QPI Morning Note For 05/12/25: The Last Three Months Was Just A Bad Dream, All Is Well This Morning or Is It?

Overnight Summary & Early Morning Trading:

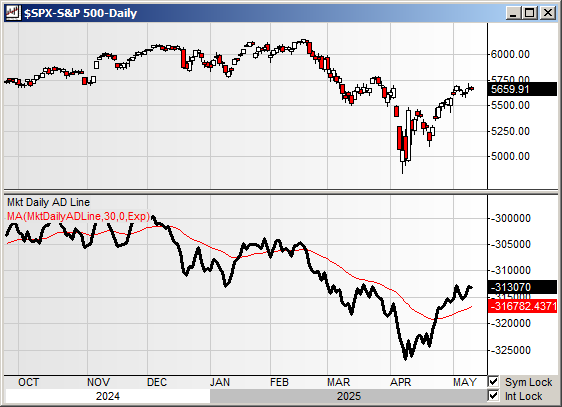

The S&P 500 finished Friday lower by -0.07% at 5659.91. Thursday higher by 0.58% at 5663.94. Futures are higher this morning by +161 (+2.84%) at 5839 around 6:10 a.m. EDT. The cash range is now 500 points on the S&P 500 cash for the year, 5600 to 6100. Year to date the S&P 500 is down -3.70% from -3.77% Wednesday's close.

Executive Summary:

All the noise is for nothing as both countries flinched and now all the pain is for what? The U.S. and China have paused tariffs for the next 90 days post the meetings in Switzerland.

Breaking News: U.S. and China agree to pause all tariffs for 90 days while negotiating a comprehensive trade deal. Treasury Secretary Bessent interviewed on CNBC at 7:00 a.m. EDT from Geneva.

Key Events of Note Today:

Treasury Budget for April is out at 3:00 p.m. EDT.

3 and 6 Month Bill Auction At 11:30 a.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note (> 0.10)

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

LEU files new prospectus supplement for common stock offering, increasing size to $200 million

ACAD: FORM S-3 - 43,576,075 Shares of Common Stock

ATNF: Form S-3.. 752,873 Shares of Common Stock

CXAI: Form S-1.. RESALE OF UP TO 18,500,000 SHARES OF COMMON STOCK

EONR: Form S-1.. Up to 7,818,600 Shares of Class A Common Stock

LUCY: Form S-1.. 1,988,099 Shares of Common Stock

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

ACAD files for 43,576,075 shares of common stock offered by selling shareholders.

MCHP files for 474,388 shares of common stock offered by selling shareholders.

Mixed Shelf Offerings:

STWD files mixed securities shelf offering

WSR files for $750 million mixed securities shelf offering

PSQH: FORM S-3 - $200,000,000 Mixed Shelf Offering

RSLS: Form S-3..$50,000,000 Mixed Shelf

STWD: Form S-3ASR - Mixed Shelf

WSR: Form S-3.. $750,000,000 Mixed Shelf

BURU: Form S-3.. $100,000,000 Mixed Shelf.

News After The Close:

Wall Street Week Ahead. (Reuters)

China and U.S. to talk trade war ceasefire but not peace. (Ceasefire)

India and Pakistan agree to a ceasefire on over the weekend.

Trump and Europe push for a 30-day ceasefire between Ukraine and Russia.

LMT awarded a $742 mln US Army contract for production of High Mobility Artillery Rocket Systems.

CSX announces tentative labor agreement with locomotive engineers for a new 5 year contract, 20% of the company's frontline workforce.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

PSMT appoints Gualberto Hernandez as CFO, effective June 1; Michael McCleary to retire.

Buybacks: None of note.

Dividends Announcements or News:

Stocks Ex Div Today: F X DK HR BRO CIG EXC GGB KKR OGN PPG ROL UAN AAPL MUSA PAYX

Stocks Ex Div Tuesday of note: None of note.

MAR increases quarterly cash dividend to $0.67/share from $0.63/share.

HBB approves a 4.3% increase to its quarterly dividend to $0.12/sh from $0.115/sh.

Stocks Moving Up & Down After The Close:

Gap Up: SIBN (18.40 +31.52%), QDEL (36.32 +24.71%), CDE (7.65 +43.97%), CMP (18.63 +35.89%),TPC (32.44 +41.41%), RUN (9.4 +28.88%), UPWK (16.84 +24.89%), GRPN (25.01 +40.35%), EYE (17.03 +29.57%), ETH (21.87 +26.12%), SKX (61.54 +24.64%), SEDG (19.82 +51.26%), LASR (11.43 +34.95%), TTD (70.86 +31%), GDOT (10.71 +30.07%), PARR (17.99 +24.93%) of note.

Gap Down: SRPT (36.25 -42.92%), AXGN (11.42 -33.36%), TCMD (9.51 -32.49%), RGNX (7.47 -28.17%), IART (12.25 -27.33%), ERII (11.27 -28.7%), CEVA (20.22 -25.36%), CODI (6.92 -60.79%), PRAA (13.58 -29.64%) of note.

What’s Happening This Morning: (as of 6:45 a.m. EDT)

Futures S&P 500 +175, NASDAQ +816, Dow Jones +996, Russell 2000 +92. Europe is higher and Asia is higher as well Bonds are at 4.451% from 4.382% yesterday on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas higher as well for a fifth trading day in a row. Gold and Silver are lower with Copper higher. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $104,392 from $102,959 lower by $-152 (-0.15%) but much higher from Friday.

Sector Action:

Daily Positive Sectors: Energy, Materials, Real Estate, Consumer Cyclical, Utilities and Financials of note.

Daily Negative Sectors: Healthcare, Consumer Defensive, Communication Services and Industrials of note.

One Month Winners: Industrials, Financials, Technology, Materials and Utilities of note.

Three Month Winners: Consumer Defensive and Utilities of note.

Six Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive and Consumer Cyclical of note.

Year to Date Winners: Utilities, Materials, Consumer Defensive and Financials of note.

Bolded means the Sector is new to the period in which it falls.

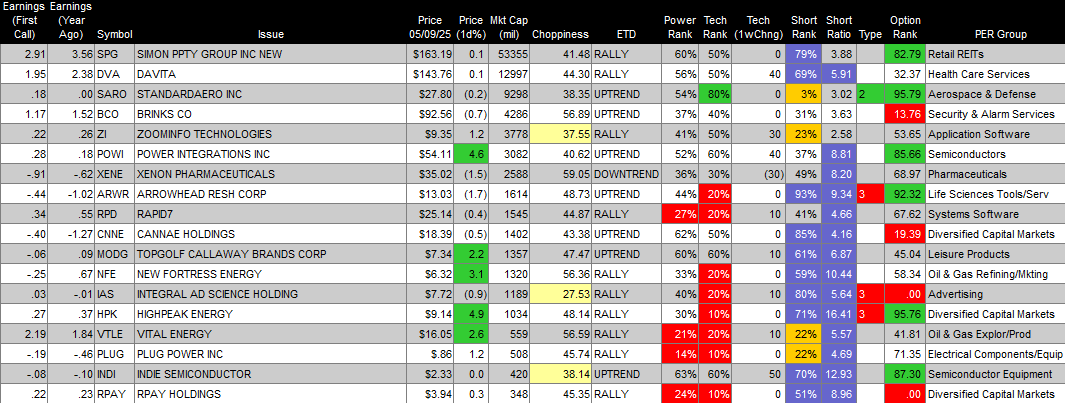

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Monday After the Close:

Tuesday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: HBM +0.14, FTRE +0.07, SBH +0.03 of note. (>than 0.10)

Misses: SDRL -0.63, PRKS -0.06, DOLE -0.04 of note.

Still to Report: KOP of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D crossed above its 30-day exponential moving average last week.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: LEU +9.7%, HUT +9.3%, MCHP +7.9%, HBM +6.5%, ABCL +6.4%, MAG +6%, DJT +6%, APGE +5.6%, APAM +5.3%, LU +5.1%, MAR +4.3%, FFAI +4.2%, AKRO +4.1%, CSX +3.6%, DAR +3.4%, ANNX +3.1%, SBH +3.1%, MRNA +2.4%, RCKT +2.1% of note.

Gap Down: PAAS -8.9%, LQDA -7.9%, DOLE -4.2%, ABBV -4%, LLY -3.8%, NVO -3.8%, NVS -3.7%, AZN -3.5%, GILD -3.5%, PFE -2.8%, MRK -2.6%, GSK -2.6%, SDRL -2.6%, HBB -2.5%, PRKS -2.5%, BMY -2.4%, FTRE -2.3% of note.

Insider Action: None of note see Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg: U.S. and China to Slash Tariffs in Step Back from Decoupling Brink. (Bloomberg)

Eli Lilly (LLY) reports Zepbound (tirzepatide) showed superior weight loss over Wegovy (semaglutide) in complete SURMOUNT-5 results published in The New England Journal of Medicine.

Markets Wrap: Tech Giants poised to surge on U.S. and China Detente. (Bloomberg)

Pharmaceutical Stocks set to tumble on Trump Plan to cut U.S. drug prices. (Bloomberg)

Trump poised to accept Qatar jet as the new Air Force One, slap in the face to Boeing (BA). (CNBC)

Nissan to cut 10,000 jobs globally. (CNBC)

Apple (AAPL) looks to raise price but says not because of tariffs. (WSJ)

Bloomberg Odd Lots: . (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

April Treasury Budget will be out at 3:00 p.m. EDT and came in last month at -$160.58 billion.

Federal Reserve Speakers of note today.

Federal Reserve Governor Adrian Kugler speaks at 10:25 a.m. EDT.

President Trump's Daily Schedule.

President Trump holds a Press Conference with the Secretary of HHS Robert Kennedy to discuss Executive Order on drug prices.

President Trump begins his trip to Saudi Arabia this afternoon.

M&A Activity and News: None of note.

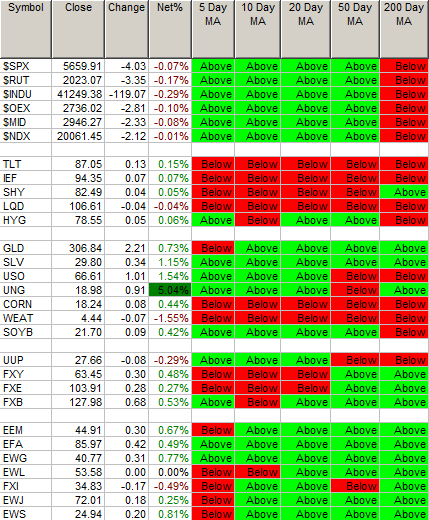

Moving Average Table: Move from 60% to 80% on Equity Indexes. Fixed Income (bonds) is struggling.

Meeting & Conferences of Note:

Sellside Conferences:

Needham Technology & Media Conference

Shareholder Meetings: CATY, IP, NSA

Top Analyst, Investor Meetings: AMZN, ATH, TYL

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

121 Mining Investment Conference

ALS Drug Development Summit

ESPE & ESE

Spring Investor Conferences

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: ACIW HLT JCI MAR of note.

Downgrades: TGT of note.