QPI Morning Note For 06/27/25: Stocks Higher Pre-Market, S&P 500 To a New High? PCE Core Out at 8:30 a.m. EDT

PLEASE TAKE A MOMENT TO READ OUR IMPORTANT NOTICE!!!!!!! IT IS FOR YOUR PROTECTION.

IMPORTANT NOTICE: Our official Substack handle is @quantpartners. An imposter is mimicking our profile, using a similar name and logo, and may be following our subscribers to promote fraudulent services. Do not engage with these accounts—it’s a scam. Please report and block any suspicious profiles.

Overnight Summary & Early Morning Trading:

The S&P 500 finished Thursday higher by 0.80% at 6141.02 from Wednesday lower, barely, down -0.0003% at 6092.16.

Futures are higher this morning by +15.25 (+0.25%) at 6210 around 6:10 a.m. EDT.

The cash range is now 0 points on the S&P 500 cash for the year, 6100 to 6200. Year to date the S&P 500 is up by 4.41% from 3.58% on Wednesday's close.

Executive Summary:

Can the S&P 500 and the NASDAQ 100 take out their February highs? The NASDAQ 100 has now done that and it is time for the S&P 500 to complete the Jim Morrison Trade and "break on through to the other side". Yields are dropping on the 10-Year and 20-Year as the 10-Year is at 4.271% this morning.

Breaking News:

"Trump administration preparing package of executive orders to boost power supplies for ai industry || executive orders could include faster grid interconnection for power projects supplying data centers, sources say – rtrs federally managed land could also be offered to data center project developers to ease siting challenges." - The Trade Exchange

Key Events of Note Today:

Economic data due out Personal Income, PCE Core and U of M Consumer Sentiment and Inflation Data.

7-Year Note Auction at 1:00 p.m. EDT.

Fed Speak of note today. 3 speakers up today. See below for details.

President Trump receives the Intelligence briefing and meets with the head of Congo and Rwanda.

Notable Earnings Out After The Close:

Beats: NKE +0.01 of note.

Misses: CNXC -0.05 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: FMFC, HCHL, JCAP of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

CRMD announces proposed public offering of $85 million of common stock.

ACHV announces proposed underwritten public offering.

PMNT - Pricing of Public Offering

ACHV - Pricing of $45.0 Million Underwritten Public Offering

Notes Priced:

PSA - Prices Public Offering of Senior Notes

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note: None of note.

Mixed Shelf Offerings:

LULU files mixed securities shelf offering.

BKKT for $1 billion mixed securities shelf offering.

CISO: Form S-3.. $100,000,000 Mixed Shelf

News After The Close:

INmune Bio (INMB) to announce top line results from MINDFuL Phase 2 Trial in Early Alzheimer’s on Monday, June 30th.

The S&P 500 finishes just shy of record closing high and just misses all-time high.

Nike (NKE) beats by $0.01, beats on revs, gross margin decreased 44 bps, North America revenue down 11%; Expects headwinds from "Win Now" actions to moderate going forward.

DNOW (DNOW) and MRC Global (MRC) have entered into a definitive merger agreement pursuant to which DNOW will acquire MRC Global in an all-stock transaction valued at approximately $1.5 bln, inclusive of MRC Global's net debt.

GD awarded a not-to-exceed $1.5 bln contract action modification to a previously awarded US Navy contract.

Amazon (AMZN) will carry a select assortment of Nike products says Nike on earnings call.

President Trump says the U.S. signed a trade deal with China on Wednesday. (Reuters)

Exchange/Listing/Company Reorg and Personnel News: None of note.

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: PM DHR MDT BTI KDP HUM RL ELS BEN VMI FLS TRNO IRT NOG XRAY TOWN REVG CTS CSR of note.

Stocks Ex Div Monday of note: None of note.

MATX increases quarterly cash dividend 5.9% to $0.36/share from $0.34/share.

AZZ increases quarterly cash dividend 17.6% to $0.20/share from $0.17/share.

Stocks Moving Up & Down After The Close:

Gap Up: INMB +82.3%, MRC +10.8%, NKE +10.6%, AOUT +8.2%, DOMO +4.3%, UNFI +3.4% of note.

Gap Down: ACHV -12.8%, CRMD -10.5%, LSAK -9.6%, ZTEK -8.1%, BTBT -6.4% of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT)

Futures S&P 500 +18.50, NASDAQ 100 +90, Dow Jones +132. Europe is higher while Asia is higher ex Australia. Bond yields are lower at 4.265% from 4.279% on the 10-Year on Monday. Crude Oil and Brent Crude are higher with Natural Gas higher. Gold, Silver and Copper lower. The U.S. Dollar is lower versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $107,061 from $107,261 lower by $-517 (-0.48%).

Sector Action:

Daily Positive Sectors: Materials, Communication Services, Energy, Industrials and Consumer Cyclical led the way.

Daily Negative Sectors: Consumer Defensive and Real Estate led the way lower.

One Month Winners: Healthcare, Energy, Basic Materials, and Communication Services of note.

Three-Month Winners: Technology, Industrials, Communication Services of note.

Six-Month Winners: Communication Services, Financials, Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: None of note.

Monday Before The Open: None of note.

Notable Earnings of Note This Morning:

Beats: AYI+0.68, of note.

Misses: None of note.

Still to Report: PAYX of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: CNXC of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: INMB +114.2%, AOUT +18.8%, MRC +14.8%, NKE +9.3%, DNOW +4.7%, AVAV +4.6%, FFAI +3.2%, UNFI +3.1%, UAMY +3%, BKKT +2.1%, MATX +2.1% of note.

Gap Down: ACHV -19.4%, CRMD -10.8%, ZTEK -7.5%, CNXC -6.9%, LI -3% of note.

Insider Action: No names sees Insider Buying with dumb short selling. INTG see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: China Confirms U.S. Trade Framework, Vows to Review Exports. (Bloomberg)

Markets Wrap: Stocks buoyed by trade talks and Fed rate cut bets. (Bloomberg).

Five Things to Know Before The Market Opens. (CNBC)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve New York President John Williams speaks at 7:30 a.m. EDT.

Federal Reserve Cleveland President Beth Hammack speaks at 9:15 a.m. EDT.

Federal Reserve Governor Lisa Cook speaks at 9:15 a.m. EDT.

Economic Releases:

May PCE Core is due out at 8:30 a.m. EDT and expected to stay at 0.10%.

May Personal Income is due out at 8:30 a.m. EDT and are expected to drop to 0.40% from 0.80%.

University of Michigan Consumer Sentiment is due out at 10:00 a.m. EDT and expected to rise to 60.50 from 52.20.

Weekly Baker Hughes Rig Count out at 1:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump receives the Intelligence Briefing at 11:00 a.m. EDT.

President Trump participates in a visit with the Foreign Ministers of Congo and Rwanda at 3:00 p.m. EDT.

M&A Activity: None of note.

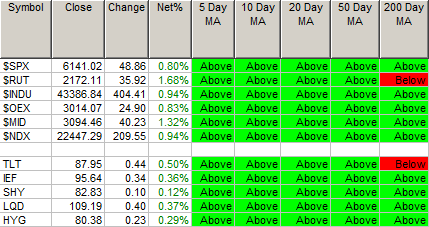

Moving Average Table: Moves to 97% for Equities. Bonds continue to improve.

Meeting & Conferences of Note:

Sellside Conferences:

Guggenheim BioFrontier

Shareholder Meetings: ATHM, BZ, PHVS, TME, TRVG, WKEY

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Multinational Association of Supportive Care in Cancer (MASCC) Meeting

Prostate Education Express National Tour

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: ADSK AMG BA BEN EL NKE of note.

Downgrades: LYFT UBER of note. (BOTH ARE HOLDS, SAME ANALYST AT CANACCORD)