QPI Morning Note For 07/15/25: Stocks Higher On Nvidia News They Can Sell To China. CPI Up At 8:30 A.M. EDT

Overnight Summary & Early Morning Trading:

The S&P 500 finished Monday higher by 0.14% at 6268.56 from Friday lower by -0.33% at 6259.75.

Futures are higher this morning by +24.75 (+0.39%) at 6333.75 on the S&P 500 around 6:20 a.m. EDT.

Year to date the S&P 500 is up by 6.58% from 6.43% on Thursday's close.

Executive Summary:

Over the weekend we wrote, President Trump raised the tariff rate on Mexico and the EU to 30%. Interesting to note that Polymarket sees a 50% chance that the high Tariff rates will stick. In other words TACO (Trump Always Chickens Out) will be the end result. And this morning we have a great example of TACO as Nvidia was given the green light by President Trump last week in a visit to the White House to sell chips again to China.

Breaking News: None of note.

Key Events of Note Today:

Economic news of note today CPI and Empire Manufacturing as well as API Petroleum Institute Data after the close.

3& 6 Month Treasury Bill Auction at 11:30 a.m. EDT.

Fed Speak of note today. 5 speakers of note.

President Trump heads to Pittsburgh, PA today for the Inaugural Pennsylvania Energy and Innovation Event.

Notable Earnings Out After The Close:

Beats: SLP +0.24 of note.

Misses: None of note.

Flat: FBK of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

AVXL files for $300 million common stock offering.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

WAY files for 75,664,799 share common stock offering by selling shareholders.

Mixed Shelf Offerings: None of note.

News After The Close:

La-Z-Boy (LZB) signs asset purchase agreement to acquire a La-Z-Boy Furniture Galleries store network in the southeast region of the U.S. from Atlanta Furniture Galleries, LLC; Also expects Q1 sales and adj. operating margin to be around low end of ranges in previously issued outlook.

Churchill Downs (CHDN) signs definitive agreement to acquire a majority of the outstanding equity interests of a Salem, New Hampshire joint venture with right to develop a charitable gaming, entertainment and dining destination featuring historical horse racing machines.

Allison Transmission (ALSN) announces that the Maryland Department of Transportation Maryland Transit Administration has selected New Flyer buses equipped with the Allison eGen Flex hybrid propulsion system to operate in the metropolitan Baltimore region.

Darden (DRI) announces that Recipe has completed the acquisition of all eight Olive Garden restaurants located in Canada; Recipe also enters into development agreement with Darden to significantly expand the Olive Garden brand across Canada.

Range Resources (RRC) expects to report a total gain on derivatives of $154.7 mln for Q2; In addition, co provides estimate for Q2 net cash settlements.

The Trade Desk (TTD) will replace ANSYS (ANSS) in the S&P 500 effective prior to the opening of trading on Friday, July 18.

SYK awarded a maximum $450 mln modification exercising 5-yr option period of a 5-yr base Defense Logistics Agency contract.

BAESY awarded a $172.4 mln US Air Force task order.

Buybacks of Note:

CGNT announces board authorization of new $20 million share repurchase program

Exchange/Listing/Company Reorg and Personnel News:

MAR announces that Leeny Oberg, its Chief Financial Officer and Executive Vice President, Development, decided to retire effective March 31, 2026; Jen Mason, a 33-year Marriott veteran, to replace her as CFO.

HASI appoints Nitya Gopalakrishnan as COO.

POWI names Jennifer Lloyd as its next CEO, effective July 21.

Newmont (NEM) announces that Executive Vice President and CFO Karyn Ovelmen has resigned from her role, effective July 11; co has commenced a search for a permanent CFO.

Dividends Announcements or News

Stocks Ex Div Today of note: None of note.

Stocks Ex Div Wednesday of note: None of note.

Stocks Moving Up & Down After The Close:

Gap Up: KLG +54.3%,TTD +14.2%, ALSN +12.3%, CGNT +2.2% of note.

Gap Down: RARE (29.51 -26.07%), ORGO -26.1%, MDXG -21.3%, EQBK -5.7%, CHDN -5.3%, SLP -4.5%, FBK -4.4%, LZB -4.4%, APP -2.8%, HASI -2.3%, SYK -2.3% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 +25, NASDAQ 100 +143, Dow Jones -11. Europe is lower ex the FTSE while Asia is lower as well. Bond yields are at 4.42% for a second day on the 10-Year on Friday. Crude Oil and Brent Crude are higher with Natural Gas is higher. Gold and Silver are higher with Copper lower. The U.S. Dollar is lower versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $116,427 from $121,935 lower by $3430 from Friday (-2.86%).

Sector Action:

Daily Positive Sectors: Communication Services, Financials, Industrials and Real Estate led the way higher.

Daily Negative Sectors: Materials and Energy led the downside.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (Erlanger Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close:

Wednesday Before The Open:

Notable Earnings of Note This Morning:

Beats: BLK +1.27, JPM +0.48, ERIC +0.27, WFC +0.19, BK +0.18, ANGO +0.09 of note.

Misses: None of note.

Still to Report: STT C ACI of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line pulled back on Friday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

GapUp: TTD +14.8%, CRWV +8.5%, NVDA +4.9%, PUMP +3.7%, CGNT +2.1% of note.

GapDown: ORGO -25.4%, MDXG -21.8%, NVA -12.6%, SLP -7.3%, FBK -6.3%, POWI -5%, BZAI -4.1%, EQBK -3.9% of note.

Insider Action: No names see Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Options Activity From Monday:

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Nvidia (NVDA) to Resume H20 AI Chip Sales To China In US Reversal. (Bloomberg)

Markets Wrap: Stocks pop on Nvidia news. (Bloomberg).

Bitcoin falls to $116,000.

EU preparing countermeasures to respond to tariffs which will target cars and planes. (Politico)

President Trump to unveil $70 billion in AI and Energy Investments in Pittsburgh today. (Bloomberg)

JP Morgan (JPM) tops estimates. (CNBC)

Crypto Industry has spent war chest to get bills passed in House this week. (Politico)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers today.

Federal Reserve Governor Bowman speaks at 9:15 a.m. EDT.

Federal Reserve Governor Barr speaks at 12:45 p.m. EDT.

Federal Reserve Richmond President Barkin speaks at 1:00 p.m. EDT.

Federal Reserve Boston President Collins speaks at 2:45 p.m. EDT.

Federal Reserve Dallas President Logan speaks at 7:45 p.m. EDT.

Economic Releases:

CPI for June is due out at 8:30 A.M. with a high trading impact and a prior reading of 0.1% with an estimate of 0.2%.

Empire State Manufacturing for July is due out at 8:30 A.M. with a low trading impact and a prior reading of -16.0 with an estimate of -11.60.

President Trump's Daily Schedule.

President Trump heads to Pittsburgh this afternoon for the Inaugural Pennsylvania Energy and Innovation Event.

M&A Activity:

Cavco Industries (CVCO) announces planned acquisition of manufactured home builder and retailer, American Homestar Corporation for $190 mln in cash.

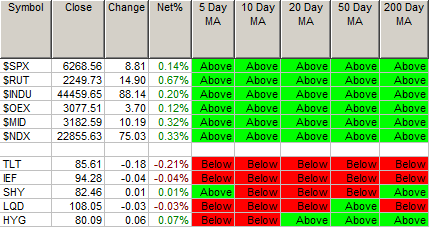

Moving Average Table: Equities move from 87% to 100%. Bonds are in trouble.

Meeting & Conferences of Note:

Sellside Conferences: None of note.

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings: None of note.

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: CTOS NFG ZBH of note.

Downgrades: AMP CVI IOVA NEXA OSCR SCCO VG of note.