QPI Morning Note For 07/03/25: Big Beautiful Bill To Pass House This Morning, Stocks Up Modestly.

Overnight Summary & Early Morning Trading:

The S&P 500 finished Wednesday higher by 0.47% from Tuesday lower by -0.11% at 6198.01.

Futures are flat this morning by +0.00 (+0.00%) at 6275 on the S&P 500 around 6:10 a.m. EDT.

Year to date the S&P 500 is up by 5.88% from 5.38% on Tuesday's close.

Executive Summary:

The House will pass the Big Beautiful Bill (BBB) this morning. That is the top catalyst today with Jobs Thursday issue #2.

Breaking News:

House voted 219-213 on procedural motion that advances “One Big Beautiful Bill” to a final House vote, which is expected this morning; House Speaker Mike Johnson says “we have the votes”.

Key Events of Note Today:

Lots of monthly data led by Jobs with Weekly Natural Gas Inventories and Jobless Claims.

Fed Speak of note today. See below for details.

President Trump heads to Des Moines, Iowa at 4:35 p,m. EDT for a Salute to America Celebration at 8:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

BORR announces plans for a public offering seeking to raise $100 million in gross proceeds though an offering of approximately 50 million shares.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note: None of note.

Mixed Shelf Offerings:

CLLS files for $200 million mixed securities shelf offering

TGB files mixed securities shelf offering

News After The Close:

Lucid Group (LCID) announces delivery totals for the quarter ended June 30; co produced 3,863 vehicles and delivered 3,309 vehicles.

Xpotential Fitness (XPOF) discloses in filing that the Securities and Exchange Commission concluded its investigation without action relating to its request for certain documents.

Embraer (ERJ) delivered 61 aircraft in the second quarter of 2025 across all its business units.

Data Dog (DDOG) to join the S&P 500 replacing Juniper Network (JNPR) next Wednesday which is part of Hewlett Packard Enterprises (HPE).

Exchange/Listing/Company Reorg and Personnel News:

Microchip (MCHP) announces that Steve Sanghi has agreed to continue to serve as the company's Chief Executive Officer and President on a permanent basis.

BORR announces CEO succession plan; Patrick Schorn to transition from CEO to Executive Chairman of the Board of Directors, current Chairman to remain as a Director

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: GD ABM AXP BMY CHX CPB JPM LEN MRP PGR SYY TWO CSCO ESAB MTCH NTAP RGLD of note.

Stocks Ex Div Monday of note: None of note.

Stocks Moving Up & Down After The Close:

Gap Up: XPOF +21.9%, DDOG +8.4% of note.

Gap Down: CNC -23.7%, INO -22%, BORR -9.7%, CLLS -6.1%, NXDT -3.2%, AOSL -2.2% of note.

What’s Happening This Morning: (as of 7:50 a.m. EDT)

Futures S&P 500 +3.50, NASDAQ 100 +17, Dow Jones +44. Europe is mixed while Asia is mixed. Bond yields are lower at 4.261% from 4.283% on the 10-Year on Monday. Crude Oil and Brent Crude are lower with Natural Gas higher. Gold lower, Silver higher and Copper lower for a second day in a row. The U.S. Dollar is higher versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $109,654 from $107,876 higher by $129 (+0.11%).

Sector Action:

Daily Positive Sectors: Materials, Energy, Technology, Consumer Cyclicals, Industrials and Real Estate led the way higher.

Daily Negative Sectors: Utilities and Healthcare of note led the downside.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (FXrom Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: None of note.

Monday Before The Open: None of note.

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: None of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: CNC of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: THTX +33.1%, XPOF +21.6%, DDOG +9.2%, TRIP +6.5%, SNPS +6.2%, ERJ +3.3% of note.

Gap Down: BORR -5.2%, BABA -2.5% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: House Nears Passage of Trump Tax Bill. (Bloomberg)

Markets Wrap: Stocks . (Bloomberg).

Five Things to Know Before The Market Opens. (CNBC)

Odd Lots: Charlie McElligott on how long the stock rally can go. (Podcast)

The Big Take: Treasury Hacks concern Banks. (Podcast)

Thoughtful Money: Home prices poised to fall as no one wants to buy. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

None of note.

Economic Releases:

June Nonfarm Payrolls are due out at 8:30 a.m. EDT and are expected to fall to 120,000 from 137,000.

May Trade Balance is out at 8:30 a.m. EDT as well and expected to fall to $-71 billion from $61.6 billion.

May Factory Orders are due out at 10:00 a.m. EDT and are expected to rise to 7.90% from -3.70%.

June ISM Services are also due out at 10:00 a.m. EDT and expected to rise to 50.3% from 49.90%. Markets close at 1:00 p.m. EDT.

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

President Trump's Daily Schedule.

President Trump has a quiet day as he heads to Des Moines, Iowa for a Salute to America Event at 8:00 a.m. EDT.

M&A Activity: None of note.

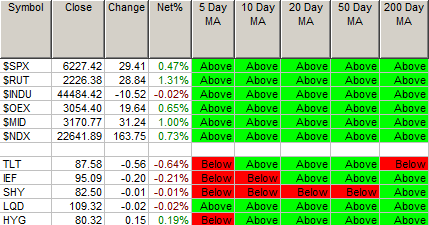

Moving Average Table: Remains at 100% for Equities. Bonds lose some ground.

Meeting & Conferences of Note:

Sellside Conferences: None of note.

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings: None of note.

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: None of note.

Downgrades: None of note.