QPI Morning Note For 07/09/25: Stocks Up Modestly, Tariff Deadline Today

Overnight Summary & Early Morning Trading:

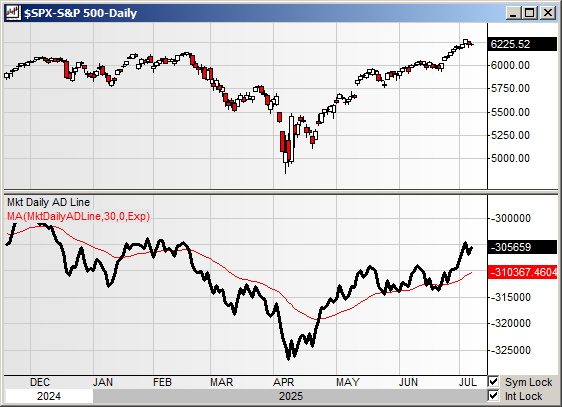

The S&P 500 finished Tuesday lower by -0.07% at 6225.52 from Monday lower by -0.79% at 6229.98.

Futures are higher this morning by +6 (+0.10%) at 6278 on the S&P 500 around 6:15 a.m. EDT.

Year to date the S&P 500 is up by 5.85% from 5.92% on Monday's close.

Executive Summary:

Our comment that, "The top catalyst this week will be tariff deadlines on Wednesday", was right on target. Key to the rest of the week is today's follow-up to yesterday. Some are calling this Liberation Day 2. On the first Liberation Day, the S&P 500 fell -4.84% by the close of April 3rd. So far the S&P 500 is down by -0.86% this week. Expect the "tape bombs" from Trump to continue.

Breaking News:

MBA Mortgage Applications Jul 4: rose 9.4% (prev 2.7%)

Key Events of Note Today:

Economic news of note today includes FOMC Minutes and Crude Oil Inventories.

10-Year Note Auction at 1:00 p.m. EDT.

Fed Speak of note today. None of note.

President Trump lunches with African Leaders.

Notable Earnings Out After The Close:

Beats: PENG +0.14 of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

EVTL files for $60 million ordinary share offering.

COGT announces proposed $150 million public offering of common stock.

BCTX: Form S-1 Offering

LIXT - Closing of $1.5 Million Registered Direct Offering

Notes Priced:

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

MBLY commences secondary public offering of 45 million shares of common stock by Intel Overseas Funding Corporation; also agrees to purchase from selling stockholder $100 million of common stock at a price per share equal to the per share purchase price to be paid by the underwriters in the offering.

Mixed Shelf Offerings: None of note.

News After The Close:

NASDAQ (NDAQ) U.S. equity options volume of 296 million versus 316 million in May 2025 and 250 million in July 2024.

Granite Construction (GVA) awarded a $111 million contract by the Utah Department of Transportation for a major infrastructure project in Salt Lake City.

Starbucks (SBUX) ticks higher on report it has received proposals from investors for its China business, $10 billion. (Bloomberg)

AES moving sharply higher as company explores options, including possible sale, amid takeover interest from large investment firms. (Bloomberg)

President Trump last night noted, "We will be releasing a minimum of 7 Countries having to do with trade, tomorrow morning, with an additional number of Countries being released in the afternoon".

Exchange/Listing/Company Reorg and Personnel News:

AAPL announces that Jeff Williams will transition from role of COO later this month to Sabih Khan, company's Senior Vice President of Operations as part of a long-planned succession.

Dividends Announcements or News

Stocks Ex Div Today of note: MA GAP IDCC NEWT

Stocks Ex Div Thursday of note: None of note.

Stocks Moving Up & Down After The Close:

Gap Up: ARRY (7.79 +20.89%), AES +12.7%, EBS +3.3%, RYTM +2.9% of note.

Gap Down: RXST -35.2%, AEHR -18.8%, EVTL -18.7%, PENG -8.5% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 +14, NASDAQ 100 +47, Dow Jones +119. Europe is higher while Asia is lower ex Japan. Bond yields are lower at 4.403% from 4.415% on the 10-Year on Thursday. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold is lower with Silver higher and Copper lower. The U.S. Dollar is higher versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $108,859 from $108,859 higher by $22 from yesterday (+0.02%).

Sector Action:

Daily Positive Sectors: Energy, Healthcare and Technology led the way higher.

Daily Negative Sectors: Consumer Defensive, Utilities, Communication Services and Materials led the downside.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (Erlanger Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: AZZ of note.

Thursday Before The Open: CAG DAL HELE SMPL of note.

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: None of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: PENG MBLY of note.

Negative or Mixed Guidance: RXST VOYA of note.

Advance/Decline Daily Update: The A/D Line stalled Monday but improved Tuesday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: AES +12.3%, ALVO +6.8%, EXAS +2.6%, RYTM +2.3%, EBS +2.3%, KRUS +2%, of note.

Gap Down: RXST -37.8%, EVTL -20.3%, AEHR -20%, WPP -18.5%, PENG -6.6%, COGT -2.1% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Unleashes Turmoil in Copper Market With 50% Tariff. (Bloomberg)

Markets Wrap: Stock Futures rise with Trump Tariff updates due today. (Bloomberg).

Five Things to Know Before The Market Opens. (CNBC)

161 still missing in Texas. (Bloomberg)

Meta (META) takes stake in EssilorLuxottica and stock jumps 6%.

Barron’s Streetwise (with Jack Hough): Roblox (RBLX) and Crocs (CROX) plus Van Eck on markets. (Podcast)

The Big Take: Trump Tax Bill Marks Sweeping Policy Shift. (Podcast)

The Big Take: Takeaways From Tesla, GM Latest Auto Sales. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today: None of note.

Economic Releases:

FOMC Minutes at 2:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump lunches with African Leaders at 12:05 p.m. EDT.

M&A Activity:

Verona Pharma (VRNA) to be acquired by Merck (MRK) for $107 per share.

Moving Average Table: Equities move from 97% to 90%. Bonds lose more ground.

Meeting & Conferences of Note:

Sellside Conferences:

TD Cowen Calgary Energy, Power & Utilities Conference

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

AI First Lounge

BRICS Summit

Federation of European Biochemical Societies (FEBS) Congress

Topgolf Block Party

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: CAT CRL HAE HOLX of note.

Downgrades: ENPH ILMN TNDM of note.