QPI Morning Note - 2/25/25: Stocks Up Modestly, Home Depot Breaks Retail Sales Slump

Overnight Summary & Early Morning Trading: The S&P 500 finished Monday lower by -0.50% at 5983.25. Friday lower by -1.71% at 6013.13. The overnight high was hit at 6016 at 10:00 a.m. EDT and the low was hit at 5977.75 at 6:00 a.m. EDT. The overnight range is 39 points. The current price is lower at 7:10 a.m by -0.08% at 5995.75 lower by -5 points.

Executive Summary: Last week we noted there could be a retest of 6100 and then 6000 on the S&P 500. That is what happened on Friday. Monday we broke 6000. So since December the S&P 500 has traded in a range of 6000 to 6100 and now that moves to 6100 to 5900.

Articles of Note:

*Note that certain articles highlighted may require a subscription. We highlight noted sources like the WSJ or Bloomberg that have wide audiences.

Daily Chart: Arista Network (ANET) is a Type 4 Long Squeeze. It is at risk for more weakness as longs sell and there are few shorts to cover. It moved lower post earnings last week.

Key Events of Note Today:

Consumer Confidence is out today.

5-Year Note Auction at 1:00 p.m. EDT

Notable Earnings Out After The Close

Beats: RIOT +2.13, VNOM +1.61, GSHD +0.39, FANG +0.32, PRA +0.19, VVX +0.19, EVER +0.13, BWXT +0.11, ZM +0.11, KBR +0.09 of note. (>+0.08)

Flat: None of note.

Misses: CWEN -0.51, CNNE -0.45, CIVI -0.21, KWR -0.19, BYON -0.18, MAX -0.15 JBTM -0.12, CLF -0.07, ZD -0.05, VCYT -0.05, PSA -0.03, AESI -0.03, AESI -0.03, TEM -0.02, O -0.02, HLIO -0.02 of note.

Capital Raises:

IPOs For The Week: APUS, BMGL, EPSM, FATN, MCRP, RYET,

WGRXNew IPOs/SPACs launched/News:

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

SKT enters into a $400 mln at-the-market equity offering.

FLGC: FORM S-3 – 3,211,508 Common Shares

UNB: Form S-3.. $50,000,000 Common Stock

Notes Priced:

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

Mixed Shelf Offerings:

KVUE files mixed shelf securities offering.

BLIN: FORM S-3 – $50,000,000 Mixed Shelf Offering

JRSH: Form S-3.. $100,000,000 Mixed Shelf

Convertible Offerings & Notes Filed:

BBIO initiates long term $500 million debt management strategy and announces proposed offering of convertible senior notes to refinance Senior Secured Debt.

CAKE announces $450 mln proposed convertible senior notes offering.

Biggest Movers Up & Down Yesterday:

Movers Up: EVER +29.3%, BYON +11.4%, FARO +10.8%, PRIM +10.1%, PRA +7.8%, TREX +6.7%, VVX +5.1%, BWXT +4.7%, SIBN +3.8%, KBR +3.5%, VNOM +2.5%, GSHD +2.1% of note.

Movers Down: CHGG -20.1%, HIMS -17%, NVTS -14.5%, UCTT -8.5%, VCYT -8.3%, TEM -7.9%, AORT -6.6%, MYGN -6.5%, CLNE -5.5%, CIVI -4.8%, MAX -4.3%, CLF -3.2%, ZM -2.6% of note.

News After The Close:

Leonardo DRS (DRS) receives a $45 million U.S. Navy Submarine Industrial Base investment commitment through contracts with HII’s Newport News Shipbuilding.

Trump says Tariffs on Mexico and Canada will move ahead. (CNBC)

10K or Qs Delays – none of note.

Exchange/Listing/Company Reorg and Personnel News:

TERN appoints Andrew Gengos as CFO, effective immediately.

MYGN appoints COO Sam Raha as President and CEO, effective April 30.

Buybacks:

SB announces a three million shares of common stock repurchase program.

SONO announces $150 million stock repurchase program.

HLIO announces $100 million multi-year share repurchase program.

ZION authorizes a share repurchase for fiscal year 2025 of up to $40 million.

Dividends Announcements or News:

Stocks Ex Div Today: WELL CO CDW ROL ATO VIV VOYA RHI TKR CE GFF PAX CNXN LOB MCS

Stocks Ex Div Tomorrow: SPGI EQIX EA TSCO L AMCR SON HTGC AVA CCS PCES

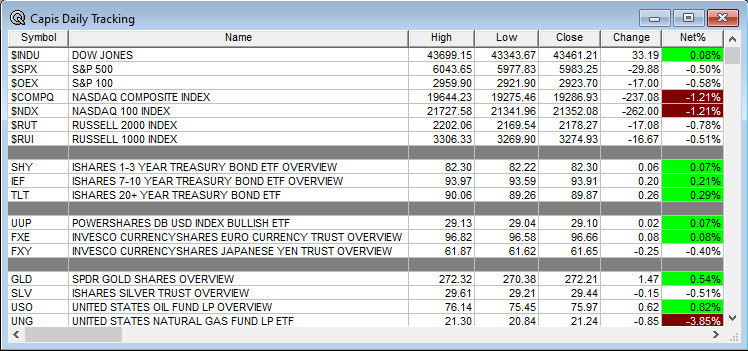

What’s Happening This Morning: (as of 8:15 a.m. EDT) Futures S&P 500 +5, NASDAQ +1, Dow Jones +65 and Russell 2000 +1.73. Europe is higher with Asia lower. Bonds are at 4.39% from 4.45% yesterday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas higher. Gold is lower with Silver lower as well with Copper higher. The U.S. Dollar is lower versus the Euro, lower against the Pound and higher against the Yen. Bitcoin is at $89,387 from $95,515 lower by $-4847 by -5.14%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Healthcare, Real Estate and Financials of note.

Daily Negative Sectors: Technology, Consumer Cyclicals, Utilities and Communication Services of note.

One Month Winners: Consumer Defensive, Healthcare and Real Estate of note.

Three Month Winners: Communication Services, Consumer Cyclical, Financials and Technology of note.

Six Month Winners: Consumer Cyclical, Financials, Communication Services, Technology, Utilities and Industrials of note.

Twelve Month Winners: Technology, Communication Services, Financials, Consumer Cyclical and Utilities note.

Year to Date Winners: Communication Services, Materials, Financials, Healthcare and Utiltities of note.

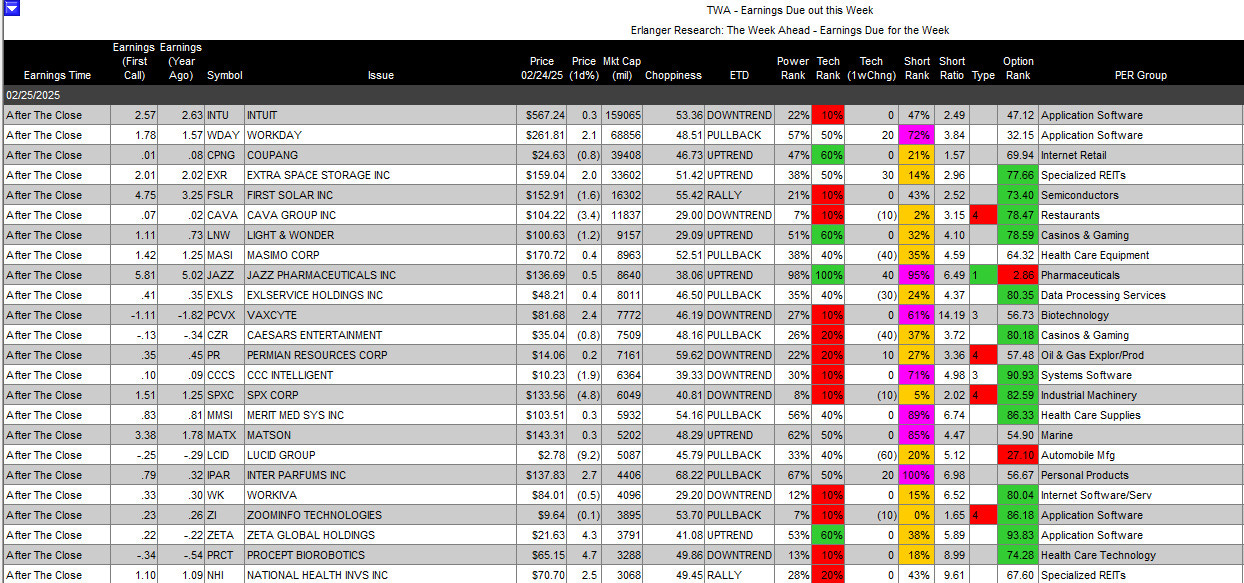

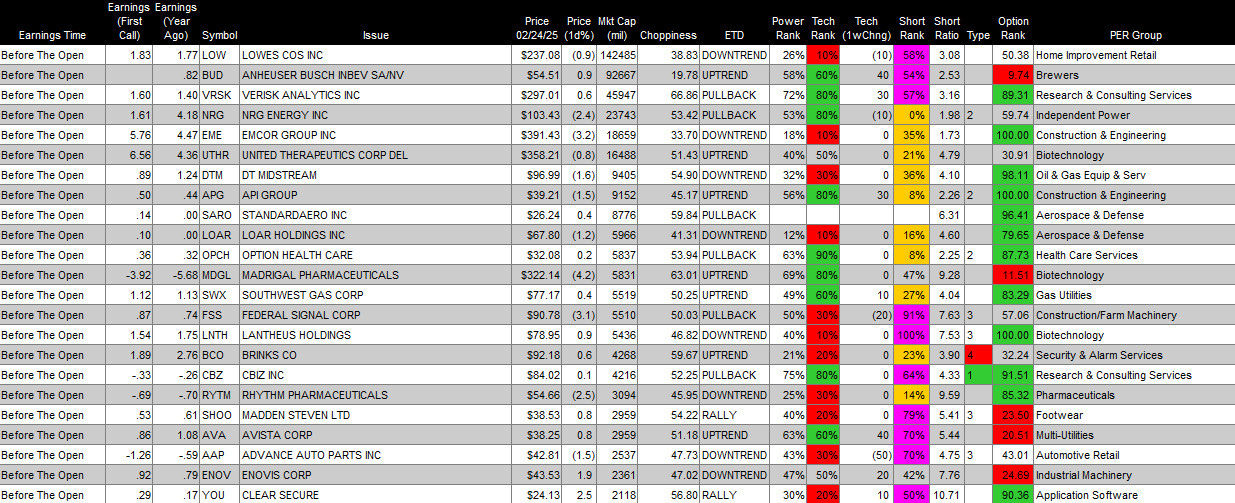

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before The Open:

Notable Earnings of Note This Morning:

Beats: DDS +3.66, BMO +0.63, BNS +0.60, CRI +0.47, MIDD +0.36, HRMY +0.34, SSTK +0.28, AMT +0.27, DFH +0.25, BEAM +0.14, DRVN +0.13, AWI +0.12, IART +0.12, PTLO +0.12, BCYC +0.11, HD +0.09 of note. (>+0.08)

Flat: of note.

Misses: IMOS -0.21, KNSA -0.14, SRE -0.10, DNUT -0.09, LGIH -0.03, IGT -0.01, HSIC -0.01, ELAN -.01 of note.

Still to Report: None of note.

Company Earnings Guidance:

Positive Guidance: CECO of note.

Negative or Mixed Guidance: TILE NOVT of note.

Advance/Decline Daily Update: The A/D fell to major support making new lows, before a rebound and is now back to struggling.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: EVER +25.9%, PRIM +13.5%, FARO +8.5%, YY +5.5%, AROC +5.1%, SNN +5.1%, HLX +3.7%, AWI +3.6%, TREX +3.3%, WDS +2.9%, API +2.5%, BMO +2.2% of note.

Gap Down: NVTS -22.8%, CHGG -21.2%, HIMS -17.7%, TEM -16.7%, UCTT -13.8%, MRVI -12.5%, CNNE -11.4%, CRI -9.7%, TCOM -8.6%, CIVI -6.7%, MYGN -6.5%, AESI -5.3%, SKT -5.2%, ZM -4.9%, RIOT -4.8%, CLF -4.5%, BBIO -4.3%, O -3.3%, AS -3.3%, DRS -3.2%, SGHT -2.8%, SIBN -2.8%, AORT -2.6%, HD -2.6%, IART -2.4%, BSM -2.3%, GFL -2.2%, MPLN -2.1%, CAKE -2%, U -2% of note.

Insider Action: None see Insider Buying with dumb short selling. None sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Market Wrap: Treasuries Rally. (Bloomberg)

Bloomberg: Trump Team Seeks to Toughen Biden Chip Controls Over China. (Bloomberg)

Stocks Making The Biggest Moves: . (CNBC)

Home Depot (HD) beats on earnings and ends sales drought. (CNBC)

5 Things To Know Before the Market Opens. (CNBC)

Bloomberg: Odd Lots- The Mar-A-Largo Accord. (Podcast)

Economic:

February Consumer Confidence is due out at 10:00 a.m. EDT and is expected to come in at 103.10 from 104.10.

Weekly API Petroleum Institute Crude Oil Inventories are released at 4:30 p.m. EDT.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

President Trump’s Daily Schedule.

Press Briefing at 1:00 p.m. EDT.

President Trump signs Executive Orders at 3:00 a.m. EDT.

Federal Dallas President Lorrie Logan spoke overnight at 4:20 a.m. EDT.

Federal Reserve Governor Michael Barr speaks at 11:45 a.m. EDT.

Federal Reserve Richmond Governor Thomas Barkin speaks at 1:oo p.m. EDT.

M&A Activity and News:

.

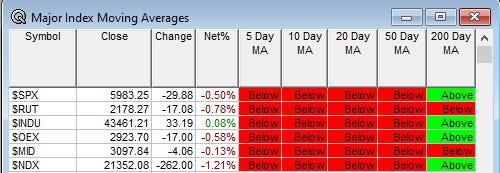

Moving Average Table: Moves from 23% to 13%.

Meeting & Conferences of Note:

Sellside Conferences:

Bank of America Animal Health Conference

Barclays Communication and Content Symposium

BMO Metals Mining & Critical Materials Conference

Cantor San Diego Biotech Bus Tour

Guggenheim Healthy Altitudes Summit

H.C. Wainwright Cell Therapy Virtual Conference

J.P. Morgan Global Leveraged Finance Conference

Oppenheimer Emerging Growth Conference

Susquehanna Tech Conference

Shareholder Meetings: AAPL, AGEN, AMCR, CASH, ILMN, INKT, RNAZ, VERY

Top Analyst, Investor Meetings: ALNY, BAC, CANF, LPTH, MAN, MIST, PECO, PYPL, RAMP

Update: None of note.

Fireside Chat

R&D Day: None of note.

FDA Presentation:

Industry Meetings or Events:

AACR IO Conference

AGBT Conference

Bitcoin Investor Week

RampUp User Conference

Telecommunications Optics and Photonics (TOP) Conference

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: WMT CSTM

Downgrades: LILA