QPI Morning Note - 4/24/25: Stocks Rally Stalls After Two Up Days

Overnight Summary & Early Morning Trading:

The S&P 500 finished Wednesday higher by 1.67% at 5375.86. Tuesday higher by 2.51% at 5287.76. Futures are higher this morning by +123 (+2.32%) at 5438 around 6:45 a.m. EDT. The range is now 800 points on the S&P 500 cash for the year, 5300 to 6100. Year to date the S&P 500 is down -8.60% from -10.10% Monday's close.

Executive Summary:

Stocks continue to trade in a volatile pattern of big declines and then big advances. Today, we are seeing a big drop on news that President Trump is back to criticizing Fed Chairman Powell and China who said there are no ongoing negotiations.

Breaking News: None of note.

Article of Note: "Is This Trump's Mitterrand Moment" by Wall Street Journal Editorial Board.

Key Events of Note Today:

Several economic releases out today, see below.

7-Year Month Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close:

Beats: DFS +0.88, KALU +0.84, CACI +0.63, NEM +0.35, NOW +0.21, MTDR +0.21, FAF+0.20, CSL +0.19, IBM +0.18, TXN +0.16, OII +0.13, PI +0.13, MOH +0.11 and MC +0.09 of note. (Greater than $0.09)

Misses: ORLY -0.51, CCS -0.34, RNR -0.32, RHI -0.19, VKTX -0.08, STC -0.08, RJF -0.03, EPRT -0.03, ASGN -0.03, RMD -0.01 of note.

Flat: None of note.

Capital Raises:

IPOs For The Week: AIRO, CHA, HXHX, OMSE, PHOE

New IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced: None of note.

ADC Common Stock Offering

ENSC -, Exercise of Warrants for $2.2 Million Gross Proceeds

GCTS: Form S-3.. 36,261,987 Shares of Common Stock 6,728,320 Warrants to Purchase Common

StockNXL: Form S-3.. $50,000,000 Common Stock

Notes Priced: None of note.

Notes Files: None of note.

Convertibles Filed: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Private Placements: None of note.

Selling Shareholders of note: None of note.

TATT files for 2,905,202 ordinary shares offering by selling shareholders

RES files for 127,235,202 shares of common stock offering by selling shareholders

MPX files for 24,414,029 shares of common stock offering by selling shareholders

Mixed Shelf Offerings:

LNKB files $100 mln mixed shelf securities offering

TATT files $70 mln mixed shelf securities offering

NG files mixed shelf securities offering

RES files $300 mln mixed shelf securities offering.

MPX files $150 mln mixed shelf securities offering

News After The Close:

IBM reaffirms FY25 revenue outlook, continues to expect full-year constant currency revenue growth of at least 5%.

President Trump planning to exempt car parts from China tariffs, but will leave 25% tariffs on autos in place; automakers will also be exempt from steel and aluminum tariffs. (FT)

Jazz Pharmaceuticals (JAZZ) showcases transformative data at ASCO 2025, highlighting advances in small cell lung cancer, HER2+ gastroesophageal cancer and diffuse glioma.

Southwest Airlines (LUV) to scale back flight schedule due to consumer demand.

General Motors (GM) aiming to increase production at Ohio plant. (Reuters)

Las Vegas Sands (LVS) will not bid for New York City Casino.

10K or Qs Filings/Delays – (Filed), (Delayed) None of note.

Exchange/Listing/Company Reorg and Personnel News:

FAST approves a 2:1 split.

Buybacks:

STEL authorizes a new share repurchase program under which the Company may repurchase up to $65 million of common stock through May 31, 2026

Dividends Announcements or News:

Stocks Ex Div Today: FMX LEVI CCU AZZ

Stocks Ex Div Tomorrow: of note.

ET increases quarterly dividend to $0.3275 from $0.325/share.

JACK drops dividend.

SUN increases quarterly dividend to $0.8976 from $0.8865/share.

HOMB increases its quarterly dividend by 2.6% to $0.20 per share

Stocks Moving Up & Down Yesterday After The Close:

Gap Up: PI +15.2%, CYH +14%, NOW +10.8%, TXN +4.8%, WHR +4%, LRCX +3.5% of note.

Gap Down: RHI -15.3%, ALK -7.7%, IBM -6%, LOB -5.9%, VRE -5%, VIST -4.7%, GSHD -4.5%, CVBF -4.1%, CCS -3.9%, KNX -3.6%, LUV -3.6% of note.

What’s Happening This Morning: (as of 7:40 a.m. EDT)

Futures S&P 500 - , NASDAQ - , Dow Jones - , Russell 2000 -. Europe is lower and Asia higher ex China. Bonds are at 4.346% from 4.305% yesterday on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold higher with Silver lower and Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $92,531 from $93,526 lower by $875 at -0.94%.

Sector Action:

Daily Positive Sectors: Technology, Consumer Cyclicals, Industrials, Financials and Communication Services.

Daily Negative Sectors: Energy and Consumer Defensive of note.

One Month Winners: Consumer Defensive of note.

Three Month Winners: Consumer Defensive of note.

Six Month Winners: Consumer Defensive and Financials of note.

Twelve Month Winners: Utilities, Financials, Consumer Defensive, Real Estate, Communication Services, Consumer Cyclical and Technology of note.

Year to Date Winners: Consumer Defensive, Utilities and Materials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before The Open:

Notable Earnings of Note This Morning:

Flat: MBLY +0.00, CNP +0.00 of note

Beats: SNY +1.57, BFH +0.63, VC +0.59, FCN +0.50, VLO +0.48, GPI +0.45, AMP +0.42, HAS +0.37, BC +0.34, STRA +0.34, TECK +0.34, FCFS +0.33, BMY +0.31, WST +0.22, TPH +0.21, ALLE +0.19, AUB +0.19, CBZ +0.18, CNX +0.16, NVCR +0.15, TXT +0.14, CURB +0.13, AAL +0.11, CMCSA +0.10, LHX +0.10, CBRE +0.10, MRK +0.09, BCPC +0.09, FSV +0.08, HZO +0.08, FI +0.07, ORI +0.07, TRU +0.07, IPG +0.07, BHLB +0.07, DOV +0.07, THRM +0.04, WNS +0.04, PRCT +0.04, KDP +0.04, FBP +0.04, SAH +0.03, DOW +0.03, NDAQ +0.02, AB +0.02, PG +0.02, ADT +0.02, LKQ +0.01, APOG +0.01, CMS +0.01, AMBP +0.01, RES +0.01 of note.

Misses: EEFT (1.54), DAR (0.40), POOL (0.14), FCNCA (0.12), XEL (0.08), WTW (0.08), WBS (0.08), HELE (0.07), STM (0.06), TSCO (0.03), FTI (0.02), VLY (0.01), PCG (0.01), PEP (0.01) of note.

Still to Report: CRS, FRME, FCX, ITGR, LADR, UNP of note.

Company Earnings Guidance:

Positive Guidance: IBM LRCX MTH STM WST of note.

Negative or Mixed Guidance: ALK EPRT KNX PG of note.

Advance/Decline Daily Update: The A/D did not make new lows with the recent volatility.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: PI +16.9%, CADL +12.6%, CYH +11.1%, NOW +9.1%, TXN +7.9%, RMD +6.1%, FARO +5.7%, AAPG +5.5%, OII +5%, TECK +4.6%, WNS +4.4%, EW +4.3%, HBNC +4.2%, STM +4.1%, PEN +4%, DOW +4%, NG +3.9%, GPI +3.5%, LRCX +3.3%, MTH +2.9%, WHR +2.9%, RJF +2.7%, NEM +2.7%, EPRT +2.5%, E +2.5%, URI +2.3%, RES +2.2%, CRVS +2%, BANC +2%, GGG +2% of note.

Gap Down: RHI -16.7%, JACK -9.5%, PPBI -8.5%, EGBN -8.4%, KALU -8.2%, IBM -7.6%, NOK -7.3%, ALK -6.8%, CCS -6.7%, KNX -6.6%, LKQ -5%, TOWN -4.7%, TPH -4.4%, LGO -4.3%, ASGN -4.3%, VRE -4.1%, LOB -4%, LUV -4%, SIGI -3.8%, CMG -3.5%, MXL -3.5%, COLB -3%, MLYS -3%, CLB -3%, VKTX -3%, BRKL -3%, MYTE -2.9%, CHDN -2.9%, TFII -2.9%, TATT -2.7%, RLI -2.7%, GSHD -2.4%, XEL -2.4%, CVBF -2.2%, QS -2% of note.

Insider Action: None of note see Insider Buying with dumb short selling. GTE ALLY see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Bloomberg: China Says U.S. Should Revoke All Unilateral Tariffs. (Bloomberg)

Market Wrap: Stocks drop on tariff concerns. (Bloomberg)

Russia attacks Ukraine as Trump presses Zelensky for a deal. (Bloomberg)

Weight Watchers prepares to file for bankruptcy. (Bloomberg)

Pepsi (PEP) cuts guidance as predicts "uncertainty" in tariffs and consumer spending. (CNBC)

Bolded on story link means behind a Pay Wall.

Economic & Geopolitical:

Economic Releases:

March Durable Orders are due out at 8:30 a.m. EDT and is expected to rise to 1.50% from 0.90%.

March Existing Home Sales is due out at 10:00 a.m. EDT and expected to fall to 4.20 million from 4.26 million.

Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Weekly Natural Gas Inventories will be out at 10:30 a.m. EDT.

Federal Reserve Speakers of note today.

Federal Reserve Minneapolis President Neel Kashkari speaks at 5:00 p.m. EDT.

President Trump's Daily Schedule.

President Trump meets with the Prime Minister of Norway at 12:00 p.m. EDT.

President Trump signs Executive Orders at 4:30 p.m. EDT.

President Trump attends a MAGA dinner at Trump National Golf Club at 7:30 p.m. EDT

M&A Activity and News:

None of note.

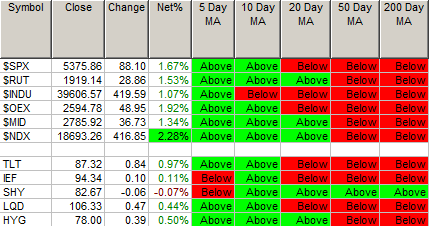

Moving Average Table: Moves from 17% to 46% from yesterday on Equity Indexes. TLT improved a bit on Wednesday.

Meeting & Conferences of Note:

Sellside Conferences:

Morgan Stanley Brazil Healthcare Day

Shareholder Meetings: BA, EIX, FAST, GL, JBHT, JNJ, LECO, MYE, PFE, SGBX, SNA

Top Analyst, Investor Meetings: CLDI, ESPR, FFAI, SKYQ

Fireside Chat: None of note.

R&D Day: None of note.

FDA Presentation: None of note.

Industry Meetings or Events:

AI Week

AACR Annual Meeting

NY Auto Show

Planet MicroCap Showcase

World Vaccine Congress

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations.

Upgrades: HBAN HCSG KMB MTB RNST SYNC TEL UTZ

Downgrades: None of note.