QPI Morning Note For 06/10/25: Stock Futures Are Mixed As Markets Await News On US and China Trade Talks

Overnight Summary & Early Morning Trading:

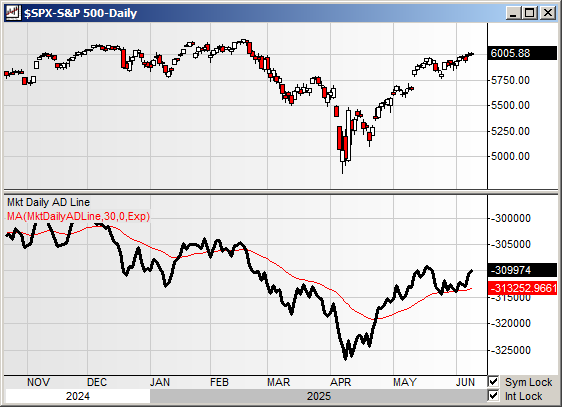

The S&P 500 finished Monday higher by 0.09% at 6005.88 from Friday higher by 1.03% at 6000.36.

Futures are higher this morning by +6 (0.10%) at 6016.25 around 6:25 a.m. EDT.

The cash range is now 100 points on the S&P 500 cash for the year, 6000 to 6100. Year to date the S&P 500 is up by 2.11% from 2.02% on Friday's close.

Executive Summary: This is inflation week with CPI and PPI due out. Earnings are quiet. Trump quiet? Unlikely. The Apple World Wide Developer's Conference was yesterday and Apple failed to impress.

Key Events of Note Today:

NFIB was out and came in at 98.8 from 95.8 last month.

3 Year Note Auction at 1:00 p.m. EDT.

Fed Speak speakers in blackout until after next week's meeting.

President Trump heads to Fort Bragg today.

Notable Earnings Out After The Close:

Beats: CASY +0.68 of note.

Misses: CVGW -0.13 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

AIRS launches 3.16 million share offering.

ONDS announces proposed public offering of common stock and pre-funded warrants.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed:

XMTR announces proposed $225 million offering of convertible senior notes due 2030.

CBRL announces proposed private offering of $275 million convertible senior notes due 2030.

GRAB announces $1.25 billion convertible notes offering.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

NATR files for 2,854,607 shares of common stock offering by selling shareholder.

NNE files for 3,888,889 share common stock offering by selling shareholders.

Mixed Shelf Offerings: None of note.

News After The Close:

Leonardo DRS (DRS) awarded $41 million contract with the Naval Sea Systems.

Cohen & Steers (CNS) reports May preliminary assets under management (AUM) of $88.6 billion, an increase of $1.1 billion at April 30, 2025.

Health and Human Services Secretary Robert F. Kennedy Jr. is retiring all members of CDC panel advising US on vaccines. (CNBC)

AT&T (T) reiterates FY25 financial and operational guidance ahead of investor conference today.

Walt Disney (DIS) finally resolves price to be paid by Disney to NBCU to purchase NBCU's interest in Hulu.

ZoomInfo (GTM) announces a 6% workforce reduction; also reaffirms Q2 and FY25 guidance.

Exchange/Listing/Company Reorg and Personnel News:

Avis (CAR) names Daniel Cunha CFO as of 7/1 as Izzy Martina is leaving to pursue other opportunities.

SYM announces appointment of Izzy Margins as CFO, effective August 9, 2025; She joins company from Avis Budget Group, see above.

FCPT appoints Douglas Hansen as the new Chair of the Board of Directors, effective immediately.

PARA announces that CFO Naveen Chopra is departing to pursue other opportunities; Andrew Warren appointed interim CFO.

RBLX appoints Naveen Chopra as its new CFO, effective June 30.

Buybacks: None of note.

Dividends Announcements or News

Stocks Ex Div Today of note: ELV TRV ROST FIS OXY AEE PPL STE OMC UMBF VFC NJR VCTR CNO TFSL YOU JOE.

Stocks Ex Div Wednesday of note: HPQ BAH REG SR.

FDX increases quarterly cash dividend 5% to $1.45/share from $1.38/share.

CASY increases quarterly dividend by 14% to $0.57 per share.

Stocks Moving Up & Down After The Close:

Gap Up: SKIL +16.3%, CASY +8.6%, QRTX +7.9%, CNS +4.9%, NOVT +2% of note.

Gap Down: CVGW -15.1%, LAKE -12.8%, AIRS -11.3%, LMNR -7.6%, CBRL -3.4%, XMTR -3.3% of note.

What’s Happening This Morning: (as of 7:50 a.m. EDT) Futures S&P 500 +5.25, NASDAQ 100 +20, Dow Jones -15. Europe is lower ex the FTSE while Asia is higher. Bonds are at 4.45% from 4.48% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $109,420 from $107,211 higher by $789 (0.73%).

Sector Action:

Daily Positive Sectors: Consumer Cyclical, Materials, Technology, Real Estate and Energy were higher of note.

Daily Negative Sectors: Financials, Utilities, Consumer Defensive and Communication Services of note.

One Month Winners: Communication Services, Technology, Industrials, Consumer Cyclicals, Financials of note.

Three-Month Winners: Technology, Industrials, Communication Services, Financials and Utilities of note.

Six-Month Winners: Communication Services, Financials, Consumer Defensive, Utilities and Materials of note.

Twelve-Month Winners: Financials, Communication Services, Technology, Consumer Cyclical, Industrials and Utilities and of note.

Year to Date Winners: Materials, Financials, Utilities, Industrials and Communication Services of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close: GME SFIX PLAY GTLB of note

Wednesday Before The Open: CHWY VSCO SAIL of note.

Notable Earnings of Note This Morning:

Beats: UNFI +0.22, SJM +0.07 of note.

Misses: None of note.

Still to Report: CNM ASO of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: SJM of note.

Advance/Decline Daily Update: The A/D Line was strong again on Monday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: SKIL +13.6%, CASY +10.4%, QTRX +8.9%, CNS +5%, IBTA +4.1%, RXRX +3%, CVEO +2.8%, LODE +2.6%, IMOS +2.2%, NOVT +2% of note.

Gap Down: AIRS -25.7%, ONDS -15.5%, LAKE -15.1%, CVGW -13.9%, LMNR -13%, SEZL -4.7%, AGAE -4.3%, XMTR -4%, CBRL -3.7%, NATR -2% of note.

Insider Action: APPF sees Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: US Deploys Marines to LA. (Bloomberg)

Markets Wrap: Stock Futures hover on second day of trade talks. (Bloomberg).

Freeport (FCX) CEO says tariffs could hurt the copper industry. (Bloomberg)

Meta (META) wants to create "superintelligence" artificial intelligence team (Bloomberg)

President Trump ordered 700 Marines to Los Angeles to support National Guard. They will not participate in law enforcement unless the Insurrection Act is invoked. (Politico)

U.S. and China talks continue in London. (Reuters)

Paramount (PARA) to cut 3% of workforce.

Big Take: The clash over ICE Raids in LA. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

May NFIB Small Business Optimism is due out at 6:00 a.m. EDT and came in last month at 95.80.

Weekly API Petroleum Institute Data is due out at 4:30 p.m. EDT.

President Trump's Daily Schedule.

President Trump heads to Fort Bragg, NC and attends a military demonstration at 2:40 p.m. EDT.

President Trump delivers remarks at 4:00 p.m. EDT and then heads back to the White House at 6:00 p.m. EDT.

Federal Reserve Speakers none of note today as they are in a blackout until next week's meeting is over.

M&A Activity: None of note.

Moving Average Table: Remains at 94% for Equities.

Meeting & Conferences of Note:

Sellside Conferences:

BMO Software Conference

Bank of America Asia Conference

BMO Software Conference

D.A. Davidson Technology + Consumer Conf

DA Davidson ACG Boston: DealFest Northeast

Evercore ISI Consumer & Retail Conference

Evercore ISI Global Automotive OEM Dealer & Supplier Conference

Goldman Sachs Healthcare Conference

Jefferies Airlines Summit

Jefferies Energy Golf Conference

Mizuho Technology Conference

Morgan Stanley U.S. Financials Conference

Oppenheimer Consumer Growth

RBC's Financial Technology Conference

Rosenblatt Securities Technology Summit

Wells Fargo Industrials & Materials Conference

Shareholder Meetings: ARI, CROX, DADA, HCI, GES, NXDT, TJX, TLRY, TWLO

Top Analyst, Investor Meetings: AAON, CGNX, CNO, DE, FTV, JAZZ, MRVL, TSM

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

AAAE Conference & Exposition

AAPL's Worldwide Developer Conference (Day 2)

Cisco Live

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: AUB QSG YUM of note.

Downgrades: MCD DPZ TTGT of note