QPI Morning Note For 06/24/25: Stocks Trading Higher On Israel-Iran Cease Fire That Is In Jeopardy, Powell To The Hill Next Two Days

Overnight Summary & Early Morning Trading:

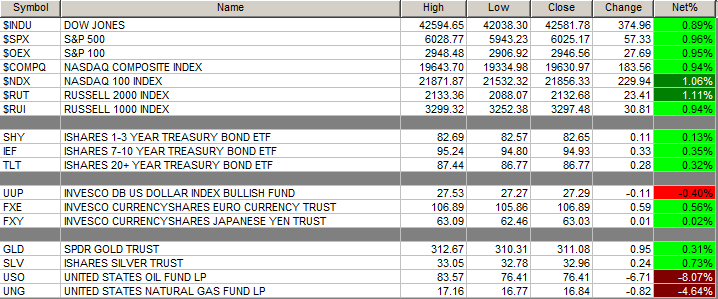

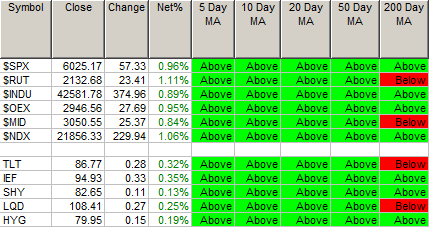

The S&P 500 finished Monday higher by 0.96% at 6025.17 from Friday lower by -0.22% at 5967.84.

Futures are higher this morning by +52.25 (+0.86%) at 6129 around 6:00 a.m. EDT.

The cash range is now 100 points on the S&P 500 cash for the year, 6000 to 6100. Year to date the S&P 500 is up by 2.44% from 1.47% on Friday's close.

Executive Summary:

Well, President Trump negotiated a cease-fire after the close and now it appears Israel is not going to adhere to it as they want to destroy Iran. FUBAR. The other catalyst for today is Fed Chairman Powell begins two days of testimony on the Hill.

Breaking News:

Israel accuses Iran of breaking the cease-fire at 3:30 a.m. EDT. IDF says they will respond with force. Trump is heading to the NATO Summit shortly.

Key Events of Note Today:

Consumer Confidence is out at 10:00 a.m. and Case Schiller Housing Index is out at 9:00 a.m. EDT. API Petroleum Index is out at 4:30 p.m. EDT.

11:30 a.m. EDT sees a 3 & 6 Month Treasury Bill Auction.

Fed Speak of note today. 5 speakers up today. See below for details.

Federal Reserve Chairman Powell to testify before the House today and the Senate tomorrow.

President Trump heads off to a NATO Summit this morning.

Notable Earnings Out After The Close:

Beats: KBH +0.04 of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: FMFC, HCHL, JCAP of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced: None of note.

Notes Priced:

SNEX - Pricing of $625.0 Million of Senior Secured Notes due 2032.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

NA US$500 Million Convertible Notes Private Placement for BNB Treasury Strategy.

Selling Shareholders of note:

CHWY announces public offering of Class A common stock by selling stockholder.

DRTS files for 3,463,202 ordinary share offering by selling shareholders.

Mixed Shelf Offerings: None of note.

News After The Close:

President Trump claimed to have negotiated a cease-fire between Israel and Iran.

KB Home (KBH) lowers FY25 housing revenue, average selling price, and housing gross profit margin guidance.

Meta Platforms (META) moved lower following a report it held deal talks with Runway AI. (Bloomberg)

LPL Financial (LPLA) advisory and brokerage assets at the end of May were $1.85 trillion, an increase of $66.6 billion, or 3.7%, compared to the end of April 2025.

Starbucks (SBUX) was higher following report the company was weighing sale of its China business, later denied.

GD awarded a $621 million modification to US Army contract.

Exchange/Listing/Company Reorg and Personnel News:

UDR appoints Dave Bragg as CFO.

ZS CTO Syam Nair to step down, effective July 4.

Buybacks:

THO announces re-authorization of $400 million share buyback.

CHWY announced a concurrent share repurchase of up to $150 million to selling shareholders.

MRNO files for 129,765,157 ordinary share offering by selling shareholders.

DTE board elects Joi Harris as CEO; Jerry Norcia elected executive board chairman.

Dividends Announcements or News

Stocks Ex Div Today of note:DIS STM EQR UMC MTN POR ARCO of note.

Stocks Ex Div Wednesday of note: HDB NXPI STX BFC of note.

SITC declares $1.50/sh special distribution.

Stocks Moving Up & Down After The Close:

Gap Up: HURA +25.3%, NKTR +23.8%, DHX +3.7%, CIFR +2.8%, IMDX +2.5% of note.

Gap Down: KBH -2.6%, CHWY -2.7% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 , NASDAQ 100 , Dow Jones . Europe is higher while Asia is higher as well. Bond yields are higher at 4.346% from 4.391% on the 10-Year on Friday. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold and Silver lower with Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $105,315 from $101,521 higher by $2355 (+2.29%).

Sector Action:

Daily Positive Sectors: Consumer Cyclical, Real Estate, Materials, Utilities and Industrials led the way.

Daily Negative Sectors: Energy was the only notable loser.

One Month Winners: Healthcare, Energy, Basic Materials, and Communication Services of note.

Three-Month Winners: Technology, Industrials, Communication Services of note.

Six-Month Winners: Communication Services, Financials, Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

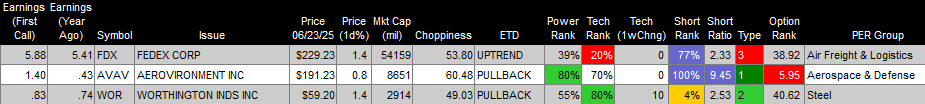

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: FDX, AVAV and WOR of note.

Wednesday Before The Open: PAYX, GIS and WGO of note.

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: None of note.

Still to Report: CCL SNX of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: NKTR +31.8%, LIMN +21.4%, NA +21.2%, TERN +8.4%, CIFR +7.4%, LAES +6.4%, BTM +6.4%, CDTX +4.4%, PHAR +3.6%, ACNT +3.1%, SMCI +2.8%, MA +2.3%of note.

Gap Down: HURA -4%, BZ -2.7%, CHWY -1.9%, IPGP -1.9%, DHX -1.9% of note.

Insider Action: No names sees Insider Buying with dumb short selling. No names see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Tells Israel to Stop Dropping Bombs. (Bloomberg)

Markets Wrap: Stock Futures rise as oil falls in price and optimism rises on truce. (Bloomberg).

Trump Truce falters as Israel claims foul on Iran. (Yahoo Finance)

Powell heads to the Hill for grilling over rates staying high. (Bloomberg)

5 Things To Know Before The Market Opens. (CNBC)

Big Take: Why Oil prices have not soared. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve Cleveland President Beth Hammack speaks at 9:15 a.m. and 10:15 a.m. EDT.

Federal Reserve Chairman Powell testifies before the House Financial Services Committee at 10:00 a.m. EDT.

Federal Reserve New York President John Williams speaks at 12:30 p.m. EDT.

Federal Reserve Boston President Susan Collins speaks at 2:05 p.m. EDT.

Federal Reserve Governor Michael Barr speaks at 4:00 p.m. EDT.

Economic Releases:

June Consumer Confidence is due out at 10:00 a.m. EDT and are expected to rise to 99 from 98.

President Trump's Daily Schedule.

President Trump heads off to the NATO Summit this morning.

M&A Activity: None of note.

Moving Average Table: Moves to 94% from 50% for Equities. Bonds continue to improve.

Meeting & Conferences of Note:

Sellside Conferences:

Goldman Sachs Building an Investment Framework Conference

Guggenheim BioFrontier

Jefferies Space Summit

JP Morgan Energy, Power, Renewables & Mining Conference

Morgan Stanley Life Sciences Data and AI Conference

Raymond James Small Cap Bank Day

RBC Capital Markets Automotive Fixed Income Conference

TD Cowen's Tools/Dx Revolution Conference

Truist Securities Healthcare Disruptors & Digital Health Summit

UBS SMID-Cap Multisector

UBS Spring Biotech Conference

Wainwright 3rd Annual Immune Cell Engager Conference

Shareholder Meetings: ADXN, AFYA, CAAS, ET, KMX, MA, STK, SUN

Top Analyst, Investor Meetings: ANVS, CF, HOTH, IOT, REPL, WM

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

iAccess Alpha Best Ideas Summer Investment Conference

NATO Summit begins later this afternoon in Europe.

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: EA LYFT NEXT of note.

Downgrades: AAP RH SM VTLE of note.