QPI Morning Note- 11/20/24: Target Misses, Retailers Weak But Stocks Still Higher

Overnight Summary: The S&P 500 closed Tuesday higher by 0.40% at 5916.98 from Monday higher by 0.39% at 5893.62. The overnight high was hit at 59573.75 at 3:20 a.m. EDT and the low was hit at 5937 at 4:55 p.m. EDT. The overnight range is 16 points. The current price is 5899457 at 6:15 a.m. The S&P 500 is higher by +6.25 up 0.11% this morning.

Executive Summary: Target had a huge earnings miss losing $-0.45. Walmart beat yesterday. The miss by Target is weighing on retailers today. That said overall stocks are higher.

Key Events of Note Today:

20 Year Bond Auction at 11:30 a.m. EDT.

Notable Earnings Out After The Close

Beats: POWL +0.22, DLB +0.16, VREX +0.11, KEYS +0.08, LZB +0.07, ZTO +0.06, AZEK +0.02 of note.

Flat: SYM of note.

Misses: GBDC -0.09, XL -0.01 of note.

Capital Raises:

IPOs For The Week: AGH, JUNS, LHAI, MSW, NAMI, PRB, ZSPC

Secondaries Filed or Priced:

KWE: Form F-3.. 8,497,660 common shares

NRSN: Form F-1,, Up to 10,000,000 Ordinary Shares

Notes Priced:

VST: Prices Private Offering of $1.25 Billion of Senior Secured Notes

Selling Shareholders of note:

QDEL files for 8,260,183 shares of common stock by selling shareholder

Mixed Shelf Offerings:

ABVX files $350 mln mixed shelf securities offering

DT files mixed shelf securities offering

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: DLB +12.8%, SGMO +11.2%, KEYS +8.9%, CON +7.6%, FLEX +5.4%, QFIN +3.4%, VREX +3.3%, AZEK +2.6%, LZB +2.5% of note.

Movers Down: SVM -15.9%, POWL -11%,QDEL -6%, XP -5.1%, LUNR -3.1% of note.

News After The Close:,

DTM reaches an agreement to acquire a portfolio of three FERC-regulated natural gas transmission pipelines from ONEOK (OKE) for $1.2 bln

“Dr. Oz” picked by President-Elect Trump to be administrator of Medicare and Medicaid Services

Insiders bought shares in ZI and ALGM.

CON to join S&P 600. FLEX to join S&P 400.

10-K “Delays – None of note.

Buybacks or Repurchases:

XP approves a new share repurchase program up to the amount in dollars equivalent to R$1.0 bln of common shares

QFIN announces new $450 mln share repurchase program for 2025

Exchange/Listing/Company Reorg and Personnel News:

PATK announces a 3-2 split.

Dividends Announcements or News:

Stocks Ex Div Today: TGT AFL MPC VLO KSPI MKTX HAS LPX ZWS BC COLM ORA POWL

Stocks Ex Div Wednesday: MSFT AMAT MAR DFS ADM CNP SNA AMCR EVRG WWD PRI TPX DINO GGB LFUS

AIZ increases quarterly cash dividend 11% to $0.80/share from $0.72/share

MCK increases quarterly cash dividend 7% to $0.45/share from $0.42/share

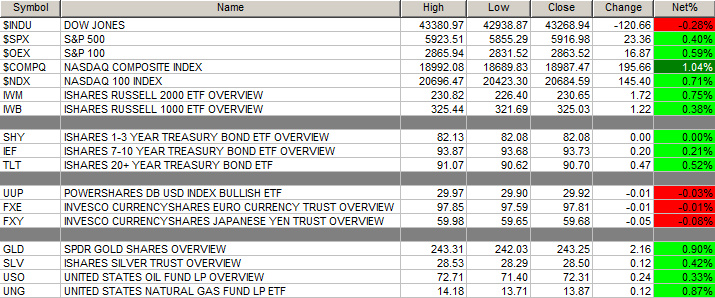

What’s Happening This Morning: Futures S&P 500 +4 NASDAQ +16 Dow Jones +123 Russell 2000 -2.13. Bonds are at 4.422% from 4.365% on the 10-Year. VIX Futures are at 16.10. Crude Oil and Brent are higher with Natural Gas higher as well. Gold and Silver are higher with Copper lower for a second day in a row. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $93,344 from $91,624 yesterday morning higher by +$426 with Futures up +0.46% this morning.

Sector Action:

Daily Positive Sectors: Technology, Communication Services, Utilities, Real Estate and Consumer Defensive of note.

Daily Negative Sectors: Energy and Financials of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Beats: DY +0.37, TJX +0.05, GLBE +0.01 of note.

Misses: TGT -0.45, NIO -0.22, SQM -0.17, WIX -0.02 and SR -0.01 of note.

Company Earnings Guidance:

Positive Guidance: WIX of note.

Negative or Mixed Guidance: TJX NIO TGT of note.

Advance/Decline Daily Update: The A/D Line hit a wall last Tuesday and rolled over having broken its monthly moving average.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

Gap Up: SGMO +13.8%, WIX +13.6%, DLB +10.4%, KEYS +9.1%, FLEX +6.3%, LZB +6.3%, AZTA +6.2%, VREX +5%, QFIN +4.5%, LNTH +4.4%, CON +4.1%, ZI +3.8%, SNEX +3.4%, VKTX +2.9%, AZEK +2.5%,

Gap Down: SAGE -26.3%, TGT -20.2%, POWL -15.4%, SVM -13.7%, QDEL -6.7%, VERI -4.1%, ZTO -4%, ATOS -3.9%, CAN -3.1%, DAL -2.7%, BLX -2.6%, CDE -2.4%, NIO -2.4%, XP -2.3%,

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Stocks making the biggest move in pre-market Check back for today’s listing. (CNBC)

President-Elect Trump to Interview Marc Rowan and Kevin Warsh for Treasury Secretary.

Comcast (CMCSA) to spin-off cable properties.

California voters rejected $18 an hour minimum wage.

Google’s (GOOGL) Chrome could be worth $20 billion if forced to divest.

Economic:

MBA Weekly Mortgage Applications were out at 7:00 a.m. EDT and rose 1.7% from o,5% last week.

Weekly Crude Oil Data is due out at 10:30 a.m. EDT.

Geopolitical: Federal Reserve speakers today.

Federal Reserve Governor Michael Barr speaks at 10:00 a.m. EDT.

Federal Reserve Governor Lisa Cook speaks at 11:00 a.m. EDT.

Federal Reserve Governor Michelle Bowman speaks at 12:15 p.m. EDT.

Federal Reserve Boston President Susan Collins speaks at 4:00 p.m. EDT.

President Biden received the Daily Briefing at 8:00 a.m. EDT from Rio de Janeiro, Brazil.

President Biden is in Brazil for day two of the G-20 Summit.President Biden

Holds a working lunch with President Lula da Silva of Brazil at 8:15 a.m. EDT.

The president returns to the White House at 10:45 p.m. EDT.

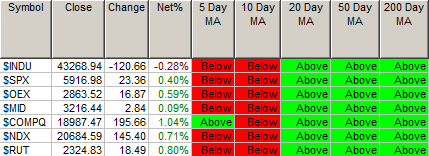

Moving Averages On Major Equity Indexes: Move from 60% to 63%.

Meeting & Conferences of Note:

Sellside Conferences:

Baird Defense & Government Conference

Barclays Automotive and Mobility Conference

Canaccord MedTech Diagnostics Forum

Jefferies London Healthcare Conference

Jefferies New Nuclear Conference

J.P. Morgan Global TMT Conference

Macquarie International Conference

Morgan Stanley Asia Pacific Summit

Needham Security Networking & Communications Conference

Raymond James Insurance Conference

Stifel Healthcare Conference

Seaport Digital Media & Advertising Conference

Stephens Investment Conference

Wolfe Energy Conference

Fireside Chat: None of note.

Top Analyst, Investor Meetings: AIOT, BRCN, DAL, IBO, NESR, PYXS, QSI, QUAD, ROK, SHC, SWK, ZETA

Shareholder Meetings: CLX, LPTH, RMD, ROK, WDC

FDA Presentation: PYXS: Data Presentation for PYX201

Industry Meetings or Events:

College of Rheumatology ConvergenceNET Medical Symposium (NANETS)

New Orleans Investment Conference

REITworld: Investor Conference

Southwest IDEAS Investor Conference

Swiss Mining Institute

Top Tier Sell-side Upgrades & Downgrades:

Upgrades: INSP GLPI EQNR CHWY AVAV

Downgrades: GLPG FN FIS