QPI Morning Note For 07/16/25: PPI Up At 8:30 A.M. EDT. Stocks Mixed Into The Data.

Overnight Summary & Early Morning Trading:

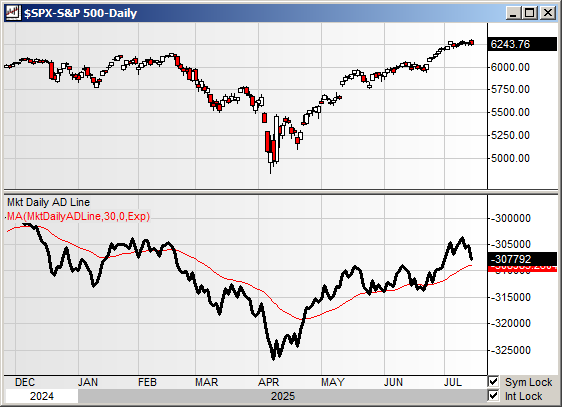

The S&P 500 finished Tuesday lower by -0.40% at 6243.76 from Monday higher by 0.14% at 6268.56.

Futures are lower this morning by -6.00(-0.10%) at 6278 on the S&P 500 around 6:25 a.m. EDT.

Year to date the S&P 500 is up by 6.16% from 6.58% on yesterday's close.

Executive Summary:

Watch to see how stocks trade post the PPI data out at 8:30 a.m. EDT. CPI was higher than recent reports but not out of control. How will PPI fair?

Breaking News: Weekly Mortgage Demand drops -10%.

Key Events of Note Today:

Economic news of note today PPI and Industrial Production as well as Weekly Crude Oil Inventories.

The latest Fed Beige Book is out in the afternoon at 2:00 p.m. EDT.

3 & 6 Month Treasury Bill Auction at 11:30 a.m. EDT.

Fed Speak of note today. 4 speakers of note.

President Trump meets with the Crown Prince of Bahrain and later in the day participates in a Bill Signing Ceremony followed by dinner with the Prime Minister of Qatar.

Notable Earnings Out After The Close:

Beats: FULT +0.13, PNFP +0.09, OMC +0.03, HWC +0.01, JBHT +0.01 of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

GANX - Proposed Public Offering

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

HPP files for 134,529,147 share common stock offering by selling shareholders.

TRNR: Form S-3.. 7,343,179 Shares of Common Stock offered by the Selling Stockholders

Mixed Shelf Offerings:

AMCR files mixed securities shelf offering

News After The Close:

Global Payments (GPN) a name to watch as Elliott Mgmt builds stake in wake of Worldpay deal. (FT.Com)

Brighthouse Financial (BHF) trading higher after hours on report that Aquarian in talks to acquire BHF.

CMS announces proposed rules for hospital payments in 2026 (release)

AeroVironment (AVAV) will replace ChampionX (CHX) in the S&P MidCap 400, and Victory Capital (VCTR) will replace AeroVironment in the S&P SmallCap 600 effective prior to the opening of trading on Friday, July 18.

10-K Delay CRMT

Buybacks of Note: None of note.

Exchange/Listing/Company Reorg and Personnel News:

CACI Chairman of the Board, Michael Daniels has passed away; Board of Directors elects Lisa Disbrow as Chair of the Board of Directors.

FLL promotes Lewis Fanger to President, Chief Financial Officer, and Treasurer, effective July 11.

Dividends Announcements or News

Stocks Ex Div Today of note: None of note.

Stocks Ex Div Wednesday of note: None of note.

CMI increases quarterly cash dividend 10% to $2.00/share from $1.82/share.

JBSS declares $0.60/share special dividend and a regular annual dividend of $0.90/share

Stocks Moving Up & Down After The Close:

Gap Up: KLG +54.3%, BHF +8.4%, GPN +5.4%, VCTR +5.2, TLS +2.2% of note.

Gap Down: RARE (29.51 -26.07%), HPP -6.2%, KALV -4.4%, KMTS -2.4% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 -2, NASDAQ 100 -46, Dow Jones +112 . Europe is mixed while Asia is lower ex China. Bond yields are at 4.475% from 4.42% on the 10-Year on Friday. Crude Oil and Brent Crude are lower with Natural Gas higher. Gold and Silver are higher with Copper lower. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $118,911 from $116,427 higher by $2317 (+1.6%) from yesterday.

Sector Action:

Daily Positive Sectors: Technology was the only Sector higher.

Daily Negative Sectors: All other sectors were lower.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (Erlanger Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Beats: ASML +0.66, PNC +0.30, MTB +0.25, CBSH +0.10, JNJ +0.09, BAC +0.03 of note.

Misses: None of note.

Still to Report: FHN GS MS PGR PLD of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line has rolled over.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

GapUp: BHF +8.2%, GPN +6.1%, VCTR +5.4%, GLXY +3.7%, TLS +2.2%, JBSS +2% of note.

GapDown: ASML -8.2%, KMTS -6.1%, HPP -3.6%, ASTL -3.3%, FLL -2.7%, HWC -2.3%, BDX -2.2% of note.

Insider Action: No names see Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Says Drug Tariffs Likely By August 1st and Chip Levies Could Follow. (Bloomberg)

Markets Wrap: Stock Futures trim losses after upbeat U.S. earnings. (Bloomberg).

Bitcoin pops to $116,000.

President Trump will sign executive order to make private investments available in 401K plans. (WSJ)

Goldman Sachs (GS) and Morgan Stanley (MS) top estimates.

Bank of America (BAC) is mixed.

Barrons is +/- on TPL, LVS, DKNG, MSTR, ALB, TSLA.

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers today.

Federal Reserve Governor Bowman speaks at 9:15 a.m. EDT.

Federal Reserve Cleveland President Hammack speaks at 9:15 a.m. EDT.

Federal Reserve Governor Barr speaks at 10:00 a.m. EDT.

Federal Reserve New York President Williams speaks at 6:30 p.m. EDT.

Economic Releases:

PPI for June is due out at 8:30 A.M. with a high trading impact and a prior reading of 0.1% with an estimate of 0.2%.

Industrial Production for June is due out at 9:15 A.M. with a medium trading impact and a prior reading of -0.2% with an estimate of 0.1%.

Fed Beige Book is out at 2:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump meets with the Crown Prince at 11:00 a.m. EDT and Prime Minister of Bahrain then they lunch together. Then the president participates in a Bill Signing Ceremony. Last, the president has dinner with the Prime Minister of Qatar.

M&A Activity: None of note.

Moving Average Table: Equities move from 100% to 70%. Bonds are in trouble.

Meeting & Conferences of Note:

Sellside Conferences: None of note.

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings: None of note.

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: CVLT PCH ROK RRR of note.

Downgrades: ARDT KRC SEDG UHS VLO of note.