QPI Morning Note - 12/6/24: Jobs, Jobs, Jobs and Hartnett Eyes Excess in US Markets

Overnight Summary & Early Morning Trading: The S&P 500 closed Thursday lower by -0.19% at 6075.11 from Wednesday higher by 0.61% at 6086.49. The overnight high was hit at 6089 at 3:50 a.m. EDT and the low was hit at 6079.50 at 6:05 p.m. EDT. The overnight range is 10 points. The current price is 6085 at 5:55 a.m.

Executive Summary: Jobs data hits the tape at 8:30 a.m. EDT. Expectation has a wide range of 155k to a high of 275k.

Key Events of Note Today:

Economic releases of note include monthly Jobs data at 8:30 a.m. EDT.

Daily Chart Request: Want to see an Erlanger Chart? Simply email us at research@quantpartners.com.

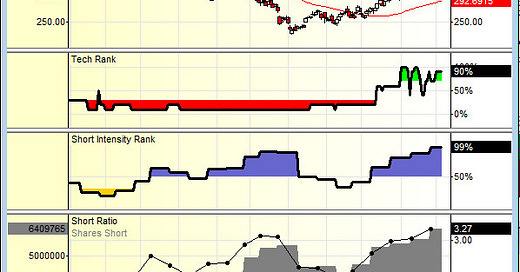

Next up is Lululemon Athletica (LULU). The stock is strong technically with a rank of 90%. Short Intensity is high at 99% with the Short Ratio at 3.27. This morning the stock is at $376.30 up 9.13%.

What to Do: We would buy this stock as a Short Squeeze.

To Short or Not To Short: We are not okay with being short or shorting this name as it is a short squeeze.

Notable Earnings Out After The Close

Beats: AGX+0.74, ULTA +0.61, RBRK +0.19, VEEV +0.17, LULU +0.16, DOMO +0.15, GWRE +0.13, SMAR +0.13, VSCO +0.12, GTLB +0.08, HCP +0.08, ASAN+0.05, COO +0.04, PATH +0.04, ZUMZ +0.04, DOCU +0.03, IOT +0.03, HPE +0.02, WOOF +0.02 of note.

Flat: NAPA of note.

Misses: SWBI -0.06 of note.

Capital Raises:

IPOs For The Week: ALEH, CJMB, DGX, FCHL, FTRK, HIT, JUNS, LSE, NAMI, NTCL, YSXT, ZSPC

Secondaries Filed or Priced:

AMC Files to sell up to 50 million Class A Shares via ATM Offer.

LSEA announces proposed secondary offering of 5,043,480 shares of common stock.

PROF intends to offer and sell common shares in an underwritten public offering.

Selling Shareholders of note:

CYBR announces secondary offering of 1,142,538 ordinary shares by Triton Seller.

Mixed Shelf Offerings:

BK files $40 billion mixed shelf securities offering.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: ASAN +19.8%, DOCU +15.3%, ULTA +12.2%, LULU +9%, ZUMZ +7.1%,VEEV +7.1%, GTLB +6.8%, DOMO +2.2% of note.

Movers Down: SWBI -13.8%, PROF -10.3%, PATH -4.8%, COO -4.6%, GWRE -4.1%, LSEA -3.1%, MAXN -3.1% of note.

News After The Close:

VLRS reports November 2024 traffic results: load factor of 87%.

CVX announces FY25 capex guidance range of $14.5 to $15.5 bln; Also expects to recognize restructuring charge of $700-$900 mln after-tax in Q4.

ASR announces that passenger traffic for November 2024 reached a total of 5.8 million passengers, representing a decrease of 1.2% compared to November 2023.

Equifax (EFX) and Mastercard (MA) announce partnership to combat payment fraud in Latin America.

Port Authority of New York and New Jersey selects Tutor/O&G joint venture team, with Parsons (PSN) as the lead designer for $1.18 billion Newark AirTrain Replacement Program.

BTBT announces monthly production update for November 2024; mines 44.9 Bitcoin.

KOP will discontinue phthalic anhydride production at its facility in Stickney, Illinois, in 2025, which will result in pre-tax charges of $51-$55 mln through end of 2026.

PTEN reports November 2024 drilling activity; had average of 105 drilling rigs operating in the United States.

FAA notes that Boeing's (BA) plan is to slowly restart production later in December. (Reuters)

Palantir Technologies (PLTR) and Shield AI team up on AI-powered autonomous aircraft. (Bloomberg)

Pfizer (PFE) Showcases Scientific Leadership in Breast Cancer and Blood Disorders Across More than 100 Presentations at ASH and SABCS. (Releases)

Meta-analysis published in Annals of Surgery shows benefits of da Vinci surgery from Intuitive Surgical (ISRG) across seven oncologic procedures compared to laparoscopic and open. (Releases)

10-K Delays - None of note.

Buybacks or Repurchases:

BYD announces additional $500 million share repurchase authorization.

LULU authorizes $1.0 billion increase in stock repurchase program.

WING approves additional $500 million for repurchases; anticipates executing $250 mln accelerate share repurchase program commencing in 4q24.

BY approves a new stock repurchase program that authorizes the Company to repurchase up to 1.25 million shares of the Company’s outstanding common stock.

Exchange/Listing/Company Reorg and Personnel News:

UIS elects Mike Thomson, current President and Chief Operating Officer, to succeed Peter Altabef as company's CEO.

OSIS appoints Ajay Mehra, current President of company's Security division and Executive Vice President, as new President and CEO.

MG appoints Natalia Shuman as its new President and Chief Executive Officer, effective January 1, 2025.

MRVL appoints Andrew Eckert as Chairman of the Board of Directors, effective Dec 5, 2024.

IRWD COO and CFO Sravan K. Emany to retire, effective December 18; CEO Thomas McCourt to servce as principal financial officer on an interim basis until a new principal financial officer is designated.

Dividends Announcements or News:

Stocks Ex Div Today: BAC PEP BKNG TT WM AJG GM NDAQ KMB AME NTRS GPC TPR GLPI CHRW TAP CHDN ORI KNX MLI BPOP

Stocks Ex Div Monday: GOOG, GOOGL, UNH, FDX, SPG, UNP, ADI, BDX, FIS, CME, GOGL, G, GBDC, AIZ, ESEA, KTB, FAF, DLNG, SPTN, DCI, CVTR, CCBG.

CRM quarterly cash dividend of $0.40 per share payable January 9, 2025.

WEC announces that it is planning to raise the quarterly dividend on the company's common stock to $0.8925/share in the first quarter of 2025.

TRIN increases quarterly cash dividend to $0.30/share from $0.28/share.

ECL increases its quarterly dividend by 14% to $0.65/share; 1.1% annual yield.

OC increases quarterly cash dividend 15% to $0.69/share from $0.60/share.

ABM approves 18% increase to its quarterly dividend to $0.265/share; 1.9% annual yield.

EMN increases quarterly cash dividend to $0.83/share from $0.81/share.

UTZ approves annual dividend increase to $0.244/share from $0.236/share.

LIEN $0.34 cash dividend for 4q 2024

What’s Happening This Morning: (as of 8:00 a.m. EDT) Futures S&P 500 -2, NASDAQ +7, Dow Jones -19 and Russell 2000 +4. Europe is mixed with the CAC 40 +1.5%. Asia is mixed with HSI +1.5% and Shanghai +1%. Bonds are at 4.18% on the 10-Year. Crude Oil and Brent are lower with Natural Gas down 2%. Gold and Silver are higher. The U.S. Dollar is down slightly versus the Euro, up a tad versus the Pound and higher against the Yen. Bitcoin is at $97,777.

Sector Action:

Daily Positive Sectors: Consumer Cyclical, Consumer Defensive, Energy, Financials and Utilities of note.

Daily Negative Sectors: Healthcare, Materials, Industrials, Communication Services and Technology of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Friday After the Close: None of note.

Monday Before The Open: MOMO of note.

Notable Earnings of Note This Morning:

Beats: GCO +0.32 of note.

Company Earnings Guidance:

Positive Guidance: GCO, GWRE, VEEV, DOCU, GTLB, RBRK of note.

Negative or Mixed Guidance: COO, WOOF of note.

Advance/Decline Daily Update: As SPX moves up through December, AD line has started to pull back. Something to watch.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: UPC, ADD, ZBAO, GXAI, LEV, PGHL, RBRK, ASAN, FET, USEA, SAG, SOUN, HLVX, XHG, ITP, AQMS, BBAI, ALBT, KIRK

Gap Down: ORIS, ZSPC, CAMP, FOXX, PRFX, VRPX, TARA, MTEM, SWBI, PBM, BRTX, BTCT, MIGI, ANTE, BJDX, RKDA, BSLK, IOT, JYD, STSS

Insider Action: No stock sees Insider buying with dumb short selling. No stock see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Lead Story on Bloomberg: US Jobs Report to Show Hiring Rebounded After Storms and Strike. (Bloomberg)

5 Things To Know Before The Market Opens. (CNBC)

Stocks Making The Biggest Moves: LULU, DOCU, ULTA, WOOF. (CNBC)

Market Wrap: Traders Adopt Caution in Countdown to Jobs Report (Bloomberg)

Bank of America strategist Michael Hartnett notes the S&P 500's SPY price-to-book ratio has surged to 5.3x this year, approaching the 5.5x peak reached in March 2000 during the height of the dot-com bubble.

This market maven raised his S&P 500 target three times this year. Now he says there’s too many bulls (MarkeWatch)

Bloomberg: The Big Take - Macron’s Grand Project in Ruins After French Government Falls. (Podcast)

Economic:

November Nonfarm Payrolls is due out at 8:30 a.m. EDT and expected to fall to 190,000 from 200,000.

The December University of Michigan Consumer Sentiment is due out at 10:00 a.m. EDT and expected to rise to 73.50 from 71.80.

Treasury Buyback Announcement, 11:00 am EDT

Baker Hughes Rig Count, 1:00 p.m. EDT

Consumer Credit. 3:00 p.m. EDT

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

9:15 a.m. EDT Federal Reserve Board of Governors Michelle Bowman, At the Missouri Bankers Association Executive Management Conference (Virtual)

10: 30 a.m. EDT Federal Reserve Chicago President Austan Goolsbee (non-voter)

12:00 p.m. EDT (voter) Federal Reserve Bank of Cleveland Beth M. Hammack (voter)

1:00 p.m. EDT Federal Reserve San Francisco President Mary Daly (voter)

M&A Activity and News:

AVVIY nears prelim agreement to acquire Direct Line Insurance Group after $4.4 bln bid. (Bloomberg)

Moving Averages On Major Equity Indexes: Moves down from 93% to 85%.

Meeting & Conferences of Note:

Sellside Conferences:

Bank of America Clean Energy Symposium

Barclays Eat Sleep Play Shop Conference

Citi Global Healthcare Conference

Evercore ISI HealthConX Conference

Goldman Sachs Industrials and Materials Conference

Goldman Sachs Energy Clean Tech & Utilities Conference

Jefferies Renewables & Clean Energy Conference

Morgan Stanley Global Consumer & Retail Conference

Needham Growth Conference

Piper Sandler Healthcare Conference

Roth Annual Sustainability Private Capital Event

Sidoti & Co. Small Cap Conference

UBS Global Technology & AI Conference

UBS Industrials and Transportation Conference

Wolfe Research Small and Mid-Cap Conference

Fireside Chat: None of note.

FDA Presentation:

CGON: Data Presentation for Cretostimogene

Industry Meetings or Events:

AMZN re:Invent Conference

Nasdaq London Investor Conference

Top Tier Sell-side Upgrades & Downgrades:

Upgrades: RSG, PCH, MO, KC, HOOD, FTI, EPAM, DG, BRX, BMO, ACN

Downgrades: PLD, LBTYA, ACDC