QPI Morning Note For 05/29/25: Stock Futures El Feugo On NVDA and Court Ruling

Overnight Summary & Early Morning Trading:

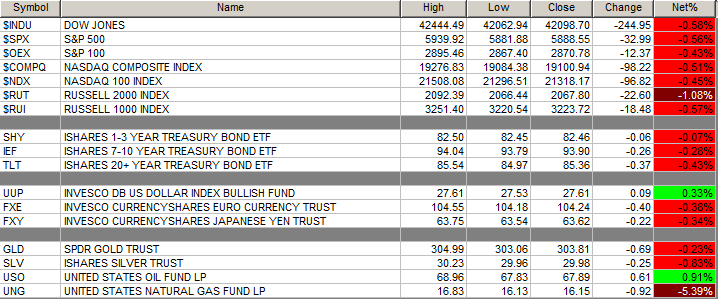

The S&P 500 finished Wednesday lower by -0.56% at 5888.55 with Tuesday higher by 2.06% at 5921.54.

Futures are higher this morning by +74 (+1.25%) at 5977 around 6:10 a.m. EDT.

The cash range is now 300 points on the S&P 500 cash for the year, 5800 to 6100. Year to date the S&P 500 is up by 0.12% from 0.68% on Tuesday's close.

Executive Summary:

Markets got positive results from Nvidia's (NVDA) after the close. Soon after a three-judge panel at the US Court of International Trade ruled that President Trump had acted illegally on tariff action putting this issue on a direct course to an appellate court and then the Supreme Court.

Breaking News: None of note.

Key Events of Note Today:

Lots of monthly and weekly economic data. See below.

7-Year Note Auction at 1:00 p.m. EDT.

President Trump has a light schedule today.

Notable Earnings Out After The Close:

Beats: SNPS +0.28, VEEV +0.23, ATS +0.14, TGI +0.13, NVDA +0.08, ELF +0.06, NDSN +0.06, A +0.05, AI +0.04, NTNX +0.04, PSTG +0.04, CRM +0.03 of note.

Misses: HPQ -0.09 of note.

Flat: None NCNO and S of note.

Capital Raises:

IPOs For The Week: FGO, HLEO, VNTG

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

AS - Pricing of Secondary Offering of Ordinary Shares

DRIO: Form S-3.. 52,139,659 SHARES OF COMMON STOCK

HESM Secondary Public Offering of Class A Shares

IMUX - Proposed Public Offering

TATT - Launch of Public Offering of Ordinary Shares

TSHA - Pricing of Public Offering of Common Stock and Pre-Funded Warrants

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

ORIC - $125 Million Private Placement Financing

Selling Shareholders of note:

TATT adds a Secondary Offering by Selling Shareholders

Mixed Shelf Offerings:

GANX: Form S-3.. $100,000,000 Mixed Shelf.

NVDA: Form S-3ASR - Mixed Shelf Offering.

UFCS: Form S-3ASR Mixed Shelf

News After The Close:

ELF announces definitive agreement to acquire Rhode in $1 billion deal.

HPQ issues downside guidance.

CRM beats estimates.

NVDA beats and guides higher.

Victoria's Secret (VSCO) lower as the company has stopped some operations and told employees to avoid using technology amid a "security incident".

Tesla (TSLA) ticking higher on report it has targeted June 12 launch of Robotaxi service in Austin.

LMT awarded a $509.8 million modification to a previously awarded US Air Force contract.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

CFO to step down at PSTG.

JACK appoints Dawn Hooper as CFO, effective immediately.

Buybacks:

SDHG announces stock repurchase program for up to $50 million.

APPN authorizes $10 million share repurchase program.

Dividends Announcements or News:

Stocks Ex Div Today: D XYL LH EXPE JKHY H KNSL CHE BPOP CNK FBP IGT CATY MTRN NVGS of note.

Stocks Ex Div Friday of note: none of note.

Stocks Moving Up & Down Yesterday:

Gap Up: ORIC +21.4%, VEEV +15.7%, TSHA +13.5%, AI +10.7%, POWW +7.1%, NVDA +5%, A +5%, SNPS +3.2%, NDSN +3% of note.

Gap Down: HPQ -13.3%, S -12.2%, TATT -5.3%, PSTG -3.7%, HESM -2.4% of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT) Futures S&P 500 +60, NASDAQ +319, Dow Jones +206. Europe and Asia are higher. Bonds are at 4.50% from 4.47% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold, Silver and Copper are higher. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $108,796 from $108,954 higher by $1464 (+1.36%).

Sector Action:

Daily Positive Sectors: All were lower of note.

Daily Negative Sectors: All weak of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: RY +0.84, BURL +0.24, AMWD +0.19, CM +0.17, BBWI +0.07, IMVT +.07, BBY +0.06, HRL +.01 of note.

Misses: LI -0.40, CAL -0.14, SPTN -0.11, FL -0.02 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: VEEV of note.

Negative or Mixed Guidance: LI, HPQ, S of note.

Advance/Decline Daily Update: The A/D Line saw weakness on Wednesday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: ORIC +21.4%, AI +16.4%, VEEV +16.4%, TSHA +13.1%, BGM +12.5%, POWW +12.5%, ELF +11%, SDHC +8.8%, ETON +8%, FATE +6.3%, NVDA +6%, FFAI +5.3%, AORT +5%, FUTU +4.8%, SNPS +4.4%, NCNO +4.4%, GOGL +3.9%, A +3.3%, BEAM +3.1%, TSLA +2.5%, VCYT +2.4%, VSCO +2%, MCY +2%, NDSN +2% of note.

Gap Down: S -13.8%, TATT -9.7%, HPQ -8.8%, LI -3.2%,of note.

Insider Action: None of note see Insider Buying with dumb short selling. ONTF and EP of note sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Trade Strategy Roiled By Court Blocking Global Tariffs. (Bloomberg)

Markets Wrap: Stock Futures Higher After Court Ruling. (Bloomberg).

Goldman calls court ruling a "Nothing Burger". (Bloomberg)

Best Buy (BBY) cuts outlook on tariffs. (Bloomberg)

United (UAL) returns to JFK with partnership with JetBlue (JBLU).

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

Q1 GDP (second estimate) is due out at 8:30 a.m. EDT and is expected to stay at -0.3%.

April Pending Home Sales are due out 10:00 a.m. EDT and are expected to fall by -1.1% after rising 6.10%.

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

Weekly Crude Oil Inventories are due out at 12:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump receives the latest Intelligence Briefing at 11:00 a.m. EDT.

The President and Vice President have lunch at 12:30 p.m. EDT.

Press Briefing at 1:00 p.m. EDT with the Press Secretary.

President Trump participates in a swearing in ceremony for the Chief of Protocol of the United States at 5:00 p.m. EDT.

Federal Reserve Speakers of note today.

Federal Reserve Richmond President Thomas Barkin speaks at 8:30 a.m. EDT.

Federal Reserve Chicago President Austan Goolsbee speaks at 10:40 a.m. EDT.

Federal Reserve Governor Adrian Kugler speaks at 2:00 p.m. EDT.

Federal Reserve San Francisco President Mary Daly speaks at 4:00 p.m. EDT.

Federal Reserve Dallas President Lorrie Logan speaks at 8:25 p.m. EDT.

M&A Activity and News: None of note.

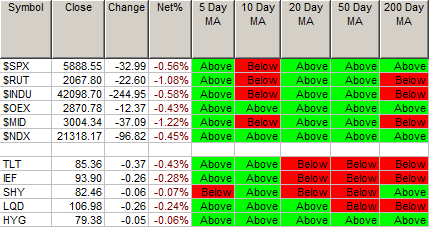

Moving Average Table: Moves from 50% to 90% on Equity Indexes and Bonds saw some improvement.

Meeting & Conferences of Note:

Sellside Conferences:

BAC Emerging Markets Conference

BAC Power Utilities & Alternative Energy Conference

Barrington Research Spring Investment Conference

Citi Napa Therapeutics Summit

Cowen Technology Conference

Deutsche Bank Global Financial Services Conference

GS Leveraged Finance and Credit Conference

Jefferies Software & Internet Conference

KeyBanc Industrials & Basic Materials Conference

Morgan Stanley ASEAN Conference

Raymond James Silver Conference

Stifel Jaws & Paws Conference

TD Cowen Technology, Media & Telecom Conference

Shareholder Meetings: AGI, ALL, CCO, DOOO, MOS, MPW, SEE, SPWR, ZVRA

Top Analyst, Investor Meetings: AKTX, ASH, CYBN, LEU, SONY, STRZ, TEVA, XPOF

Fireside Chat: None of note.

FDA Presentation: None of note.

R&D Day: None of note.

Meetings:

Bitcoin (Las Vegas, NV)

Lytham Partners Spring Investor Conference

Sohn Montreal Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: EXPI LAMR LUV NVDA of note.

Downgrades: CLF SBUX GEV of note.