QPI Morning Note For 05/16/25: Stocks Look To Finish Strong Week

Overnight Summary & Early Morning Trading:

The S&P 500 finished Thursday higher by 0.41% at 5916.93. Wednesday higher by 0.10% at 5892.58. Futures are higher this morning by +12 (+0.20%) at 5945 around 6:15 a.m. EDT. The cash range is now 200 points on the S&P 500 cash for the year, 5900 to 6100. Year to date the S&P 500 is up 0.60% from 0.19% on Wednesday's close.

Executive Summary:

The S&P 500 is now back in positive territory for the year while the NASDAQ 100 is in a new bull market as it is up more than 20% from its April low, now up 24.03% from that low. Pretty amazing run.

Breaking News:

Charter (CHTR) to buy Cox Communications.

NVO CEO Lars Fruergaard Jørgensen steps down as stock plays second fiddle to Eli Lilly (LLY).

Key Events of Note Today:

Housing Starts and University of Michigan Consumer Sentiment are due out this morning with Baker Hughes Rig Count in the afternoon.

Trump's Travels continue as he moves on from U.A.E. and heads home tonight, due back at Andrews Airforce Base at 10:20 p.m. EDT.

Chart of the Day: See Breaking News. Shorts may start to cover on CEO transition.

Notable Earnings Out After The Close:

Beats: DOCS +0.11 AMAT +0.08, CAVA +0.08, SOBO +0.03 of note.

Misses: TTWO (21.03), GLOB (0.08) of note.

Flat: CSWC+0.00 of note.

Capital Raises:

IPOs For The Week: ANTA, EGG, FMFC, LHAI, MSGY, OFAL

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

SENS - Pricing of $50 Million Public Offering of Common Stock

VVX announces sale of 2,000,000 shares of common stock in secondary offering by Vertex Aerospace

Notes Priced:

HRI Pricing of $2.75 Billion of Senior Unsecured Notes Offering

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

SENS also files a Concurrent Private Placement

Selling Shareholders of note: None of note.

Mixed Shelf Offerings:

HP files a mixed shelf offering.

LAC files a $1 billion mixed shelf offering.

LFWD files a $100 million mixed shelf offering.

MODD files a $75 million mixed shelf offering.

SLDB files a $400 million mixed shelf offering.

FIHL files mixed securities shelf offering.

News After The Close:

Live Nation (LYV) heads lower on report that DOJ probes collusion for Covid-era refunds.

Lots of 13-Fs filed.

RTX awarded a $580.6 million US Navy contract

NOC awarded a $189 million modification to a US Navy contract

10K or Qs Filings/Delays – (Filed), EVLV ASPI (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

ST announces that CFO Brian Roberts informed the Company of his intention to resign from his position effective May 15, Andrew Lynch appointed as interim CFO

MNKD Chief Medical Officer Burkhard Blank to step down

Buybacks:

KAI authorizes share repurchase of up to $50 million of its equity securities effective May 15, 2025 through May 15, 2026

GMED announces $500 million share repurchase program

Dividends Announcements or News:

Stocks Ex Div Today: BP CC MT UL ABR APO CEG COR DIA DUK EMR ERJ FIX GSK HON HSY KKT LPG MAG MCO MGA MUR RGR SHW SJM WHT AMGN APAM ATKR EQNR FTAI HRZN OTIS RPRX SBRA SBUX SHEL WING WYNN of note.

Stocks Ex Div Monday of note: of note.

Stocks Moving Up & Down After The Close:

Gap Up: AREN +10.3%, RKT +5.4%INV +4.8% of note.

Gap Down: GLOB -26.8%, DOCS -23.6%, TVTX -22.4%, AMAT -5.6%, CAVA -4.3%, TTWO -3% of note.

What’s Happening This Morning: (as of 7:25 a.m. EDT)

Futures S&P 500 +18, NASDAQ +68, Dow Jones +128, Russell 2000 +14. Europe is higher and Asia is mixed. Bonds are at 4.394% from 4.51% unchanged from yesterday on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold, Silver and Copper lower. The U.S. Dollar is lower versus the Euro, higher against the Pound and lower against the Yen. Bitcoin is at $103,655 from $101,711 higher by $572 (+0.56%).

Sector Action:

Daily Positive Sectors: Utilities, Consumer Defensive, Real Estate and Healthcare of note.

Daily Negative Sectors: Consumer Cyclical and Technology of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three Month Winners: Consumer Defensive and Utilities of note.

Six Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Friday After the Close: None of note.

Monday Before The Open: None of note.

Notable Earnings of Note This Morning:

Flat: None of note

Beats: NTES +3.60, DE +1.08, GAMB+0.22, of note.

Misses: ZK -8.20, BABA -0.04, WMS -0.03 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: DOCS GLOB of note.

Advance/Decline Daily Update: The A/D Line improved yesterday.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: EVLV +13.1%, EBS +12.8%, QUBT +12.8%, RKT +6%, OMER +5.1%, VST +4.9%, INV +4.8%, POOL +4%, CVAC +3.9%, ASPI +3.9%, GMED +3.5%, STZ +3.5%, CRWV +3.3%, AREN +2.4%, NNE +2.4%, WRD +2.3% of note.

Gap Down: GLOB -26.7%, DOCS -21.5%, TVTX -16%, XHG -10.5%, KULR -10.5%, LAC -7.6%, AMAT -5.8%, VVX -3.9%, CRNX -3.4%, TTWO -3.2%, CAVA -2.8%, NWTN -2.4% of note.

Insider Action: ULBI sees Insider Buying with dumb short selling. OGN GOGO MYO VYX WEST see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg Lead Story: Trump Says Will Set Tariff Rates on Other Countries Within Weeks. (Bloomberg)

Markets Wrap: US Futures rise as S&P 500 eyes strong week. (Bloomberg).

House's latest budget is a fiscal time bomb. (Bloomberg)

Apple (AAPL) blocks Fortnight. (CNBC)

Barron's is + on NFLX.

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

April Housing Starts are due out at 8:30 a.m. EDT and expected to rise ot 1,383,000 from 1,324,000.

May University of Michigan Consumer Sentiment (prelim) is due out at 10:00 a.m. EDT and is expected to rise to 55 from 52.20.

Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Federal Reserve Speakers of note today.

None of note.

President Trump's Daily Schedule.

President Trump's travels continue as he moves on from U.A.E. and heads home tonight, due back at Andrews Airforce Base at 10:20 p.m. EDT.

M&A Activity and News: Charter (CHTR) and Cox Communications to merge.

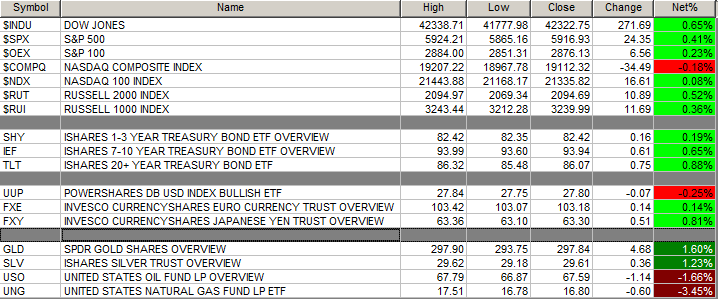

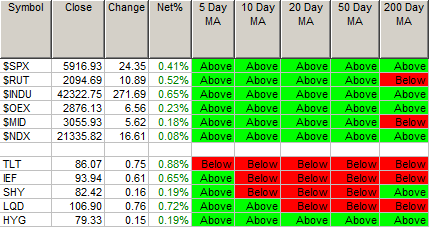

Moving Average Table: Moves from 94% to 90% on Equity Indexes.

Meeting & Conferences of Note:

Sellside Conferences:

BAC Health Care Conference

Deutsche Bank's Depositary Receipts Conference

JPM Technology Media and Communications Conference

Moffett Media Internet & Communications Conference

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: PCRX: Data Presentation for PCRX-201

Industry Meetings or Events:

American Society of Gene & Cell Therapy

Cytokine-Based Drug Development Summit

ESMO Breast Cancer Annual Congress

SID Display Week

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: C of note.

Downgrades: C of note.