QPI Morning Note For 06/26/25: Stocks Higher As S&P 500 Approaches February High

PLEASE TAKE A MOMENT TO READ OUR IMPORTANT NOTICE!!!!!!! IT IS FOR YOUR PROTECTION.

IMPORTANT NOTICE: Our official Substack handle is @quantpartners. An imposter is mimicking our profile, using a similar name and logo, and may be following our subscribers to promote fraudulent services. Do not engage with these accounts—it’s a scam. Please report and block any suspicious profiles. As Sergeant Phil Esterhaus said on Hills Street Blues after his end of roll call: " All right, that's it, let's roll. And Hey!....let's be careful out there!"

Overnight Summary & Early Morning Trading:

The S&P 500 finished Wednesday lower, barely, down -0.0003% at 6092.16 from Tuesday higher by 1.11% at 6092.18.

Futures are higher this morning by +17.25 (+0.28%) at 6164.25 around 6:10 a.m. EDT.

The cash range is now 100 points on the S&P 500 cash for the year, 6000 to 6100. Year to date the S&P 500 is up by 3.58% from 3.58% on Tuesday's close.

Executive Summary:

Fed Chairman Powell concluded two days of testimony on the Hill and it was a "nothing burger". Can the S&P 500 and the NASDAQ 100 take out their February highs? The NASDAQ 100 has now done that and it is time for the S&P 500 to complete the Jim Morrison Trade and "break on through to the other side". Yields are dropping on the 10-Year and 20-Year as the 10-Year is at 4.279% this morning.

Breaking News:

The latest Short Interest from 5/31 through 6/15/25 and it rose on NYSE and NASDAQ.

Table of the Day:

New Short Squeezes of Note With New Short Interest Data

Key Events of Note Today:

Durable Orders, Q1 GDP and Pending Home Sales are out between 8:30 a.m. and 10:00 a.m. EDT, while Weekly Jobless Claims and Natural Gas Inventories by 10:30 a.m. EDT.

7-Year Note Auction at 1:00 p.m. EDT.

Fed Speak of note today. 3 speakers up today. See below for details.

President Trump participates in One, Big, Beautiful Event at 4:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: MU +0.31, WS +0.23, MLKN +0.16, FUL +0.10, SCS +0.06 of note.

Misses: JEF +0.04 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: FMFC, HCHL, JCAP of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced:

Jefferson Capital (JCAP) prices 10.0 million share IPO at $15.00 per share, at the low end of the $15-17 expected range.

Secondaries Filed or Priced:

KTOS announces proposed public offering of $500 million of common stock.

NATR announces launch of secondary public offering of up to 2,854,607 shares common stock.

KYMR announces proposed public offering of $250 million of shares of common stock.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed:

GLNG announces proposed offering of $500 million of convertible senior notes due 2030

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note: None of note.

Mixed Shelf Offerings: None of note.

News After The Close:

Micron (MU) beats by $0.31, beats on revs; guides Q4 EPS above consensus, revs above consensus.

Jefferies (JEF) misses by $0.04, beats on revs, Investment Banking net revenues up 6% yr/yr.

Sunrun (RUN) dispatches more than 340 megawatts of power in single evening to support the grid from coast to Coast.

Ralliant (RAL) to join the S&P 600 replacing Wolfspeed (WOLF) that will file for bankruptcy.

Client assets under administration at Raymond James (RJF) grew 9% year-over-year and 3% over the preceding month, primarily due to higher equity markets and net asset inflows.

Exchange/Listing/Company Reorg and Personnel News:

TREX announces that Brenda Lovcik has resigned as CFO to accept a position in Minnesota; The company has begun a search to identify the next CFO.

ASAN names Dan Rogers as CEO.

LOGC announces appointment of Michael Scarola as CFO, effective June 30.

LMT awarded a $250 mln modification to previously awarded US Navy contract.

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: SRE INVH ZBH GTY of note.

Stocks Ex Div Thursday of note: None of note.

Stocks Moving Up & Down After The Close:

Gap Up: WS+13.7%, MLKN +9.9%, FUL +6.6%, MU +2.2% of note.

Gap Down: BTBT -6.4%, KTOS -5.5%, NATR -4%, KYMR -3.9%, NUS -2.8%, SCS -3.4%, JEF -2.7% of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT)

Futures S&P 500 +21, NASDAQ 100 +106, Dow Jones +115. Europe is higher while Asia is higher ex Australia. Bond yields are higher at 4.279% from 4.29% on the 10-Year on Monday. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $107,261 from $107,095 lower by $-531(-0.49%).

Sector Action:

Daily Positive Sectors: Technology, Communication Services led the way.

Daily Negative Sectors: Real Estate, Consumer Defensive and Utilities led the way lower.

One Month Winners: Healthcare, Energy, Basic Materials, and Communication Services of note.

Three-Month Winners: Technology, Industrials, Communication Services of note.

Six-Month Winners: Communication Services, Financials, Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: NKE CNXC

Friday Before The Open: APOG

Notable Earnings of Note This Morning:

Beats: AYI+0.68, LNN +0.38, WBA +0.05 MKC +0.04 of note.

Misses: None of note.

Still to Report: PAYX of note.

Company Earnings Guidance:

Positive Guidance: MU, FUL of note.

Negative or Mixed Guidance: SCS of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: WS +15.8%, MLKN +10.2%, KEQU +10%, AYI +9.6%, ALT +9.3%, TBPH +6.8%, FUL +6.3%, GLNG +4.6%, MXCT +3.1%, SHEL +2.5%, MU +2.3% of note.

Gap Down: KTOS -7.2%, BTBT -6.8%, KYMR -4.2%, NATR -4.1%, RITR -3.1%, JEF -2.4% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Pivots to Tax Cuts to Calm Voters. (Bloomberg)

Markets Wrap: Dollar Falls as Trump Pressures Powell. (Bloomberg).

Shell (SHEL) clarifies that it has not been actively considering making an offer for BP and confirms it has not made an approach to, and no talks have taken place with, BP with regard to a possible offer.

Republican senators tell leadership that they are not ready to support the reconciliation bill and want changes. (Politico)

Waymo (unit of GOOGL) could be worth $45 billion based on Tesla (TSLA) Robotaxi launch. (WSJ)

Trump CIA Chief says Iran damage counters other intel report. (CNBC)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve Richmond President Tom Barkin speaks at 8:00 a.m. EDT.

Federal Reserve Cleveland President Beth Hammack speaks at 9:00 a.m. EDT.

Federal Reserve Governor Michael Barr speaks at 1:10 p.m. EDT.

Economic Releases:

May Durable Orders are due out at 8:30 a.m. EDT and are expected to rise to 6.6% from -6.6%.

Q1 GDP is expected to stay at -0.2%.

May Pending Home Sales are due out at 10:00 a.m. EDT and are expected to rise to 0.4% from -6.3%.

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

President Trump's Daily Schedule.

President Trump participates in One Big, Beautiful Event at 4:00 p.m. EDT.

There is a press briefing at 1:00 p.m. EDT.

M&A Activity: None of note.

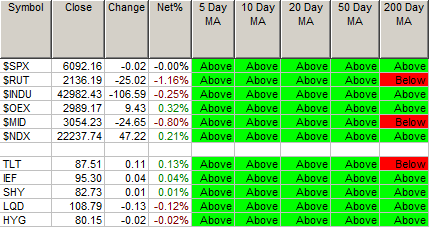

Moving Average Table: Hangs at 94% for Equities. Bonds continue to improve.

Meeting & Conferences of Note:

Sellside Conferences:

Guggenheim BioFrontier

Piper Sandler & Co. Obesity Day with ADA Takeaways

ROTH London Conference

Wolfe Research Biotech Day

Shareholder Meetings: AMS, CLLS, EQR, FURY, GDS, GIGM, KR, NEON

Top Analyst, Investor Meetings: BCTX, CRNX, DFDV, G, HFRO, JAGX, LEU, ONC, UPXI

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Advanced Automotive Battery Conference (AABC) Europe

Morningstar Investment Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: FWRD TFC of note.

Downgrades: ASML NFE of note.