QPI Morning Note For 05/07/25: Stocks Futures Rebound on U.S. China Talks Starting Thursday

Overnight Summary & Early Morning Trading:

The S&P 500 finished Tuesday lower by -0.77% at 5606.91. Monday lower by -0.64% at 5650.38. Futures are higher this morning by 32.50 (+0.57%) at 5658.25 around 6:30 a.m. EDT. The range is now 500 points on the S&P 500 cash for the year, 5600 to 6100. Year to date the S&P 500 is down -4.67% from -3.93% Monday's close.

Executive Summary:

Stocks are beginning to trade with less volatility as the VIX is below 25. The S&P 500 broke its nine-day win streak on Monday. Now we have a two day losing streak going into FOMC today. Note that the S&P 500 did not lose more than -1%.

Breaking News: MBA Mortgage Applications up +11% for the week .

Key Events of Note Today:

FOMC Is out at 2:00 p.m. EDT with presser at 2:30 p.m. EDT with Chairman Powell.

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

March Consumer Credit is out at 3:00 p.m. EDT and expected to rise by $11 billion.

3-Year Note Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

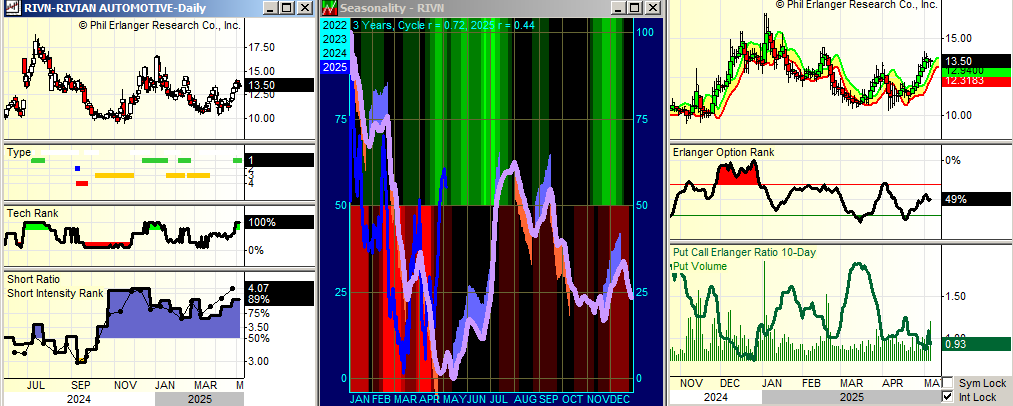

Beats: PTCT +11.05, KROS +4.77, AIZ +3.04, ALGT +0.57, VOYA +0.56, CRUS +0.49, SU +0.43, ANGI +0.36, RIVN +0.29, QLYS +0.21, HALO +0.19, JKHY +0.15, VSEC +0.15, UPST +0.13, DHT 0.10 of note (> 0.10)

Misses: KLIC -0.71, CRSP -0.35, AFG -0.22, SRPT -0.21, WYNN -0.17, SMCI -0.10, DNLI -0.08, CC -0.07, DVN -0.03, MRCY -0.02 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: ALEH, EGG, OMSE, YB

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

NG announces proposed public offering of 43.5 million common shares.

AKTX: Form S-3.. 51,770,782,000 Ordinary Shares

CYCN: Form S-3.. 499,998 Shares of Common Stock

Notes Priced:

AMH Announces Pricing of Public Offering of $650 Million of 4.950% Senior Notes due 2030

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

WLFC files 3,161,294 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

WLFC files for $500 mln mixed securities shelf offering; also files for 3,161,294 share common stock offering by selling shareholders.

ALE files mixed securities shelf offering.

CCG files $200 million mixed securities shelf offering.

News After The Close:

EV Makers Rivian (RIVN) and Lucid (LCID) flag increasing costs as tariffs hit. (Reuters)

AMD beats on earnings and revenues. (Yahoo Finance)

India hits terrorist camps in the Kashmir section of Pakistan. (Bloomberg)

Super Micro (SMCI) cuts outlook again, as admits tariff impacts.

Weight Watchers files for bankruptcy. (WSJ)

CoreWeave (CWAV) increased the company's revolving credit facility from $650 million to $1.5 billion and extend the maturity date.

China and U.S. set to start talks on Thursday in Switzerland. (BBC)

Amazon (AMZN) disclosed updated portfolio positions in 13F filing: Confirms new position in AMD, Exited TWLO, Maintained positions in RIVN ATSG VITL ALAB OWLT NAUT MRVL.

Aecom Tech (ACM) among several firms to compete for US Army orders within $249 mln contract.

Jones Lang LaSalle (JLL) awarded a $165 mln US Air Force contract for housing and transient housing privatization initiative.

Mercury (MRCY) increases FY25 revenue growth outlook.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

CMG hires Jason Kidd as its COO, effective May 19.

Buybacks: None of note.

Dividends Announcements or News:

Stocks Ex Div Today: BUD EQT FE NTB UVSP

Stocks Ex Div Thursday of note: RMD HESM WTFC AWI MTG MAIN FELE KBH MATX ARLP FHI BSM SEB DKL HTH SIMO NWBI JBGS VBTX

LFVN increases quarterly cash dividend 12.5% to $0.045/share form $0.04/share.

PEP increases quarterly cash dividend 5% to $1.4225/share from $1.355/share.

ASH increased quarterly cash dividend to $0.415/share from $0.405/share.

VSTS announces elimination of dividend

Stocks Moving Up & Down After The Close:

Gap Up: CURI +24.5%, FLYW +17.5%, PRCH +15.1%, NRDS +13.7%, ANGI +13%, JAMF +12.7%, EOSE +12.3%, REZI +11.7%, LITE +8.4%, KVYO +7.6%, WOW +6.7%, BL +6.6%, ATRO +6.4%, HALO +6.1%, EA +6%, ARDT +6%, PTCT +5.3%, CRUS +5.1%, KROS +4.7%, VRNS +4.5%, ALGT +4.4%, CDRE +3.8%, GEN +3.5%, QLYS +3.3%, ANDE +3.2%, DEI +2.9%, ACA +2.8%, SSRM +2.6%, DNLI +2.4%, OVV +2.3%, CRC +2.1%, RCUS +2.1%, CRSP +2.1% of note.

Gap Down: VSTS -28.2%, SRPT -20.7%, UPST -18.1%, MYGN -15.1%, RVLV -10.6%, CC -9%, MASI -7.1%, ANET -6.7%, RYAM -6.4%, SMCI -6%, JAZZ -5.3%, INTA -5.2%, TEM -5.2%, NCMI -5.2%, MBC -5.1%, BKD -5%, PARR -4.8%, MRVL -4.8%, TDC -4.6%, POWL -3.8%, MTW -3.6%, KLIC -3.3%, ARQT -3.1%, AMTM -2.8%, COTY -2.7%, ALAB -2.6%, MCY -2.1% of note.

What’s Happening This Morning: (as of 7:00 a.m. EDT)

Futures S&P 500 +37, NASDAQ +129, Dow Jones +304, Russell 2000 +16.21. Europe is lower and Asia is higher ex Japan. Bonds are at 4.32% from 4.351% yesterday on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas higher. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $97,052 from $94,219 higher by $+1977 (+2.08%).

Sector Action:

Daily Positive Sectors: Utilities, Materials and Energy of note.

Daily Negative Sectors: Healthcare, Industrials, Real Estate and Technology of note.

One Month Winners: Communication Services, Technology, Consumer Defensive, Industrials and Utilities of note.

Three Month Winners: Consumer Defensive and Utilities of note.

Six Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive, Real Estate and Consumer Cyclical of note.

Year to Date Winners: Consumer Defensive, Utilities, Materials and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Flat: None of note

Beats: BG+0.52, ROK +0.35, UBER +0.32, GOLF +0.30, CRL +0.27, DIS +0.26, KMT +0.23, SHOO +0.15, JLL +0.13, U +0.12, TRIP +0.11 of note. (>than 0.10)

Misses: JCI -0.18, HAIN -0.06, NI -0.05, GOLD -0.01 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: ANET COTY GEN JAMF NRDS of note.

Negative or Mixed Guidance: ALGT HALO HLIO INVX JKHY KLIC MYGN REZI SMCI VSTS WOW of note.

Advance/Decline Daily Update: The A/D crossed above its 30-day exponential moving average last week.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: MNPR +25%, CURI +20.6%, RIGL +19.6%, AVDX +19%, NRDS +18.9%, PRCH +18.9%, REZI +16.2%, OSCR +14.8%, ANGI +12.8%, FLYW +12.8%, CRCT +12.4%, EOSE +12.1%, LFMD +12%, BKD +11%, ZK +10.7%, ATRO +8.5%, NEXT +7.6%, KVYO +7.4%, LITE +7%, WOW +6.9%, CRSP +6.7%, ALGT +6.2%, BL +6%, HALO +5.8%, EA +5.6%, NVO +5.4%, ALVO +5.3%, JAMF +5.2%, CYTK +4.9%, TPG +4.8%, VRNS +4.8%, QLYS +4.7%, KROS +4.7%, LIVN +4.7%, FTS +4.7%, AZEK +4.6%, VTOL +4.5%, BG +4.3%, MOS +4.1%, SWX +3.5%, CANG +3.5%, LOPE +3.5%, CRUS +3.4%, TTI +3.3%, VSEC +3.3%, HLIO +3.2%, ACDC +3.1%, WYNN +3%, FVRR +2.9%, AMD +2.8%, PRA +2.7%, ET +2.6%, SSRM +2.4%, BNL +2.1%, WLFC +2.1%, SAFE +2% of note.

Gap Down: VSTS -25.7%, SRPT -19.6%, PARR -19.5%, MYGN -17.2%, UPST -15.8%, ARQ -14.1%, CC -11.3%, INVX -10.8%, MBC -10.3%, LFVN -9.8%, EPC -8.5%, RVLV -8.2%, EXPI -7.7%, MRVL -6.9%, ENTG -6.7%, ANET -5.3%, ONC -5.3%, KLIC -5.2%, MRC -5.2%, NG -5%, INTA -5%, MCY -5%, MASI -4.8%, SMCI -4.7%, FBIN -4.4%, AXTA -4.4%, NCMI -4.1%, JAZZ -3.8%, TDC -3.8%, IRS -3.2%, SUPN -3.1%, AMTM -3%, ARTNA -2.8%, GOLF -2.6%, ARQT -2.5%, VOYA -2.5%, HL -2.4%, COTY -2.3%, OVV -2.2%, RDFN -2.1%, IAG -2% of note.

Insider Action: LYB of note sees Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg: Xi Fortifies China's Economy Before First Trade Talk with U.S. (Bloomberg)

Market Wrap: Stock futures get a lift from U.S. China Trade Talks. (Bloomberg)

Disney (DIS) raises profit forecast. (Bloomberg)

AMD beats on estimates but takes a hit on restctions with China . (CNBC)

Bloomberg Odd Lots: Brad Stetser on Taiwan Dollar Surge. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

March Consumer Credit is out at 3:00 p.m. EDT and expected to rise by $11 billion.

Weekly Crude Oil Inventories are out at 10:30 a.m. EDT.

Federal Reserve Speakers of note today.

Fed Speakers are back in Blackout period through today's FOMC meeting.

FOMC Is out at 2:00 p.m. EDT with presser at 2:30 p.m. EDT.

President Trump's Daily Schedule.

President Trump receives the latest intelligence briefing at 11:00 a.m. EDT.

President Trump participates in a Swearing-In Ceremony for the Ambassador to the People's Republic of China at 12:30 p.m. EDT.

President Trump has lunch with Vice President Vance at 1:00 p.m. EDT.

At the same time as lunch, there is a Press Briefing.

M&A Activity and News: None of note.

Moving Average Table: Moves from 77% to 60% on Equity Indexes. Fixed Income (bonds) is back to struggling.

Meeting & Conferences of Note:

Sellside Conferences:

Barclays Americas Select Franchise Conference

Bloom Burton & Co. Healthcare Investor Conference

BMO Capital Markets GRAMC

Davidson Financial Institutions Conference

Oppenheimer Industrial Growth Conference

Wells Fargo Real Estate Securities Conference

Shareholder Meetings: BAX, BMY, CF, DHR, EQ, HSY, INTC, MTW, OSK, TX, VLO

Top Analyst, Investor Meetings: ALLE, ALGN, CGAU, EXLS, PEV, QNTM, RA

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

Advanced Semiconductor Manufacturing Conference

Acute Kidney Injury

Digestive Disease Week

EAS Congress

FICO World

IUCX Annual Conference

Milken Institute Global Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: AMD HON LOGI STZ WYNN of note.

Downgrades: ITW of note.