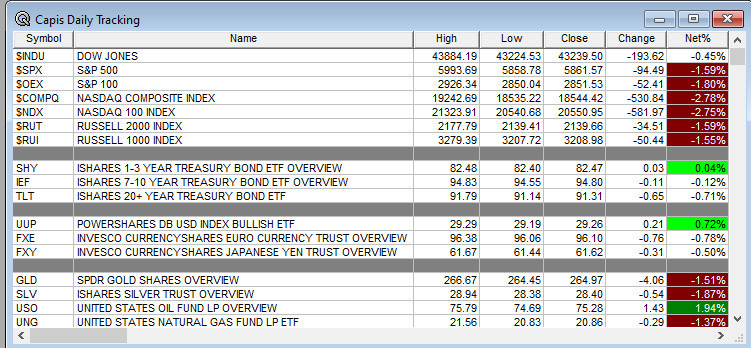

QPI Morning Note - 2/28/25: S&P 500 Failed Again To Rally Yesterday, Now Red For The Year. PCE Up Shortly.

Overnight Summary & Early Morning Trading: The S&P 500 finished Thursday lower by -1.59% at 5861.57. Wednesday higher by 0.01% at 5956.06. The overnight high was hit at 5900.50 at 6:40 a.m. EDT and the low was hit at 5858.505 at 10:45 p.m. EDT. The overnight range is 42 points. The current price is higher at 7:00 a.m. by 0.27% at 5892.25 higher by +16. points.

Executive Summary: Last week we noted there could be a retest of 6100 and then 6000 on the S&P 500. That is what happened on Friday. Monday we broke below 6000. So since December the S&P 500 has traded in a range of 6000 to 6100 and now that moves to 6100 to 5800 with yesterday’s break of 5900. The range moves from 200 to 300 points on the S&P 500. Futures are higher and trying to get back above 5900.

Key Events of Note Today:

Personal Income, PCE Core and Chicago PMI are out today along with weekly Baker Hughes Rig Count.

Notable Earnings Out After The Close

Beats: SDRL +1.83, ROOT +1.75, MARA +1.37, MIRM +1.26, UHS +0.78, ACAD +0.64, SBGI +0.61, CDNA +0.59, VAC +0.34 of note. (>+0.30)

Flat: None of note.

Misses: IONQ -0.68, CORZ -0.51, PARA -0.24, BYND -0.20, APA -0.17 of note. (>-0.15)

Capital Raises:

IPOs For The Week: APUS, BMGL, EPSM, FATN, MCRP, RYET,

WGRXNew IPOs/SPACs launched/News:

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

Notes Priced:

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

LTH announces that certain affiliates of Leonard Green & Partners and Partners Group intend to offer and sell 18,000,000 shares of the Company’s common stock in an underwritten public offering pursuant to Life Time’s shelf registration statement filed with the Securities and Exchange Commission.

SPSC files for 378,100 shares of common stock offering by selling shareholders.

Mixed Shelf Offerings:

ARLP files mixed shelf securities offering.

SYRE files $500 mln mixed shelf securities offering

RMNI files $200 mln mixed shelf securities offering

CRDF files $400 mln mixed shelf securities offering

DNLI files mixed shelf securities offering

WBD files mixed shelf securities offering

ABCL files mixed shelf securities offering

JBLU files mixed shelf securities offering

ALT files $400 mln mixed shelf securities offering

ACRS files $300 mln mixed shelf securities offering

CYTK files mixed shelf securities offering

Convertible Offerings & Notes Filed:

Biggest Movers Up & Down Yesterday:

Movers Up: ORGO +17.3%, PGNY +15.7%, ESTC +14.9%, BE +9.7%, SOUN +9.2%, ICUI +5.9%, FOXF +5.6%, TMDX +5.4%, SYRE +4.9% of note.

Movers Down: IOVA-19.2%, DLO -18.8%, DCGO -16.3%, DV -15.7%, NTAP -14.1%, ACHR -13.3%, ACHC -12.7%, ARRY -12.7%, RKLB -12.6%, PUBM -11.9%, DUOL -6.9%, HPQ -3.6%, DELL -1.5% of note.

News After The Close:

Autodesk (ADSK) reducing workforce by 9%.

President Trump says there is a “very good chance” tariffs will not be necessary with UK because a trade deal will be reached.

Rocket Lab (RKLB) reveals Ocean Platform for Neutron Rocket Landings at Sea.

Entegris (ENTG) to join S&P MidCap 400

Meta Platforms (META) to debut a standalone AI app to compete with ChatGPT

10K or Qs Filings/Delays – SMCI (Filed), ASTH LFUS (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

CPF promotes David Morimoto to Chief Operating Officer and Dayna Matsumoto to Chief Financial Officer effective March 1, 2025.

ESTC announces the appointment of Navam Welihinda as chief financial officer, effective February 28, 2025.

JILL announces the appointment of Mary Ellen Coyne as Chief Executive Officer and President, effective May 1, 2025.

Buybacks:

MATX approves adding three million shares to the existing twelve million share repurchase program and extending the program to December 31, 2027.

Dividends Announcements or News:

Stocks Ex Div Today: TMUS GS UNP NEE UL HON IBKR DEO CSX BCS D GLW FTV DOW DOV EL CBOE BIP TSN ECR HUBB BAX FDS H ULS

Stocks Ex Div Tomorrow:

UNTY increases quarterly cash dividend 8% to $0.14/share from $0.13/share.

CCK increases quarterly cash dividend to $0.26/share from $0.25/share.

BLX increases quarterly cash dividend to $0.625/share from $0.50/share.

NEU increases quarterly cash dividend 10% to $2.75/share from $2.50/share.

What’s Happening This Morning: (as of 8:15 a.m. EDT) Futures S&P 500 +16, NASDAQ +17, Dow Jones +184 and Russell 2000 -3.66. Europe is lower ex the FTSE with Asia lower. Bonds are at 4.26% from 4.292% yesterday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold, Silver and Copper lower. The U.S. Dollar is lower versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $80,864 from $86,266 lower by $2,253 by -2.80%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Real Estate and Financials of note.

Daily Negative Sectors: All others of note.

One Month Winners: Consumer Defensive, Healthcare and Real Estate of note.

Three Month Winners: Communication Services, Consumer Cyclical, Financials and Technology of note.

Six Month Winners: Consumer Cyclical, Financials, Communication Services, Technology, Utilities and Industrials of note.

Twelve Month Winners: Technology, Communication Services, Financials, Consumer Cyclical and Utilities note.

Year to Date Winners: Communication Services, Materials, Financials, Healthcare and Utiltities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Friday After the Close: None of note

Monday Before The Open: SGRY

Notable Earnings of Note This Morning:

Beats: CLMT +0.33, AES +0.19, ANIP +0.19, AKRO +0.17, FLGT+0.16, PAR -0.09, APLS +0.07, FUBO +0.07, OMI +0.03, of note. (>+0.20)

Flat: of note.

Misses: GTLS -0.44, RXRX -0.17, WULF -0.05, FRO -0.05, IAS -0.03, NWN -0.01 of note. (>-0.09)

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: AES ANIP of note.

Negative or Mixed Guidance: FLGT of note.

Advance/Decline Daily Update: the A/D fell to major support making new lows, before a rebound and is now back to struggling.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: ESTC +13.4%, NXDT +12%, PGNY +11.5%, ORGO +10.7%, IBRX +9.1%, RPID +7.6%, BE +7.6%, OMI +7.3%, TPC +6.9%, RKT +6.7%, RGTI +6.6%, SOUN +6.6%, ENTG +5.9%, DRH +5.9%, COLL +5.6%, AES +5.5%, ALHC +5.4%, TMDX +4.9%, GTLS +4.7%, AMRX +3.2%, MESO +3%, EFC +2.5%, LIF +2.4%, RUN +2.4%, RMNI +2.3%, MYGN +2.3%, TMCI +2.2%, NVTS +2.1%, NTRA +2.1%, MNST +2.1%, NWN +2.1% of note.

Gap Down: DH -38.8%, DCGO -28.6%, SBCF -24.7%, DLO -20.7%, PUBM -19.6%, ACHC -18.7%, IOVA -18.6%, DV -16.3%, NTAP -15.2%, GSAT -13.9%, HCAT -13.2%, RKLB -11.9%, AVPT -11.7%, ACHR -11.5%, RDFN -11.1%, ARRY -11%, ASTH -10.3%, AHR -9.8%, LMAT -9.7%, ALEX -9.7%, GPCR -8.9%, CODI -8.5%, AMRC -8.4%, DUOL -8.2%, RDNT -8%, XPEV -7.7%, BLND -7.1%, PTCT -6.9%, RXRX -6.8%, JAMF -6.3%, GDOT -5.8%, ICFI -5.4%, CRDF -4.7%, IGT -4.5%, OPEN -4.5%, SOLV -3.5%, ABCL -3.4%, PRGO -3.4%, GNL -3.3%, COIN -3.2%, CUBE -3.1%, DELL -3.1%, CYTK -3%, ARLP -2.9%, HPQ -2.7%, ALKT -2.5%, MRUS -2.2%, PSNL -2.1%, SYRE -2.1%, TDW -2% of note.

Insider Action: None see Insider Buying with dumb short selling. None sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Market Wrap: Stock Futures Rebound while Bitcoin continues to sink. (Bloomberg)

Bloomberg: Biggest Treasury Rally Since July Faces Key Economic Data. (Bloomberg)

Jeremey Grantham warns stocks about to get crushed. (Bloomberg)

Stocks Making The Biggest Moves: Yet to post. (CNBC)

China vows to retaliate on Tariffs. (CNBC)

German inflation stays at 2.80%. (CNBC)

5 Things To Know Before the Market Opens. (CNBC)

Bloomberg: Odd Lots – Growing risks to the labor market. (Podcast)

Economic:

January Personal Income is due out at 8:30 a.m. EDT and is expected to fall to 0.30% from 0.40%.

January PCE Core is expected to rise to 0.30% from 0.20%.

February Chicago PMI is due out at 9:45 a.m. EDT and expected to rise to 41.20% from 39.50%.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

President Trump’s Daily Schedule.

President Trump meets with the President of Ukraine at 11 a.m. EDT through 2:00 p.m. EDT.

President Trump leaves the White House at 5:00 p.m. EDT to head to Mar-A-Largo.

Federal Reserve Chicago President Austan Goolsbee speaks at 10:15 a.m. EDT.

M&A Activity and News:

Alkami Technologies (ALKT) to acquire Fin Technologies for an enterprise value of $400 mln to expand account opening capabilities.

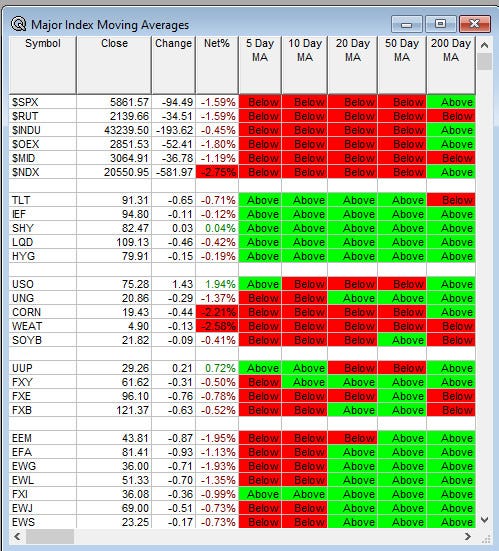

Moving Average Table: Move from 3% to 6%. Fixed Income and International show strength.

Meeting & Conferences of Note:

Sellside Conferences:

B Riley Precision Oncology & Radiopharma Conference

J.P. Morgan Global Emerging Markets Conference

Susquehanna Tech Conference

Shareholder Meetings: AADI, ADTX, BNZI, JACK

Top Analyst, Investor Meetings: PRGO

Update: None of note.

Fireside Chat

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

ACTRIMS Forum

Bitcoin Investor Week

Precision Oncology & Radiopharma Investor Conference

Southeastern Energy Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: RMNI VITL UUUU PYPL NXST BBWI

Downgrades: WBA LOGI BSY