QPI Morning Note For 05/22/25: Futures Up Modestly As House Passes Reconciliation Bill, Onto The Senate

Overnight Summary & Early Morning Trading:

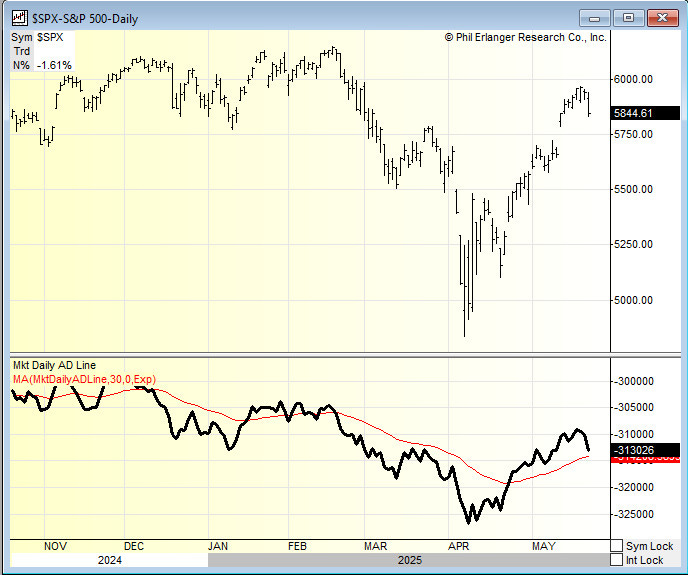

The S&P 500 finished Wednesday lower by -1.61% at 584461. Tuesday lower by -0.39% at 5940.46. Futures are higher this morning by -68 (-1.13%) at 5945 around 6:50 a.m. EDT. The cash range is now 300 points on the S&P 500 cash for the year, 5800 to 6100. Year to date the S&P 500 is down by -0.63% from 1.00% on Friday's close.

Executive Summary:

Suddenly, the stock and bond market turned their focus to the Tax Bill and away from Tariffs. Funny or ironic how that happens. Then yesterday a poor 20-Year auction threw gasoline on the fire. 10-Year TIPS Auction today. How will that go? Demand was weak and all of a sudden Treasury debt is a concern as well. The House passed the Reconciliation Bill see below.

Breaking News:

The House passed the Reconciliation Bill 215-214. Bill now heads to the Senate where it is likely to be modified, which will send it back to the House..

Key Events of Note Today:

Weekly Natural Inventories due out at 10:30 a.m. EDT.

Weekly Jobless Claims are out at 8:30 a.m. EDT.

President Trump has a busy day with multiple meetings.

10-Year TIPS Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: URBN +0.32, ENS +0.19, ZM +0.12, DOMO +0.10, SNOW +0.03, AMSC +0.02, RAMP +0.02 of note.

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

CVM Proposed Public Offering.

ESLT Underwritten Public Offering of 1,365,450 Shares.

SOC Proposed Public Offering of Common Stock.

VTAK: Form S-3.. 12,859,716 Shares of Common Stock.

Notes Priced:

CACI Pricing of $1.0 Billion Upsized Offering of 6.375% Senior Notes

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

Mixed Shelf Offerings:

ESLT files mixed shelf offering.

News After The Close:

FAST to split 2-1.

Snowflake (SNOW) guides Q2 product revenue above consensus at $1.035-$1.040 billion; Raises FY26 product revenue guidance to $4.325 bln from prior guidance of $4.28 billion.

AT&T (T) to acquire substantially all of Lumen's (LUMN) Mass Markets fiber business for $5.75 billion.

Zoom Communications (ZM) beats and guides higher.

NVIDIA (NVDA) and Navitas Semiconductor (NVTS) announce a collaboration on next-gen 800 V HVDC architecture to support ‘Kyber’ rack-scale systems.

CMS rolls out aggressive strategy to enhance and accelerate Medicare Advantage audits.

Nike (NKE) moves modestly higher as the company plans to raise prices on a wide range of footwear, apparel, and equipment as soon as this week.

Pfizer (PFE) sees FDA setback on prostate cancer drug.

PLTR awarded a $795 million modification to US Army contract.

BAESY awarded a US Army contract action not-to-exceed $423 million.

CACI awarded a $147.5 million US Army contract.

RTX awarded a $380 million modification to previously awarded US Air Force contract.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

SYNA hires former Qualcomm Executive Rahul Patel as its new CEO.

Buybacks:

RDN announces new $750 million share repurchase authorization.

Dividends Announcements or News:

Stocks Ex Div Today: LTC TER WWD AMAT AMCR CGAU GPRK MCHP of note.

Stocks Ex Div Friday of note: None of note.

UVV increases quarterly cash dividend to $0.82/share from $0.81/share.

EQH increases quarterly cash dividend to $0.27/share from $0.24/share.

CCI decreases quarterly cash dividend to $1.565/share from $1.625/share.

Stocks Moving Up & Down Yesterday:

Gap Up: NVTS +186.4%, URBN +15.3%, LUMN +12.2%, PBI +9.9%, SNOW +7.5%, RAMP +7.3% of note.

Gap Down: SOC -6%, ESLT -4.3%, LAZR -4.3%, CVS -4.2%, HUM -4% and MELI -2% of note.

What’s Happening This Morning: (as of 7:35 a.m. EDT) Futures S&P 500 +3.50, NASDAQ +42.50, Dow Jones -45. Europe is lower and Asia is lower. Bonds are at 4.609% from 4.535% on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and flat against the Yen. Bitcoin is at $110,700 from $106,376 higher by $2664 (+2.47%).

Sector Action:

Daily Positive Sectors: Communication Services of note.

Daily Negative Sectors: All others led by Real Estate, Healthcare and Consumer Cyclical of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close: INTU WDAY CPRT ADSK ROST STEP DECK

Friday Before The Open: BAH BKE PDD

Notable Earnings of Note This Morning:

Flat: None of note

Beats: AAP +1.22, ADI +0.15, TD +0.70, BJ +0.22, THR +0.05 of note.

Misses: LPG -0.15, LSPD -0.01 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: ADI AMSC ZM of note.

Negative or Mixed Guidance: THR of note.

Advance/Decline Daily Update: The A/D Line was weak yesterday

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: NVTS +139.8%, AAP +20.2%, URBN +18.2%, LUMN +12.9%, PBI +12%, SNOW +10.2%, RAMP +9%, AMSC +7.2%, TIL +7.1%, TATT +6.9%, RDN +4.4%, HIVE +2.5%, NKE +2.3% of note.

Gap Down: SOC -6.8%, LAZR -6.3%, ESLT -4%, HUM -4%, LIVN -3.8%, DOMO -3%, LPG -2.9%, UNH -2.8%, CVS -2.4% of note.

Insider Action: None sees Insider Buying with dumb short selling. None see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Tax Bill Narrowly Passes. (Bloomberg)

Markets Wrap: Stocks and Bonds are steady as House passes Bill. (Bloomberg).

Walmart (WMT) to cut 1.500 jobs.

Bitcoin rallies to new high. (CNBC)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

April Existing Home Sales are due out at 10:00 a.m. EDT and are expected to rise to 4.10 million from 4.02 million.

Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

Federal Reserve Speakers of note today.

Federal Reserve New York President John Williams speaks at 2:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump receives the Intelligence Briefing at 11:00 a.m. EDT.

President Trump has lunch with the Vice President at 12:30 p.m. EDT.

Press Briefing at 1:00 p.m. EDT.

President Trump participates in a MAHA Commission Event at 3:45 p.m. EDT.

President Trump attends a private dinner at Trump National at 7:00 p.m. EDT.

M&A Activity and News: None of note.

Moving Average Table: Moves from 94% to 87% on Equity Indexes.

Meeting & Conferences of Note:

Sellside Conferences:

B. Riley Institutional Investor Conference

Canaccord Genuity Metals & Mining Conference

CIBC Technology & Innovation Conference

Citi's Spotlight on SMID Energy Day

Evercore ISI Biotechnology Summit

Jefferies Automotive Aftermarket Conference

Raymond James Spring Therapeutics Symposium

Sidoti & Co. Micro-Cap Conference

Wolfe Transportation and Industrials Conference

Shareholder Meetings: APA, DD, HD, NEE, SCHW, THC, VZ

Top Analyst, Investor Meetings: AMIX, CDTX, EMBC, FRPH, IPHA, MRUS, NEXN, STX

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

A.G.P. Virtual Healthcare Conference

American Society of Clinical Oncology (ASCO)

Dell Technologies World

Microsoft Build

Singular Research Spring Select Webinar

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: INGN ITGR PLNT ZM of note.

Downgrades: CRWD RUN of note.