QPI Morning Note -12/12/24: NASDAQ Composite Breaks 20,000 on Wednesday.

Overnight Summary & Early Morning Trading: The S&P 500 closed Wednesday higher by 0.82% at 6084.19 from Tuesday lower by -0.30% at 6034.91. The overnight high was hit at 6087.50 at 1:02 a.m. EDT and the low was hit at 6079.75 at 6:15 a.m. EDT. The overnight range is 7.75 points. The current price is slightly down at 6:53 a.m.

Executive Summary: PPI is out this morning.

Key Events of Note Today:

President Elect Trump to ring NYSE opening bell Thursday and named Times Person of the Year.

PPI Out at 8:30 a.m. EDT along with Jobless Claims and Natural Gas Inventories at 10:30 a.m. EDT.

Daily Chart Request: Want to see an Erlanger Chart? Simply email us at research@quantpartners.com.

Quantum Computing has come up lately and timely with MarketWatch droping a story as "the next big thing'. (MarketWatch). Below are the names mentioned in the story along with some charts from Erlanger Chartroom Software.

Notable Earnings Out After The Close

Beats: NDSN +0.19, ADBE +0.14 of note.

Misses: OXM -0.20 of note.

Capital Raises:

IPOs For The Week: ALEH, FTRK, HIT, MIMI, MTRS, NTCL, PHH, YSXT

Secondaries Filed or Priced:

BCTX: Pricing of $5.5 Million Public Offering 7,400,000 common shares @$0.75.

FISI: Pricing of Common Stock Offering.. 4M @$25.

Notes Priced:

DBD: Prices Offering of Senior Secured Notes.

MAA: Pricing of Senior Unsecured Notes Offering.

Selling Shareholders of note:

CHWY: announces $500 million public offering of Class A common stock by selling stockholder Buddy Chester.

ORA: Public Offering of Common Stock on Behalf of Stockholder ORIX Corporation. (see Mixed Shelf too)

QNRX: FORM S-1 - Up to 19,230,769 Ordinary Shares Represented by Ameri.

Mixed Shelf Offerings:

BTDR files $1.0 billion mixed shelf securities offering.

BNED files $40 million mixed shelf securities offering.

ORA: FORM S-3ASR - Mixed Shelf Offering - 6,676,077 Shares of Common Stock.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: DBVT +25%, KR +2.9%, BTDR +2.6% of note.

Movers Down: ADBE -8.4%, NDSN -5.8%, CMTL -5.2%, OXM -4.2%, CHWY -2.7%, CORT -2.4% of note.

News After The Close:

10-K Delays - CMTL of note.

AB announces that preliminary assets under management increased to $813 billion during November 2024 from $793 billion last month.

HOOD reports November 2024 operating data; Assets Under Custody (AUC) up 22% from October to $195 billion.

MSFT expects to record impairment charge of approximately $800 million in 2Q25 due to General Motors' (GM) intent to realign its autonomous driving strategy.

Kroger (KR) terminates merger agreement with Albertsons (ACI), approves new $7.5 billion share repurchase program, and announces merger debt redemption.

Eldorado Gold (EGO) releases updated mineral reserve and mineral resource statement; 2024 Gold Mineral Reserves Increased to 11.9 Million Oz with M&I Gold Mineral Resources of 22.0 million Oz; inaugural mineral reserve declared at Ormaque; Outline of 2025 reporting schedule.

LDOS awarded $987 million U.S. Air Force contract.

BAESY awarded $656 million U.S. Army contract.

Buybacks or Repurchases:

FLXS approves a new $30 million share repurchase program.

CHWY also to add $50 million share repurchase.

NOC authorizes an additional $3.0 billion share repurchase program, increasing outstanding authorized amount to approximately $4.2 billion.

Exchange/Listing/Company Reorg and Personnel News:

KO appoints Henrique Braun as Executive Vice President and Chief Operating Officer, effective Jan. 1, 2025.

VLY announces retirement of President Thomas Iadanza, effective June 2025.

Dividends Announcements or News:

Stocks Ex Div Today: TSM VALE ADT AL BDC RYN MCY MDU MPW NSSC JACK CTO

Stocks Ex Div Tomorrow: ADP, ALB, BR, CB, CCI, DVN, DLR, DPZ, GRMN, GILD, GPN, HCA, MSI, PSA, STX, TROW, TXT, TMO, VRSK, WMT, WMB

HST announces a special dividend of $0.10 per share, payable on January 15, 2025, to stockholders of record as of December 31.

What’s Happening This Morning: (as of 7:46 a.m. EDT) Futures S&P 500 -11.44, NASDAQ -91.73, Dow Jones -28.56 and Russell 2000 -4.86. Europe is mixed with Asia is higher (NIKKEI and HSI +4.2%) ex Australia. Bonds are at 4.30% from 4.25% on the 10-Year. Crude Oil and Brent are higher with Natural Gas down 2.34%. Gold and Silver are lower and Copper edging up. The U.S. Dollar is slightly lower versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $100,820 from $98,381.

Sector Action:

Daily Positive Sectors: Communication Services and Consumer Defensive of note.

Daily Negative Sectors: Real Estate, Technology, Materials and Utilities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before The Open: None of note

Notable Earnings of Note This Morning:

Beats: LOVE +0.03 of note.

Misses: CIEN (0.11) of note.

Company Earnings Guidance:

Positive Guidance: None of note.

Negative or Mixed Guidance: LOVE of note.

Advance/Decline Daily Update: SPX A/D sits at the moving average line.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: AGL +3.52%, WLK +3.46%, UBER +3.25%, ACHC +3.16%, REXR +3.02%, CWEN +3.02%, CUBE +2.89%, CELH +2.82%, AS +2.68%, CNC +2.62%

Gap Down: ADBE -11.29%, NDSN -6.23%, DRVN -5.59%, CIEN -5.34%, CERT -5.01%, CTVA -2.98%, VYX -2.95%, GD -2.49%, PVH -2.42%, AXS -2.32%

Insider Action: No stock sees Insider buying with dumb short selling. No stock see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Lead Story on Bloomberg: China Signals More Fiscal Stimulus, Rate Cuts to Lift Growth. (Bloomberg)

5 Things to Know Before the Stock Market Opens (CNBC)

Stocks Making The Biggest Moves: . (CNBC)

Market Wrap: Stocks Slip as ECB, Fed Interest-Rate Cuts Priced. (Bloomberg)

Police Investigate NYC 'Wanted' Posters of Finance Executives (Bloomberg)

IPO investors are hopeful about 2025 after last major offering of this year prices on a high note. (CNBC)

MicroStrategy shares could surge even higher if added to Nasdaq 100 on Friday, crypto analyst says. (MarketWatch)

Bloomberg: The Big Take - Market-Moving Data Under Threat as Trump Returns to Washington. (Podcast)

Economic:

November PPI is due out at 8:30 a.m. EDT and expected to rise to 0.30% from 0.20%.

Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

1:30 p.m. EDT Press Briefing by Press Secretary Karine Jean-Pierre.

M&A Activity and News:

GIB signs an equity purchase agreement to merge operations with Daugherty, expands operations in multiple U.S. metro markets.

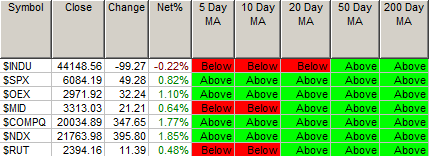

Moving Averages On Major Equity Indexes: Moves back up to 80% from 57%.

Meeting & Conferences of Note:

Sellside Conferences:

Abu Dhabi Finance Week

AI Executive Conference

Barclays Global Technology Conference

ESMImmuno-Oncology Congress

Global Blockchain Congress

Goldman Sachs Energy Clean Tech & Utilities

Gordon Haskett Consumer & Retail Holiday

Needham Growth Conference

Northland Growth Conference

SEMICON Japan

Seaport Research Automotive Dealer Days

Truist Securities Gaming Lodging Leisure & Restaurants Summit

Wells FargPrivate Biotech Symposium

Fireside Chat: None of note.

Top Analyst, Investor Meetings: CHRW, CNC, GRRR, GSAT, GTI, HTOO, INCY, KAI, LUV, MET, NEXN, OLN, PDFS, PSEC, PZZA, RPTX, UA, UAA, ZYME.

Shareholder Meetings: DAO, MARX, SFIX, VYNE, WDFC.

FDA Presentation:

SABCS Meeting December 10-13

Industry Meetings or Events:

AI Summit

Capital Link Shipping Sectors Webinar Series

Melius Research Conference

Nasdaq Investor Conference

Nuclear Energy Revisited Conference

Top Tier Sell-side Upgrades & Downgrades:

Upgrades: BEP, BEPC, ROK, PEP, MSCI, KO, KDP, CHTR

Downgrades: AMPS, OTIS, HSY, GD