QuantPartners: Morning Note - 03/28/23 $SPX $PVH, $BABA, $LYFT, $IVR

Stocks Flat Into Tuesday Trading

Overnight Summary: The S&P 500 closed Monday higher by 0.16% at 3977.53 from Friday higher by 0.56% at 3970.99. The overnight high of 4023.75 was hit at 3:05 a.m. EDT. The low was hit at 3999.50 at 6:50 a.m. EDT, a range of ~243 points high to low. At 7:20 a.m. EDT, the S&P 500 (mini) was lower by 5 points which is -0.12%.

Earnings Out After The Close:

Beats: PVH +0.71 of note.

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Capital Raises:

IPOs Priced or News:

CBL International Limited (BANL) Announces Closing of Initial Public Offering.

Jin Medical International Ltd. (ZJYL) Announces Pricing of $8,000,000 Initial Public Offering.

YanGuFang International Group Co., Ltd. (YGF) Announces Pricing of Initial Public Offering.

New SPACs launched/News:

Bitdeer Technologies Holding Company (BSGA) and Blue Safari Group Acquisition Corp. (BSGAU) Announce Effectiveness of Registration Statement and Extraordinary General Meeting Date for Proposed Business Combination.

Notes Priced of note:

LNT: Prices Public Offering of Green Bonds.

PXD: Pricing of Public Offering of $1.1 billion of 5.100% Senior Notes Due 2026.

Common Stock filings/Notes:

AZ: Extension of Share Purchase Warrants.

ETNB: Files for 16,923,077 share common stock offering.

NYXH: Raises $3 Million from an At-the-Market Equity Offering.

Direct Offering:

INVO: Announces Closing of $3.0 Million Registered Direct Offering.

WISA: registered direct offering.

Mixed Shelf Offerings:

NUTX: Filed Form S-3.. $300 Million Mixed Shelf.

PLRX: Filed Form S-3ASR.. Mixed Shelf.

Debt/Credit Filing and Notes:

HROW: Announces New $100 Million Secured Credit Facility with Oaktree.

Tender Offer:

BERY: Announces Consideration for and Upsizing of Tender Offer for 0.95% First Priority Senior Secured Notes due 2024.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close:

After Hours:

Trading Up: PVH +9% of note.

Trading Down: RSI (4%) of note.

News After The Close:

LYFT CEO and president to step down in mid-April, former Amazon exec David Risher named as replacement. (WSJ)

Federal Reserve Board of Governors Philip N. Jefferson: 'Still Learning' Impact Of Tighter Monetary Policy. (Reuters)

PVH joins the ranks of RL as apparel stocks worth owning. (Cramer CNBC)

Pinterest (PINS) sheds S.F. office space. (MarketWatch)

Disney (DIS) layoffs will begin this week, CEO Bob Iger says in memo. (CNBC)

Over 300 Sysco (SYY) Workers Walk off Job.

Forum Energy Technologies (FET) Awarded Approximately $25 Million Contract to Provide Desalter Systems to Saudi Aramco.

Russia Fires Supersonic Anti-Ship Missile At Mock Target In Sea Of Japan. (Reuters)

Exchange/Listing/Company Reorg and Personnel News:

Consensus Cloud Solutions, Inc. (CCSI) Announces Receipt of Notice from Nasdaq Regarding Late Filing of Annual Report on Form 10-K.

Edgio, Inc. (EGIO) Receives Expected Notice from NASDAQ.

Enviva (EVA) co-founder John Keppler returning as Executive Chairman.

Havertys (HVT) Announces Officer Changes.

LendingClub (LC) Appoints Stephen Cutler to its Board of Directors.

Mannkind (MNKD) announces that Lauren Sabella has joined as COO.

MaxCyte (MXCT) names Douglas Swirsky as CFO.

MYR Group Inc. (MYRG) Announces Senior Leadership Succession Plan.

Nikola (NKLA) Announces Leadership Succession; Anastasiya Pasterick To Become Chief Financial Officer. (MarketWatch)

Oscar Health (OSCR) announces the appointment of Mark Bertolini to the role of Chief Executive Officer.

RH files amended 10-Qs for three quarters in 2022.

SigmaTron International, Inc. (SGMA) Receives Nasdaq Notice Regarding Late Form 10-Q Filing.

Buyback Announcements or News:

BioNTech (BNTX) Announces New ADS Repurchase Program o fup to $0.5 billion.

TransAlta (TAC) enters into automatic share purchase plan up to 14 million Common Shares.

Stock Splits or News: None of note.

Dividends Announcements or News:

Invesco Mortgage Capital (IVR) cuts its quarterly dividend by 38% to $0.40 per share.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 +1, Dow Jones +17, NASDAQ +1, and Russell 2000 -2. (as of 7:54 a.m. EDT). Asia and Europe higher. VIX Futures are at 22.45 from 22.88 yesterday. Gold and Silver higher with Copper lower. WTI Crude Oil and Brent higher with Natural Gas lower. US 10-year Treasury sees yields at 3.568% from 3.468% yesterday. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $26,936 from $27,975 yesterday, lower by -0.46%.

Sector Action:

Daily Positive Sectors: Energy, Financial, Industrials, Healthcare, Basic Materials of note.

Daily Negative Sectors: Communication Services, Technology of note.

U.S. stocks closed mostly higher Monday, as bank shares climbed after First Citizens BancShares Inc. agreed to buy failed Silicon Valley Bank’s deposits and loans. The Dow Jones Industrial Average finished 0.6% higher, while the S&P 500 gained 0.2% and the technology-heavy Nasdaq Composite slipped 0.5%. Regional and big banks helped buoy the S&P 500, with First Republic Bank FRC, +11.81% among the index’s top-performing stocks. Shares of major Wall Street banks such as Bank of America Corp. BAC, +4.97%, Citigroup Inc. C, +3.87%, Wells Fargo & Co. WFC, +3.42% and JPMorgan Chase & Co. JPM, +2.87% also saw sharp gains in Monday’s trading session.(MarketWatch - edited by QPI)

Click here for a video explanation of Erlanger Value Lines.

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before the Open:

Earnings of Note This Morning:

Beats: MKC +0.09, WBA +0.05 of note.

Flat: None of note.

Misses: IHS (0.87), LOVE (0.22), CNM (0.02) of note.

Still to Report: SNX of note.

Guidance:

Positive Guidance: PVH, IHS of note.

Negative Guidance: WEC, CCL of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: PVH +11%, FREY +7%, LYFT +6% of note.

Gap Down: IVR -5% of note.

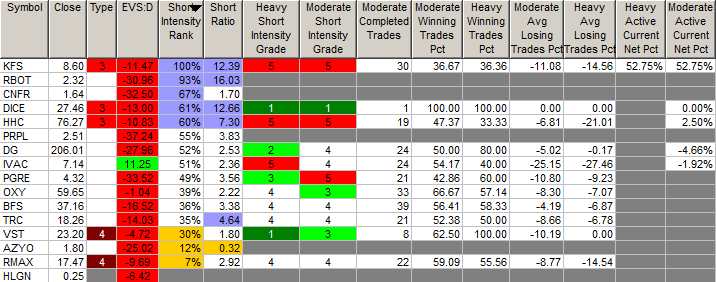

Insider Action: DICE, DG sees Insider buying with dumb short selling. KFS, HHC sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

5 things to know before the stock market opens. (CNBC)

5 Things You Need to Know to Start Your Day. (Bloomberg)

Bloomberg Lead Story: Markets are Wrong on Rate Cut Bets, Blackrock says. (Bloomberg)

Bloomberg Most Read Story: Schwab's $7 Trillion Empire Built on Low Rates Is Showing Cracks. (Bloomberg)

Alibaba (BABA) to split into 6 new IPOs in historic overhaul. (Bloomberg)

Walgreens (WAG) sees a rise in revenues despite decline in demand for Covid tests, vaccines. (CNBC)

2 Year Treasury rises back above 4%. (CNBC)

Moving Average Update:

Score notches up 11% to 71%. Getting green like spring.

Geopolitical:

President’s Public Schedule:

The President receives the President’s Daily Briefing, 9:30 a.m. EDT

The President departs the White House en route to Joint Base Andrews and Morrisville, North Carolina, 11:25 a.m. EDT

The President tours Wolfspeed, a semiconductor manufacturer, 1:25 p.m. EDT

The President discusses how his Investing in America agenda has led to the strongest job growth in history, hundreds of billions of dollars in major private sector investments nationwide, stronger infrastructure, and a Made in America manufacturing boom that is strengthening supply chains and national security, 2:30 p.m. EDT

The President departs Morrisville, North Carolina en route to Joint Base Andrews and White House, 3:50 p.m. EDT

Economic:

International Trade in Goods 8:30 a.m. EDT

Wholesale Inventories 8:30 a.m. EDT

Redbook Sales 8:55 a.m. EDT

FHFA House Price Index 9:00 a.m. EDT

January S&P Case Shiller Home Price Index is due out at 9:00 a.m. EDT and is expected to come in at 2.5% from 4.6%.

March Consumer Confidence is due out at 10:00 a.m. EDT and is expected to fall to 101.50 from 102.90.

Richmond Fed Mfg Index 10:00 a.m. EDT

API Crude Oil Data 4:30 p.m. EDT

Federal Reserve / Treasury Speakers:

Federal Reserve Vice Chair for Supervision Michael S. Barr 10:00 a.m. EDT

M&A Activity:

Albemarle (ALB) Announces Proposal to Acquire Liontown.

Energy Transfer (ET) to acquire Lotus Midstream for approximately $1.45 billion.

Transcat (TRNS) purchases privately-held TIC-MS, Inc. for $9.7 million paid in combination of 70% stock and 30% cash.

Meeting & Conferences of Note:

Sellside Conferences:

Barclays ESG Sustainability and Finance

BMO BioPharma Spotlight Series

HSBC Global Investment Seminar

Jefferies eVTOL Summit

New Street Research Fiber to the Future Conference

Stifel CNS Days (03/28/23-03/29/23)

Truist Gulf Coast Casino Bus Tour

UBS Chicago Ultilities Mini Conference 2023

Wells Fargo Clean Energy Symposium

Previously posted and ongoing conferences:

HSBC West Coast Financials Conference (03/27/23-03/28/23)

SVB Securities Biotech Mountain Meeting

Company Meetings: HOV, HPLT, NCPL

Industry Meetings:

Society for Virology 32nd Annual Meeting 2023 (03/28/23-03/31/23)

American Medical Group Association (AMGA) Annual Conference 2023 (03/28/23-03/31/23)

AD/PD 2023 International Conference on Alzheimer's and Parkinson's Diseases (AD/PD) (03/28/23-04/01/23)

NABE Economic Policy Conference

Previously posted and ongoing conferences:

Indian Gaming Tradeshow & Convention (03/27/23-03/30/23)

Enterprise Connect Conference (03/27/23-03/30/23)

International Wireless Communications Expo (IWCE) 2023 (03/27/23-03/30/23)

Society of Gynecologic Oncology (SGO) 37th Annual Meeting on Women(R)s Cancer 2023 (03/25/23-03/28/23)

International Pediatric Transplant Association (IPTA) 2023 (03/25/23-03/28/23)

ViVE 2023 - Health Industry (03/26/23-03/29/23)

Top Tier Sell-side Upgrades & Downgrades: