QPI Morning Note For 06/25/25: Day Two of Chairman Powell To The Senate, Stocks Mixed.

Overnight Summary & Early Morning Trading:

The S&P 500 finished Tuesday higher by 1.11% at 6092.11 from Monday higher by 0.96% at 6025.17.

Futures are lower this morning by -4.25 (-0.07%) at 6129 around 6:15 a.m. EDT.

The cash range is now 100 points on the S&P 500 cash for the year, 6000 to 6100. Year to date the S&P 500 is up by 3.58% from 2.44% on Monday's close.

Executive Summary:

Fed Chairman Powell concludes two days of testimony on the Hill as he appears before the Senate today. Can the S&P 500 and the NASDAQ 100 take out their February highs? If so, then we are breaking out and more upside ahead. Yields are dropping on the 10-Year and 20-Year.

Breaking News:

Weekly MBA Mortgage Applications rose +1.1% this morning.

Chart of the Day: FedEx (FDX) is lower this morning by -5% on weak earnings and guidance, the shorts got it right.

Key Events of Note Today:

New Home Sales are out at 10:00 a.m. EDT and Crude Oil Inventories at 10:30 a.m. EDT.

5-Year Note Auction at 1:00 p.m. EDT.

Fed Speak of note today. 2 speakers up today. See below for details.

Federal Reserve Chairman Powell testifies before the Senate today.

President Trump returns from the NATO Summit this morning.

Notable Earnings Out After The Close:

Beats: AVAV +0.23, WOR +0.23, FDX +0.22 of note.

Misses: None of note.

Flat: BB of note.

Capital Raises:

IPOs For The Week: FMFC, HCHL, JCAP of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

ALLT files for share ordinary share offering.

QXO files for $2 billion common stock offering.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

CURV announces launch of secondary offering of 10 million common stock.

LIMN files for 21,154,961 share common stock offering by selling shareholders, relates to warrants.

Mixed Shelf Offerings

GAU files for $500 million mixed securities shelf offering.

News After The Close:

Walmart (WMT) ticks slightly lower as it considers opening "dark stores" closed to the public to speed up delivery. (Bloomberg)

OUTFRONT Media (OUT) announces restructuring and reduction in force plan; includes reduction of workforce by 120 employees and costs of $18.6 million.

Exchange/Listing/Company Reorg and Personnel News:

NPCE appoints Patrick Williams as CFO, effective since June 20.

JACK announces return of Shannon McKinney as senior vice president, COO and new member of the executive leadership team.

NetApp (NTAP) hires former Zscaler, Salesforce and Microsoft executive Syam Nair as its new Chief Product Officer, effective July 7.

Buybacks:

CURV share repurchase in addition to selling shareholders.

Mixed Shelf Offerings: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: HDB NXPI STX BFC of note.

Stocks Ex Div Thursday of note: of note. SRE INVH ZBH GTY

Stocks Moving Up & Down After The Close:

Gap Up: HURA +25.3%, QS +19.7% WOR +11.3%, BB +6.6%, MIR +5.7%, VSTM +5.3%, DDD +2.4% of note.

Gap Down: KBH -2.6%, CURV -25.3%, ALLT -8.1% FDX -4.8%, SITM -3.6%, GAU -3.3%, AVAV -3.3% of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT)

Futures S&P 500 +1.50, NASDAQ 100 +44, Dow Jones -43. Europe is lower while Asia is higher. Bond yields are higher at 4.29% from 4.346% on the 10-Year on Monday. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold higher with Silver lower and Copper higher. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $107,095 from $105,315 higher by $1597 (+1.51%).

Sector Action:

Daily Positive Sectors: Technology, Financials, Communication Services, Healthcare, Consumer Cyclical and Industrials led the way.

Daily Negative Sectors: Energy was the only notable loser.

One Month Winners: Healthcare, Energy, Basic Materials, and Communication Services of note.

Three-Month Winners: Technology, Industrials, Communication Services of note.

Six-Month Winners: Communication Services, Financials, Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

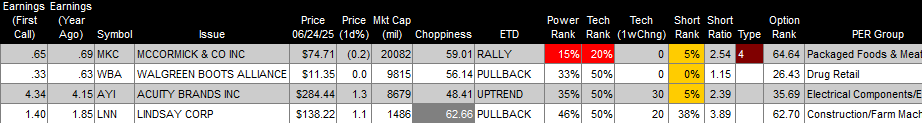

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Beats: GIS +0.03, WGO +0.02 of note.

Misses: None of note.

Still to Report: PAYX of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: QS +33.9%, LIMN +22%, BB +11.3%, WOR +10.7%, ATEX +9.5%, ECX +5.5%, ALVO +4.9%, MIR +3.9%, ARRY +3.3%, DDD +2.8%, HIVE +2.4%, JACK +2.2%, VSTM +2% of note.

Gap Down: CURV -27.1%, CURV -27.1%, ALLT -10.8%, FBRX -8.8%, CDTX -7.3%, QXO -5.9%, FDX -5.7%, SITM -3% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: President Trump Disputes Pentagon View, Says Iran Atomic Sites Destroyed. (Bloomberg)

Markets Wrap: Stock Futures are steady ahead of day two of Powell. (Bloomberg).

Huge upset in NYC Mayorial Race as Socialist Mamdani wins. (Bloomberg)

Powell moves to the Senate for Day 2 of testimony. (Bloomberg)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve Chicago President Austan Goolsbee speaks at 8:00 a.m. EDT.

Federal Reserve Chairman Powell testifies before the Senate at 10:00 a.m. EDT.

Economic Releases:

May New Home Sales are due out at 8:30 AM ET and expected to fall to 700,000 from 743,000.

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

President Trump's Daily Schedule.

President Trump returns from the NATO Summit this morning and arrives back in Washington D.C. at 6:50 p.m. EDT.

M&A Activity: None of note.

Moving Average Table: Moves to 94% from 50% for Equities. Bonds continue to improve.

Meeting & Conferences of Note:

Sellside Conferences:

Guggenheim BioFrontier

Jefferies Space Summit

JP Morgan Energy, Power, Renewables & Mining Conference

JP Morgan US Credit Roadshow

Morgan Stanley Life Sciences Data and AI Conference

Northland Growth Conference

RBC Capital Markets Automotive Fixed Income Conference

TD Cowen's Tools/Dx Revolution Conference

Truist Securities Healthcare Disruptors & Digital Health Summit

UBS SMID-Cap Multisector

UBS Spring Biotech Conference

Shareholder Meetings: AEO, AFRM, BB, EBAY, HTOO, LIEN, LU, NIO, NVDA, ZH

Top Analyst, Investor Meetings: ACAD, DFDV, ELTX, EQIX, NNOX, NXDT, OTLK

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Chips to Systems Conference (DAC)

iAccess Alpha Best Ideas Summer Investment Conference

International Neoantigen Summit

Morningstar Investment Conference

NATO Summit concludes today in Europe.

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: DUK STLA YUM of note.

Downgrades: ACDC WEC WPP of note.