QPI Morning Note For 05/21/25: Futures Lower For A Second Day, Focus on Tax Bill Over Tariffs.

Overnight Summary & Early Morning Trading:

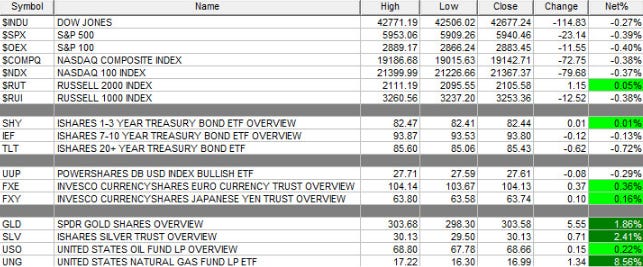

The S&P 500 finished Tuesday lower by -0.39% at 5940.46. Monday higher by 0.09% at 5963.60. Futures are lower this morning by -68 (-1.13%) at 5945 around 6:50 a.m. EDT. The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up 1.00% from 1.39% on Friday's close.

Executive Summary: Suddenly, the stock and bond market turn their focus to the Tax Bill and away from Tariffs. Funny or ironic how that happens.

Breaking News: None of note.

Weekly Mortgage Applications fell -5.1% week over week.

Key Events of Note Today:

Weekly Crude Oil Inventories due out at 10:30 a.m. EDT.

President Trump meets with the President of South Africa.

20-Year Bond Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: TOL +0.67, MOD +0.17, XP +0.10, KEYS +0.05, PANW +0.03 of note.

Misses: VSAT -1.31, ZTO -0.13 of note.

Flat: JHX of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

TTWO announces proposed public offering of $1 billion shares of its common stock.

QXO announces launch of concurrent separate public offering of shares of common stock and depository shares; Aggregate proceeds from offerings are expected to be $1.0 billion.

GRDN launches offering.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed:

CIFR announces proposed convertible senior notes offering of $250 million,

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

TPG announces that DB Holdings I, L.P., a vehicle controlled by, and for the benefit of, the estate of David Bonderman, intends to offer 21.0 million shares of common stock.

SWX announces secondary public offering of Centuri Holdings (CTRI) common stock pursuant to which Southwest Gas Holdings is offering 9.0 million shares of CTRI's common stock.

VLY files for 72,861,862 share common stock offering by selling shareholder.

GTX announces launch of secondary public offering of 17 million common stocks by certain entities managed by affiliates of Oaktree Capital Management and concurrent share repurchase, subject to a maximum aggregate repurchase amount of $25 million.

Mixed Shelf Offerings:

BAM files for $2.5 billion mixed securities shelf offering.

OSUR files for $300 million mixed securities shelf offering.

MFH files for $500 million mixed securities shelf offering.

News After The Close:

Cipher Mining (CIFR) proposes hedging transaction to place borrowed common stock.

PANW beat estimates and revenues and had positive guidance yet stock lower.

Granite Construction (GVA) awarded a Federally funded $54 million contract to build the first of two construction phases under a Construction Manager/General Contractor contract with the Alaska Department of Transportation and Public Facilities.

Kraft Heinz (KHC) has been evaluating potential strategic transactions to unlock shareholder value. takes board seats away from Berkshire Hathaway (BRKB).

Wolfspeed (WOLF) down -36% under pressure after hours on WSJ report it's preparing to file for bankruptcy within weeks.

GD awarded a $199 million US Navy contract.

Tesla (TSLA) CEO Elon Musk was interviewed by CNBC's David Faber.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

PFG announces appointment of Joel Pitz as executive vice president and chief financial officer, effective immediately.

MTUS Kristopher Westbrooks to President and Chief Operating Officer; appoints John Zaranec III as Executive Vice President and Chief Financial Officer, both effective June 16.

NU announces that President and COO is stepping down; current remit will be absorbed by CEO David Velez.

Buybacks:

XP approves new share repurchase program for up to the dollar equivalent of R$1.0 billion of common shares

Dividends Announcements or News:

Stocks Ex Div Today: EQIX AFL MPC TEL ADM CNH HAS ALV CHRD ORA EE POWL OSW DHT ENT SILA of note.

Stocks Ex Div Thursday of note: None of note.

NIC increases quarterly cash dividend 14% to $0.32/share from $0.28/share.

NOC increases quarterly cash dividend 12% to $2.31/share from $2.06/share.

CRI declares a quarterly dividend of $0.25/share, down from $0.80/share.

LOGI increases quarterly cash dividend to CHF 1.26/share from CHF 1.16/share.

Stocks Moving Up & Down Yesterday:

Gap Up: FINV +6.9%, TUYA +5.9%, KEYS +5.5%, TOL +5.4% and EVLV +2.9% of note.

Gap Down: WOLF -58.2%, QXO -10.2%, CTRI -6.7%, CRI -6.7%, GRDN -6.4%, CIFR -6.3%, GTX -5.5%, PANW -4.2%, TTWO -3.9%, TPG -3.8% and NU -3.8% of note.

What’s Happening This Morning: (as of 7:05 a.m. EDT) Futures S&P 500 -41, NASDAQ -150, Dow Jones -384, Russell 2000 -23. Europe is lower and Asia is higher ex Japan. Bonds are at 4.535% from 4.463% on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $106,376 from $105,285 lower by $-230 (-0.21%).

Sector Action:

Daily Positive Sectors: Healthcare, Consumer Defensive, Materials and Utilities of note.

Daily Negative Sectors: Real Estate, Communication Services, Energy, Consumer Cyclical and Financials of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three-Month Winners: Consumer Defensive and Utilities of note.

Six-Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve-Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close: ZM URBN ENS RAMP DOMO

Thursday Before The Open: TD ADI RL AAP LSPD

Notable Earnings of Note This Morning:

Flat: None of note

Beats: BIDU +4.16, DY +0.36, GOOS +0.16, WB +0.07, WIX +0.06, LOW +0.04, MDT +0.04, VFC +0.01 of note.

Misses: TGT -0.31 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: VSAT of note.

Negative or Mixed Guidance: MDT WIX DY KEYS of note.

Advance/Decline Daily Update: The A/D Line was weak yesterday

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: GOOS +6.3%, WB +6.2%, XPEV +5.1%, BLTE +5%, TOL +4.8%, EVLV +4.7%, KEYS +4.7%, TUYA +4.3%, FINV +4.3%, GNFT +3.9%, WRD +3.8%, SLNO +3.6%, MTUS +3.5%, LOW +2.6%, BIDU +2.4% of note.

Gap Down: WOLF -57.2%, VFC -10.7%, QXO -8.7%, CRI -7.6%, CTRI -7.2%, GRDN -6%, JHX -5%, TTWO -4.6%, TPG -4.4%, CIFR -4.2%, CVAC -4.2%, OSUR -3.9%, PANW -3.7%, GTX -3.4%, CLCO -3.4%, WIX -2.9%, NU -2.8% of note.

Insider Action: None sees Insider Buying with dumb short selling. None see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Loses Patience On SALT Demands as Tax Bill Stalls. (Bloomberg)

Markets Wrap: S&P 500 stalls after six day run as Tax Bill becomes focus. (Bloomberg).

Target (TGT) misses but stock not getting killed. (CNBC)

Lowe's (LOW) sticks by forecast. (CNBC)

30-Year hits 5.0% again and 10-Year at 4.50%. (CNBC)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

Federal Reserve Speakers of note today.

Federal Reserve Richmond President Thomas Barkin speaks at 12:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump greets the President of South Africa at 11:30 a.m. EDT and then the two have lunch at 11:45 a.m. EDT.

President Trump holds a bilateral meeting with the President of South Africa at 12:45 p.m. EDT.

President Trump greets the University of Florida Basketball team who won the NCAA March Madness Tournament at 4:00 p.m. EDT.

M&A Activity and News: RBC Bearings (RBC) enters agreement to acquire VACCO Industries from ESCO Technologies (ESE) for $310 million in cash.

Moving Average Table: Moves from 94% to 87% on Equity Indexes.

Meeting & Conferences of Note:

Sellside Conferences:

Bank of America Ag Tech Conference

Barclays Leveraged Finance Conference

B. Riley Institutional Investor Conference

Canaccord Genuity Metals & Mining Conference

Evercore ISI Biotechnology Summit

HC Wainwright BioConnect Investor Conference

JP Morgan Homebuilding and Building Products

Ladenburg Thalmann Technology Innovation

Mizuho Neuro & Ophthalmology Summit

RBC Capital Markets Global Healthcare Conference

Sidoti & Co. Micro-Cap Conference

Truist Securities Financial Services Conference

Wolfe Transportation and Industrials Conference

Shareholder Meetings: AMZN, FE, FL, HAL, HAS, HTZ, ROST, TRV, UAL, WEN, XRX

Top Analyst, Investor Meetings: APG, CMND

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

Aegis Capital Corp. Conference

Alliance Global Partners Healthcare Company

Google I/O

Microsoft Build

National Restaurant Association (NRA) Show

NYSE Energy Infrastructure CEO & Investor Conf

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: ACAD AZO BILI HD of note.

Downgrades: PNNT UNH of note.