QPI Morning Note For 05/08/25: Stocks Futures Higher For a Second Day

Overnight Summary & Early Morning Trading:

The S&P 500 finished Wednesday higher by 0.43% at 5631.28. Tuesday lower by -0.77% at 5606.91. Futures are higher this morning by 60.50 (+1.07%) at 5712.50 around 6:20 a.m. EDT. The range is now 500 points on the S&P 500 cash for the year, 5600 to 6100. Year to date the S&P 500 is down -4.26% from -4.67% Tuesday's close.

Executive Summary:

Stocks are beginning to trade with less volatility as the VIX is below 25. Stocks ended a two-day losing streak yesterday. A two-day winning streak for today?

Breaking News: The Bank of England cut rates by 25 basis points.

Chart of the Day: Semis Moved on an Opening of Exports On Chips. Here is a list of the top market cap names notice several are heavily shorted.

Key Events of Note Today:

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

3-Year Note Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: MELI +1.47, CVNA +0.79, CF +0.37, MKSI +0.26, PRI +0.24, APP +0.23, PAYC +0.23, APA +0.22, VAC +0.15, IONQ +0.12 of note (> 0.10)

Misses: HHH -0.90, HP -0.63, FLUT -0.32, BYND -0.21, CLF -0.10, AMC -0.02 and GT -0.01 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: None of note.

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

XGN announces proposed public offering of common stock.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

ECO files for 18,102,286 share common stock offering by selling shareholders.

EOSE files for 158,433,112 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

ECO files for $500 million mixed securities shelf offering.

BALL files mixed securities shelf offering.

DSGN files for $300 million mixed securities shelf offering.

FHN files mixed securities shelf offering.

News After The Close:

Costco (COST) sees April sales up +6.7%.

President Trump plans to connect the amount the government pays for some drugs to lower prices in foreign nations. (Politico)

President Trump nominates Dr. Casey Means as next Surgeon General.

AppLovin (APP) to sell mobile gaming business to Tripledot for $400 mln and approximately 20% stake in Tripledot.

Arm Holdings (ARM) shares drop on weak forecast. (CNBC)

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

ESTA appoints Peter Caldini as CEO, effective May 7.

SWKS announces that Mark Dentinger has been appointed senior vice president and chief financial officer, effective June 2, 2025.

HNST announces the appointment of Curtiss Bruce, seasoned finance executive, as the Company’s new Chief Financial Officer, effective June 2, 2025.

MTN Chief Marketing Officer Courtney K. Goldstein to resign for personal reasons effective May 16.

Buybacks: None of note.

Dividends Announcements or News:

Stocks Ex Div Today: RMD HESM WTFC AWI MTG MAIN FELE KBH MATX ARLP FHI BSM SEB DKL HTH SIMO NWBI JBGS VBTX

Stocks Ex Div Thursday of note: None of note.

MTRN increases quarterly cash dividend to $0.14/share from $0.135/share.

BCO increases quarterly cash dividend 5% to $0.255/share from $0.2425/share.

Stocks Moving Up & Down After The Close:

Gap Up: SEZL +31.3%, TPC +20.6%, MEG +17.4%, LZ +14.5%, APP +13.2%, STKL +12.1%, UTI +11.5%, LEU +11.4%, ACVA +10%, MGNI +10%, GDRX +9.8%, RUN +9.6%, AOSL +9.2%, PBPB +8.8%, EVTC +8.5%, TTEK +8.5%, VAC +8.3%, HCAT +8.3%, MELI +8%, CMP +7.6%, RVMD +7.5%, BMBL +7.3%, ALVO +7.3%, QDEL +7%, DGII +6.8%, FSLY +5.7%, AXON +5.3%, CXW +5.3%, RELY +5.3%, PBI +5% of note.

Gap Down: ERII -19.5%, FLNC -18%, G -15.3%, MG -14.8%, FTNT -12.1%, ARM -11.1%, ASLE -10.8%, CLF -9.8%, QNST -9.5%, SEMR -8.6%, STAA -5.2%, ZG -5.2% of note.

What’s Happening This Morning: (as of 7:15 a.m. EDT)

Futures S&P 500 +63, NASDAQ +275, Dow Jones +384, Russell 2000 +25.64 . Europe is higher and Asia is higher ex China. Bonds are at 4.31% from 4.32% yesterday on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas higher as well for a third day in a row. Gold, Silver and Copper are lower for a second day in a row. The U.S. Dollar is higher versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $99,631 from $97,052 higher by $+3433 (+3.57%).

Sector Action:

Daily Positive Sectors: Technology, Healthcare, Consumer Cyclical and Financials of note.

Daily Negative Sectors: Communication Services and Materials of note.

One Month Winners: Communication Services, Technology, Consumer Defensive, Industrials and Utilities of note.

Three Month Winners: Consumer Defensive and Utilities of note.

Six Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive, Real Estate and Consumer Cyclical of note.

Year to Date Winners: Consumer Defensive, Utilities, Materials and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: PENN +0.90, CROX +0.52, ATHM +0.41, AMG +0.27, SN +0.14, APPN +0.10 of note. (>than 0.10)

Misses: SHOP -0.79, TAP -0.28, WRBY -0.08, PTON -0.05, CHH -0.03 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D crossed above its 30-day exponential moving average last week.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: DSGN +52.6%, SEZL +37.6%, PBPB +36.6%, MXCT +31.8%, EBS +21.3%, MEG +18.5%, LZ +18.1%, ALVO +16.4%, TPC +16.4%, MGNI +15.2%, APP +14.8%, LEU +13.7%, RUN +13.3%, ECPG +12.1%, RVMD +11.3%, ACVA +10.1%, HNST +9.2%, UTI +9.2%, BV +9.1%, TIGO +8.8%, STKL +8.4%, HCAT +8.3%, TTEK +8.2%, RELY +8.1%, MELI +8%, EPAM +8%, DVAX +7.5%, KAR +6.8%, QDEL +6.8%, RXST +6.6%, SNDX +6.5%, ROOT +6.5%, FSLY +6.5%, PBI +6.3%, AXON +6.3%, BMBL +6.2%, CXW +6.1%, COHR +6%, XRAY +6%, CORZ +5.6%, CMP +5.4%, CVNA +5.3%, AOSL +5.2%, SNEX +5%, IONQ +5%, VCYT +4.7%, EVTC +4.7%, HP +4.5%, SNDK +4.4%, BHF +4.4%, CXT +4.3%, BKH +4.3%, ESE +4.2%, MRUS +3.9%, MQ +3.9%, EE +3.8%, ORA +3.7%, SITM +3.5%, PAYC +3.2%, ADTN +3%, ATHM +3%, QTWO +2.9%, IHG +2.8%, HUN +2.6%, EIG +2.5%, VLRS +2.5%, CCRN +2.5%, AWR +2.4%, HAE +2.4%, CNQ +2.3%, JXN +2.2%, WDC +2.1%, ATO +2.1%, KNTK +2%, BUD +2% of note.

Gap Down: ERII -19.7%, XGN -17.4%, FLNC -14.9%, ARGX -12.6%, EQX -9.1%, ARM -8.9%, CLF -8.5%, FTNT -8.3%, ENOV -8%, FWRD -7.8%, YETI -7.6%, EOLS -6.4%, G -6.2%, HASI -6%, STAA -5.8%, ASLE -5.5%, LNW -4.4%, BBSI -4.3%, SEMR -4.1%, NTR -3.8%, GT -3.6%, TNK -3.4%, CENX -3.3%, ADMA -3%, VIR -3%, MUSA -3%, CTVA -3%, TAK -3%, PBH -2.7%, NATL -2.5%, CON -2.1%, TM -2.1%, QNST -2%, ZG -2%, CIVI -2% of note.

Insider Action: LYB of note sees Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg: Trump Touts Full US UK Trade Pact After Weeks of Talks. (Bloomberg)

Market Wrap: US Futures gain on UK Trad Deal and Chip Rule Change. (Bloomberg)

China says it should be "remove from unilaterally imposed tariffs" by the U.S.

India and Pakistan esclate conflict with drones. (Bloomberg)

President Trump calls Fed Chairman Powell "a fool". (CNBC)

President Trump says have a comprehensive trade deal with the U.K.

Barron's is + on FCX DIS ABM COLB NWN CRM.

Bloomberg Odd Lots: How China might really handle a trade war with the US. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

Weekly Jobless Claims are out at 8:30 a.m. EDT.

Weekly Crude Oil Inventories are out at 10:30 a.m. EDT.

Federal Reserve Speakers of note today.

Fed Speakers out of the Blackout period after yesterday's FOMC meeting.

President Trump's Daily Schedule.

President Trump makes a trade announcement at 10:00 a.m. EDT.

President Trump and the First Lady participate in a Celebration of Military Mothers at 12:00 p.m. EDT.

M&A Activity and News: None of note.

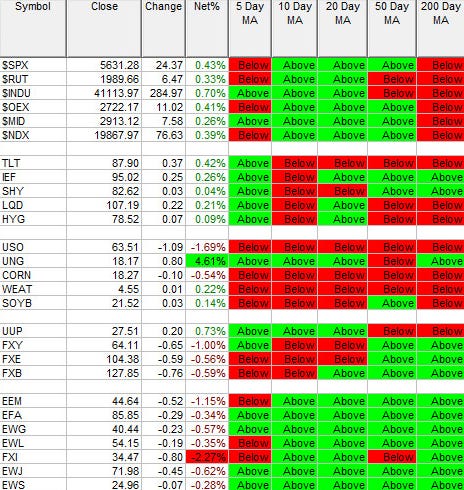

Moving Average Table: Remains at 60% on Equity Indexes. Fixed Income (bonds) is back to struggling.

Meeting & Conferences of Note:

Sellside Conferences:

Barclays Americas Select Franchise Conference

Bloom Burton & Co. Healthcare Investor Conference

BMO Capital Markets GRAMC

Davidson Financial Institutions Conference

Oppenheimer Industrial Growth Conference

Wells Fargo Real Estate Securities Conference

Shareholder Meetings: None of note.

Top Analyst, Investor Meetings: None of note.

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

Advanced Semiconductor Manufacturing Conference

Acute Kidney Injury

Digestive Disease Week

EAS Congress

FICO World

IUCX Annual Conference

Milken Institute Global Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: AMD TBLA of note.

Downgrades: ADM of note.

Note - ADM is a Downgrade and is heavily shorted.......BUT.......keep in mind - sometimes the shorts can be correct. That is why we give each stock a "grade". Have the shorts been correct in the past when entering a stock and by the time they cover they make money? Have the shorts entered a stock only to get squeezed as the stock goes higher. ADM has 18 instances historically where the shorts have been "heavy" based on Erlanger Research's work. During those 18 periods, the shorts usually made money. Shorts because there are shorts in the stock, does not automatically mean they will get squeezed. Know which shorts are being put on!