QPI Morning Note -12/11/24: CPI Comes In As Expected Up +0.3%. Stocks Move Higher After The Release.

Overnight Summary & Early Morning Trading: The S&P 500 closed Tuesday lower by -0.30% at 6034.91 from Monday lower by -0.61% at 6052.85. The overnight high was hit at 6054.75 at 6:00 p.m. EDT and the low was hit at 6045.50 at 2:35 a.m. EDT. The overnight range is 7 points. The current price is 6053.75 up 7.50 (0.12%) at 6:40 a.m.

Executive Summary: CPI is out today and PPI on Thursday. CPI rose +0.3%. CPI Core rose +0.3%. Year over Year Inflation rose +2.7% after being up +2.6% in October. Inflation is not hot but it is still “warm”. No harm, no foul.

Key Events of Note Today:

10-Year Treasury Note Auction at 1:00 p.m. EDT.

CPI Out at 8:30 a.m. EDT and Crude Oil Inventories at 10:30 a.m. EDT.

Weekly Mortgage Applications were out at 7:00 a.m. EDT and rose 5.4% while rates moved lower.

Notable Earnings Out After The Close

Beats: SKIL +1.18, SFIX +0.09, GME +0.07 of note.

Flat: of note.

Misses: PLAY -0.44 of note.

Capital Raises:

IPOs For The Week: ALEH, FTRK, HIT, MIMI, MTRS, NTCL, PHH,

YSXTNew IPOs/SPACs launched/News: None of note.

IPOs Filed/Priced: None of note.

Secondaries Filed or Priced:

RCKT to offer $150 mln of shares of its common stock in an underwritten public offering.

CCB announces proposed public offering of common stock.

CUZ commences public offering of 9,500,000 shares of its common stock.

Joby Aviation (JOBY) enters into Equity Distribution Agreement under which it may sell up to an aggregate of $300 mln of shares of its common stock offering.

IBRX announces proposed public offering of common stock

NAMS announces commencement of $300 million public offering of ordinary shares and pre-funded warrants.

SATL files for $150 mln Class A ordinary share offering.

Notes Priced: None of note.

Direct Offering: None of note.

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

SATL also files for 3,571,429 Class A ordinary share offering by selling shareholder.

Mixed Shelf Offerings:

CNOB files mixed shelf securities offering.

ALUR: Form S-3.. $100,000,000 Mixed Shelf

PIPE:

Convertible Offerings & Notes Filed:

NTNX announces proposed $750 million convertible senior notes offering.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: FEIM +27.1%, SFIX +20.4%, SKIL +16.2%, GM +3.2%, SATL +3%, GME +2% of note.

Movers Down: QTTB -66.5%, IBRX -17%, SLRN -16.7%, JOBY -9.4%, PLAY -9.8%, SIGA -8.5%, RCKT -6.4%, GEV -2.8% of note.

News After The Close:

10-K Delays – None of note.

Interim Results from STOMP Study of SIGA’s (SIGA) Tecovirimat in Treatment of Mpox announced and did not work.

Marvell (MRVL) announces breakthrough custom HBM compute architecture to optimize cloud AI accelerators.

GE Vernova (GE) reaffirms FY24 revenue and free cash flow guidance, raises FY25 revenue guidance, but still below consensus, and raises 2028 outlook.

Mantle Ridge files definitive proxy statement and sends letter to Air Products and Chemicals Inc. (APD) shareholders highlighting material underperformance, misguided capital allocation strategy, and succession failures.

Booking Holdings (BKNG) estimates previously announced restructuring will reduce annual run rate expenses by around $400-450 mln versus 2024 expense base over the next three years.

ACELYRIN, INC. (SLRN) Announces Topline Results From Phase 2b/3 Study of Izokibep for the Treatment of Uveitis. (Press Release)

General Motors (GM) to realign its autonomous driving strategy; GM will no longer fund Cruise’s robotaxi development work; will raise its ownership in Cruise to more than 97% vs 90% now.

Victory Capital (VCTR) reports total Assets Under Management (AUM) of $179.7 bln, up from $172.3 bln as of October 31, 2024.

Synovus (SNV) provides FY25 guidance in slides ahead of Goldman Sachs Conference; sees +3-7% adjusted revenue growth yr/yr.

Microsoft (MSFT) released new data center design yesterday centered on optimizing AI; to consume zero water for cooling.

BA awarded $450 mln U.S. Air Force contract.

LMT awarded $376 mln U.S. Army contract modification.

Department of Commerce has awarded Micron (MU) a grant in a maximum funding amount of $1.5 bln for the construction of a fab facility in Boise, Idaho.

Department of Commerce has also awarded Micron (MU) grants in a maximum funding amount of $4.6 bln for the construction of two fab facilities in Clay, New York.

Uber (UBER) moving down after Mexico’s Lower House of Congress approves gig worker reform affecting workers at Uber. (Bloomberg)

Buybacks or Repurchases:

GE Vernova (GEV) Approves initial $6.0 bln share repurchase authorization.

Exchange/Listing/Company Reorg and Personnel News:

CRML appoints Steven R Parkes as CFO following the agreed transition of Ms. Melissa Chapman from the role, effective December 9

ROG appoints Laura Russell as CFO, effective December 10.

IFF appoints Michael DeVeau, current Senior Vice President, Corporate Finance and Investor Relations, as Executive Vice President and Chief Financial Officer.

CEO Chris Morris of Dave & Busters (PLAY) resigns; Chairman Kevin Sheehan will also serve as interim CEO.

MORN appoints Michael Holt as CFO, effective January 1, 2025.

MAA appoints Bradley Hill as President and CEO, effective April 1, 2025; succeeds Eric Bolton, Jr. who is retiring and will serve as Executive Chairman.

Dividends Announcements or News:

Stocks Ex Div Today: LRCX HPQ AEE LEA NJR SR FRO KSS DOLE GES

Stocks Ex Div Tomorrow: TSM VALE ADT AL BDC RYN MCY MDU MPW NSSC JACK CTO

O increases quarterly cash dividend to $0.2640/share from $0.2635/share.

LSTR declares a special one-time cash dividend of $2.00/share.

TTC increases quarterly cash dividend to $0.38/share from $0.36/share.

AMGN raises its quarterly dividend by 5.8% to $2.38/share; annual yield of 3.5%.

BCPC increases its quarterly dividend by 10.1% to $0.87 per share.

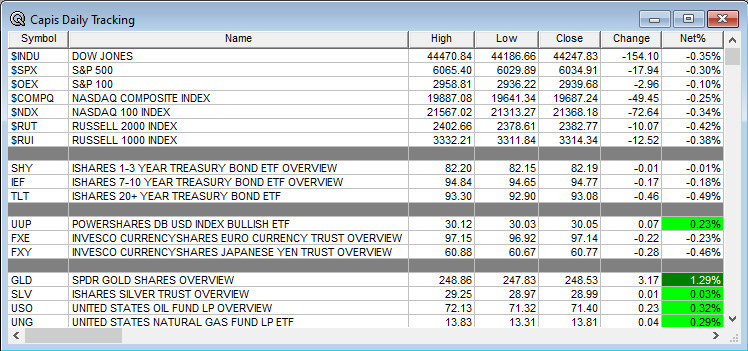

What’s Happening This Morning: (as of 8:20 a.m. EDT) Futures S&P 500 +6.75, NASDAQ +48, Dow Jones -18 and Russell 2000 +4.46. Europe is higher with Asia is higher ex Australia. Bonds are at 4.25% from 4.232% on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher as well. Gold is higher with Silver and Copper lower. The U.S. Dollar is higher versus the Euro, higher against the Pound and higher against the Yen. Bitcoin is at $98,381 from $97,259 yesterday higher by $2030 at 2.11%.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Communication Services and Consumer Defensive of note.

Daily Negative Sectors: Real Estate, Technology, Materials and Utilities of note.

One Month Winners: Consumer Cyclicals, Financials, Industrials, Energy and Utilities of note.

Three Month Winners: Consumer Cyclicals, Financials, Communication Services, Industrials, Utilities, Consumer Defensive and Technology of note.

Six Month Winners: Financials, Real Estate, Utilities, Consumer Cyclical and Technology of note.

Twelve Month WinnerMOmONTs: Financials, Technology, Industrials, Utilities and Communication Services note.

Year to Date Winners: Technology, Financials, Utilities, Communication Services and Industrials of note.

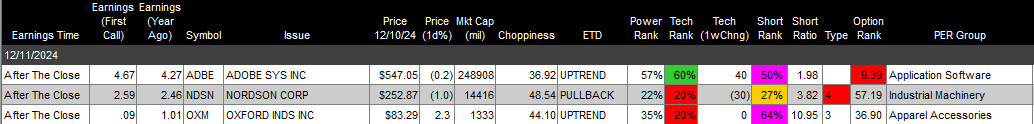

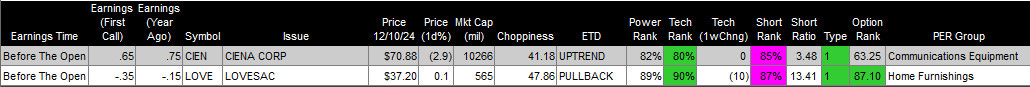

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Beats: PLAB +0.07, UNFI +0.18, OLLI +0.01 of note.

Flat: none of note.

Misses: AZO -1.01, FERG -0.17, DBI -0.08 of note.

Still to Report: none of note.

Company Earnings Guidance:

Positive Guidance: of note.

Negative or Mixed Guidance: of note.

Advance/Decline Daily Update: As SPX moves up through December, AD line has started to pull back. Worth watching.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

Gap Up: FEIM +25%, SFIX +24.1%, SKIL +12.8%, RLAY +12%, PHAR +10.3%, NAMS +3.9%, GME +3.2%, OUST +3%

Gap Down: QTTB -66%, IBRX -16.6%, PLAY -16.4%, SLRN -16.3%, JOBY -6%, CRML -4.9%, CGON -4.6%, GEV -3.9%, SATL -3.8%, CNOB -3.4%, QUBT -3%, NTNX -2.7%, RCKT -2.1%

Insider Action: BAH sees Insider buying with dumb short selling. None see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Lead Story on Bloomberg: US Inflation Data to Show Fourth Consecutive Month of Firm Gains. (Bloomberg)

Stocks Making The Biggest Moves: GME GEV M. (CNBC)

Market Wrap: Dollar gains on reports China may let the Yuan weaken. (Bloomberg)

ECB Heads for Last Rate Cut Of The Year. (CNBC)

Bloomberg: The Big Take -Inside United Healthcare After The Shooting. (Podcast)

Economic:

November CPI is due out at 8:30 a.m. EDT and expected to rise to 0.30% from 0.20%.

Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

Federal Reserve Speakers are in a blackout until the last FOMC meeting of the year which is next Tuesday & Wednesday 17th and 18th.

President Biden receives the Daily Briefing at 3:30 P.m. EDT.

President Biden delivers remarks at before the first ever White House Conference on Women’s Health Research 11:30 a.m. EDT.

M&A Activity and News:

Eagle Materials (EXP) enters into definitive agreement to acquire Bullskin Stone & Lime, LLC for $152.5 mln.

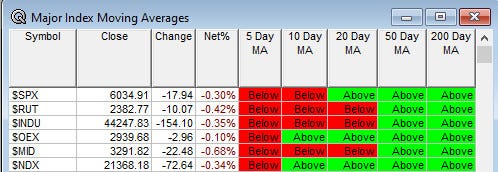

Moving Averages On Major Equity Indexes: Moves down from 80% to 57%.

Meeting & Conferences of Note:

Sellside Conferences:

Barclays Global Technology Conference

Craig-Hallum Nuclear Energy Revisited Conference

Goldman Sachs Financial Services Conference

Jefferies Real Estate Conference

Mizuho Power, Energy & Infrastructure Conference

Needham Growth Conference

Oppenheimer Midwest Summit

Raymond James TMT and Consumer Conference

Seaport Research Partners Automotive Dealer

Scotiabank Global Technology Conference

Stifel MedTech Madness West Coast Bus Tour

TD Cowen IT Services & Digital Engineering

Wells Fargo Midstream, Energy & Utilities

Wolfe Research Reshoring Conference

Fireside Chat: None of note.

Top Analyst, Investor Meetings: ADCT, ANVS, BCLI, CYBN, GEF, GMAB, ICU, INBS, JAZZ, JBTC, LOW, MTCH, NVA,

OXBRShareholder Meetings: HIVE, IVA, LANV, LASE, ODC, TEAM, XBIO

Update: None of note.

R&D Day: None of note.

FDA Presentation:

SABCS Meeting December 10-13

Company Event: None of note.

Industry Meetings or Events:

AI Summit

Capital Link Shipping Sectors Webinar Series

Melius Research Conference

Nasdaq Investor Conference

Nuclear Energy Revisited Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: SPWH MLI ICUI GKOS FOXF EGP AMCR

Downgrades: OCSL PFG PD MRCC MGA ETWO CX BWIN AMBP AI