QPI Morning Note -3/12/25: Futures Higher Again But It Hold Once CPI Out?

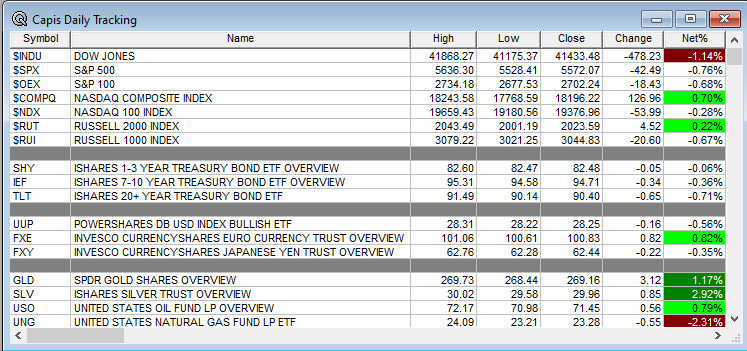

Overnight Summary & Early Morning Trading: The S&P 500 finished Tuesday lower by -0.76% at 5572.07. Monday lower by -2.70% at 5614.56. It was the worst trading day of the year on Monday. Futures are higher this morning by +39.75 (+0.71%) on the S&P 500 at 7:10 a.m. EDT. Current level is 5618.50 on the Futures of the S&P 500.

Executive Summary: Back and forth we go. The S&P 500 is now below 5600. The range moved from 500 to 600 points on the S&P 500 for the year, 5500 to 6100. Futures are higher this morning and 5500 is now support.

Breaking: Weekly MBA Mortgage Applications came out at 7:00 a.m. EDT and rose 11.20% as rates remain near recent lows. CPI comes in at 0.2% light by -0.10% which is good.

Chart of the Day: Crocs got an upgrade today and is heavily shorted. Bounce candidate?

Key Events of Note Today:

CPI is due out at 8:30 a.m. EDT and will drive today’s action.

The latest Treasury Budget (February) is due out at 2:00 p.m. EDT and came in last month at $-129 billion.

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

10 Year Note Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close

Beats: CASY +0.33, SFIX +0.06 of note.

Misses: WEST -0.15, CDRE -0.14 of note.

Capital Raises:

IPOs For The Week: APUS, FATN, KMTS. OMGE, SAGT,

WGRXNew IPOs/SPACs launched/News:

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

MATW: FORM S-3ASR – 3,000,000 Shares of Class A Common Stock

OWLT: Form S-3.. Up to 750,000 Shares of Class A Common Stock

RKLB “At The Market” (ATM) Equity Offering Program

Notes Priced:

AMT Prices Senior Notes Offering

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

Mixed Shelf Offerings:

AES: FORM S-3ASR – Mixed Shelf Offering

RKLB: FORM S-3ASR – Mixed Shelf Offering

VRCA: Form S-3.. $150,000,000 Mixed Shelf

NAT files $200 mln mixed shelf securities offering

Convertible Offerings & Notes Filed:

Biggest Movers Up & Down Last Week:

Movers Up: SFIX +19.6%, BWMN +6.4%, GRPN +4.9%, CASY +1.9% of note.

Movers Down: FOA -17.5%, ZYXI -14.6%, WEST -5.2%, CDRE -3.2% of note.

News After The Close:

House passed a spending bill to keep the government going to September.

AB reports preliminary assets under management (AUM) of $805 bln as of February 28, 2025, down from $809 bln from January 31, 2025/

A Federal Judge rules in Merck’s (MRK) favor regarding a safety lawsuit over Gardasil. (Bloomberg)

USDOT noting that Verizon (VZ) is not moving fast enough on its $2.4 bln 15-year FAA contract. (Reuters)

GOOGL in final talks to purchase AdHawk Microsystems, an eye-tracking technology company. (Bloomberg)

10K or Qs Filings/Delays – (Filed), TH (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

GERN Announces Departure of CEO John Scarlett on March 31; a search for a new CEO is underway, Dawn Carter Bir as Interim President and CEO.

BALY appoints Mira Mircheva as CFO.

PROP promotes Gregory S. Patton to CFO, effective April 1.

ADUS announces that President and COO W. Bradley Bickham will retire in March 2026

MATV announces appointment of Shruti Singhal as President and CEO, effective today

VUZI COO Peter Jameson to step down due to health reasons, effective immediately

ENB appoints Steven W. Williams as Chair of the Board, effective May 7; succeeds Pamela L. Carter, who is retiring.

Buybacks

Dividends Announcements or News:

Stocks Ex Div Today: NVDA LUV HPQ NVS SFL PFG POOL AER ORA ICL NWSA REG CRGY NSSC NWS PHI OSW EE.

Stocks Ex Div Tomorrow: HD LIN PSA BR SBAC CTRA LKQ DRS ADT AMKR BDC NSP MDU CCOI MCY TUYA VSH LMAT AMBP CASH ARIS PRG.

TOL increases quarterly cash dividend 9% to $0.25/share from $0.23/share.

What’s Happening This Morning: (as of 8:15 a.m. EDT) Futures S&P 500 +41.50, NASDAQ +174 Dow Jones +228 Russell 2000 +13.40. Europe is higher with Asia lower ex Japan. Bonds are at 4.31% from 4.236% Tuesday on the 10-Year. Crude Oil and Brent Crude are higher with Natural Gas lower. Gold lower with Silver and Copper higher. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $83,034 from $81,559 lower by $203 by -0.24%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Materials and Consumer Cyclicals were higher.

Daily Negative Sectors: Industrials, Real Estate, Healthcare, Consumer Defensive and Communication Services were lower.

One Month Winners: Real Estate, Consumer Defensive, Utilities and Healthcare of note.

Three Month Winners: Communication Services, Consumer Defensive, Financials and Healthcare of note.

Six Month Winners: Communication Services, Financials, Consumer Cyclical and Utilities of note.

Twelve Month Winners: Financials, Utilities, Communication Services, Technology and Consumer Defensive of note.

Year to Date Winners: Financials, Healthcare, Consumer Defensive, Materials and Real Estate of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Flat: FWRG of note

Beats: ABM +0.87, ARCO +0.07 of note.

Misses: IRBT -0.33 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: SFIX of note.

Negative or Mixed Guidance: CDRE of note.

Advance/Decline Daily Update: the A/D fell to major support making new lows, before a rebound and continues to make new low.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: SSP +30.8%, GRPN +21.8%, SFIX +19.4%, EH +9.8%, VNET +6.5%, MATW +6.4%, IRBT +4.4%, LYTS +4.2%, GTN +3.4%, GERN +3.1%, ATI +3.1%, BHB +3%, COHR +2.9%, TEM +2.5%, CASY +2.5% of note.

Gap Down: ZYXI -35.9%, FOA -19.3%, MOMO -15.1%, CDRE -12.3%, MXCT -10.4%, MLYS -4.6%, BALY -3.9%, VUZI -3.4%, WEST -3%, PROP -2.3% of note.

Insider Action: TRS sees Insider Buying with dumb short selling. TTSH sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Market Wrap: S&P 500 Futures head higher into inflation data. (Bloomberg)

Bloomberg:EU Targets $39 Billion of US Products in Tariff Reduction. (Bloomberg)

Stocks Making The Biggest Moves: INTC CROX TSLA GRPN. (CNBC)

US Inflation is seen as inflated with higher food prices. (Bloomberg)

Morgan Stanley cuts Apple. (CNBC) Behind Paywall.

5 Things To Know Before the Market Opens. (CNBC)

Bloomberg Odd Lots – Cathie Wood on what’s next in AI and Big Tech. (Podcast)

Bloomberg The Big Take – China piles pressure on India. (Podcast)

Economic:

February CPI is due out at 8:30 a.m. EDT and is expected to drop to 0.3% from 0.5%.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

President Trump’s Daily Schedule.

President Trump greets the Irish Prime Minister at 10:45 a.m. EDT and meets until 11:50 a.m. EDT.

President Trump heads to the Capitol at 11:50 p.m. EDT for the Friends of Ireland lunch until 1:30 p.m. EDT.

President Trump participates in a St. Patrick’s Day Reception at 5:00 p.m. EDT.

Federal Reserve Speakers are in blackout now until March 20th when the latest meeting has concluded.

M&A Activity and News:

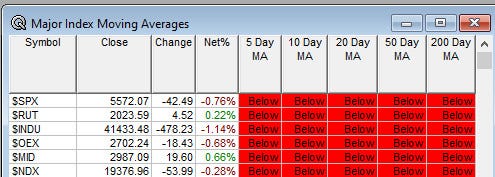

Moving Average Table: Remains at 0% today.

Meeting & Conferences of Note: (Not updated today, back tomorrow)

Sellside Conferences:

Bank of America Consumer and Retail Conference

Barclays Global Healthcare Conference

Cantor Global Technology Conference

Citi TMT Conference

Deutsche Bank Media, Internet & Telecom Conference

Evercore Private Markets Forum

JPM Industrial Conference

Jefferies Biotech on the Bay Summit

KeyBanc Healthcare Tour

Leerink Healthcare Conference

Mizuho US Consumer Industrials & TMT Summit

UBS Consumer and Retail Conference

Wolfe Research FinTech Forum

Shareholder Meetings: ACET, ADI, GAME, JCI, SBUX, TEL, VRAX, XBIO

Top Analyst, Investor Meetings: BNRG, KLTR, NET, PII

Update: None of note.

Fireside Chat

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

Women in Data Science Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: RBRK ICUI CROX AMAT ACVA

Downgrades: HPE PEP