QPI Morning Note For 06/20/25: Stocks Modestly Lower To End Week, No Imminent Bombing By U.S. on Iran

Overnight Summary & Early Morning Trading:

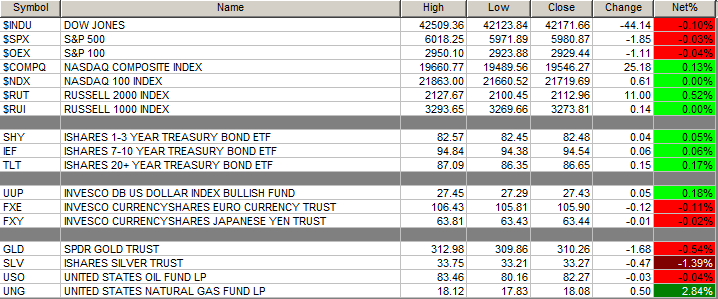

The S&P 500 finished Wednesday lower by -0.03% at 5980.87 from Tuesday lower by -0.84% at 5982.72.

Futures are lower this morning by -7 (-0.12%) at 6027 around 7:45 a.m. EDT.

The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up by 1.72% from 2.52% on Friday's close.

Executive Summary:

Well, FOMC day has come and gone. The Fed did alter a few things. First, they noted that the unemployment rate stays low from "stabilizing at a low level in recent months". The economic outlook has "diminished but remains elevate" from "increased further". As Scooby Doo would say, "Rut roh Shaggy". They admitted the economy is starting to slow even if it is in Fed Speak. Last, they removed "the risks of higher unemployment and higher inflation have risen". Yet, they are admitting that they are winning or have won the battle on inflation but are not willing to cut rates. Do not worry, they will.

Quote of the Day:

"For traders, there’s one takeaway bigger than any other - and that’s that this particular FOMC, if it were held at some point in the past when the market was more pessimistic, would have likely taken the market lower. However, the fact that the market closed almost perfectly flat today tells us that thankfully, the market is resilient to the massive continued pressure that the Fed is putting on the economy. That sets up extremely well for our base case, which is that when rates do eventually fall, and fall hard, the stock market is poised for a spring-loaded rally the likes of which are rarely seen historically." Justin Nugent, Market Rebellion's The Rebel Roundup.

Breaking News: None of note.

Key Events of Note Today:

Leading Indicators out at 10:00 a.m. and Baker Hughes Rig Count out at 1:00 p.m. EDT.

Fed Speak speakers are out of the blackout after Thursday's meeting. Federal Reserve San Francisco President Mary Daley speaks this afternoon.

President Trump attends a National Security Meeting then heads to Bedminster, NJ for a MAGA Dinner at 7:30 p.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: SWBI -0.03 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: CAI, SLDE of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

MMA - Closing of $5.0 Million Underwritten Offering

RCAT - Closing of $46.75 Million Registered Direct Offering of Common Stock

Notes Priced:

AMCX - Pricing of Private Offering of $400 Million of 10.50% Senior Secured Notes due 2032

BLCO - Pricing of Upsized Senior Secured Notes Offering

DAR - Pricing of Offering of €750 Million of Senior Notes Due 2032 by Darling Global Finance B.V.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: QNCX - Closing of Up to $22 Million Private Placement of Securities

Selling Shareholders of note:

LODE files for 2.2 million share common stock offering by selling shareholders

Mixed Shelf Offerings: None of note.

News After The Close:

Prothena (PRTA) initiates an approximate 63% reduction in its workforce to substantially reduce its operating costs to those necessary to support its remaining wholly owned programs, its obligations to partnered programs, and its anticipated business development activities.

Simulations Plus (SLP) pushes back release of Q3 (May) earnings to July 14 after the close from July 2.

DOJ and SEC close investigations into Innodata (INOD) without any enforcement actions.

GD awarded a $987 mln modification to previously awarded US Navy contract.

Brazil Central Bank raises interest rate to 15%.

Exchange/Listing/Company Reorg and Personnel News:

PSTL announces that CFO Robert Klein intends to resign in order to accept a position with a privately-held real estate company; President Jeremy Garber will serve as interim CFO while the company conducts a search process for a permanent successor.

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: None of note.

Stocks Ex Div Monday of note: None of note.

Stocks Moving Up & Down After The Close:

Gap Up: GRRR +18%, PRTA +6.1%, APG +4.2%, SLP +4.1%, ANNX +3.8%, NUVB +2.8%, of note.

Gap Down: SWBI -13.2% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT)

Futures S&P 500 -6, NASDAQ 100 -23, Dow Jones -62. Europe is higher while Asia is lower ex China. Bond yields are higher at 4.41% from 4.375% on the 10-Year on Wednesday. Crude Oil is higher while Brent Crude is lower with Natural Gas higher. Gold, Silver and Copper are lower. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $106,138 from $104,475 higher by $1872 (+1.80%).

Sector Action:

Daily Positive Sectors: Financials, Technology, Real Estate and Utilities were positive sectors.

Daily Negative Sectors: Energy, Communication Services, Materials and Healthcare were notable losers.

One Month Winners: Healthcare, Energy, Basic Materials, and Communication Services of note.

Three-Month Winners: Technology, Industrials, Communication Services of note.

Six-Month Winners: Communication Services, Financials, Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Today After the Close: None of note.

Monday Before The Open:

Notable Earnings of Note This Morning:

Beats: KMX +0.22, ACN +0.17 of note.

Misses: DRI -0.38 of note.

Still to Report: KR of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line is in consolidation mode.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: GMS +25%, GRRR +13.2%, SOL +6.7%, BKKT +6.2%, PRTA +5.4%, SMLR +5%, APG +4.4%, NUVB +3.9%, ANNX +3%, FICO +2.6% of note.

Gap Down: SWBI -12.2%, RGR -5%, ACB -3.2%, FINV -3.2%, MNSO -2.8%, ORN -2.8%, TLX -2.7% of note.

Insider Action: GIII PANL ARDX see Insider Buying with dumb short selling. NAMS WSC see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Hints He'll Hold Off Iran Strike , Give Diplomacy A Chance. (Bloomberg)

Markets Wrap: Stock Futures gain, Oil eases as Trumps weighs on Iran Role. (Bloomberg).

Meta Platforms (META) tried to buy Ilya Sutskever;s AI Startup for $32 billion but now trying to hire Ilya. (CNBC)

Big Take: Trump is driving off investors and threatening the Dollar's reign. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today

Federal Reserve San Francisco President Mary Daley speaks at 1:20 p.m. EDT.

Economic Releases:

May Leading Indicators are due out at 10:00 a.m. EDT and are expected to drop by -0.10% from -1.0%.

President Trump's Daily Schedule.

President Trump attends a National Security Meeting at 11:00 a.m. EDT.

President Trump heads to Bedminster, NJ at 2:00 p.m. EDT for a MAGA Dinner at 7:30 p.m. EDT.

M&A Activity: None of note.

Moving Average Table: Moves to 47% from 43% for Equities. Bonds improved.

Meeting & Conferences of Note:

Sellside Conferences: None of note.

Shareholder Meetings: BILI, CRON, EURK, JD, LRFC

Top Analyst, Investor Meetings: BBNX, REGN, SENS

Fireside Chat: None of note.

FDA Presentation:

CORT: Data Presentation on Korlym

LCTX: Data Presentation on OpRegen

REGN: PDUFA Decision on Dupixent

VRTX: Data Presentation on Zimislecel

R&D Day: None of note.

Meetings:

ESMO Gynaecological Cancers Congress

World Conference on Infectious Diseases

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: EPR of note.

Downgrades: JACK of note.