QPI Morning Note For 07/11/25: Stocks Lower As Trade Rhetoric Spikes With Trump Threats to Canada

Overnight Summary & Early Morning Trading:

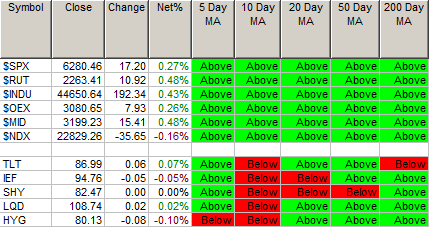

The S&P 500 finished Thursday higher by 6280.46 from Wednesday higher by 0.61% at 6263.26.

Futures are lower this morning by -39 (-0.62%) at 6285 on the S&P 500 around 6:20 a.m. EDT.

Year to date the S&P 500 is up by 6.78% from 6.49% on Thursday's close.

Executive Summary:

Our comment earlier this was that, "Expect the "tape bombs" from Trump to slow down since we are beyond the deadline". That was yesterday, not this morning. The heat on Epstein Files and the lack of disclosure is putting pressure Trump, from the far right of the MAGA crew, so we should expect something to arise that pushes Epstein back, in order of importance. We wrote this before Trump did exactly that as he deflected to higher taxes in Canada last night.

Breaking News: Latest Short Interest is Out And It Continues to Move Higher!

Key Events of Note Today:

Economic news of note today include the latest Treasury Budget update and weekly Baker Hughes Rig Count.

Fed Speak of note today. 3 speakers of note.

President Trump has nothing on his schedule for today.

Notable Earnings Out After The Close:

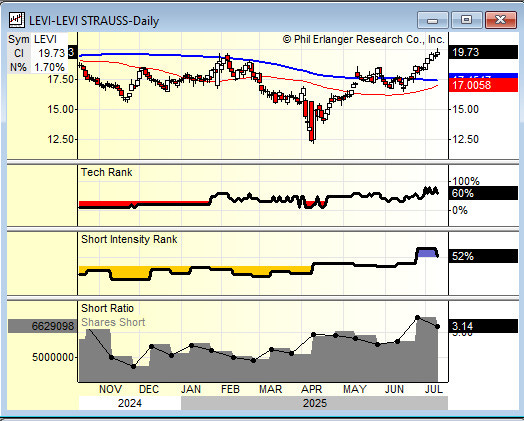

Beats: WDFC +0.10, LEVI +0.09, PSMT +0.02 of note.

Misses: None of note.

Flat: None of note.

Comments: Levi Strauss (LEVI) had a good quarter and positive guidance. Can it clear $20 as shorts cover?

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

RYTM announces proposed public offering of $150 million of common stock.

NVVE - Proposed Public Offering of Common Stock.

EXK - At-the-Market Offering of up to US$60 Million.

EP - Announces Commencement of Previously Announced Rights Offering.

Notes Priced: None of note.

Notes Files:

UFCS - Senior notes offering

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

PLUG files for 31.5 million share common stock offering by selling shareholder.

FTK 6,250,000 Shares of Common Stock by selling shareholder.

BG files for 65,611,831 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

FTK: FORM S-3 - $200,000,000 Mixed Shelf Offering

IPSC: Form S-3.. $200,000,000 Mixed Shelf

TKNO: Form S-3.. $225,000,000 Mixed Shelf

News After The Close:

PriceSmart (PSMT) said on its earnings call that it is currently evaluating Chile as a potential new market for multiple PriceSmart warehouse clubs.

Invesco (IVZ) reports preliminary month-end assets under management of $2,001.4 billion, an increase of 3.0% versus previous month-end.

Boyd Gaming (BYD) to sell the Company's 5% equity interest in FanDuel Group to Flutter Entertainment plc (FLUT) for cash consideration of $1.755 billion.

Diamondback Energy (FANG) anticipates a Q2 net loss on cash settlements for derivative instruments of $37 mln and a net non-cash loss on derivative instruments of $160 mln.

Drone Stocks higher after hours on report that Defense Secretary Hegseth has issued orders to fast-track drone production and deployment (RCAT ZENA KTOS ONDS)

LMT awarded a $197.5 mln modification to a previously awarded US Navy contract.

Vermilion Energy (VET) announces closing of Saskatchewan asset sale for $415 mln.

President Trump threatens Canada with a 35% tariff on Canadian Goods. (CNN)

Buybacks of Note: None of note.

Exchange/Listing/Company Reorg and Personnel News:

VOR appoints Sandy Mahatme as CFO, effective July 9.

TOL announces Gregg Ziegler to succeed Marty Connor as CFO, effective at the end of the Company’s fiscal year on October 31.

AGM announces departure of CFO to accept the CEO position with the Federal Home Loan Banks Office of Finance.

Dividends Announcements or News

Stocks Ex Div Today of note: AAP AEO AMX MRVL OZK OL PMT

Stocks Ex Div Monday of note: None of note.

LEVI increases quarterly dividend to $0.14/sh from $0.13/share.

R increases quarterly cash dividend 12% to $0.91/share from $0.81/share.

ADC increases dividend 2.4% to $0.256.

Stocks Moving Up & Down After The Close:

Gap Up: KLG +54.3%, RCAT +15%, PSMT +7.1%, LEVI +5.1%, BYD +5%, VOR +3.5%, AVAV +3.5% of note.

Gap Down: CIVB -9.8%, BG -6.2%, TKNO -2.5% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 -35, NASDAQ 100 -112, Dow Jones -270. Europe is lower while Asia is lower as well. Bond yields are higher at 4.383% from 4.342% on the 10-Year on Thursday. Crude Oil and Brent Crude are higher with Natural Gas is higher. Gold and Silver are higher with Copper lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $117,969 from $111,111 higher by $4547 from yesterday (+4.00%).

Sector Action:

Daily Positive Sectors: Materials, Consumer Cyclicals, Real Estate, Healthcare and Industrials led the way higher.

Daily Negative Sectors: Technology and Communication Services led the downside.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (Erlanger Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: None of note.

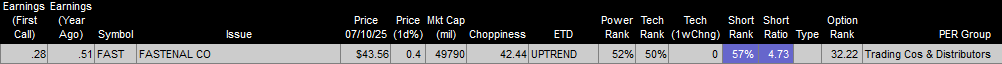

Monday Before The Open: FAST of note.

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: None of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: LEVI of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line improved on Thursday. Impressive.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

GapUp: RCAT +16.1%, LEVI +7.2%, HIVE +5.6%, VOR +4.8%, PSMT +4.4%, AVAV +3%, EXK +2.8%, HAFN +2.3% of note.

GapDown: MREO -35.9%, MIST -14.8%, CIVB -10.2%, FEIM -4.7%, CRWV -4.2%, TKNO -2.5%, RXO -2% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Threatens 35% Canada . (Bloomberg)

Markets Wrap: Stocks drop on Trump restarting trade war. (Bloomberg).

Bitcoin to new highs. (CNBC)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers None of note today.

Economic Releases:

June Treasury Budget is due out at 2:00 p.m. EDT and is expected to fall to $-257.50 billion from $-316 from last month.

President Trump's Daily Schedule.

President Trump has nothing on his schedule for today.

M&A Activity: None of note.

Moving Average Table: Equities move from 97% to 100%.

Meeting & Conferences of Note:

Sellside Conferences:

KeyBanc Asia Supply Chain & Semiconductor Takeaways

Shareholder Meetings: IMNN, NAOV, YMAB

Top Analyst, Investor Meetings: BBIO

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Amazon Prime Day Shopping Event

Expo Osaka

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: ATRO GXO TEL TXN VC of note.

Downgrades: ALB EXPD NTRS OSCR of note.