QPI Morning Note For 05/05/25: Monday Early Weakness Trend Continues As Markets Evaluate Weekend Talking Points

Overnight Summary & Early Morning Trading:

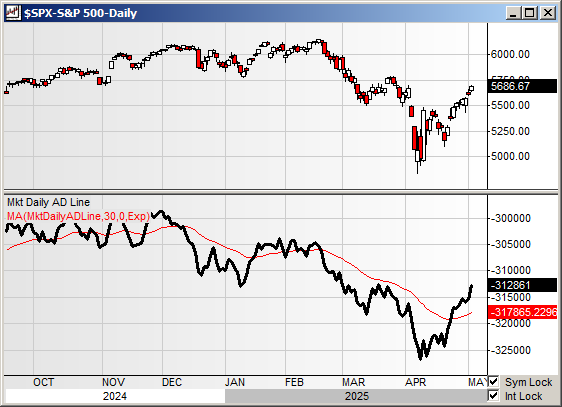

The S&P 500 finished Friday higher by 1.47% at 5686.67. Thursday higher by 0.63% at 5604.14. Futures are lower this morning by -44.50 (-0.78%) at 5664 around 6:15 a.m. EDT. The range is now 500 points on the S&P 500 cash for the year, 5600 to 6100. Year to date the S&P 500 is down -3.31% from -4.72% Thursday's close.

Executive Summary:

Stocks are beginning to trade with less volatility as the VIX is at 22.68 from 24.60 Thursday morning. The S&P 500 is now higher for nine days in a row. Time for the market to catch its breath.

Key Events of Note Today:

April ISM Services are out at 10:00 a.m. EDT. Global US Service PMI is also out, but less important, at 9:45 a.m. EDT.

3 & 6-Month Bill Auction at 11:30 a.m. EDT

3-Year Note Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: None of note

Misses: None of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: ALEH, EGG, OMSE, YB

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced: None of note.

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note:

UCSB files for 9,004,218 shares Class A Common offering by selling shareholders.

LPTH files for 21,193,380 share common stock offering by selling shareholders

Mixed Shelf Offerings:

GMGI: Form S-3.. $300,000,000 Mixed Shelf

INN files a Mixed Shelf Offering.

NAVI files a Mixed Shelf Offering.

IMAB: Form F-3.. $250,000,000 Mixed Shelf I

NN: FORM S-3ASR - Mixed Shelf Offering

JSM: FORM S-3ASR - Mixed Shelf Offering

NBIS: FORM S-3ASR - Mixed Shelf Offering

OUST: Form S-3.. $200,000,000 Mixed Shelf

USAU: Form S-3.. $150,000,000 Mixed Shelf

USCB: FORM S-3 - $100,000,000 Mixed Shelf Offering.

News After The Close:

Bank stocks worth keeping on radar on report Fed seeking to review the confidential ratings for the health of large banks. (WSJ)

District Court Dismisses Dispute Filed by United Therapeutics (UTHR) Against Liquidia.

Warren Buffet announced on Saturday that he would retire from Berkshire Hathaway (BRKB) and Greg Abel would replace him as CEO. Buffet will remain as Chairman.

President Donald Trump was interviewed on "Meet The Press" and noted several key items. Most important was that he would not try to run a third time. Also, Trump might not follow the Constitution related to due process.

Apple (AAPL) will change the delivery of iPhones this fall with standard models pushed to spring of 2027. (The Information)

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

HELE announces that Noel Geoffroy is departing as CEO, effective immediately; Brian Grass appointed interim CEO. Tracy Scheuerman as its interim Chief Financial Officer.

MTRX COO Alan Updyke to step down.

NEM promotes Natascha Viljoen to President and COO

Buybacks: None of note.

Dividends Announcements or News:

Stocks Ex Div Today: C AB ETN HCC LAZ NOK OHI OKE PNW SYF CAPL

Stocks Ex Div Tuesday of note: None of note.

CNO increases quarterly cash dividend to $0.17/share from $0.16/share.

Stocks Moving Up & Down Last Week:

Gap Up: KPTI (7.49 +33.19%), SLDB (4.32 +30.76%), KNSA (27.7 +29.65%), IRTC (131.76 +24.31%), ABEO (6.63 +24.3%), THC (147.65 +20.93%), ATI (66.29 +24.86%), CSTM (11.2 +20.38%), JBLU (4.78 +23.07%), FWRD (17.81 +21.81%), CPS (21.77 +53.49%), LEG (9.54 +30.86%), CECO (25.79 +29.4%), FTDR (50.84 +23.83%), TTMI (25.06 +22.72%), GDS (28.26 +22.07%), TRUP (44.96 +24.13%) of note.

Gap Down: NEO (7.75 -24.54%), CDNA (14.95 -19.1%), SEM (14.19 -18.21%), BDX (168.41 -17.88%), SIGA (5.61 -13.77%), HTZ (6.73 -18.92%), NSP (66.85 -15.38%), FTAI (89.64 -14.5%), EAF (0.6 -14.45%), BE (16.36 -13.6%), EAT (132.94 -16.73%), SQ (46.32 -20.26%), CSIQ (9.49 -14.9%), TREE (42.84 -16.88%), EHTH (5.25 -16.01%), LANC (162.21 -14.72%), PPC (46.14 -13.85%) of note.

What’s Happening This Morning: (as of 7:00 a.m. EDT)

Futures S&P 500 , NASDAQ , Dow Jones , Russell 2000 . Europe is higher and Asia higher ex Australia. Bonds are at 4.318% from 4.21% Friday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas higher. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $94,385 from $96,855 lower by $-1174 (-1.23%).

Sector Action:

Daily Positive Sectors: Communication Services, Financials, Industrials, Healthcare and Technology of note.

Daily Negative Sectors: None of note.

One Month Winners: Communication Services, Technology, Consumer Defensive, Industrials and Utilities of note.

Three Month Winners: Consumer Defensive and Utilities of note.

Six Month Winners: Financials, Consumer Defensive, Communication Services and Utilities of note.

Twelve Month Winners: Financials, Communication Services, Utilities, Technology, Consumer Defensive, Real Estate and Consumer Cyclical of note.

Year to Date Winners: Consumer Defensive, Utilities, Materials and Financials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Monday After the Close:

Tuesday Before The Open:

Notable Earnings of Note This Morning:

Flat: none of note

Beats: BNTX +0.54, BCRX +0.28, ARES +0.15, JBTM +0.13, HSIC +0.04, PK +0.04, ZBH +0.04 of note.

Misses: FRPT -0.36, TGTX -0.14, CNA -0.11, OCUL -0.09, IART -0.02 of note.

Still to Report: none of note.

Company Earnings Guidance:

Positive Guidance: TGTX of note.

Negative or Mixed Guidance: FRPT of note.

Advance/Decline Daily Update: The A/D crossed above its 30-day exponential moving average last week.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: FFAI +7.7%, NEM +2.9%, HSIC +2.9%, USAU +2.7% of note.

Gap Down: IBRX -9.1%, LPTH -7.2%, RXRX -5.8%, CIFR -5.4%, OUST -4%, USCB -3.6%, NBIS -2.8%, CNA -2.6%, LQDA -2.1%, FRPT -2.1%, BRK.B -2% of note.

Insider Action: None of note sees Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg: Trump Suggests Some Trade Deals As Soon As This Week. (Bloomberg)

Trump admitted at some point the U.S. would lower tariffs on China. (Bloomberg)

Social Security Administration to reduce clawbacks to 50% from 100%. (CNBC)

Student Loan Collections to restart for 5 million borrowers. (CNBC)

Bloomberg Odd Lots: Henry Blodgett on AI versus the 90s Dot.com. (Podcast)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Federal Reserve Speakers of note today.

Fed Speakers are back in Blackout period until this week's FOMC meeting is concluded.

Economic Releases:

April ISM Services are due out at 10:00 a.m. EDT and are expected to fall to 50.40% from 50.80%. Global US Services PMI is due out at 9:45 a.m. EDT and came in last month at 51.40.

President Trump's Daily Schedule.

President Trump delivers a Sports Announcement at 1:00 p.m. EDT.

President Trump to sign Executive Orders at 3:00 p.m. EDT.

President Trump welcomes home a returned citizen at 3:30 p.m. EDT.

President Trump attends a MAGA dinner at 7:30 p.m. EDT.

M&A Activity and News: None of note.

Moving Average Table: Moves from 70% to 80% on Equity Indexes. Fixed Income (bonds) back to struggling.

Meeting & Conferences of Note:

Sellside Conferences:

Davidson Financial Institutions Conference

Bloom Burton & Co. Healthcare Investor Conf

Morgan Stanley Healthcare Private Company

Oppenheimer Industrial Growth Conference

Stifel Investor Summit at WasteExpo

Wells Fargo Real Estate Securities Conference

Shareholder Meetings: ADT, CVNA, LLY, REGN, UBER

Top Analyst, Investor Meetings: NBTX, VZIO

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

Digestive Disease Week

EAS Congress

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: RDDT SHC WOR of note.

Downgrades: SPOT of note.