million Registered Direct Offering and Concurrent Private Placement.

Selling Shareholders of note:

CXAI: Files 6,977,776 common stock offering by selling shareholders.

Private Placement of Public Entity (PIPE):

AIM: Form 424B5.. Up to $8,500,000 Common Stock With Maxim Group.

Mixed Shelf Offerings:

ATEC: Announces $60 Million Underwritten mixed shelf securities offering.

SWAG: Filed Form S-3.. $150 Million Mixed Shelf.

Debt/Credit Filing and Notes:

RIVN: Upsizes and Extends Credit Facility.

VAL: Announces Closing of $700 Million Private Placement of 8.375% Senior Secured Second Lien Notes Due 2030 and Availability of $375 Million Revolving Credit Facility.

Tender Offer: None of note.

Convertible Offering & Notes Filed: None of note.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close:

After Hours:

Trading Up: CALX +10%, NBHC +5%, LVS +4% of note.

Trading Down: FFIV -4%, ZION -4% of note.

News After The Close:

Stocks making the biggest moves after hours: TSLA, LVS, IBM, ZION, LRCX, WYNN, SLG, ATEC (CNBC)

Tesla (TSLA) Counts the Cost of Its Price War. (WSJ)

Alcoa (AA) swings to surprise quarterly loss. (MarketWatch)

Las Vegas Sands (LVS) says a ‘robust’ recovery from travel restrictions is underway in Macau, Singapore and elsewhere. (MarketWatch)

U.S. Department Of Commerce's Bureau Of Industry And Security Imposed A $300 Mln Civil Penalty Against Seagate Technology (STX)

Primoris Services Corporation (PRIM) Receives Renewables Projects Valued Over $200 Million.

Deutsche Bank (DB) Plans To Cut Jobs, Shrink Board. (Reuters)

Exchange/Listing/Company Reorg and Personnel News:

BIMI Receives Nasdaq Notification of Non-Compliance with Listing Rule.

Crown PropTech Acquisitions (CPTK) Announces Receipt of Notice of Late Filing From NYSE.

Maturing into a Multi-Brand Ecosystem, BeautyHealth (SKIN) Appoints Aesthetics Veteran Brad Hauser as Chief Operating Officer.

Dollar General (DG) announced the promotion of Kelly Dilts to Executive Vice President and Chief Financial Officer.

Genco Shipping & Trading (GNK) CFO Apostolos Zafolias departing.

NYSE To Suspend Trading Immediately In Lannett Company, Inc. (LCI) And Commence Delisting Proceedings

Malibu Boats, Inc. (MBUU) Announces Leadership Changes.

Mondee Holdings (MOND) announced the appointment of Jesus Portillo as its new CFO.

Nevro (NVRO) Names Kevin Thornal as New Chief Executive Officer and President.

PotlatchDeltic (PCH) announces that VP and CFO Jerry Richards will relocate to accept an opportunity with another co.

Semler Scientific (SMLR) Announces Appointment of Eric Semler and William Chang as Directors.

Buyback Announcements or News:

DFS: The Board of Directors has approved a new $2.7 billion share repurchase program.

Stock Splits or News:

Actelis Networks (ASNS) Announces 1-For-10 Reverse Stock Split to Aid Compliance With Nasdaq Listing Requirements.

Dividends Announcements or News:

CAT Goes ex div tomorrow for $1.20.

Costco Wholesale Corporation (COST) Announces an Increase in Its Quarterly Cash Dividend. (MarketWatch)

First Industrial Realty (FR) beats by $0.01, beats on revs; increases quarterly dividend 8.5% to $0.32 per share.

Kinder Morgan (KMI) Board of directors today approved a cash dividend of $0.2825 per share for the first quarter ($1.13 annualized).

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 -30, Dow Jones -175, NASDAQ -125, and Russell 2000 -18. (as of 7:52 a.m. EDT). Asia lower ex the Nikkei and Europe lower. VIX Futures are at 19.50 from 20.52 yesterday. Gold and Silver lower with Copper higher. WTI Crude Oil and Brent Crude Oil lower with Natural Gas higher. US 10-year Treasury sees yields at 3.562% from 3.615% yesterday. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $28,749 from $29,285 yesterday, lower by -1.80%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Real Estate, Utilities, Financials of note.

Daily Negative Sectors: Basic Materials, Energy, Communication Services, Technology, Consumer Cyclical of note.

Stocks ended mostly lower on Wednesday, but not by much, after the Federal Reserve’s latest Beige Book survey showed that little has changed in economic activity, as banks pulled back on lending. The Dow Jones Industrial Average fell about 79 points, or 0.2%, ending near 33,897, while the S&P 500 index shed less than a point. The Nasdaq Composite Index was less than 0.1% higher. Stocks have been struggling for direction this week as quarterly earnings season picks up. (MarketWatch - edited by QPI)

Click here for a video explanation of Erlanger Value Lines.

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before the Open:

Earnings of Note This Morning:

Beats: DHI +0.82, TSM +0.56, NUE +0.56, SASR +0.47, SNA +0.46, WSO +0.43, AN +0.33, VIRT +0.15, HRI +0.14, CMA +0.12, GPC +0.11, UNP +0.10, IRDM +0.07, MMC +0.06, PM +0.04, HBAN +0.01, T +0.01, BX +0.01 of note.

Flat: KEY of note.

Misses: POOL (0.61), RAD (0.47), AXP (0.27), TCBI (0.17), ALK (0.14), MAN (0.12), WBS (0.09), TFC (0.06), BHLB (0.02), NOK (0.01), BANC (0.01), FITB (0.01) of note.

Still to Report: BMI , EWBC , HOMB , STX , SNV of note.

Guidance:

Positive Guidance: CALX, IPAR, NVRO, ATEC, ALK of note.

Negative Guidance: LRCX, REXR, CCI, EFX, FFIV, TSM of note.

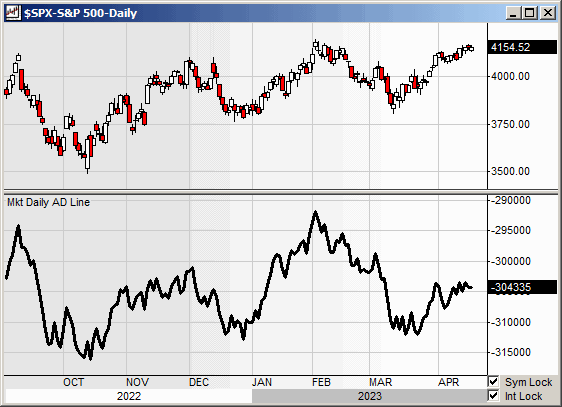

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: CALX +9%, LVS +5%, NBHC +4% of note.

Gap Down: FFIV -7%, NOK -7%, TSLA -7%, ZION -5% of note.

Insider Action: No stock sees Insider buying with dumb short selling. No stock sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

5 things to know before the stock market opens. (CNBC)

5 Things You Need to Know to Start Your Day. (Bloomberg)

Bloomberg Lead Story: Blackstone Profit Slides as Dealmaking Hit By Market Tumult. (Bloomberg)

Bloomberg Most Read Story: Is It Time To Cash Out Your I Bonds? (Bloomberg)

US Futures Drop With Earnings, Rates in Focus: Market Wrap. (Bloomberg)

Treasury Secretary Yellen says that security worry on China eclipses economic interests. (Bloomberg)

Federal Reserve New York President John Williams supports a rate hike in May. (WSJ)

Microsoft (MSFT) removes Twitter from its advertising platform and Elon Musk threatens to sue. (Bloomberg)

Bed, Bath & Beyond (BBBY) preparing from bankruptcy in the next few days. (WSJ)

AT&T (T) lower as earnings beat but revenues miss. (Reuters)

Comerica (CMA) beats as interest income trumps deposit loss. (Reuters)

Moving Average Update:

Score pulls back to 85% from 91%.

Geopolitical:

President’s Public Schedule:

The President receives the President’s Daily Briefing, 7:30 a.m. EDT

The President convenes the fourth virtual leader-level meeting of the Major Economies Forum on Energy and Climate, 8:30 a.m. EDT

Press Briefing by Press Secretary Karine Jean-Pierre, 1:00 p.m. EDT

The President hosts a bilateral meeting with President Gustavo Petro of Colombia, 2:30 p.m. EDT

Economic:

Initial Jobless Claims 8:30 a.m. EDT

April Philadelphia Fed Index is due out at 8:30 a.m. EDT and is expected to improve to -20 from -23.20.

The latest European Central Bank (ECB) Minutes from their last meeting are due out before the open.

March Existing Home Sales are due out at 10:00 a.m. EDT and are expected to fall to 4.50 million from 4.58 million.

March Leading Indicators are due out at 10:00 a.m. EDT and are expected to fall to -0.40% from -0.30%.

EIA Natural Gas Report 10:30 a.m. EDT

Federal Reserve / Treasury Speakers:

Federal Reserve Board of Governors Christopher Waller 8:45 a.m. EDT

Federal Reserve Cleveland President Loretta Mester 12:20 p.m. EDT

Federal Reserve Bank of Dallas Lorie Logan 3:00 p.m. EDT

Federal Reserve Atlanta President Raphael Bostic 5:00 p.m. EDT

Federal Reserve Philadelphia President Patrick Harker 7:45 p.m. EDT

M&A Activity:

FCPT Announces Acquisition of a WellNow Urgent Care Property for $2.4 million.

National Bank Holdings Corporation (NBHC) Announces Acquisition of StoneCastle Digital Solutions, LLC.

WPP announces the acquisition of amp.

Meeting & Conferences of Note:

Sellside Conferences:

Benzinga All Access Event 2023

Canaccord Horizons in Oncology Conference

RBC Capital Markets Battery Value Chain Conference 2023

TD Cowen Private Technology Growth Summit

Warburg Conference Meet the Future: Renewable 2023

Previously posted and ongoing conferences:

Credit Suisse Carbon Negative Conference (04/19/23-04/21/23)

Needham Healthcare Conference (04/17/23-04/20/23)

Company Meetings: ADBE, AES, CE, HUM, KBH, KMB, MYMD, OC, PPG

Fireside Chat: FTK, GTEC

Investor/Analyst Day/Calls: ATHX, AVNS, INKT, LVO, OECD, RGLD

Update: None of note.

R&D Day: None of note.

Company Event:

SAP Aerospace & Defense Innovation Days

Industry Meetings:

Preserving the Brain Scientific Conference 2023

19th European Association of Dermato-Oncology (EADO) Congress 2023 (04/20/23-04/22/23)

American Alliance of Orthopaedic Executives (AAOE) Annual Conference 2023 (04/20/23-04/23/23)

Xpectives.Health SUMMIT Innovations in Women's Health Business Conference 2023

Previously posted and ongoing conferences:

BEAD Success Summit 2023 (Telecom) (04/19/23-04/20/23)

The Aesthetic Meeting 2023 (Healthcare) (04/19/23-04/23/23)

Society for Biomaterials (SFB) Annual Meeting 2023 (04/19/23-04/23/23)

CYBERUK 2023 (Cyber Security) (04/19/23-04/20/23)

International Society for Heart and Lung Transplantation (ISHLT) 43rd Annual Meeting and Scientific Sessions (04/19/23-04/22/23

Space Symposium 2023 (04/17/23-04/20/23)

Healthcare Information and Management Systems Society HIMSS 2023 (04/17/23-04/21/23)

World Nuclear Fuel Conference 2023 (04/18/23-04/20/23)

MRO Americas Aviation Week 2023 (04/18/23-04/20/23)

BritSpine 2023 (04/18/23-04/20/23)

World Congress Experience (WCX) 2023 (04/18/23-04/20/23)

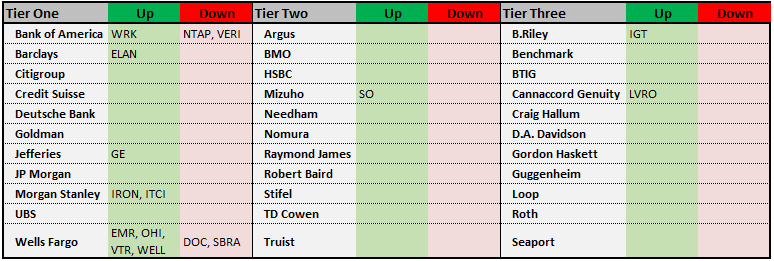

Top Tier Sell-side Upgrades & Downgrades: