QPI Note - 11/30/23: PCE Core Up At 8:30 a.m. EST, Stock Futures Rebound From Yesterday.

Overnight Summary: The S&P 500 closed Wednesday lower by -0.09% at 4550.58 from Tuesday higher by 0.10% at 4554.89. The overnight high was hit at 4570.25 at 5:50 a.m. EST while the low was hit at 4558.50 at 3:55 a.m. EST. The range overnight was 12 points as of 6:25 a.m. EST. The 10-day average of the overnight range is at 14 from 14.50. The average for May-October average was 22.06 from 20.96. Currently, the S&P 500 is higher by +10 points which is 0.22% at 6:25 a.m. EST.

Executive Summary: The last day of the month. Yesterday large cap tech got pounded. Will that continue today and into December? Time will tell. PCE Core is the most important economic data point due out today as it is the Fed's favorite measure of inflation and can move markets, especially the bond market.

October Personal Income is due out at 8:30 a.m. EST and is expected to drop to 0.2% from 0.7%.

October PCE Core is due out at 8:30 a.m. EST and expected to drop to 0.2% from 0.3%.

Federal Reserve New York President John Williams 9:05 a.m. EST

Tesla (TSLA) will hold CyberTruck delivery event today in Austin, TX (CompanyRelease)

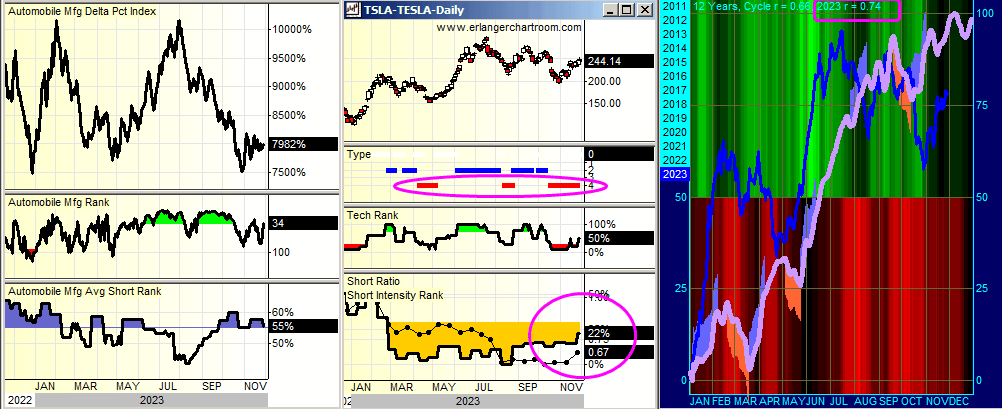

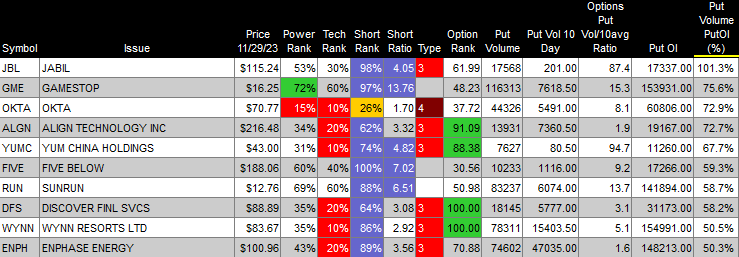

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Earnings Out After The Close:

Beats: PVH +0.16, SNPS +0.13, LZB +0.12, NTNX +0.11, PSTG +0.10, SNOW +0.09, CRM +0.06, ZUO +0.06, NCNO +0.03, FIVE +0.03, CRDO +0.01 of note.

Flat: None of note.

Misses: ARWR (1.31), VSCO (0.08) of note.

Capital Raises:

IPOs Priced or News:

Fenbo Holdings Limited (FEBO) Announces Pricing of Its Initial Public Offering.

Secondaries Priced:

XENE: Prices $300.0 million offering consisting of shares and warrants.

Notes Priced of note:

GFL: Prices Upsized Private Offering of Senior Secured Notes.

PCG: Announces upsize and pricing of $1.9 billion convertible senior secured notes due 2027 to prepay portion of existing term loan.

Common Stock filings/Notes:

GYRE: Filed Form RW.

PAX: Files Class A common stock offering.

WB: Proposed Offering of American Depositary Shares in connection with the Delta Placement of Borrowed ADSs.

XENE: Announces proposed public offering of $225 million of its common shares.

XRTX: Announces US ATM Offering.

Private Placement of Public Entity (PIPE):

NCTY: Raised US$12 million in a Private Placement Transaction to Fund Business Growth.

Mixed Shelf Offerings:

BWMN: Files $100 million mixed shelf securities offering; also files for 340,000 shares of common stock by selling shareholders.

ISTR: Files $150 million mixed shelf securities offering.

Tender Offer:

VLTO: recommends shareholders reject mini-tender offer by TRC Capital Investment Corporation.

Convertible Offering & Notes Filed:

WB: Announces proposed offering of $300 million convertible senior notes due 2030.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

After Hours Movers:

CNXA: +25% SC 13D Filed on name

NTNX: +8.3% Earnings

CRM: +7.75% Earnings

SNOW: +7.25% Earnings

ZUO: +6.5% Earnings

PSTG: -13% Earnings

WB: -6.5% Offering

PVH: -4.5% Earnings

CRDO: -3.5% Earnings

News Items After the Close:

Stocks making the biggest moves after hours: CRM, SNOW, ARWR, NTNX, PVH, FIVE, PSTG (CNBC)

Salesforce (CRM) shares jump on better-than-expected earnings report. (CNBC)

Snowflake (SNOW) earnings smash expectations as CEO cheers ‘stabilizing’ conditions. (MarketWatch)

Pure Storage’s (PSTG) stock tanks 14% after tech company calls for worse-than-expected current quarter, year. (MarketWatch)

JPMorgan’s S&P 500 Outlook for 2024 Is Grimmest on Wall Street. (Bloomberg)

Elon Musk, Slinging Expletives, Says Advertiser Boycott on X May Kill It. (Bloomberg)

Walt Disney (DIS) appoints James Gorman, CEO of Morgan Stanley, and Sir Jeremy Darroch as new members of Board of Directors.

COST: today reported net sales of $20.14 billion for the retail month of November, the four weeks ended November 26, 2023, an increase of 5.1 percent from $19.17 billion last year.

NASCAR extending media rights with Fox Sports (FOXA), NBC Sports (CMCSA), adding Amazon (AMZN) and TNT. (Sportico)

MORGAN STANLEY: “We expect the $SPX to finish 2024 at 4,500, virtually flat from .. today. .. Our bull case price target is 5,050 and assumes a stronger earnings backdrop in 2024 (+13%) .. Our bear case price target is 3,850 and reflects a weaker earnings environment (-7%) .” (Carl Q CNBC)

Elon Musk owner of Twitter in an interview at DealBoook yesterday tells advertisers they can "Go f--- themselves". (CNBC)

RTX awarded $702 million U.S. Navy contract modification.

Exchange/Listing/Company Reorg and Personnel News:

Adial Pharmaceuticals (ADIL) Regains Compliance with Nasdaq Listing Requirement.

Air Industries Group (AIRI) Receives Notice from NYSE American Regarding Late Filing of Quarterly Report on Form 10-Q.

ASML intends to appoint Christophe Fouquet as President and CEO.

Big Lots (BIG) Appoints Off-Price Retail Veterans to Leadership Team.

Bogota Financial Corp. (BSBK) Announces CEO Transition.

Desktop Metal, Inc. (DM) Receives Continued Listing Standard Notice from NYSE.

Electriq Power Holdings, Inc. (ELIQ) Announces Receipt of Continued Listing Standard Notice from NYSE.

Fastly (FSLY) Chief Revenue Officer Brett Shirk notified the Company of his resignation.

FOXO Technologies Receives Notice from NYSE American Regarding Late Filing of Quarterly Report on Form 10-Q.

The GEO Group (GEO) announces that Jose Gordo will be departing as CEO and as a Board member on mutually agreeable terms and transitioning to the role of an advisor.

Inspired Entertainment, Inc. (INSE) Receives Expected Nasdaq Notification Regarding Delayed Form 10-Q.

Meiwu Technology Company Limited (WNW) Received Nasdaq Delisting Determination.

Mueller Water (MWA) files to delay its 10-K citing previously announced cybersecurity incident.

Ocean Biomedical, Inc. (OCEA) Announces Receipt of Notice from Nasdaq Regarding Late Filing of Quarterly Report on Form 10-Q.

Stellantis (STLA) names two executives to key roles supporting the Jeep brand as it prepares for its electric offensive in 2024.

TRxADE (MEDS) Announces Receipt of Notification of Deficiency from Nasdaq Regarding Requirement to Timely File Quarterly Report on Form 10-Q.

Timber Pharmaceuticals (TMBR) Announces Commencement of NYSE American Delisting Proceedings: Common Stock Expected to Begin Trading on the OTC Market.

Buyback Announcements or News:

Allegheny Tech (ATI) announces new share repurchase authorization of $150 million.

CNH Industrial (CNHI): Periodic Report on $1 Billion Buyback Program.

Markel Group (MKL) approved a new share repurchase program with immediate effect authorizing the Company to repurchase up to $750 million of the Company's outstanding common stock.

PVH increases repurchase plan by $150 million.

Stock Splits or News:

Cazoo (CZOO) Announces Expected Record Date for Distribution of Warrants and Expected Effective Date for Reverse Stock Split.

Dividends Announcements or News:

Stocks ex dividend today: KO BAC PEP MCD TMUS LMT NTES WM MCK AJG

CIBC (CM) declared a dividend of CAD 0.90 per share on common shares. An increase of CAD 0.03 per share from the previous quarter.

La-Z-Boy Incorporated (LZB) Dividend Increased 10%.

Insider Sales Of Note: None of note.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 +12, Dow Jones +233, NASDAQ +5, and Russell 2000 +6. (as of 7:55 a.m. EST). Asia and Europe are higher this morning. VIX Futures are at 13.82 from 13.70 this morning. Gold and Silver are lower while Copper is higher this morning. WTI Crude Oil and Brent Crude Oil are higher with Natural Gas higher as well. US 10-year Treasury sees yields at 4.297% from 4.284% yesterday. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $37,722 from $38,167 higher by +0.03% this morning.

Sector Action –

Daily Positive Sectors: Real Estate, Financial, Technology, Industrials of note.

Daily Negative Sectors: Communication Services, Consumer Defensive, Utilities, Energy of note.

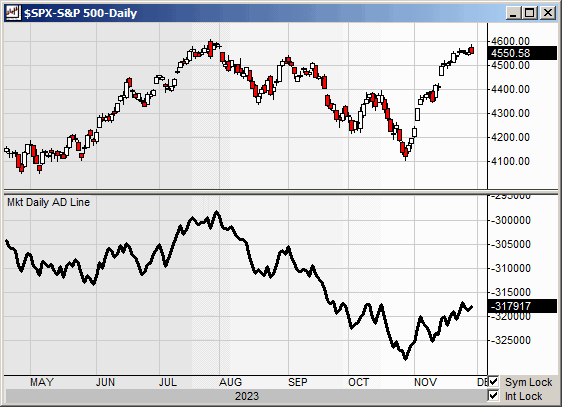

Stocks wavered Wednesday, dampening a November rally that has sent the S&P 500 toward its best month since July 2022. The S&P 500 edged lower 0.1%. The Dow Jones Industrial Average added 13 points, or less than 0.1%. The tech-heavy Nasdaq Composite fell 0.2%. The yield on the 10-year Treasury note fell for the third consecutive day and closed at 4.27%, its lowest level since September. It is a rapid plunge from just around a month ago, when government bond yields touched 5% for the first time in 16 years. (WSJ - edited by QPI)

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before the Open:

Earnings of Note This Morning:

Beats: RY +0.86, CM +0.44, TD +0.44, BIG +0.30 of note.

Misses: FRO (0.25), TITN (0.21) of note.

Still to Report: ASO, AMWD, CBRL, KR of note.

Company Earnings Guidance:

Positive Guidance: CLS, VRT, CRM, SNPS, ZUO, CRDO, NTNX of note.

Negative Guidance: WOOF, PDCO, VSTS, NCNO, PSTG, PVH, OGS of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

Gap Up: VFS +25%, NTNX +9%, CRM +9%, SNOW +8%, ZUO +7%, NUS +4%, HOOD +4% of note.

Gap Down: LIZI -18%, PSTG -16%, WB -5%, CRDO -5%, PVH -4% of note.

Insider Action: HTLD, YMAB, LAZY sees Insider buying with dumb short selling. KYN sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Five Things You Need To Know Before You Start Your Day. (Bloomberg)

5 Things To Know Before The Stock Market opens Tuesday. (CNBC)

Bloomberg Lead Story: Biggest Blowout In Bonds Since the 1980s Sparks Every Asset Class Rally. (Bloomberg)

Bloomberg Third Most Shared Story: Saudi Arabia offers Iran money to blunt Gaza War. (Bloomberg)

Stocks gain before inflation data, Euro sinks: Market Wrap. (Bloomberg)

Eurozone inflation sinks to 2.4% below expectations. (CNBC)

OPEC+ agrees to 1 million bpd cut. (Reuters)

Ford (F) reinstates 2023 guidance and says UAW contract will cost it $8.8 billion over life of contract. (CNBC)

Bloomberg Odd Lots: How banks manage rate risk. (Podcast)

NPR Marketplace: Big advertisers flee Twitter. (Podcast)

NY Times Daily: Bad vibes around a good economy. (Podcast)

BBC Global News Daily Podcast: More hostages released from Gaza. (Podcast)

Wealthion: Decoding market disconnects, up at 10:00 a,m. EST. (Podcast)

Moving Average Update:

Score goes to 82% from 88%.

Geopolitical:

President’s Public Schedule:

Press Briefing by Press Secretary Karine Jean-Pierre, 1:00 p.m. EST

The President hosts a bilateral meeting with President João Manuel Gonçalves Lourenço of the Republic of Angola, 2:30 p.m. EST

The President and The First Lady participate in the National Christmas Tree Lighting; The Vice President and The Second Gentleman attend, 6:00 p.m. EST

Economic:

Initial Jobless Claims 8:30 a.m. EST

October Personal Income is due out at 8:30 a.m. EST and is expected to drop to 0.2% from 0.7%.

October PCE Core is due out at 8:30 a.m. EST and expected to drop to 0.2% from 0.3%.

November Chicago PMI is due out at 9:45 a.m. EST and expected to rise to 45 from 44.

October Pending Home Sales are due out at 10:00 a.m. EST and expected to fall to -2.3% from 1.1%.

EIA Natural Report 10:30 a.m. EST

Farm Prices 3:00 p.m. EST

Federal Reserve / Treasury Speakers:

Federal Reserve New York President John Williams 9:05 a.m. EST

M&A Activity and News:

AbbVie (ABBV) to Acquire ImmunoGen (IMGN) for $31.26 a share in cash. This includs its Flagship Cancer Therapy ELAHERE® (mirvetuximab soravtansine-gynx), Expanding Solid Tumor Portfolio.

Meeting & Conferences of Note:

Sellside Conferences:

BAC Securities Renewables Conference

BMO Capital Markets Insurance Summit

Canaccord AgriFood Tech Innovation Forum

JMP Securities BDC Summit

UBS Global Technology Conference

Previously posted and ongoing conferences:

Barclays Global Automotive and Mobility Conference

Credit Suisse TMT Conference 2023

UBS Industrials Summit

Top Shareholder Meetings: ATNM, DLNG, DWSN, GURE, MGRM, PCTY, TENX

Investor/Analyst Day/Calls: CTV, CYBN, GSK, IR, TSLA

Industry Meetings: None of note.

Previously posted and ongoing conferences:

World Vaccine Congress

Top Tier Sell-side Upgrades & Downgrades: