QPI Morning Note For 06/02/25: Stock Futures Lower, Trade Issues Weigh On Market

Overnight Summary & Early Morning Trading:

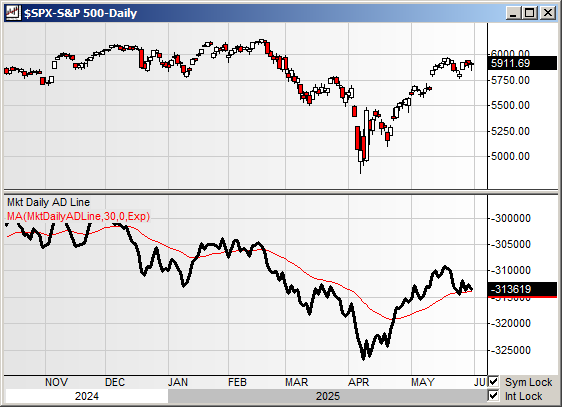

The S&P 500 finished Friday lower by -0.01% at 5911.69 with Thursday higher by 0.40% at 5912.17.

Futures are lower this morning by -32.50 (-0.55%) at 5883.25 around 5:30 a.m. EDT.

The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up by 0.51% from 0.52% on Thursday's close.

Executive Summary:

A three-judge panel at the US Court of International Trade ruled Wednesday that President Trump had acted illegally on tariff action putting this issue on a direct course to an appellate court and then the Supreme Court. Yesterday, the appellate court ruled that the tariffs could stay in effect. So we are right back to where we were before the US Court of International Trade ruled on Wednesday.

Key Events of Note Today:

ISM Manufacturing and Construction Spending out this morning.

Fed Speak today of note.

Federal Reserve Dallas President Lorrie Logan speaks at 10:15 a.m. EDT.

Federal Reserve Chicago President Austan Goolsbee speaks at 12:45 p.m. EDT.

Federal Reserve Chairman Powell speaks at 1:00 p.m. EDT.

President Trump has lunch with the vice president.

3 & 6 Month Bill Auction at 11:30 a.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: FGO, HLEO, VNTG

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

ABAT: Form S-3.. 2,296,460 Shares of Common Stock

ADIL: FORM S-3 - Up to 6,730,376 Shares of Common Stock

IMNN: Form S-1.. UP TO 22,027,780 SHARES OF COMMON STOCK

MGRX: FORM S-1 - 4,461,718 Shares of Common Stock

MSGM: FORM S-3 - 2,272,728 Shares Class A common stock

TLSI: Form S-3.. 5,500,000 Shares of Common Stock

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed:

Life360 (LIF) offering of $250 million of convertible senior notes due 2030.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

STN Private Offering of $425 Million Senior Unsecured Notes

Selling Shareholders of note:

ABAT 4,116,733 Shares of Common Stock Issuable Upon Exercise of Warrants Offered by the Selling Stockholders

TRVD files for 2,084,117 share common stock offering by selling shareholders

TLSI files for 5.5 mln share common stock offering by selling shareholders

Mixed Shelf Offerings:

ENTX: Form S-3.. $100,000,000 Mixed Shelf

MDV: FORM S-3 - $250,000,000 Mixed Shelf Offering

SBET: Form S-3ASR - Mixed Shelf

SIEB: FORM S-3 - $100,000,000 Mixed Shelf Offering

CMDB: files for $200 mln mixed securities shelf offering

News After The Close:

CACI International (CACI) has been awarded nearly $638 million in new contracts within the intelligence community to support various national security efforts.

LMT eighth GPS III space vehicle, designed and built by Lockheed Martin, successfully launched from Cape Canaveral

LMT awarded an unpriced letter contract modification not-to-exceed $1.002 billion under an existing US Navy contract

RTX awarded a $536.7 million US Navy contract

Hims & Hers Health (HIMS) ticking lower on report it's cutting 4% of workforce, according to Bloomberg

President Trump doubles steel and aluminum tariffs during speech at U.S. Steel. (Time)

10K or Qs Filings/Delays – (Filed), FRHC (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News: None of note.

Buybacks:

REAX authorizes new share repurchase program for up to the lesser of $150 million in value, or 35 million in shares

Dividends Announcements or News:

Stocks Ex Div Today: None of note.

Stocks Ex Div Tuesday of note: None of note.

Stocks Moving Up & Down Last Week:

Gap Up: VEEV (278.86 +19.68%), TROX (5.71 +20.36%), RRGB (5.19 +63.72%) ,DOOO (44.15 +23.19%), MNRO (15.34 +21.13%), SNBR (10.77 +16.88%), ETSY (55.46 +16.51%), ULTA (471.32 +15.79%), LOCO (10.55 +15.55%), BOX (37.8 +21.58%), ELF (112.36 +33.87%), NUS (8.67 +19.35%), HLF (7.83 +17.49%) of note.

Gap Down: GAP -14.6%, NTLA (6.89 -24.84%), REGN (491.97 -16.38%), COO (68.4 -13.23%), CMCO (14.51 -11.63%), SKY (65.51 -22.26%), PDD (96.62 -18.97%), CAL (13.43 -15.88%), GDS (23.8 -16.49%), OKTA (103.43 -16.4%), AMBA (52.69 -15.17%), PLAB (16.72 -14.15%), AAOI (15.44 -13.67%), ESTC (81.19 -11.99%), HPQ (24.96 -10.81%), SUPV (13.00 -17.2%) of note.

What’s Happening This Morning: (as of 6:35 a.m. EDT) Futures S&P 500 -16.75, NASDAQ -87.25, Dow Jones -79. Europe is lower ex the FTSE while Asia is lower. Bonds are at 4.432% from 4.426% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas higher. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $104,157 from $105,650 lower by $-951 (-0.91%).

Sector Action:

Daily Positive Sectors: Consumer Defensive, Utilities, Communication Services, Healthcare and Financials were higher of note.

Daily Negative Sectors: Energy, Consumer Cyclicals and Technology of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

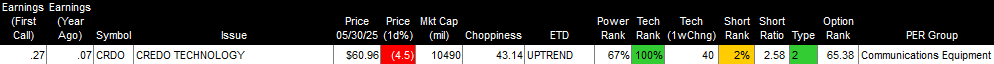

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Monday After the Close:

Tuesday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: SCPB +0.08 of note.

Misses: SAIC -0.20 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line was flat on Friday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: VERA +37.8%, BPMC +27%, ACTU +17.6%, KYMR +13%, TVRD +12.9%, TBPH +11.5%, LQDA +10.6%, ATAI +10.4%, KURA +7.7%, PONY +5.3%, MRNA +5.3%, TLSI +5%, ALLO +3.4%, ASPI +2.9%, IMTX +2.8%, NIO +2% of note.

Gap Down: LOGC -19.4%, ARVN -9.7%, LIF -2.9%, REPL -2.4% of note.

Insider Action: BDL sees Insider Buying with dumb short selling. REYN sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Russia and Ukraine Set to Restart Talks After Ukraine Hits Russian Bombers. (Bloomberg)

Markets Wrap: Stock Futures . (Bloomberg).

China calls out U.S. for undermining trade deal. (CNBC)

Buyers strike hits long bond as PIMCO and Doubleline stay away. (Bloomberg)

Moderna (MRNA) announced that the FDA has approved mNEXSPIKE (mRNA-1283), a new vaccine against COVID-19, for use in all adults 65 and older, as well as individuals aged 12-64 years with at least one or more underlying risk factor as defined by the Centers for Disease Control and Prevention.

Bristol Myers (BMY) to pay BioNTech (BNTX) up to $1.1 billion in Cancer Deal. (Bloomberg)

OPEC+ keeps output hike steady for July. (Release)

Odd Lots: Why It's Hard for Apple to Move Out of China. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

May ISM Manufacturing Index is due out at 10:00 a.m. EDT and expected to rise to 49% from 48.70%.

April Construction Spending is due out at the same time and expected to improve to 0.1% from -0.5%.

President Trump's Daily Schedule.

President Trump and Vice President Vance have lunch at 1:00 p.m. EDT.

Federal Reserve Speakers of note today.

Federal Reserve Atlanta President Raphael Bostic speaks at 12:30 p.m. EDT.

Federal Reserve San Francisco President Mary Daly speaks at 4:45 p.m. EDT.

Federal Reserve Chicago President Austan Goolsbee speaks at 7:30 p.m. EDT.

Federal Reserve Governor Christopher Waller speaks at 8:00 p.m. EDT.

M&A Activity and News: None of note.

Moving Average Table: Moves from 80% to 74% on Equity Indexes and Bonds continue to see improvement.

Meeting & Conferences of Note:

Sellside Conferences:

Baird Consumer Tech & Services Conf

Citi Silicon Valley Bus Tour

Deutsche Bank Data Center Summit

JP Morgan European Automotive Conf

Raymond James REITweek

Scotiabank U.S. Energy Access

Shareholder Meetings: GCI, GPRO, UNH, VXRT

Top Analyst, Investor Meetings: ARQT, PEGA, RAPP, VSTM

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

American Society of Clinical Oncology Annual Meeting

Ferment Series

Maritime Leaders Summit

Nareit REITweek Investor Conference

PegaWorld

Snowflake Summit

ZenithLive

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: ARCB BA DOCS KNX ODFL ROL SAIA SNDR SPXC WERN of note.

Downgrades: CSX JBHT NSC UNP GLBE PYPL XYZ of note.