QPI Morning Note For 05/23/25: Futures Plummet As Trump Proclaims High Tariffs on Apple and the EU

Overnight Summary & Early Morning Trading:

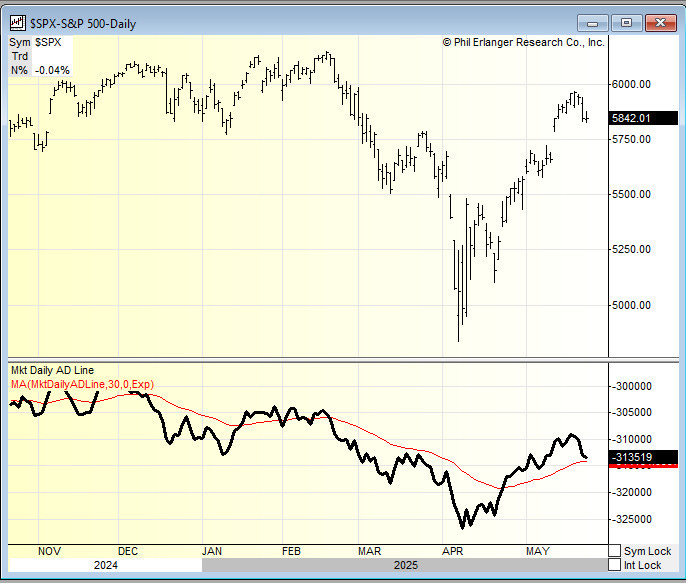

The S&P 500 finished Thursday lower by -0.04% at 5842.01. Wednesday lower by -1.61% at 584461. Futures are lower this morning by -18 (-0.31%) at 5838 around 7:35 a.m. EDT. The cash range is now 300 points on the S&P 500 cash for the year, 5800 to 6100. Year to date the S&P 500 is down by -0.67% from -0.63% on Wednesday's close.

Executive Summary:

Enjoy the Memorial Day Weekend as we move into summer trading hours next week where traders leave early or do not come in at all on Fridays. That creates interesting Fridays sometimes during summer.

Breaking News:

Trump proclaims that Apple (AAPL) will pay a 25% tariff on iPhones not made in the U.S. Then Trump says 50% tariff on the EU as of June 1st as negotiations getting nowhere.

Key Events of Note Today:

New Home Sales and the Baker Hughes Rig Count are due out today.

President Trump has an easy day as he signs Executive Orders and then heads off to New Jersey for the Memorial Day Weekend.

Notable Earnings Out After The Close:

Beats: INTU+0.72, DECK +0.40, STEP +0.24, WDAY +0.22, ADSK +0.14, ROST +0.03, RAMP +0.02 of note.

Misses: LFGA -0.20 of note.

Flat: CPRT of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

GYRE announces proposed underwritten public offering of common stock.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

UPXI files for 43,859,649 share common stock offering by selling shareholder.

Mixed Shelf Offerings:

VECO files mixed securities shelf offering.

TALO files mixed securities shelf offering.

News After The Close:

Honeywell (HON) completes the sale of its Personal Protective Equipment business to Protective Industrial Products, Inc. for $1.325 billion in an all-cash transaction.

Stifel (SF) sees Total Client Assets increased 7% yr/yr to $485.6 million, Fee-based Client Assets increased 11% yr/yr to $190.5 million

Granite Construction (GVA) awarded an ~$26 million contract by the San Francisco International Airport to upgrade Taxiway Z and a portion of Taxiway S at SFO in San Francisco, California.

Goodyear Tire (GT) signs definitive agreement to sell the majority of its Goodyear Chemical business to Gemspring Capital Management; Gemspring to pay cash proceeds of approximately $650 million at closing.

Wyerhaeuser (WY) to acquire 117,000 acres of timberlands in NC and VA for $375 million.

Federal Trade Commission (FTC) discloses on its website that it has dismissed the case that sought to block Microsoft's (MSFT) acquisition of Activision Blizzard.

Federal Trade Commission (FTC) dismisses price discrimination lawsuit against PepsiCo (PEP).

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

DECK appoints Cynthia Davis as Chair of the Board; Michael Devine, III to retire from the board after over 14 years of service

Buybacks:

SSNC grows stock repurchase program 50% to $1.5 billion.

FIX increases stock repurchase program to purchase back up to 1 million shares.

PFBC shareholders approved a new $125 million stock repurchase plan.

Dividends Announcements or News:

Stocks Ex Div Today: None of note.

Stocks Ex Div Tuesday of note: None of note.

XRX reducing the quarterly dividend to $0.025/share.

Stocks Moving Up & Down Yesterday:

Gap Up: MRUS +17.80%, VSTM +12.6%, STEP +12.1%, INTU +8.2%, PDSB +5.1%, ADSK +3.1%, GT +2.9%, SSNC +2.7%, CGEM +2.6% of note.

Gap Down: BCAX -29.7%, GYRE -15.3%, DECK -14.7%, ROST -10.3%, XRX -9.2%, WDAY -6.7%, BURL -5.4%, BULL -5.3%, ACTU -2.5%, REGN -2% of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT) Futures S&P 500 -69, NASDAQ -290, Dow Jones -4. Europe is lower and Asia is higher. Bonds are at 4.49% from 4.609% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas higher. Gold, Silver and Copper are higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $110,948 from $110,700 lower by $-505 (-0.71%).

Sector Action:

Daily Positive Sectors: Consumer Cyclical, Technology and Communication Services of note.

Daily Negative Sectors: All others led by Utilities, Healthcare and Consumer Defensive of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Friday After the Close: None of note.

Tuesday Before The Open: AZO BNS

Notable Earnings of Note This Morning:

Flat: None of note

Beats: AAP +1.22, ADI +0.15, TD +0.70, BJ +0.22, THR +0.05 of note.

Misses: LPG -0.15, LSPD -0.01 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: INTU of note.

Negative or Mixed Guidance: DECK of note.

Advance/Decline Daily Update: The A/D Line was weak again yesterday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: MRUS +13%, ASPI +11.3%, PDSB +10.2%, INTU +8.5%, CADL +7.7%, STEP +7.7%, IPHA +5%, KMT +4.6%, FFAI +4.4%, CGEM +3.2%, FRO +3%, ADSK +2.5%, BILI +2.1%, GH +2%, FIX +2%, SF +2% of note.

Gap Down: BCAX -25.8%, DECK -17.4%, GYRE -15.3%, ROST -11.5%, XRX -9.4%, WDAY -6.4%, BURL -3.2%, CPRT -3.1%, ZYME -3%, ACTU -2.5%, VECO -2% of note.

Insider Action: None sees Insider Buying with dumb short selling. None see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Threatens 25% Tariffs on iPhone. (Bloomberg)

Markets Wrap: Stock Futures churn. (Bloomberg).

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

April New Home Sales are due out at 10:00 a.m. EDT and expected to fall to 679,000 from 724,000.

Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump signs Executive Orders at 1:00 p.m. EDT.

President Trump heads to Trump National Golf Club Bedminster at 3:00 p.m. EDT.

Federal Reserve Speakers of note today.

Federal Reserve Governor Lisa Cook speaks at 12:00 p.m. EDT.

M&A Activity and News: None of note.

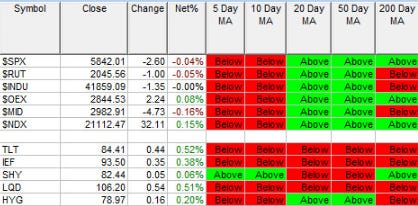

Moving Average Table: Moves to 87% on Equity Indexes.

Meeting & Conferences of Note:

Sellside Conferences: None of note.

Shareholder Meetings: AMGN, GP, VMAR

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

American Society of Clinical Oncology (ASCO)

European Calcified Tissue Society (ECTS)

Generative AI Dual Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: CRL MS of note.

Downgrades: UMC of note.