QPI Morning Note - 3/4/25: Stocks Sink On Target Miss, Tariff Implementation and Bitcoin Fall.

Overnight Summary & Early Morning Trading: The S&P 500 finished Monday lower by -1.76% at 5849.72. Friday higher by 1.59% at 5954.50. The overnight high was hit at 5884 at 12:05 a.m. EDT and the low was hit at 5848.75 at 5:35 a.m. EDT. The overnight range is 36 points. The current price is lower at 7:00 a.m. by -0.05% at 5858 lower by -2.75 points.

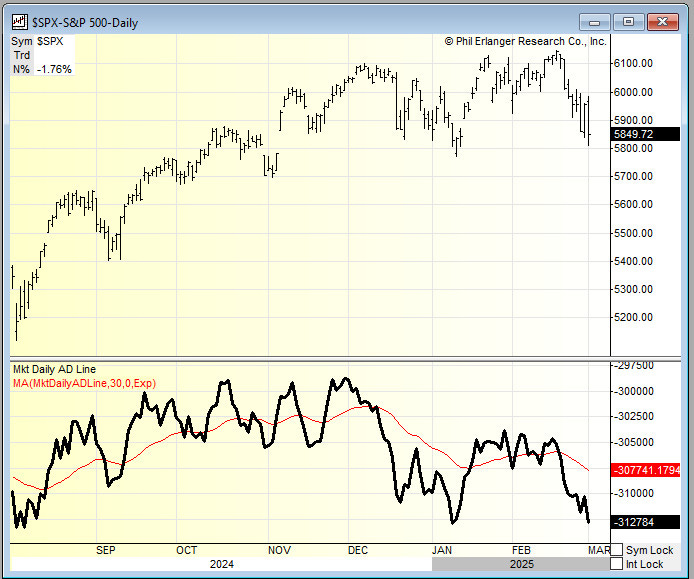

Executive Summary: Last week we noted there could be a retest of 6100 and then 6000 on the S&P 500. That is what happened on Friday. Monday we broke below 6000. So since December the S&P 500 has traded in a range of 6000 to 6100 and now that moves back to 6100 to 5800 with yesterday’s break back below 5900. The range moves from 200 to 300 points on the S&P 500. Futures are lower but only modestly despite lots of negative Tariff, economic and earnings news.

Articles of Note:

Key Events of Note Today:

Only API Petroleum Data is out at 4:30 p.m. EDT.

President Trump to address Congress tonight at 9:10 a.m. EDT.

Notable Earnings Out After The Close

Beats: ADMA +0.31, GTLD +0.10, NFE +0.10, NATL +0.09, OKTA +0.04, WTI +0.02 of note.

Misses: GCT -0.05, RPAY -0.01 of note. (>-0.15)

Capital Raises:

IPOs For The Week: APUS, BMGL, EPSM, FATN, MCRP, RYET,

WGRXNew IPOs/SPACs launched/News:

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

STKH: Form F-3.. 3,940,112 American Depositary Shares, each representing one hundred (100)

Ordinary SharesTNYA – TNYA – pricing of its underwritten public offering of 75,000,000 total units

Notes Priced:

AA Pricing of Debt Offering

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

VRE files for 522,020 shares of common stock offering by selling shareholders.

CIFR files for 10,438,413 shares of common stock offering by selling shareholder.

Mixed Shelf Offerings:

SRPT files mixed shelf securities offering.

LPLA files $4.0 bln mixed shelf securities offering.

RWT files mixed shelf securities offering.

BMO files $75 bln mixed shelf securities offering.

CLS files mixed shelf securities offering.

GUTS: Form S-3.. $300,000,000 Mixed Shelf

Convertible Offerings & Notes Filed:

ATEC announces intention to offer $300 mln proposed convertible senior notes offering.

RPAY files for 9,166,652 shares of Class A common stock offering issuable upon conversion of 0.00% Convertible Senior Notes due 2026.

Biggest Movers Up & Down Last Week:

Movers Up: OKTA +15.9%, DAVE +8.9%, NFE +8.4%, NATL +5.9%, HSII +5.5%, RPAY +5.3% of note.

Movers Down: GCT -13.8%, EBS -8.5%, DSP -11.4%, ATEC -9.5%, PLUG -3.3% of note.

News After The Close:

President Trump hit Mexico and Canada with 25% Tariffs and they countered.

President Trump hit China with another 10% Tariff and they countered with a 15% tax on the U.S. (Bloomberg)

B.Rily (RILY) completes the Sale of Atlantic Coast Recycling, LLC for $70 million in cash proceeds.

Okta (OKTA) achieves milestone of reaching $1 billion in aggregate sales over the past four years in AWS Marketplace (AMZN).

10K or Qs Filings/Delays – SMCI (Filed), IRWD NABL RGEN IPAR ADMA (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

PSMT announces that Robert Price has notified company about his intention to step down as interim CEO, effective August 31, 2025.

ACI announces that COO Susan Morris will assume the role of CEO following the planned retirement of Vivek Sankaran, effective May 1.

HAE announces executive leadership team updates, including Frank Chan, Ph.D joining company as Executive Vice President, Chief Operating Officer on April 7, 2025.

BWMX appoints Rodrigo Muñoz as Chief Financial Officer, effective today.

DNUT names Nicola Steele as COO.

Buybacks:

Dividends Announcements or News:

Stocks Ex Div Today: ADI NEM ES KEY RYAN WLK SWK AA HRB PIPR MAC ATMU SBLK LZB EXPI CRAI

Stocks Ex Div Tomorrow:

AXP increases quarterly dividend by 12% to $0.82/sh, new yield is 1.1%.

SNV increases quarterly dividend to $0.39/sh from $0.38/share.

What’s Happening This Morning: (as of 8:05 a.m. EDT) Futures S&P 500 -31, NASDAQ -127, Dow Jones -136 and Russell 2000 -20.54. Europe is lower with Asia lower. Bonds are at 4.14% from 4.25% Friday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas higher. Gold and Silver higher with Copper lower. The U.S. Dollar is lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $83,603 from $93,144 lower by $-2178 by -2.59%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Consumer Defensive and Real Estate were higher.

Daily Negative Sectors: Technology, Energy, Consumer Cyclical, Industrials and Materials were lower.

One Month Winners: Real Estate, Consumer Defensive, Utilities and Healthcare of note.

Three Month Winners: Communication Services, Consumer Defensive, Financials and Healthcare of note.

Six Month Winners: Communication Services, Financials, Consumer Cyclical and Utilities of note.

Twelve Month Winners: Financials, Utilities, Communication Services, Technology and Consumer Defensive of note.

Year to Date Winners: Financials, Healthcare, Consumer Defensive, Materials and Real Estate of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before The Open:

Notable Earnings of Note This Morning:

Flat: of note

Beats: BBY +0.18, ONON +0.15, TGT +0.14, OLPX +0.01 of note.

Misses: AZO -0.76, SE -0.32, PSFE -0.25, GENI -0.13, EVGO -0.02 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: OLPX GENI of note.

Negative or Mixed Guidance: PSFE of note.

Advance/Decline Daily Update: the A/D fell to major support making new lows, before a rebound and just made a new low.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: OKTA +16.3%, SNV +12.4%, ESPR +10.1%, ONON +10%, DAVE +7.3%, AMRX +4.5%, BWMX +4.1%, ONC +2.8%, CON +2.8%, SRPT +2.5%, HSII +2.3%, ACI +2.2% of note.

Gap Down: GCT -17.6%, EBS -12.2%, DSP -10.7%, RILY -9.3%, SMR -3.6%, ATEC -3.5%, YEXT -3%, PTLO -2.9% of note.

Insider Action: None of note see Insider Buying with dumb short selling. None of note see Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Market Wrap: Stock Futures fall amid growing jitters on trade. (Bloomberg)

Bloomberg: Trump Escalates Trade War. (Bloomberg)

Xi leaves the door open for talks. (Bloomberg)

Putin agrees to help Trump negotiate a nuclear deal with Iran. (Bloomberg)

Stocks Making The Biggest Moves: . (CNBC)

Best Buy (BBY) warns of price increases after Trump tariffs. (CNBC)

Target (TGT) warns as February sales are soft. (CNBC)

5 Things To Know Before the Market Opens. (CNBC)

Economic:

Weekly API Petroleum Report is due out at 4:30 p.m. EDT.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

President Trump’s Daily Schedule.

President Trump delivers an address to Congress at 9:10 p.m. EDT. He will be prepping for it today.

Federal Reserve New York President John Williams speaks at 2:20 p.m. EDT.

M&A Activity and News:

.

Moving Average Table: Move from 3% to 13%.

Meeting & Conferences of Note:

Sellside Conferences:

Baird Franchising Sector Symposium

Citi Global Property CEO Conference

Citizens JMP Technology Conference

Cowen Health Care Conference

Deutsche Bank Shipping Conference

Evercore Industrial Conference

Jefferies Renewables & Clean Energy Conference

JMP Securities Technology Conference

KeyBanc Emerging Technology Summit

Morgan Stanley Energy & Power Conference

Morgan Stanley Technology, Media & Telecom Conference

RBC Global Financial Institutions Conference

Raymond James Institutional Investors Conference

Scotiabank TMT Conference

T.D. Cowen HealthCare Conference

Wolfe Research Housing Conference

Shareholder Meetings: BV, FEAM, NDSN, WMG, ZVSA

Top Analyst, Investor Meetings: AXGN, ENB, TGT

Update: None of note.

Fireside Chat

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

AIFA Conference

NABE Economic Policy Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: VST SMG OKTA MDT LH

Downgrades: TFX NOVA ADNT