QPI Morning Note -6/6/24: Stocks Flat. ECB Cuts Rates

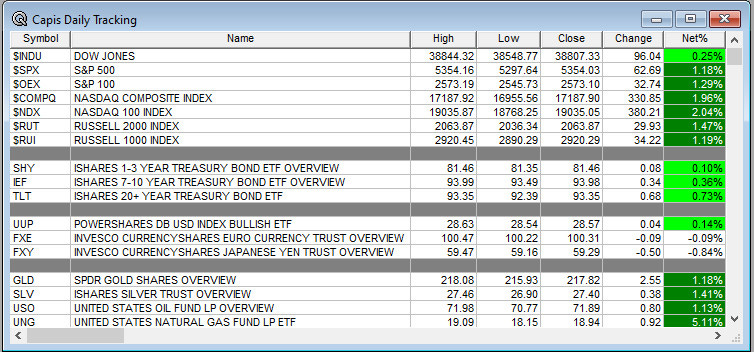

Overnight Summary: The S&P 500 closed Wednesday higher by 1.18% at 5354.03 from Tuesday higher by 0.15% at 5291.34. The overnight high was hit at 5,372.25 at 7:10 p.m. EDT and the low was hit at 5362.50 at 5:50 a.m. EDT. The overnight range is 10 points. The current price is 5365.50 at 6:30 a.m. EDT down by -0.50.

Executive Summary: Yesterday borrowed from today's energy. Expect a range bound day.

A quiet day.

ECB just cut interest rates.

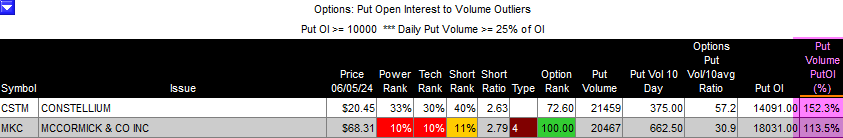

Unusual Options Activity:

Daily Screen in Erlanger Chartroom that highlights unusual Call and Put Options activity in the S&P 500. It looks for volume outliers relative to the Open interest in Calls or puts. Usually, the stock price activity reflects the outlier situation (earnings/buyout/announcement), but once in a while, you can uncover stocks prior to a pop or drop.

Earnings Out After The Close:

Beats: LULU +0.14, BASE +0.05, SMTC +0.05, SMAR +0.05, VSCO +0.03, CHPT +0.02, CXM +0.02 of note.

Misses: GEF -0.03, FIVE -0.03 of note.

Capital Raises:

IPOs For The Week: FLYE GAUZ NVL WAY

New IPOs/SPACs launched/News:

AppsFlyer considers going public. (Bloomberg)

Secondaries Files or Priced:

DX announces 10.5 mln share public offering.

LPG announces public offering of 2 mln common shares

RNLX files 26,815,841 ordinary shares

ANNX priced at $6.25

Notes Priced of note:

WEC issues an additional $37.5 mln aggregate principal amount of its 4.375% Convertible Senior Notes due 2027.

Selling Shareholders of note:

NN files for 237,722 shares of common stock by selling shareholders; also files for 397,037 shares of common stock by selling shareholders

CDNS files for 1,740,931 shares of common stock by selling shareholders.

Mixed Shelf Offerings:

WY: files a mixed shelf offering

ET: files a mixed shelf offering.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

Biggest Gainers and Losers After The Close:

LULU +12.3%, SMAR +10.6%, SMTC +6.3%, BASE +4.5%, RNW +2.7%, GEF +1.3%

FIVE -15.8%, CXM -15.4%, VSCO -3.5%, ODFL -3.4%, DX -2.9%, HYLN -2.7%

Items After the Close:

The S&P 500 hit its 25th record for the year on Wednesday. (Bloomberg).

Nvidia (NVDA) value passes $3 trillion and overtakes Apple in value. (BBC)

Apollo President notes , " ...Everything is Not Going to Be OK in Private Equity". (Bloomberg)

Lulu Lemon (LULU) shares jump on buyback and profit forecast as well as earnings beat. (WSJ)

American Airlines (AAL) offers flight attendants immediate 17% wage hike. (Fox)

COST May Same Store Sales up +6.5%.

CBOE May Trading Volume. (Press Release)

Jim Cramer interviewed CEOs of CRWD and SNOW on Mad Money. (CNBC).

Buybacks or Repurchases:

SMAR announces new $150 mln share repurchase program.

THRM announces a new $150 mln share repurchase program.

Exchange/Listing/Company Reorg and Personnel News:

Allison Transmission (ALSN) appoints Frederick Bohley as COO, effective immediately.

Dividends Announcements or News:

Stocks Ex Div Today: CME NTES KHC KIM MOS LEA TEX

ODC increases quarterly cash dividend 7% to $0.31/share from $0.29/share

What’s Happening This Morning: Futures S&P 500 +1 , NASDAQ 100 +20.50 , Dow Jones -20 , Russell 2000 -6.07. Asia is higher and Europe is higher this morning. VIX Futures are at 13.31 from 13.60 yesterday. Gold, Silver and Copper are higher. WTI Crude Oil and Brent Crude Oil are higher while Natural Gas is higher as well. US 10-year Treasury sees its yield at 4.297% from 4.338% yesterday. The U.S. Dollar is lower versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $70,994 from$70,877 lower by -0.248% this morning.

Sector Action:

Daily Positive Sectors: Technlogy, Communication Services, Industrials and Materials of note.

Daily Negative Sectors: Real Estate, Utilities and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software - sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before The Open: None of note

Earnings of Note This Morning:

Beats: SJM +0.33, GIII +0.15, CIEN +0.12, ABM +0.08 of note.

Misses: BIG -0.59, NIO -0.19 of note.

Still to Report: TTC of note.

Company Earnings Guidance:

Positive Guidance: NIO of note.

Negative Guidance: CHPT FIVE of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

Gap Up: SGMT +14%, NVAX +13.5%, SMAR +13.2%, SMTC +8.8%, LULU +7.7%, RLAY +5.2%, KEN +4.3%, FSM +3.9%, RNW +3.5%, SGML +2.8%, HALO +2.4%, BASE +2.1% of note.

Gap Down: CXM -23.6%, FIVE -16.3%, LPG -6.2%, APLD -4.3%, TOUR -3.8%, CHPT -3.5%, GPCR -3.2%, DX -2.2%, BTBT -2.1%, ANNX -2.1%, ODFL -2%of note.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

5 Things To Now Before The Market Opens on Thursday. (CNBC)

What You Need To Know To Start Your Day. (Bloomberg)

Stocks Making The Biggest Moves in Pre-Market: (CNBC)

Market Wrap: Stocks lose steam as data sows worries. (Bloomberg)

Bloomberg Lead Story: Nvidia's Rise to $3 Trillion Fuels Jensanity. (Bloomberg)

Robinhood (HOOD) to buy Bitstamp for $200 million

Earth has hit 12 straight months of record heat in each month. (USA Today)

Bloomberg: The Big Take: Stunning Blow For Modi. (Podcast)

Bloomberg: Odd Lots: How Companies Got Smarter About Price Hikes. (Podcast)

Marketplace: The universe is expanding faster than we thought. (Podcast)

Geopolitical:

President’s Public Schedule:

There is a Daily Briefing scheduled for 1:00 a.m. EDT today in Paris.

President Biden goes to to Normandy and Omaha Beach today for D-Day Anniversary.

Economic:

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

April Trade Balance is due out at 8:30 a.m. EDT.

Weekly Natural Gas Inventory Report is due out at 10:30 a.m. EDT.

Federal Reserve / Treasury Speakers:

Federal Reserve Speakers are in a blackout period through next Wednesday's FOMC announcement.

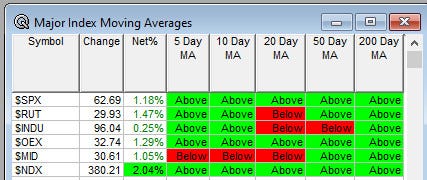

Moving Averages On Major Indexes: 80% of the moving averages are positive up from 60%.

Meeting & Conferences of Note:

Sellside Conferences:

Baird Global Consumer Tech & Services Conference

Bank of America Global Technology Conference

William Blair Growth Stock Conference

Deutsche Bank Global Consumer Conference

Deutsche Bank Global Industrial Materials and Building Products Conference

Goldman Sachs Global Healthcare Conference

Jefferies Global Healthcare Conference

RBC Consumer & Retail Day

TD Cowen Financial Services & Fintech Summit

UBS Decarbonization Conference

Wolfe Research SMID Conference

Top Shareholder Meetings: AAL, ABNB, AFYA, AMBC, AMC, APP, BMBL, DVN. FIS, HLNE, INDO, MVIS, NYCB, PLTR, U, URBN, WMT

Investor/Analyst Day/Calls: HLNE, IFRX, LVO, PCAR, USFD

Industry Meetings:

International Liver Congress

Nareit's REITweekInvestor Conference

NYSE Consumer Virtual Investor Day

Spinal Cord Injury Investor Symposium

Top Tier Sell-side Upgrades & Downgrades:

Upgrades COF PNW SEE RARE UAL of note.

Downgrades ZIM TVST of note.