QPI Morning Note For 06/30/25: Stocks Higher As Canada Cancel Digital Tax, Big Win For Tariff Argument

IMPORTANT NOTICE: Our official Substack handle is @quantpartners. An imposter is mimicking our profile, using a similar name and logo, and may be following our subscribers to promote fraudulent services. Do not engage with this account—it’s a scam. Please report and block any suspicious profiles.

Overnight Summary & Early Morning Trading:

The S&P 500 finished Friday higher by 0.52% at 6173.07 from Thursday higher by 0.80% at 6141.02.

Futures are higher this morning by +26.75 (+0.43%) at 6250 around 7:00 a.m. EDT.

The cash range is now 0 points on the S&P 500 cash for the year, 6100 to 6200. Year to date the S&P 500 is up by 4.96% from 4.41% on Thursday's close.

Executive Summary:

Well, the S&P 500 and the NASDAQ 100 are above their February highs but the Russell 2000 and S&P 400 Mid Cap have more to go before they clear their recent highs. Both hit their recent highs in late 2024. It will probably take a couple of months for those indexes to clear their highs.

Breaking News:

Canada overnight ended its tax on U.S. Technology Companies.Big win for President Trump.

Key Events of Note Today:

Economic data due out today Chicago PMI at 9:45 a.m. EDT.

7-Year Note Auction at 1:00 p.m. EDT.

Fed Speak of note today. 3 speakers up today. See below for details.

President Trump signs Executive Orders at 2:30 p.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

SST: FORM S-3 - Up to $250,000,000 of Class A Common Stock

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed:

ARRY - Closes Upsized Offering of Its 2.875% Convertible Senior Notes

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

QNTM Private Placement

Selling Shareholders of note:

APLD files for 14,062,521 share common stock offering by selling shareholders.

TBN files 4,740,419 Shares Common Stock Offered by the Selling Securityholders.

Mixed Shelf Offerings:

GCMG files for $350 million mixed securities shelf offering.

NVVE: Form S-3.. $300,000,000 Mixed Shelf

TAOP: Form F-3.. $100,000,000 Mixed Shelf

TRNR: FORM s-3.. $250,000,000 Mixed Shelf

TBN: FORM S-3 $500,000,000 Mixed Shelf Offering -

News After The Close:

Federal Reserve Annual Bank Stress Test is out and Bank stocks passed with flying colors. (Fed Release)

RTX awarded a $279 million US Army contract.

GE Verona (GEV) edges slightly higher as company explores potential sale of its Proficy Software business. (Bloomberg)

Exchange/Listing/Company Reorg and Personnel News:

IDYA appoints Joshua Bleharski as CFO.

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: None of note.

Stocks Ex Div Tuesday of note: None of note.

Stocks Moving Up & Down After The Close:

Gap Up: INMB +82.3% of note.

Gap Down: ACHV -12.8% of note.

What’s Happening This Morning: (as of 7:50 a.m. EDT)

Futures S&P 500 +26, NASDAQ 100 +141, Dow Jones +236. Europe is lower while Asia is higher ex China. Bond yields are lower at 4.255% from 4.265% on the 10-Year on Monday. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold is higher with Silver and Copper lower. The U.S. Dollar is lower versus the Euro, higher against the Pound and lower against the Yen. Bitcoin is at $107,511 from $107,061 higher by $15 (+0.01%).

Sector Action:

Daily Positive Sectors: Consumer Cyclical, Communication Services, Industrials, Consumer Defensive and Financials led the way.

Daily Negative Sectors: Materials, Energy and Healthcare led the way lower.

One Month Winners: Technology, Communication Services, Energy, Industrials and Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Consumer Cyclicals and Utilities of note.

Six-Month Winners: Financials, Utilities, Industrials, Materials and Communication Services of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Cyclical, and Industrials of note.

Year to Date Winners: Communication, Services Materials, Financials, Utilities, Industrials and Technology of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

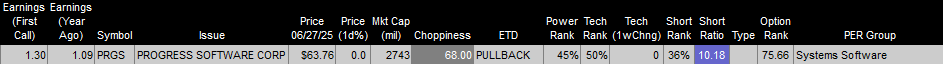

Today After the Close: PRGS of note.

Tuesday Before The Open: MSM of note.

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: Noneof note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: CNXC of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode. Can it breakout here?

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: JNPR +8.5%, HPE +7.0%, FSLR +4.8%, RERE +3.2%, AUPH +2.6%, META +2.0%, FTV +2.0% of note.

Gap Down: HMC -2.1%, TM -1.4%, TSLA -1.3%, SWK -1.3%, THC -0.9%, STLA -0.8%, PDD -0.7% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Canada drops Digital Tax to Restart Trade Talks. (Bloomberg)

Markets Wrap: Stocks rise as trade progress lifts stocks. (Bloomberg).

GOP fights it out over Trump Big Beautiful Bill. (WSJ)

Five Things to Know Before The Market Opens. (CNBC)

Elon Musk rips Trump's Mega Bill. (CNBC)

North Carolina Senator Thom Tillis will not run for re-election after opposing Trump Megabill. (CNBC)

Odd Lots: Jim Chanos on markets and AI. (Podcast)

The Big Take: Electronic warfare crashes Global Shipping navigation systems. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve Atlanta President Raphael Bostic was on CNBC early this morning.

Economic Releases:

June Chicago PMI will be out at 9:45 a.m. EDT and is expected to rise by 43.50 from 40.50.

President Trump's Daily Schedule.

President Trump signs Executive Orders at 2:30 p.m. EDT.

Press Briefing at 1:00 p.m. EDT.

M&A Activity: None of note.

Moving Average Table: Remains at 97% for Equities. Bonds continue to improve. Commodities are in trouble.

Meeting & Conferences of Note:

Sellside Conferences:

Guggenheim BioFrontier

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Multinational Association of Supportive Care in Cancer (MASCC) Meeting

Prostate Education Express National Tour

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: DIS KTOS LIN ORCL VOR WHR of note.

Downgrades: PROK TROX of note.