QPI Morning Note For 07/14/25: Stocks Lower As Trump Raises Mexico and EU Tariffs, Bit Coin El Fuego As Clears 120K

Overnight Summary & Early Morning Trading:

The S&P 500 finished Friday lower by -0.33% at 6259.75 from Thursday higher by 0.27% at 6280.46.

Futures are lower this morning by -17.50 (-0.28%) at 6282.50 on the S&P 500 around 6:10 a.m. EDT.

Year to date the S&P 500 is up by 6.43% from 6.78% on Thursday's close.

Executive Summary:

Over the weekend, President Trump raised the tariff rate on Mexico and the EU to 30%. Interesting to note that Polymarket sees a 50% chance that the high Tariff rates will stick. In other words TACO (Trump Always Chickens Out) will be the end result.

Breaking News: None of note.

Key Events of Note Today:

No economic news of note today. A busy week however, as we get CPI, Empire Manufacturing, PPI, Industrial Production, Fed Beige Book, Retail Sales, Philadelphia Fed Index, NAHB Housing Index, Housing Starts and University of Michigan Consumer Sentiment Survey.

3& 6 Month Treasury Bill Auction at 11:30 a.m. EDT.

Fed Speak of note today. No speakers of note.

President Trump meets with the Secretary General of NATO at 10:00 a.m. EDT. Then the President lunches with Faith leaders at 12:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: FAST +0.01 of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

SNES: FORM S-3 - 1,531,816 Shares of Common Stock

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note: None of note.

Mixed Shelf Offerings: None of note.

News After The Close:

Boeing (BA) ticking higher after authorities in India release initial conclusions on Air India crash; engines fuel cutoff switches shifting from cutoff to run within seconds of each other.

Ramaco Resources (METC) higher after hours following CNBC interview on their new rare earth mine.

US Cellular (USM) and Telephone and Data Systems (TDS) announce that the Federal Communications Commission issued an order today approving our transaction with T-Mobile US (TMUS).

Buybacks of Note: None of note.

Exchange/Listing/Company Reorg and Personnel News:

UVV announces that Johan Kroner will retire from his role as CFO; Kroner to serve in role until new CFO appointed.

ACHR CFO Mark Mesler steps down, has been on medical leave since Sept 2024.

NUTX COO Joshua DeTillio to resign, effective August 8.

RCKT names Christopher Stevens as COO.

KVUE CEO steps down. Deal coming?

Dividends Announcements or News

Stocks Ex Div Today of note: HRL UVV

Stocks Ex Div Tuesday of note: None of note.

Stocks Moving Up & Down Last Week:

Gap Up: KLG +54.3%, RYTM (86.72 +31.85%), AUPH (8.81 +16.01%), BKD (7.92 +15.79%), OMER (3.67 +14.53%), KTOS (51.72 +15.81%), AAP (62.64 +21.35%), IRBT (3.95 +18.26%), ETH (28.36 +16.9%), GOOS (13.99 +15.96%), PBF (28.7 +19.07%), GPRE (8.01 +14.68%), DK (26.52 +14.66%) of note.

Gap Down: RARE (29.51 -26.07%), GLYC (12.92 -18.69%), ENTA (6.56 -16.92%), OMI (8.12 -11.89%), ERJ (53.9 -11.67%), HELE (22.54 -30.99%), MOD (92.16 -11.84%), MEI (6.93 -30.98%), FICO (1541.61 -16.91%), COMM (7.52 -13.26%), TEAM (186.89 -12.48%), FSLR (162.61 -12.12%), DXC (14.3 -11.98%), NMIH (37.88 -12.22%), ELF (110.1 -15.94%) of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 -21, NASDAQ 100 -86, Dow Jones -136. Europe is lower ex the FTSE while Asia is lower as well. Bond yields are higher at 4.42% from 4.383% on the 10-Year on Friday. Crude Oil and Brent Crude are higher with Natural Gas is higher. Gold and Silver are higher with Copper lower. The U.S. Dollar is lower versus the Euro, higher against the Pound and lower against the Yen. Bitcoin is at $121,935 from $117,969 higher by $2775 from Friday (+2.33%).

Sector Action:

Daily Positive Sectors: Energy and Consumer Cyclicals led the way higher.

Daily Negative Sectors: Healthcare, Financials, Technology and Consumer Defensive led the downside.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

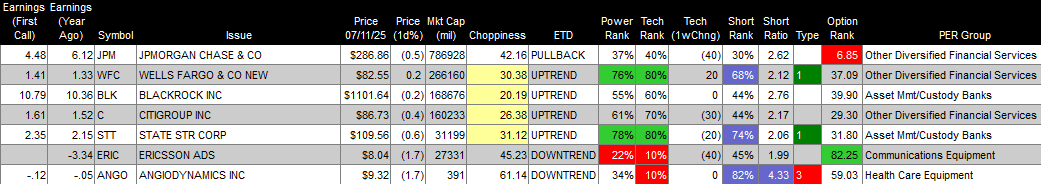

Upcoming Earnings Of Note: (Erlanger Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: FBK SLP of note.

Tuesday Before The Open:

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: None of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line pulled back on Friday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

GapUp: METC +8.4%, HIFS +7.9%, AMLX +4.2%, FFAI +3.4%, TAK +3.2%, RCKT +3% of note.

GapDown: MREO -35.9%, DGNX -15.6%, RARE -5.5%, ZTEK -3.2%, LION -3% of note.

Insider Action: SHEN sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

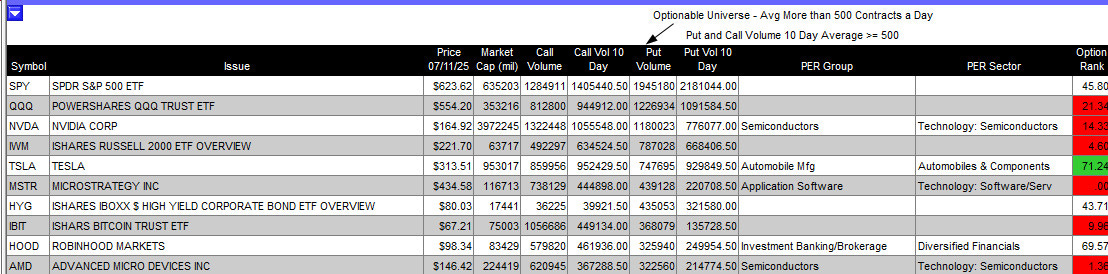

Options Activity From Friday:

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Tariff Salvos Push Economies To Seek to Broaden Trade Ties. (Bloomberg)

Markets Wrap: Stocks drop on Tariffs but Bitcoin rallies. (Bloomberg).

Bitcoin to new highs as above $120,000 and lawmakers to vote on several pieces of legislation on Crypto. (CNBC)

White House NEC Director Kevin Hassett says tariffs will go into place if President Trump doesn't get a deal that is "good enough." Said Trump has the authority to fire Fed Chairman Jerome Powell for cause amid criticism over Fed building cost overruns. (ABC News)

EU plans to keep tariff countermeasures on hold until August. (Reuters)

Iran mulling offer to restart nuclear talks. (Bloomberg)

White House Trade Advisor Peter Navarro says goods imported under USMCA trade deal will not be subject to tariffs. (Bloomberg)

EU plans to talk with other nations impacted by U.S. tariffs. (Bloomberg)

President Trump expected to announce plan to arm Ukraine with offensive weapons. (Axios)

"Superman" earned $122 mln at box office over the weekend.

AMZN U.S. online sales across all retailers hit $24.1B during the 4-day AMZN Prime Day period ending July 11, up 30.3% from the same stretch last year, per Adobe. That beat the 28.4% growth estimate.

House will vote this week on stablecoin legislation that Senate already passed. (Politico)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers None of note today.

Economic Releases: None of not today.

President Trump's Daily Schedule.

President Trump meets with the Secretary General of NATO at 10:00 a.m. EDT. Then lunches with Faith Leaders at 12:00 p.m. EDT.

M&A Activity: None of note.

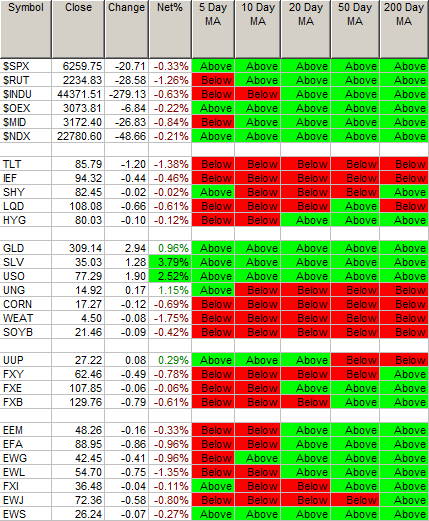

Moving Average Table: Equities move from 100% to 87%. Bonds are back in trouble.

Meeting & Conferences of Note:

Sellside Conferences: None of note.

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Expo Osaka

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: AXL BFH GPN H MA SYF VC of note.

Downgrades: ENLT INTA VSTS of note.