QPI Note - 12/04/23: Gold Hits $2,100, Bitcoin Hits $41,000 While Stocks Fall Into A New Week

Overnight Summary: The S&P 500 closed Friday higher by 0.59% at 4594.63 from Thursday higher by 0.38% at 4567.80. The overnight high was hit at 4604.50 at 6:05 a.m. EST while the low was hit at 4582.50 at 7:05 a.m. EST. The range overnight was 22 points as of 7:15 a.m. EST. The 10-day average of the overnight range is at 15 from 14.10. The average for May-October average was 22.06 from 20.96. Currently, the S&P 500 is lower by -17 points which is -0.37% at 7:15 a.m. EST.

Executive Summary:

October Factory Orders is due out at 10:00 a.m. EST and is expected to fall to -2.6% from 2.8%.

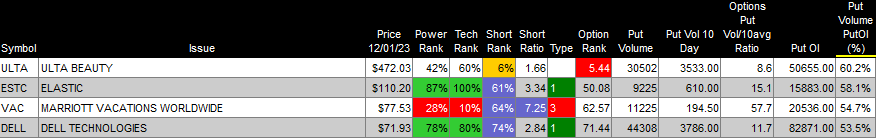

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Earnings Out After The Close: None of note.

Capital Raises:

IPOs Priced or News:

Fenbo Holdings Limited (FEBO) Announces Closing of Its Initial Public Offering.

New SPACs launched/News:

APX Acquisition Corp. I (APXI) and Bioceres Group announce Letter of Intent for a business combination.

Common Stock filings/Notes:

SONM: Filed Form S-3.. 20,833,333 Shares of Common Stock.

SN: Announces Launch of Secondary Offering of Ordinary Shares.

TENX: Filed Form S-1.. Sell Common Stock.

VERO: Filed Form S-3.. 1,229,393 Shares of Common Stock.

VRM: “At The Market” (ATM) Equity Offering Program.

Selling Shareholders of note:

TRUP: Files for 3,636,364 share common stock offering by selling shareholder Aflac.

Mixed Shelf Offerings:

ACRV: Filed Form S-3.. $300,000,000 Mixed Shelf.

BKR: Files mixed securities shelf offering.

CTM: Filed Form S-3.. $10 Million Mixed Shelf and 1,425,000 Shares of Common Stock.

EOSE: Files for $300 million mixed securities shelf offering.

FG: Files for $1 billion mixed securities shelf offering.

GLW: Files mixed securities shelf offering.

OPTT: Filed Form S-3..$100,000,000 Mixed Shelf.

SCHW: Files mixed securities shelf offering.

SYK: Files mixed securities shelf offering.

TRVN: Filed Form S-3. $200,000,000 Mixed Shelf.

Debt/Credit Filing and Notes:

HASI: Announces Proposed Private Offering of $500 Million Green Senior Unsecured Notes to Invest in Near-Term Opportunities at Attractive Yields.

KNTK: Announces $500 Million Sustainability-Linked Senior Notes Offering.

Tender Offer:

POINT Biopharma (PNT): Lilly (LLY) extends tender offer to acquire POINT Biopharma to Dec 15, 2023 from Dec 1, 2023.

Convertible Offering & Notes Filed:

EVRG: Announces proposed offering of convertible notes due 2027.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close and Over the Week:

Weekly Wrap Up: Best and Worst performing large cap stocks:

Trading Up: IMGN 82%, BIG 52%, MOR 48%, ESTC 42%, OSTK 35%, FL 26%, APLS 26%, RUN 26%, AAOI 25%, ALLK 24%, GME 24%, PDD 22%, HMST 22%, TREE 21%.

Trading Down: EGRX -34%, FTCH -27%, ARWR -24%, PDCO -18%, TWOU -17%, DOOO -13%, PBYI -13%, ATRC -13%, ALLO -12%, IRBT -12%, DAKT -11%, BAK -11%.

News Items After the Close:

Dow near record high because traders are calling bluff on ‘higher-for-longer’ Fed. (MarketWatch)

Zero-day commodity options have now entered the ETF space. (CNBC)

Boeing (BA) eliminated from the US Air Force's 'Doomsday Plane' competition. (Reuters)

News Items Over the Weekend:

The Score: Stocks That Defined the Week: SHOP, GM, TSLA, CI, HUM, CRM, PFE (WSJ)

Defense Stocks Benefit From War, Renewing ESG Debate for Everyday Investors. (WSJ) LMT, NOC, GD, RTX

The Executives Who Could Be Johnson & Johnson’s (JNJ) Next CEO. (WSJ)

Fed, With Rates At A Peak, Now Looks At A Hold And An Eventual Pivot Lower. (Morgan Stanley)

“.. November’s rally was broad-based .. the percentage of SPX stocks above their 200dma, from 26.5% to 67.1%. 452 stocks within the SPX produced a positive gain, with 63 adding at least 20%.” (JPM desk SPX Carl Q CNBC)

JP Morgan Sees 8% Downside Risk For S&P 500 Next Year.

Ed Yardeni: “It’s Starting To Look a Lot Like a Santa Claus Rally. “.. wages and salaries .. rose to record highs in October .. .. employment rose to yet another record high .. .. inflation rates .. are coming unstuck. Even rent inflation .. is moderating ..” (Carl Q CNBC)

We believe the new tech bull market has now begun and tech stocks are set up for a strong 2024 with tech stocks we expect to be up 20%+ led by Big Tech as the AI spending tidal wave hits the shores of the tech sector. Focused on 2nd/3rd/4th derivatives of AI Revolution (Wedbush - Dan Ives)

Nvidia (NVDA) received a stern warning from US Commerce Secretary Raimondo on China export controls, media report: “If you redesign a chip around a particular cut line that enables them to do AI, I’m going to control it the very next day,” she said.

Gold futures hit record high above $2100/ounce overnight.

Spotify (SPOT) to reduce its total headcount by approximately 17% across the company.

Barron's:

Positive View: SMCI, VRT, CRL, LH, RPM, NEM, CCI, AMT, SBAC, HPE, CSCO, TXN, ON, NXPI, TSEM, INTC, GLW, OKTA, CIEN, IBM of note.

Cautious View: None of note.

Mixed View: None of note.

Erlanger Type 1 Short Squeezes and Type 4 Long Squeezes reporting earnings this week:

Exchange/Listing/Company Reorg and Personnel News:

Index Changes (WSJ):

S&P Dow Jones Indices announces quarterly rebalance; UBER, JBL, BLDR to join S&P 500.

Removed: ALK, SEE, SEDG

BowFlex Inc. (BFX) Announces Receipt of Continued Listing Standard Notice from NYSE.

Citizens Holding Company (CIZN) Announces Voluntary Delisting from the Nasdaq Global Market.

MKS Instruments (MKSI): Seth H. Bagshaw to retire as Chief Financial Officer.

Provident Financial (PROV) Holdings Announces CFO Succession.

PureCycle Technologies (PCT) names Jeff Fieler as interim CFO.

Starbox Group Holdings Ltd. (STBX) Receives Nasdaq Notification Regarding Minimum Bid Price Deficiency.

Theseus Pharmaceuticals (THRX) terminated the employment of Timothy P. Clackson, Ph.D. as President and Chief Executive Officer.

Buyback Announcements or News:

National Storage Affiliates (NSA) approves a new share repurchase program authorizing the repurchase of up to $275 million - 8K.

Star Bulk (SBLK) Successfully Completes the Second Repurchase of 10 Million of Its Common Shares From Oaktree.

STMicroelectronics (STM) Announces Status of Common Share Repurchase Program.

Stock Splits or News:

XOS: Announces 1-for-30 Reverse Stock Split.

Dividends Announcements or News:

Morningstar (MORN) increases quarterly cash dividend to $0.405 per share from $0.375 per share.

SL Green Realty (SLG) announces that its board of directors has established an annual ordinary dividend on SL Green’s common stock of $3.00 per share.

Insider Sales Of Note: None of note.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 -14, Dow Jones -45, NASDAQ -66, and Russell 2000 +13. (as of 7:57 a.m. EST). Asia is higher ex Japan while Europe is lower ex Germany this morning. VIX Futures are at 13.95 from 12.95 this morning. Gold, Silver and Copper are lower this morning after early overnight highs. WTI Crude Oil and Brent Crude Oil are lower with Natural Gas lower as well. US 10-year Treasury sees yields at 4.251% from 4.344% Friday. The U.S. Dollar is higher versus the Euro, higher versus the Pound and lower against the Yen. Bitcoin is at $41,814 from $38,351 higher by +5.51% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Real Estate, Basic Materials, Industrials, Utilities, Consumer Cyclical, Financial of note.

Daily Negative Sectors: None of note.

One Month Winners: Real Estate, Technology, Consumer Cyclical of note.

Three Month Winners: Technology, Financial, and Communication Services of note.

Six Month Winners: Consumer Cyclical, Financial and Technology

Communication Servicesof note.Twelve Month Winners: Technology, Communication Services, and Consumer Cyclical of note.

Year to Date Winners: Technology, Communication Services, Consumer Cyclical, and Industrials of note.

Hopes that the Federal Reserve is done raising interest rates turbocharged a broad-based rally, driving prices of everything from stocks to Treasurys and Gold sharply higher. The Dow Jones Industrial Average added 2.4% for the week, notching a fifth weekly gain to mark its longest winning streak since late 2021. The S&P 500 added 0.8% and closed at its highest level since March 2022. The tech-heavy Nasdaq Composite added 0.4%. On Friday, Federal Reserve Chair Jerome Powell offered the strongest signal yet that officials are likely done raising rates, saying the central bank’s policy is “well into restrictive territory.” His comments were laced with caution, but they appeared to reassure investors who have been digging in on expectations of rate cuts next year. Traders have ramped up bets that the Fed will trim rates as soon as March, CME Group data show. (WSJ - edited by QPI)

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Monday After the Close: None of note.

Tuesday Before the Open:

Earnings of Note This Morning:

Beats: SAIC +0.58 of note.

Company Earnings Guidance:

Positive Guidance: SAIC of note.

Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: HA +177%, GERN +5%, APXI +5% of note.

Gap Down: ALK -10%, TRUP -9%, SN -4% of note.

Insider Action: ITW, YMAB sees Insider buying with dumb short selling. HHH, PLSE sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

What You Need To Know To Start Your Day. (Bloomberg)

5 Things To Know Before the Stock Market Opens on Monday. (CNBC)

Stock Market Strategist Tom DeMark says NASDAQ and the Dow could peak this week. (CNBC)

Bloomberg Lead Story: Bitcoin Surges Past $42,000 as Crypto Rally Gathers Steam. (Bloomberg)

Bloomberg Most Shared Story: Alaska Air (ALK) to Buy Hawaiian Air (HA) in $1.9 billion deal. (Bloomberg)

China borrowers are defaulting in record numbers. (FT)

Gold soars past $2,100 overnight before pulling back, yet analysts don't expect it to stop there. (CNBC)

A U.S. Destroyer and several commercial ships were attacked by drones from Houthi rebels who are backed by Iran. (WSJ)

Shortage of air traffic controllers are leading to dangerous mistakes. (NYT)

Crypto executives say Bitcoin could reach $100,000 a year next year. (CNBC)

Bloomberg Odd Lots: What dead malls tell us about the future of commercial real estate. (Podcast)

NPR Marketplace: Controversial U.S. Surveillance Program to expire this month. Will it be renewed? (Podcast)

NY Times Daily: The October 7th Warning that Israel ignored. (Podcast)

BBC Global News Daily Podcast: Israel pushes into Southern Gaza. (Podcast)

Wealthion: Friday's "Speak Up With Anthony Scaramucci". (Podcast)

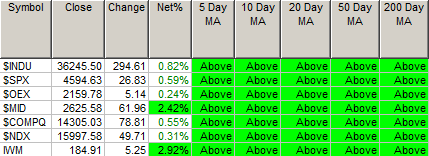

Moving Average Update:

We hit 100%! "If I woke up tomorrow with my head sewn to the carpet, I wouldn't be more surprised." —Clark Griswold

Geopolitical:

President’s Public Schedule:

The President receives the Presidential Daily Briefing; The Vice President attends, 12:15 p.m. EST

Press Briefing by Press Secretary Karine Jean-Pierre and NSC Coordinator for Strategic Communications John Kirby, 1:00 p.m. EST

Economic:

PMI Composite Final 9:45 a.m. EST

October Factory Orders are due out at 10:00 a.m. EST and are expected to fall to -2.6% from 2.8%.

Investor Movement Index 12:30 p.m. EST

Federal Reserve / Treasury Speakers:

Fed Blackout Period.

M&A Activity and News:

Alaska Airlines (ALK) announced it has agreed to acquire Hawaiian Airlines (HA) for $18 per share in cash.

IZEA Announces Acquisition of Australian Influencer Marketing Leader HoozuCompany Continues Global Expansion Within APAC Region.

LianBio (LIAN) confirms is receives takeover proposal at $4.30 per share in cash.

ProPetro (PUMP) acquires Par Five Energy Services creating a Permian cementing services company.

Roche Hldg (RHHBY) enters into a definitive merger agreement to acquire Carmot Therapeutics for $2.7 billion.

reAlpha Tech Corp. (AIRE) to acquire Naamche to develop next-generation AI solutions in real estate and diverse digital platforms.

Vertiv (VRT) Acquisition of CoolTera Ltd. Boosts Liquid Cooling Portfolio

Meeting & Conferences of Note:

Sellside Conferences:

Bank of America Home Care Conference

Craig-Hallum's Online Gaming Conference

Jefferies Bank Summit

Jefferies Real Estate Conference

Morgan Stanley Global Consumer & Retail Conf

Mizuho Power Energy & Infrastructure Conference

Noble Capital Markets Emerging Growth Equity Conference

Raymond James TMT & Consumer Conference

UBS Global Media and Communications Conference

Wolfe Research Inaugural Reshoring Conference

Top Shareholder Meetings: AFRM, ARCE, AXLA, CDIO, CHEK. SNCR

Investor/Analyst Day/Calls: BVN, ED, GM, IDYA, MGM, NNOX, SLG

Industry Meetings:

AES Annual Meeting

American Aerospace and Defense Summit

Med-Cannabis 2023 Conference

Top Tier Sell-side Upgrades & Downgrades: