QPI Morning Note For 05/27/25: Stock Futures Higher On Extension of Tariff Relief For EU and Japan Slowing Of Long Term Debt

Overnight Summary & Early Morning Trading:

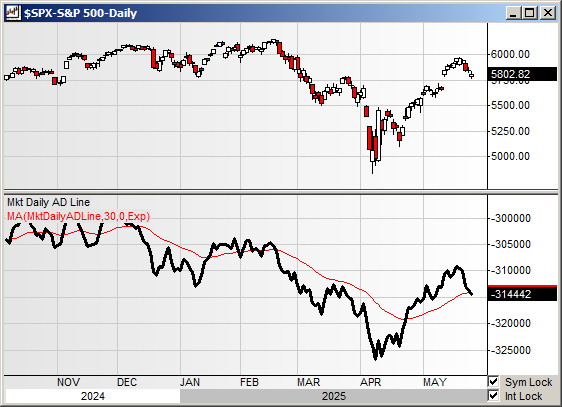

The S&P 500 finished Friday -0.67% at 5802.82 from Thursday lower by -0.04% at 5842.01.

Futures are higher this morning by +88 (+1.52%) at 5905 around 6:00 a.m. EDT.

The cash range is now 300 points on the S&P 500 cash for the year, 5800 to 6100. Year to date the S&P 500 is down by -1.34% from -0.67% on Thursday's close.

Executive Summary:

And like that, last week's pullback is history thanks to President Trump's back-and-forth on tariffs. This morning, the perception is being a willing negotiator with the EU. Enjoy it while it lasts.

Breaking News:

President Trump extends EU Tariffs extension to July 9th so both sides can negotiate further to lower tariffs on both sides.

Key Events of Note Today:

Durable Orders, Consumer Confidence and Case Schiller are due out this morning.

3 & 6 Month Bill Auction at 11:30 a.m. EDT.

2-Year Note Auction at 1:00 p.m. EDT.

President Trump has a day off.

Notable Earnings Out After The Close:

Beats: None of note.

Misses: None of note of note.

Flat: None None of note.

Capital Raises:

IPOs For The Week: FGO, HLEO, VNTG

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced: None of note.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

BNTC files for 900,000 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

MBIN files for $500 mln mixed securities shelf offering.

LTBR files for $150 mln mixed securities shelf offering.

News After The Close:

Stocks lose ground as tariff threats rise again.

Prothena (PRTA) today announced the Phase 3 AFFIRM-AL clinical trial evaluating birtamimab in patients with AL amyloidosis did not meet its primary endpoint (HR=0.915, p-value=0.7680.

United Airlines (UAL) and Flight Attendants union reach labor agreement.

LMT awarded a $214.4 mln US Army contract.

PSN warded a $169.4 mln US Army contract for design and construction of a new ammonium nitrate solution tank farm facility.

U.S. Steel (X) rockets 22% after Trump give okay for deal.

Trump threatens other smartphone manufacturers as well.

China stands in the way of U.S. Vietnam trade deal. (Telegram)

How Trump could push companies to eat tariffs. (Yahoo Finance)

Rising bond yields give investors the yips. Watch these levels. (MarketWatch)

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

MSEX names Nadine Leslie as Chair of the Board.

Buybacks: None of note.

Dividends Announcements or News:

Stocks Ex Div Today: JNJ NEM YUM WAB ATO KEY PAYC WMG PAC PAG SWKS VOYA FBIN MKSI DLO MRX PATK DAC SPB ADEA CRAI of note.

Stocks Ex Div Wednesday of note: SPGI EA TSCO ; EG ASR CCS of note.

Stocks Moving Up & Down Yesterday:

Gap Up: LOMA (13.8 +12.75%), DY (224.64 +15.3%), AAP (48.72 +39.08%), GOOS (11.89 +30.52%), GME (32.99 +15.94%), URBN (72.6 +15.58%), DOMO (11.28 +25.75%), LASR (14.67 +15.75%), JRVR (5.45 +13.07%), NXE (6.27 +14.84%), CCJ (58.55 +14.2%), KEP (11.41 +14.44%) of note.

Gap Down: EVH (7.21 -18.35%), RUN (6.94 -43.39%), ENPH (39.63 -21.38%), ENS (80.64 -19.29%), CPRT (54.13 -15.22%), DECK (101.71 -20.48%), VFC (12.05 -18.5%), SEDG (16.7 -24.17%), FICO (1703.39 -22.64%), BAH (108.31 -15.92%), SATS (19.76 -15.52%), AES (10.05 -17.7%) of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT) Futures S&P 500 , NASDAQ , Dow Jones . Europe is higher and Asia is higher ex China. Bonds are at 4.47% from 4.49% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $109,780 from $110,948 higher by $+727 (+0.66%).

Sector Action:

Daily Positive Sectors: Utilities, Materials, Energy and Consumer Defensive of note.

Daily Negative Sectors: All others led by Technology, Consumer Cyclical and Communications Services of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close: OKTA SQM SMTC

Wednesday Before The Open: BMO DKS ANF M KC CPRI PHR PLAB CMCO MNRO

Notable Earnings of Note This Morning:

Flat: None of note

Beats: AAP +1.22, of note.

Misses: LPG -0.15, of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: I of note.

Negative or Mixed Guidance: D of note.

Advance/Decline Daily Update: The A/D Line was weak again Friday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: MRUS +13%, of note.

Gap Down: BCAX -25.8%, of note.

Insider Action: EXP IFF see Insider Buying with dumb short selling. EP sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Global Bonds Rally as Japan Looks to Stablize Its Debt Market. (Bloomberg)

Markets Wrap: U.S. Stocks rally on bets Japan to curb bond sales. (Bloomberg).

Senator Ron Johnson (R-WI) in an interview with CNN says there are enough Senate Republicans to hold up the reconciliation bill unless larger spending cuts are included. (CNN)

President Trump condemned Russian President Putin for recent attacks on Ukraine and said he is considering additional Russian sanctions. (NYT)

Japan wants to reach tariff agreement with U.S. in June (Bloomberg).

Barron's is + on Gold.

Nvidia (NVDA) aims to introduce less expensive Blackwell chip in China. (Reuters)

Tesla (TSLA) Europe sales fall in April. (Bloomberg)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

Durable Orders are due out at 8:30 a.m. EDT and are expected to fall by-8.1% from an increase of 9.2% last month.

Case Schiller Home Price Index due out at 9:00 a.m. EDT and expected to fall to 4.4% from 4.5%.

May Consumer Confidence is due out at 10:00 a..m. EDT and expected to rise to 87 from 86 in April.

President Trump's Daily Schedule.

President Trump has not public events set for today. Golf?

Federal Reserve Speakers of note today.

Federal Reserve Minneapolis President Neel Kashkari spoke at 4:00 a.m. EDT.

Federal Reserve New York President John Williams speaks at 8:00 a.m. EDT.

Federal Reserve Governor Christopher Waller speaks at 10:10 p.m. EDT.

M&A Activity and News: None of note.

Moving Average Table: Moves from 87% to 50% on Equity Indexes.

Meeting & Conferences of Note:

Sellside Conferences:

Citi Napa Therapeutics Summit

Evercore Biotech Diamonds in the RoughVirtual Event

Goldman Sachs Brazil Commodity Days

Jefferies Defense Technology Summit

Kepler Cheuvreux ESG Conference

Piper Lung Day with ATS Takeaways

Raymond James Silver Conference

Stifel Ophthalmology Forum

TD Cowen Oncology Innovation Summit

Shareholder Meetings: MRK, SLGN, TTD

Top Analyst, Investor Meetings: CPM, WWR

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: RVPH: Data Presentation on Brilaroxazine

Industry Meetings or Events:

American Society of ClinicalPsychopharmacology Meeting

Bitcoin (Las Vegas, NV)

Louisiana Energy Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: BRBR CMI KYTX LFST TEX WING of note.

Downgrades: NSA of note.