QPI Morning Note For 06/03/25: Stock Futures Lower On OECD Comments on Tariffs

Overnight Summary & Early Morning Trading:

The S&P 500 finished Monday higher by +0.41% at 5935.94 from Friday lower by -0.01% at 5911.69.

Futures are lower this morning by -24.50 (-0.41%) at 5922.75 around 6:00 a.m. EDT.

The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up by 0.92% from 0.51% on Friday's close.

Executive Summary:

Strong words today from the JP Morgan Trading Desk, "...tariffs are a net negative .. WHEN does this become fully apparent in the macro data. Our best guess is either July or August .. “.. if we get to the point that NFP is printing materially below 100k AND there is no change to the trade war rhetoric, this is a market that will crumble.” I look forward to July/August and see if this is hyperbole.

Key Events of Note Today:

Construction Spending and JOLTS out this morning with API Petroleum Inventories out at 4:30 p.m. EDT.

Fed Speak today of note.

Federal Reserve Chicago President Austan Goolsbee speaks at 12:45 p.m. EDT.

Federal Reserve Governor Lisa Cook speaks at 1:00 p.m. EDT.

Federal Reserve Dallas President Lorrie Logan speaks at 3:30 p.m. EDT.

President Trump has a quiet day with nothing on the schedule.

Notable Earnings Out After The Close:

Beats: CREDO +0.08 of note.

Misses: Noneof note.

Flat: None of note.

Capital Raises:

IPOs For The Week: CRCL FMFC OMDA

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

TRVI announces proposed public offering of $100 million of common stocks.

MSTR announces proposed initial public offering of STRD Stock; Also, 2.5 million shares of Strategy’s 10.00% Series A Perpetual Stride Preferred Stock.

AYTU: Form S-1.. 6,741,573 shares of Common Stock.

MBRX: Form S-1.. Up to 10,989,010 Shares of Common Stock and up to 21,978,020 Accompanying Series E Warrants to Purchase up to 21,978,020 Shares of Common Stock.

RMCO: Form S-3.. $50,000,000 Common Stock, Warrants and Units.

Notes Priced:

LIF prices offering of $275.0 million of 0.00% convertible senior notes due 2030.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note: None of note.

Mixed Shelf Offerings:

PNR files mixed securities shelf offering.

MPW files mixed securities shelf offering.

MDV files for $250 million mixed securities shelf offering.

FLYX: Form S-3..$250,000,000 Mixed Shelf.

News After The Close:

NTSB to hold a June 24 hearing to determine the probable cause of a mid-air cabin panel blowout of a new Boeing.

Moonlake Immunotherapeutics (MLTX) jumps +17% after hours on report Merck held talks for a potential acquisition.

RTX awarded a $1.1 billion modification to a previously awarded US Navy contract.

J awarded a $4 billion US Air Force contract for Space Force range contract.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

DCI announces appointment of Richard Lewis as COO, effective August 1, 2025.

BILL announces Rohini Jain will join BILL as CFO.

UBER appoints Andrew “Mac” Macdonald as President & COO, effective immediately.

COLD appoints Rob Chambers to new executive role of President; Also reaffirms FY25 guidance.

Buybacks:

BUSE approves an amendment to Busey’s previously adopted share repurchase program to increase the number of shares of Busey’s common stock available for repurchase by 2 million shares.

Dividends Announcements or News:

Stocks Ex Div Today: CI LHX TXRH SWK GGAL GLNG MAC EBC SEI LZB LOB

Stocks Ex Div Wednesday of note: None of note.

EPRT increases quarterly dividend to $0.30/sh from $0.295/sh.

Stocks Moving Up & Down Last Week:

Gap Up: MLTX +26.2%, CRDO +10.4%, CURB +2% of note.

Gap Down: TRVI -3.4% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT) Futures S&P 500 -12 , NASDAQ -20 , Dow Jones -`112. Europe is higher ex the STOXX600 while Asia is lower ex Australia. Bonds are at 4.41% from 4.432% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas higher. Gold, Silver and Copper lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $105,323 from $104,157 higher by $960 (+0.92%).

Sector Action:

Daily Positive Sectors: Materials, Energy, Technology, Communication Services and Healthcare were higher of note.

Daily Negative Sectors: Industrials and Real Estate of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

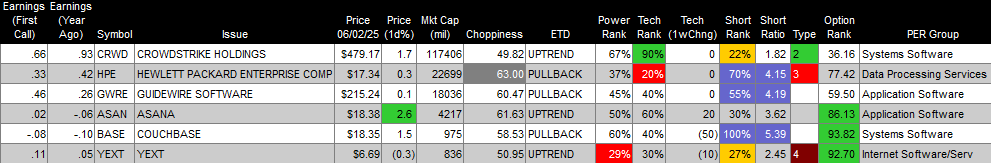

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: FERG +0.49, DG +0.30, SIG +0.18, DCI +0.04, of note.

Misses: NIO -0.45 of note.

Still to Report: OLLI of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line was flat again yesterday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: MLTX +23.4%, CRDO +13.9%, STR +8.5%, UUUU +6.4%, DFDV +5.3%, CRDF +5.1%, CANG +3.4%, AAPG +3.1%, WRD +2.7%, DCI +2.2%, CURB +2% of note.

Gap Down: TRVI -4.8%, SATS -3% of note.

Insider Action: SHEN PANL sees Insider Buying with dumb short selling. None sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Tariffs Are Hurting the U.S. and Global Economy, OECD Warns. (Bloomberg)

Markets Wrap: Stock Futures fall on OECD warning. (Bloomberg).

Meta Platforms (META) to buy nuclear power from Constellation (CEG).

How Ukraine's Drone Attack Shocked Russia and Changed Modern Warfare. (Bloomberg)

Odd Lots: Why It's Hard for Apple to Move Out of China. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

April Factory Orders are due out at 10:00 a.m. EDT and are expected to fall by -3.1% from an increase of 4.3% last month.

April JOLTS is due out at 10:00 a.m. EDT and last month came in at 7.192 million.

President Trump's Daily Schedule.

President Trump has no events scheduled today.

Press Briefing at 1:00 p.m. EDT led by Press Secretary Karoline Leavitt..

Federal Reserve Speakers of note today.

Federal Reserve Chicago President Austan Goolsbee speaks at 12:45 p.m. EDT.

Federal Reserve Governor Lisa Cook speaks at 1:00 p.m. EDT.

Federal Reserve Dallas President Lorrie Logan speaks at 3:30 p.m. EDT.

M&A Activity and News: Cal-Maine (CALM) signs definitive agreement to acquire Echo Lake Foods in all cash transaction for approximately $258 million.

Moving Average Table: Remains at 74% on Equity Indexes and Bonds saw deterioration yesterday.

Meeting & Conferences of Note:

Sellside Conferences:

Baird Consumer Tech & Services Conf

BAC Global Technology Conference

BAC Housing Symposium

DB dbAccess Global Consumer Conference

Jefferies Global Life Sciences Conference

JP Morgan European Automotive Conf

Maxim Group Tech Conference

Morgan Stanley Travel & Leisure Conference

RBC Capital Markets Global Energy Power & Infrastructure Conference

Scotiabank U.S. Energy Access

TD Cowen Future of the Consumer Conf

William Blair Growth Stock Conference

Wolfe Research Small & Mid-Cap Conf

Shareholder Meetings: BKNG, CTSH, EXPE, GM, MTLS, PRQR, SLG

Top Analyst, Investor Meetings: ANAB, CADL, ELVA, IMMX, SNOW, XERS, ZS

Fireside Chat: None of note.

FDA Presentation: American Society of Clinical Oncology (ASCO)

R&D Day: None of note.

Meetings:

American Society of Clinical Oncology Annual Meeting

Boston Equity Conferences

Datacloud Global Congress

ISG AI Impact Summit

Nareit REITweek Investor Conference

Snowflake Summit

THE Mining Investment Event

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: KYMR OSK UBS WWD of note.

Downgrades: BMBL of note.