QPI Morning Note -2/26/25: Stocks Higher As House Passes Budget

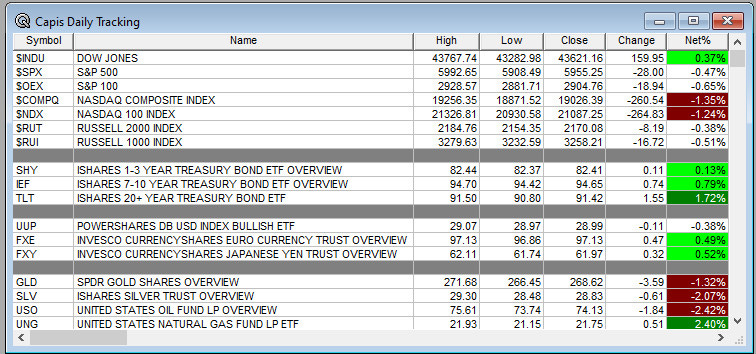

Overnight Summary & Early Morning Trading: The S&P 500 finished Tuesday lower by -0.47% at 5965.25. Monday lower by -0.50% at 5983.25. The overnight high was hit at 6003.25 at 6:40 a.m. EDT and the low was hit at 5976 at 4:55 p.m. EDT. The overnight range is 27 points. The current price is higher at 7:00 a.m. by 0.44% at 5996.25 higher by +26.50 points.

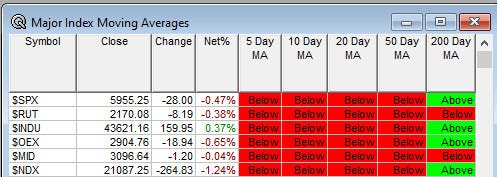

Executive Summary: Last week we noted there could be a retest of 6100 and then 6000 on the S&P 500. That is what happened on Friday. Monday we broke below 6000. So since December the S&P 500 has traded in a range of 6000 to 6100 and now that moves to 6100 to 5900. Futures are higher but still under 6000.

Articles of Note:

*Note that certain articles highlighted may require a subscription. We highlight noted sources like the WSJ or Bloomberg that have wide audiences.

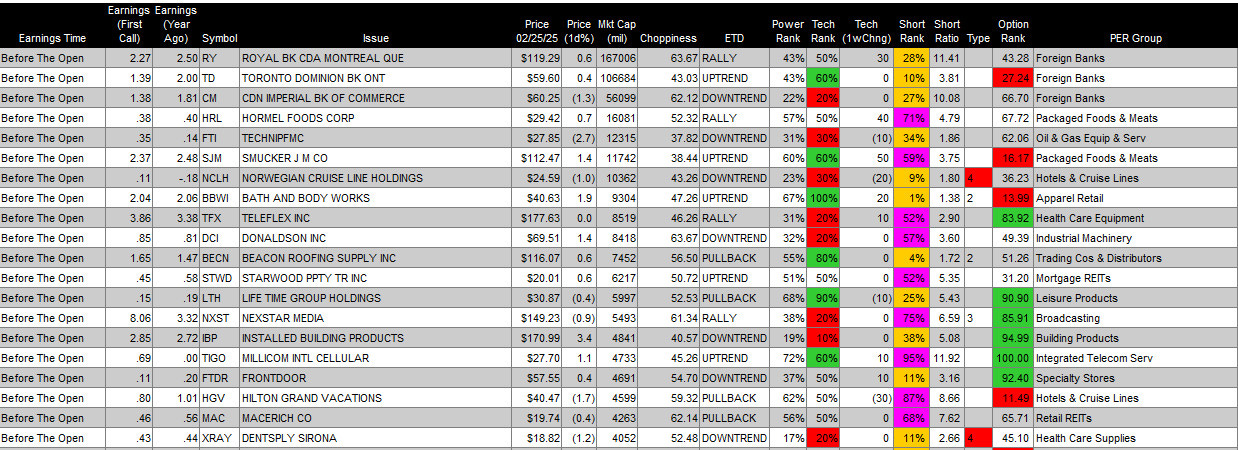

Daily Chart: Norweigian Cruise Lines (NCLH) is a Type 4 Long Squeeze. It is at risk for more weakness as longs sell and there are few shorts to cover.

Key Events of Note Today:

New Home Sales are out today along with weekly Crude Oil Inventories.

7-Year Note Auction at 1:00 p.m. EDT

Weekly Mortgage Applications fell -1.2% this morning.

Notable Earnings Out After The Close

Beats: JAZZ +0.79, INTU +0.75, CHRD +0.72, AXON +0.68, MATX +0.42, HURN +0.38, MASI +0.37, LNW +0.31, JACK +0.23, RCUS +0.22, CZR +0.18, LMND +0.18, WDAY +0.14, KEYS +0.13, MMSI +0.10, ODD +0.09 of note. (>+0.08)

Flat: None of note.

Misses: FSLR -0.98, SAM -0.37, FLYW -0.11, CAVA -0.02, PRCT -0.01 of note.

Capital Raises:

IPOs For The Week: APUS, BMGL, EPSM, FATN, MCRP, RYET,

WGRXNew IPOs/SPACs launched/News:

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

BEAT Exercise and Closing of Underwriter’s Over-Allotment Option for Public Offering of Common

Stock.

Notes Priced:

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

SPNT announces that entities associated with Daniel S. Loeb are offering an aggregate of 4,106,631 common shares through a registered secondary offering

Mixed Shelf Offerings:

ZBH files mixed shelf securities offering.

BAX files mixed shelf securities offering.

KAI files mixed shelf securities offering.

NOVT files mixed shelf securities offering.

HRMY files mixed shelf securities offering.

OFIX files mixed shelf securities offering.

OLO files mixed shelf securities offering.

Convertible Offerings & Notes Filed:

Biggest Movers Up & Down Yesterday:

Movers Up: PRCH +24.8%, INVX +19.1%, ZI +17.4%, OLO +15.5%, AXON +13%, WDAY +10.2% of note.

Movers Down: FLYW -18.4% GO -17.1%, AGL -15%, LMND -13.3%, ZETA -10.2%, OSUR -10%, CART -9.3%, EXLS -4.3%, KEYS -3.5%, SPT -3%, SKWD -2.8%, RLJ -2% of note.

News After The Close:

First Solar (FSLR) announces the filing of a lawsuit against Shanghai-headquartered JinkoSolar and its related entities alleging infringement of First Solar’s US Patent No. 9,130,074.

B Riley (RILY) received a notice from Nasdaq indicating that, based on the Company’s filing of the Third Quarter 10-Q, the Company is in compliance with the Rule and the matter is now closed.

Lands’ End (LE) confirms that it has received a letter from Edward S. Lampert requesting that the Company initiate a strategic sale process to maximize shareholder value.

President Trump tells reporters that Ukrainian President Volodymyr Zelensky will visit White House Friday to sign minerals deal. (Axios)

President Trump says his administration will create a new visa category for high level immigrants with $5 mln or more to invest in US; the new visa category will be called “gold cards”.

President Trump signs executive order to provide price transparency on healthcare costs.

President Trump orders probe into potential new tariffs on copper imports. (Reuters)

Walgreens Boots Alliance (WBA) enters settlement agreement with Everly/PWN; to pay $595 mln.

Embraer SA (ERJ) approves an additional four-year pause in the E175-E2 jet development program. (Reuters)

10K or Qs Filings/Delays – SMCI (Filed), CCI (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

WDAY appoints Gerrit Kazmaier to the role of President, product and technology.

LCID announces that Peter Rawlinson has stepped aside from his prior roles and will transition to the role of Strategic Technical Advisor to the Chairman of the Board; Arc Winterhoff, COO, has been appointed Interim CEO.

INVH announces the promotion of Timothy J. Lobner to Executive Vice President and Chief Operating Officer, effective March 2.

Buybacks:

Dividends Announcements or News:

Stocks Ex Div Today: SPGI EQIX EA TSCO L AMCR SON HTGC AVA CCS PCES

Stocks Ex Div Tomorrow: MAR DAL LH TRU VIV TAP KNSL LPX CGNX CATY PBF MNR

SLGN increases quarterly cash dividend to $0.20/share from $0.19/share.

GAP increases quarterly cash dividend 10% to $0.165/share from $0.15/share.

What’s Happening This Morning: (as of 8:25 a.m. EDT) Futures S&P 500 +28.5, NASDAQ +149.50, Dow Jones +105 and Russell 2000 +1.73. Europe is higher with Asia lower. Bonds are at 4.283% from 4.39% yesterday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas lower. Gold, Silver and Copper higher. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $87,692 from $89,387 lower by $-531 by -0.58%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Healthcare, Real Estate and Financials of note.

Daily Negative Sectors: Technology, Consumer Cyclicals, Utilities and Communication Services of note.

One Month Winners: Consumer Defensive, Healthcare and Real Estate of note.

Three Month Winners: Communication Services, Consumer Cyclical, Financials and Technology of note.

Six Month Winners: Consumer Cyclical, Financials, Communication Services, Technology, Utilities and Industrials of note.

Twelve Month Winners: Technology, Communication Services, Financials, Consumer Cyclical and Utilities note.

Year to Date Winners: Communication Services, Materials, Financials, Healthcare and Utiltities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Beats: MDGL +1.13, AER +0.74, EME +0.56, JBI +0.55, SWX +0.33, BUD +0.19, COMM +0.16, LOW +0.09 of note. (>+0.09)

Flat: of note.

Misses: UTHR -0.37, IMCR -0.24, PRKS -0.14, ODP -0.14, NRG -0.05, COCO -0.01, GERN -0.01 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: AVA CBZ JBI OPCH of note.

Negative or Mixed Guidance: TJX LOW PLAB BLMN of note.

Advance/Decline Daily Update: the A/D fell to major support making new lows, before a rebound and is now back to struggling.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: PRCH +39.6%, SMCI +25%, INGN +20.7%, ZI +19.6%, OLO +18.4%, AXON +14.8%, WDAY +12.5%, INVX +11.5%, ACMR +11.2%, GOTU +10.7%, JACK +10.1%, ARQT +9.8%, INTU +8.7%, BUD +7.8%, BLZE +7.4%, CPNG +6.8%, TLX +6.7%, TELO +5.8%, ODD +5.3%, LNW +5.1%, MASI +5%, ALC +4.2%, JKS +3.9%, RVLV +3.8%, GNL +3.7%, IGIC +3.5%, VIV +3.3%, FSLR +3%, WK +3%, CAKE +2.7%, MMSI +2.7%, MATX +2.6%, STRL +2.6%, ABEV +2.6%, PDFS +2.5%, RUM +2.4%, DOLE +2.4%, RRC +2.3%, CHRD +2.3%, LOW +2.3%, BGS +2.2%, CAVA +2.1% of note.

Gap Down: FLYW -28%, GO -19.9%, AGL -17.4%, SKWD -14.4%, LMND -14.1%, CART -11.3%, ZETA -9.6%, DAWN -5.7%, CCCS -5.3%, BASE -3.7%, ICL -3.7%, STLA -3.5%, SPNT -2.9%, SPT -2.8%, LE -2.5%, OSUR -2.5%, OFIX -2.3%, USNA -2.3%, FIHL -2.1%, EYE -2.1%, HRMY -2% of note.

Insider Action: None see Insider Buying with dumb short selling. None sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Market Wrap: Global Stocks gain ahead of Nvidia earnings. (Bloomberg)

Bloomberg: Tax Cut Chances Rise (Bloomberg)

Stocks Making The Biggest Moves: . (CNBC)

Nvidia (NVDA) faces its most critical earnings day yet. (Bloomberg)

General Motors (GM) boosts buyback and dividend. (Bloomberg)

TJ Maxx (TJX) issues weak guidance. (CNBC)

5 Things To Know Before the Market Opens. (CNBC)

Bloomberg: Odd Lots – . (Podcast)

Economic:

January New Home Sales are expected to fall to 681,00 from 698,000 when released at 10:00 a.m. EDT.

Weekly Crude Oil Inventories are released at 10:30 a.m. EDT.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

President Trump’s Daily Schedule.

President Trump holds a Cabinet Meeting at 1:00 p.m. EDT.

President Trump signs Executive Orders at 3:00 p.m. EDT.

Federal Atlanta President Raphael Bostic speaks at 12:00 p.m. EDT.

M&A Activity and News:

.

Moving Average Table: Stays at 13%.

Meeting & Conferences of Note:

Sellside Conferences:

Bank of America Animal Health Conference

Bank of America Agriculture and Materials Conference

Cantor San Diego Biotech Bus Tour

Cantor Private Company Software Conference

Citigroup Medtech and Life Sciences Access Day

DA Davidson 1st Private Company Conference

Gabelli Pump, Valve & Water Systems Symposium

Guggenheim Healthy Altitudes Summit

J.P. Morgan Global Emerging Markets Conference

Scotia Bank Howard Weil Energy Conference

Scotiabank Global Energy Conference

Susquehanna Tech Conference

TD Cowen Glowing Ahead: Beauty & Wellness Summit

UBS Midwest Utilities Mini-Conference

Wolfe March Madness Software Conference

Wolfe Research Real Estate Conference

Shareholder Meetings: DE, HOLX, SAIH

Top Analyst, Investor Meetings: AMZN, DBD, IMXI, LFUS, MMM

Update: None of note.

Fireside Chat

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

ACTRIMS Forum

Bitcoin Investor Week

RampUp User Conference

Telecommunications Optics and Photonics (TOP) Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: SR CFLT RCUS PRCH LUMN CPNG AAL

Downgrades: LCID DNUT