QPI Morning Note For 5/19/25:Moody’s Downgrades U.S. Debt, Futures Fall

Overnight Summary & Early Morning Trading:

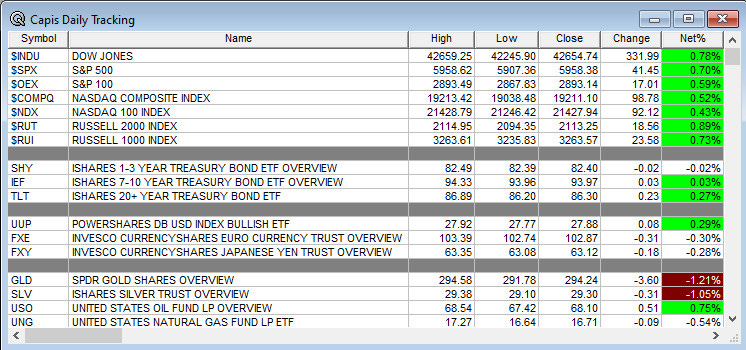

The S&P 500 finished Friday higher by 0.70% at 5958.38. Thursday higher by 0.41% at 5916.93. Futures are lower this morning by -68 (-1.13%) at 5945 around 6:50 a.m. EDT. The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up 1.30% from 0.60% on Thursday’s close.

Executive Summary:

This might be the dumbest downgrade I have ever seen. Yes, deficits are thanks to the Biden Administration. Trump is cutting expenses through its DOGE efforts. Drug costs are about to be cut up to 65%. The Tariff efforts are starting to create low taxes on trade globally. The Trump Administration are looking to raise taxes on those with income above $2.5 million. The reality is the U.S. is starting to get its house in order. Trump’s overseas visit to the Middle East has created lots of future income for the U.S.

Breaking News:

Yields on the 30-Year are back above 5.00%.

Key Events of Note Today:

3 & 6 month Bill Sales at 11:30 a.m. EDT.

Leading Indicators are due out at 10:00 a.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week:

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

WINT: FORM S-1 – Up to 42,168,035 Shares of Common Stock.

Notes Priced:

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

Selling Shareholders of note:

FIP files for 22,237,370 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

WEAV files mixed securities shelf offering.

TRC files for $200 mln mixed securities shelf offering.

MET files mixed securities shelf offering.

News After The Close:

Zillow (ZG) fully settles $419 mln of convertible notes, co is now debt-free other than credit facility borrowings.

Coca Cola Consolidated (COKE) announces that its 10-for-1 split of its common stock and Class B common stock has been approved by its stockholders.

Binance and Kraken targets of Coinbase-style hacks, but were able to fend off the attacks without losing customer data. (Bloomberg)

Moody’s downgrades US credit rating on increase in govt debt from AAA to AA1. (CNBC)

Signet Jewelers (SIG) estimates that $30-45 mln of restructuring costs.

RTX awarded a $1 bln Missile Defense Agency contract.

10K or Qs Filings/Delays – (Filed), PACS TTGT (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

PAYX founder Thomas Golisano to Step Down from Company’s Board of Directors, effective after the Board’s July, 2025 meeting.

JHG COO James Lowry will step down.

Buybacks:

Dividends Announcements or News:

Stocks Ex Div Today: CVX COP KLAC SO UPS PSC CTSH ABEV ROK UI VRSN TPG GEN CSL CG BAP IEX CNA DOC JEF BG BWXT ALSN TECH R ACT NXST of note.

Stocks Ex Div Tuesday of note:

Stocks Moving Up & Down Last Week:

Gap Up: ARRY (7.73 +29.83%), ACAD (22.36 +28.21%), EXEL (45.33 +25.32%), RUN (12.44 +32.62%), TBI (5.64 +28.18%), FL (23.81 +98.25%), SERV (10.69 +43.23%), BOOT (157.88 +34.21%), KSS (8.71 +29.81%), AAOI (18.69 +27.4%), FSLR (178.95 +27.2%), PI (125.43 +25.43%), GPRE (5.24 +28.75%), NRG (158.56 +32.88%) of note.

Gap Down: URGN (7.1 -31.6%), UNH (290.51 -23.68%), HALO (52.07 -20.96%), BHVN (16.26 -19.66%), PAAS (22.64 -16.8%), GLOB (101.92 -20.87%), of note.

What’s Happening This Morning: (as of 7:25 a.m. EDT) Futures S&P 500 -628, NASDAQ -304, Dow Jones -261, Russell 2000 +14. Europe is lower and Asia is lower. Bonds are at 4.554% from 4.394% from Friday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $102,989 from $103,655 lower by $-1264 (-1.24%).

Sector Action:

Daily Positive Sectors: Utilities, Healthcare, Consumer Defensive, Real Estateand Industrials of note.

Daily Negative Sectors: Energy of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Monday After the Close:

Tuesday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: None of note.

Misses: TH -0.05 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line improved Friday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: NVAX +16%, FIP +4.5%, SVRA +3.3%, NTLA +2.7% of note.

Gap Down: NIU -5.5%, RKLB -5.1%, TITN -2.7%, RPRX -2.6%, ZG -2.5% of note.

Insider Action: CMI ALKT sees Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Treasuries. and the Dollar Fall as Moody’s Sharpens Focus on US Debt. (Bloomberg)

Markets Wrap: Treasuries, Stocks slide as retreat from US assets. (Bloomberg).

UK and EU agree on a “new chapter” in post Brexit relations. (CNBC)

House Budget Committee advanced large reconciliation bill that includes tax cuts, spending cuts, energy reform, immigration reform, and a debt ceiling increase.

Treasury Secretary Bessent in an interview says Moody’s downgrade is a “lagging indicator.”

Former President Biden diagnosed an aggressive form of prostate cancer.

Barron’s is + on NVDA.

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

April Leading Indicators are due out at 10:00 a.m. EDT and are expected to remain at -0.7% from last month.

Federal Reserve Speakers of note today.

Federal Reserve Atlanta President Raphael Bostic interviewed on CNBC at 7:15 a.m. EDT.

Several others are out at 8:45 a.m. EDT, 9:45 a.m. and 1:15 a.m. EDT.

President Trump’s Daily Schedule.

President Trump to speak with Russian President Putin today about a cease fire after Russian’s attack on Ukraine over the weekend.

Press Briefing at 9:00 a.m. EDT with Press Secretary Karoline Leavitt.

President Trump participates in a bill signing at 3:00 p.m. EDT.

President Trump participates in a Law Enforcement Event at 4:30 p.m. EDT.

President Trump participates in a Kennedy Center Board Dinner at 7:00 p.m. EDT.

M&A Activity and News:

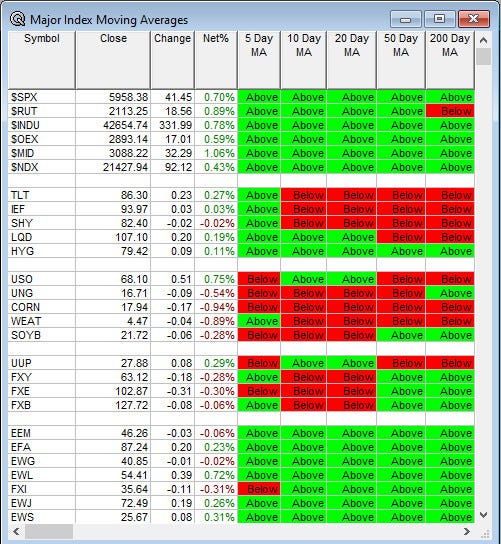

Moving Average Table: Moves from 90% to 97% on Equity Indexes.

Meeting & Conferences of Note:

Sellside Conferences:

Barclays Emerging Payments and FinTech Forum

Cantor Oncology Symposium

Oppenheimer Israeli Conference

Shareholder Meetings: APLE, CRL, DKNG, ED, RSG

Top Analyst, Investor Meetings: CARR, ECL, JPM, KFS, OCS

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

AAES Meeting

American Thoracic Society (ATS) International Conference

Dell Technologies World

Microsoft Build

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: ADM CHTR DAL UAL of note.

Downgrades: JACK NBR of note.