QPI Morning Note For 06/23/25: Stocks Trading Mostly Lower Post Iran Raid By U.S.

Overnight Summary & Early Morning Trading:

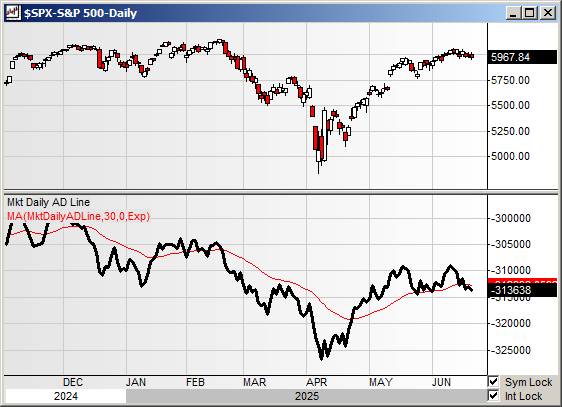

The S&P 500 finished Friday lower by -0.22% at 5967.84 from Wednesday lower by -0.03% at 5980.87.

Futures are higher this morning by +13.25 (+0.22%) at 6031 around 6:00 a.m. EDT.

The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up by 1.47% from 1.72% on Friday's close.

Executive Summary:

Well, President Trump hit Iran on Saturday night in a similar fashion to Top Gun: Maverick 2. It appears to be a success. Now we wait to see if or how Iran retaliates. The most likely responses would be a cyber attack. Stocks have recovered overnight losses. So far this action is a win as a threat to the U.S. and the world has been greatly reduced.

Quote of the Day:

"Now is the time for peace." President Trump on Truth Social over the weekend.

Breaking News: None of note.

Key Events of Note Today:

Existing Home Sales are out at 10:00 a.m. and Global Manufacturing PMI and Services PMI are out at 9:45 a.m. EDT.

11:30 a.m. EDT sees a 3 & 6 Month Treasury Bill Auction.

Fed Speak of note today. 5 speakers up today. See below for details.

President Trump attends a National Security Meeting at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: FMFC, HCHL, JCAP of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced: None of note.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed:

SMCI announces intention to offer $2.0 billion aggregate principal amount of convertible senior notes due 2030.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

XGN files for 1.15 million share common stock offering by selling shareholder.

CELH files prospectus supplement for 22,451,224 share common stock offering by selling shareholder.

TVGN also files for 30,728,804 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

STT files mixed securities shelf offering.

FIS files mixed securities shelf offering.

BTM files for $100 million mixed securities shelf offering.

IKT files for $300 million mixed securities shelf offering.

TVGN files for $150 million mixed securities shelf offering;

News After The Close:

The U.S. attacked Iran on Saturday night as it bombed several different facilities that were enriching uranium.

Rogers Communication (RCI) closes its CDN$7 billion equity investment from funds managed by Blackstone (BX).

Walmart (WMT) to pay $10 million to settle FTC charges that it turned a blind eye to scammers who used its in-store money transfer services

Apple (AAPL) ticking slightly higher on report it held internal talks about buying AI startup Perplexity. (Bloomberg)

Steris (STE) awarded a maximum $450 million modification exercising option period of a five-year base Defense Logistics Agency contract.

Exchange/Listing/Company Reorg and Personnel News:

Factset (FDS) names Sanoke Viswanathan as CEO.

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: JCI FDX WRB CINF TKC DX of note.

Stocks Ex Div Tuesday of note: DIS STM EQR UMC MTN POR ARCO of note.

Stocks Moving Up & Down After The Close:

Gap Up: SAGE (9.18 +36.94%), URGN (14.89 +23.77%), EVH (9.41 +13.78%), GMS (101 +32.84%), BLMN (9.5 +17.8%), CBRL (59.44 +14.18%), AAOI (23.24 +50.19%), SATS (25.07 +48.87%), JBL (204.65 +16.38%), MXL (13.28 +13.8%), CRK (30.41 +20.06%) of note.

Gap Down: SWBI -13.2%, SRPT (20.23 -44.09%), SGRY (19.4 -14.69%), MESO (10.5 -10.87%), SLP (17.11 -10.28%), CENX (16.77 -12.04%), RUN (6.28 -37.2%), ENPH (35.9 -21.27%), SEDG (16.59 -28.82%), FSLR (145.36 -17.03%), PRO (14.00 -11.31%) of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 -7, NASDAQ 100 -31, Dow Jones -79. Europe is lower ex the FTSE while Asia is lower ex Hong Kong and Shanghai. Bond yields are higher at 4.391% from 4.41% on the 10-Year on Friday. Crude Oil and Brent Crude is higher with Natural Gas higher as well. Gold is lower with Silver higher and Copper lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $101,521 from $106,138 higher by $2410 (+2.45%) but was below $99,000 after the raid.

Sector Action:

Daily Positive Sectors: Energy, Consumer Defensive, Financials and Utilities were positive sectors.

Daily Negative Sectors: Communication Services, Materials, Healthcare, Technology and Consumer Cyclicals were notable losers.

One Month Winners: Healthcare, Energy, Basic Materials, and Communication Services of note.

Three-Month Winners: Technology, Industrials, Communication Services of note.

Six-Month Winners: Communication Services, Financials, Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

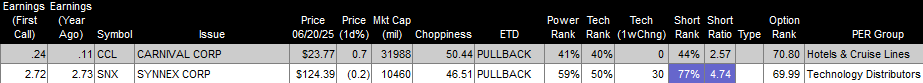

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close:

Tuesday Before The Open:

Notable Earnings of Note This Morning:

Beats: None of note.

Misses: FDS -0.03, CMC -0.11 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: EXEL +23.9%, SQNS +18.1%, FI +6.7%, WVE +4.6%, FFAI +3.6%, CANG +2.5%, LRMR +2.3% of note.

Gap Down: CMPS -34.6%, VZLA -5.5%, NVO -4%, XGN -3.2%, BTM -2.7%, CMC -2.4%, BIOA -2.1%, STLA -2% of note.

Insider Action: VAC sees Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Iran's Payback Threat For US Strike Keeps World Powers on Alert. (Bloomberg)

Markets Wrap: Stock Futures rise as fears of Oil Shock drop. (Bloomberg).

Iran's Parliament backs blocking the Strait of Hormuz. (CNBC)

U.S. calls on China to pressure Iran to keep the Strait of Hormuz open. (CNBC)

Big Take: A weakened Iran can still inflict pain on the U.S. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve Governor Christopher Waller speaks at 3:0 a.m. EDT.

Federal Reserve Governor Michelle Bowman speaks at 10:00 a.m. EDT.

Federal Reserve Chicago President Austan Goolsbee speaks at 1:10 p.m. EDT.

Federal Reserve Governor Adrian Kugler speaks at 2:30 p.m. EDT.

Federal Reserve New York President John Williams speaks at 2:30 p.m. EDT.

Economic Releases:

May Existing Home Sales are due out at 10:00 a.m. EDT and are expected to drop to 3.94 million from 4.00 million. Also, Manufacturing and Service PMIs are due out at 9:45 a.m. EDT.

President Trump's Daily Schedule.

President Trump attends a National Security Meeting at 1:00 p.m. EDT.

M&A Activity: None of note.

Moving Average Table: Moves to 50% from 47% for Equities. Bonds continue to improve.

Meeting & Conferences of Note:

Sellside Conferences:

BAC Commodities Conference

TD Cowen's Tools/Dx Revolution Conference

Shareholder Meetings: DTCK, GEHC, TVGN

Top Analyst, Investor Meetings: AMGN, LEU, MRK, NUVB

Fireside Chat: None of note.

FDA Presentation:

MRK: PDUFA Date for KEYTRUDA KEYNOTE-689

NUVB: PDUFA Date for ROS1+ NSCLC

SANA: Data Presentation for UP421

R&D Day: None of note.

Meetings:

ADA Scientific Sessions

Congress of the European Academy of Neurology (EAN) - Helsinki

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: AMD EL of note.

Downgrades: CCCS DOW LINE of note.