QPI Morning Note - 4/7/25: Trump Tariff Tantrum Continues and Stocks Continue To Fall But Off Lows

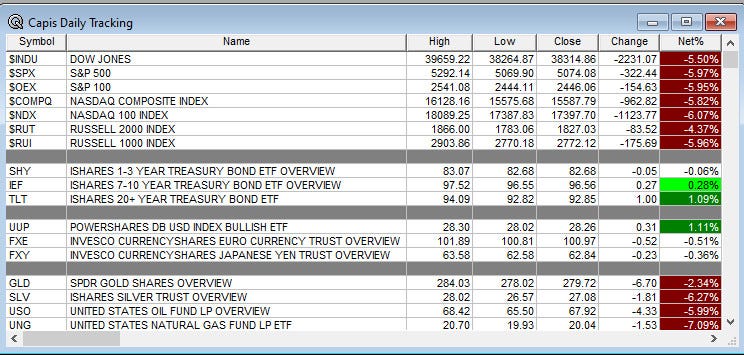

Overnight Summary & Early Morning Trading: The S&P 500 finished Friday lower by -5.97% at 5074.08. Thursday lower by -4.84% at 5396.52. Futures are lower this morning by -159 (-2.93%) at 5273 around 7:05 a.m. EDT. The range is 800 points on the S&P 500 for the year, 5300 to 6100 a drop of 200 points. Thought for the upcoming week: Ground Hog Day as a third really fugly day. Someone is going to “bend the knee” sooner than later in this global trade game of chicken.

Quote of the Day: “In 1930, the Republican-controlled House of Representatives, in an effort to alleviate the effects of the… Anyone? Anyone?… the Great Depression, passed the… Anyone? Anyone? The tariff bill? The Hawley-Smoot Tariff Act? Which, anyone? Raised or lowered?… raised tariffs, in an effort to collect more revenue for the federal government. Did it work? Anyone? Anyone know the effects? It did not work, and the United States sank deeper into the Great Depression.” Ben Stein as the Economic Teacher in “Ferris Bueller’s Day Off”

Article of Note: JP Morgan CEO Jamie Dimon Annual Letter – link to letter.

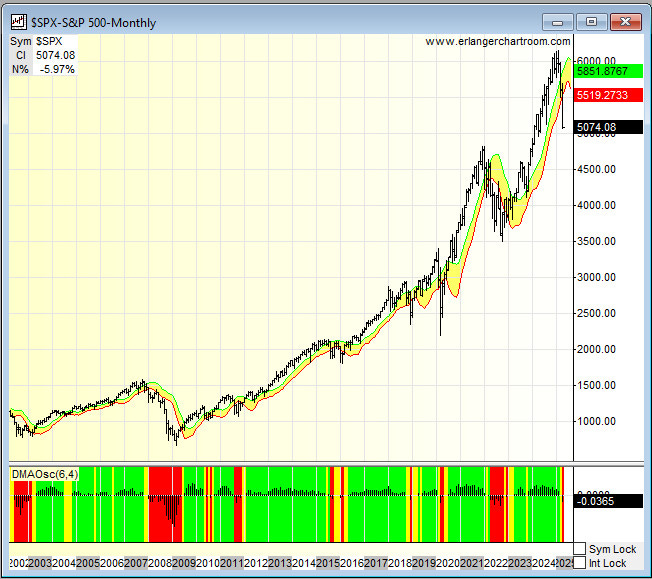

Chart of the Day: The S&P 500 broke its Monthly Displaced Moving Average (DMA) Channel on Friday. When this breaks move to a defensive position until we get back in the channel. Prior breaks include 2000-2002, 2007-2009, 2010, 2011, 2015, 2018, 2020 and 2022. We will have a video on this tomorrow.

ChatGPT Fact of the Day:

Breaking News:

Key Events of Note Today:

No major economic data of note today. Key releases this week include CPI ad PPI.

Monthly Consumer Credit due out at 3:00 p.m. EDT.

3 and 6-month Treasury Auction at 11:30 a.m. EDT.

Only one thing matters: Tariff negotiations and the tone of it.

Notable Earnings Out After The Close

Beats: None of note.

Misses: None of note.

Capital Raises:

IPOs For The Week: ALEH, FATN, LAWR, MB, OMSE, PHOE, RYET

New IPOs/SPACs launched/News:

IPOs Filed/Priced:

Secondaries Filed or Priced:

ACXP: Form S-1 8,399,700 Shares of Common Stock

IMNN: Form S-1.. UP TO 10,000,000 SHARES OF COMMON STOCK

LIXT: Form S-1.. 467,393 Shares of Common Stock

PSTV: Form S-3.. Up to 1,565,044,860 Shares of Common Stock

SCNX: Form S-1.. 2,643,421 SHARES OF COMMON STOCK

TNON: Form S-1.. 5,673,550 Shares of Common Stock

ZVSA: Form S-3.. 2,105,265 Shares of Common Stock Issuable Upon Exercise of Pre-Funded Warrants

Notes Priced:

Notes Files:

Convertibles Filed:

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements:

Selling Shareholders of note:

BEEP files for 37,626,865 shares of common stock offering by selling shareholders.

LENZ files for 13,070,093 share common stock offering by selling shareholders.

NMAX files for 121,288,655 share common stock offering by selling shareholders.

Mixed Shelf Offerings:

LENZ files for $500 mln mixed securities shelf offering.

KSCP: Form S-3.. $100,000,000 Mixed Shelf

News After The Close:

Meta (META) planning a nearly $1.0 bln data center project in Wisconsin. (Bloomberg)

Trump Administration dropping Medicare obesity drug coverage. (Bloomberg)

RTX awarded a $117 mln modification to a previously awarded US Navy contract,

President Trump puts TikTok sale negotiations on hold by China in response to reciprocal tariffs and sale negotiations put on hold by China in response to reciprocal tariffs.

10K or Qs Filings/Delays – (Filed), (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

DK names Robert Wright as CFO.

Buybacks

LENZ announces $150 mln ATM offering program

Dividends Announcements or News:

Stocks Ex Div Today: EIX MKC ERIE DGX YMM OGE UTZ SPNS SCS PFBC

Stocks Ex Div Tomorrow: JD DG MNSO TIGO MAIN GBCI THO SLVM WLY OPFI

Stocks Moving Up Last Week:

Gap Up: CORT (73.59 +34.71%), BLUE (4.95 +21.32%), MOH (349.11 +8.13%), CNC (62.95 +4.85%), RUN (6.75 +13.59%), GT (9.75 +10.92%), DG (93.69 +8.81%), GME (23.62 +8.7%), ROST (132.36 +5.53%), TJX (124.24 +5.1%), PRGS (56.16 +9.28%), SQQQ (48.73 +27.22%), COOP (132.25 +26.57%), HMST (11.34 +21.94%), LW (59.67 +10.48%), NGVC (41.07 +7.73%) of note.

Gap Down: BHVN (18.74 -32.22%), RCKT (5.22 -31.29%), CIVI (24.37 -30.41%), QURE (8.72 -30.11%), FWRD (13.05 -37.02%), RH (147.87 -37.42%), AAOI (10.77 -34.25%),PTEN (5.66 -30.95%), NBR (28.9 -30.76%), LBRT (11.03 -30.22%), PUMP (5.25 -28.93%) of note.

What’s Happening This Morning: (as of 8:15 a.m. EDT) Futures S&P 500 -136, NASDAQ -530, Dow Jones -880, Russell 2000 -64. Europe and Asia are lower. Bonds are at 3.975% from 3.90% Friday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold and Silver higher with Copper lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and lower against the Yen. Bitcoin is at $76,591 from $82,423 lower by $2786 at -3.40%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: None of note.

Daily Negative Sectors: All led the way lower with biggest drops in Energy, Materials, Financials and Technology.

One Month Winners: None of note.

Three Month Winners: Consumer Defensive of note.

Six Month Winners: None of note.

Twelve Month Winners: Utilities, Consumer Defensive, Financials, Communication Services and Real Estate of note.

Year to Date Winners: Consumer Defensive of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Monday After the Close: PLAY GBX LEVI of note

Tuesday Before The Open: RPM TLRY WDFC of note

Notable Earnings of Note This Morning:

Flat: None of note

Beats: None of note.

Misses: None of note.

Still to Report:

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D made a new low. Awful.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: KVUE +8.2%, QGEN +4.2%, SMHI +4.1%, XEL +2%, SO +2% of note.

Gap Down: BHVN -9.6%, BEEP -9.2%, RILY -8.5%, CANG -7.2%, IBRX -7.1%, HUT -6.8%, CIFR -6.2%, RYTM -5.8%, LENZ -5.6%, VZLA -5.3%, SHEL -5.2%, HIVE -5%, BEAM -4.5%, MRNA -4.1%, DK -3.8%, NMAX -3.8%, NIO -3.8%, UFPT -3.6%, PAC -2.3%, AVXL -2.3%, RTX -2.2%, MT -2.2% of note.

Insider Action: None see Insider Buying with dumb short selling. None see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg: Stock Futures Pare Declines. (Bloomberg)

Three day selloff wipes out $9.5 trillion of value. (Bloomberg)

Morgan Stanley downgrades Banking Sector. (Bloomberg)

White House put on defense over Tariff Chaos. (CNBC)

Jaguar Land Rover pauses sending parts to U.S. (CNBC)

Five Things To Know Before The Market Opens. (CNBC)

Bloomberg Big Take: Trump’s Tariff Has Wall Street Facing Harsh Reality. (Bloomberg)

Bolded Royal Blue means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases: None of note today.

Federal Reserve Speakers of note today.

Federal Reserve Governor Adriana Kugler speaks at 10:30 a.m. EDT.

Federal Reserve to hold a Board Meeting today at 11:30 a.m. EDT.

President Trump’s Daily Schedule.

President Trump greets the MLB Champs Los Angeles Dodgers at 11:00 a.m. EDT.

President Trump greets the Israeli Prime Minister at 1:00 p.m. EDT then hold a bilateral meeting at 2:00 p.m. EDT followed by a presser at 2:30 p.m. EDT.

M&A Activity and News:

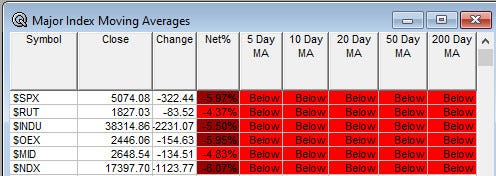

Moving Average Table: Remains at 0%.

Meeting & Conferences of Note: (Not updated today, back tomorrow)

Sellside Conferences:

Bank of America Nuclear Conference

Canaccord Horizons in Oncology Conference

Needham Healthcare Conference

Shareholder Meetings: CIGI, RNTX

Top Analyst, Investor Meetings: DSX, EXK, MLYS, NXDT, SRAD, VYGR

Update: None of note.

Fireside Chat

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

Ablation Innovation Summit

Alzheimer’s and Parkinson’s Diseases and Related Neurological Conference

American Academy of Neurology Meeting

CinemaCon 2025

NAB Show

NDASA Conference and Trade Show

Optical Fiber Communications Conference and Exhibition (OFC)

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: KN

Downgrades: LAZ