QPI Morning Note- 11/19/24: Stocks Lower On Russia U.S. Tensions As Ukraine Fires U.S. Missiles

Overnight Summary: The S&P 500 closed Monday higher by 0.39% at 5893.62 from Friday lower by -1.32% at 5870.62. The overnight high was hit at 5933.75 at 11:30 a.m. EDT and the low was hit at 5882 at 4:30 a.m. EDT. The overnight range is 52 points. The current price is 5897 at 6:15 a.m. The S&P 500 is lower by -23 down -0.39% this morning.

Executive Summary: Tensions are higher as DEFCON level has to go up a notch this morning.

Key Events of Note Today:

Bill Auction at 11:30 a.m. EDT.

Notable Earnings Out After The Close

Beats: TCOM +1.82, ACM +0.03, BRBR +0.01of note.

Flat: SYM of note.

Capital Raises:

IPOs For The Week: AGH, JUNS, LHAI, MSW, NAMI, PRB, ZSPC

Secondaries Filed or Priced:

SYRE commences $200 mln common stock offering and pre-funded warrants

Mixed Shelf Offerings:

SEI files $500 mln mixed shelf securities offering.

OSK files mixed shelf securities offering.

ADTN files $200 mln mixed shelf securities offering

FFIC files $400 mln mixed shelf securities offering

PIPE:

MSTR to offer $1.75 bln aggregate principal amount of its 0% convertible senior notes due 2029 in a private offering.

OMCL intends to offer $150 mln aggregate principal amount of Convertible Senior Notes in a private placement

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: SMCI +26%, SYM +24%, ECX +5.6%, ERII +5.4%, TCOM +3.7%, MCHP +2.7% of note.

Movers Down: INCY -10.4%, PTGX -3.4%, DJT -2.3% of note.

News After The Close:,

GRAIL (GRAL) announces first patient tested with blood-based assay in Phase 3 adjuvant lung cancer study. GRAL was spun off from Illumina (ILMN).

IRM acquires two data center development sites in Virginia, adding estimated 350+ megawatts of planned future capacity.

ADM updates its filings and is now current.

INCY announces that it will pause enrollment in the ongoing Phase 2 study of MRGPRX2 (INCB000262) in chronic spontaneous urticaria (CSU).

SMCI engages BDO USA, P.C. as its independent auditor, effective immediately.

WY plans to invest approximately $500 mln to build new TimberStrand facility, expanding its engineered wood products capacity in the U.S. South.

AMTM awarded $389 mln U.S. Army contract modification

The Department of Justice pushes Alphabet (GOOGL) to sell Chrome.

Barron's: +/- on CAG SJM KLG TSN LW KHC HSY. (Barron's)

Buybacks or Repurchases:

ERII approves share repurchase program for up to $50.0 mln of company's common stock.

Exchange/Listing/Company Reorg and Personnel News:

MCHP CEO Ganesh Moorthy to retire; Steve Sanghi appointed interim CEO, effective today

AHH names COO Shawn Tibbetts as its new CEO, effective January 1, 2025

AMD Chief Accounting Officer Darla Smith resigns, effective November 18; Philip Carter appointed successor.

KWR appoints Joseph Berquist as CEO and President, and a member of the Board of Directors, effective immediately.

WEN names Ken Cook as Chief Financial Officer, effective December 2, 2024. Cook will succeed Gunther Plosch who will depart the company at the end of the year after a transition with Cook.

Dividends Announcements or News:

Stocks Ex Div Today: EQNR E PRU CTSH TS STE WMG FTI BWXT LSTR TKR OGS STR OMAB PRG NRP DLX

Stocks Ex Div Wednesday: TGT AFL MPC VLO KSPI MKTX HAS LPX ZWS BC COLM ORA POWL

What’s Happening This Morning: Futures S&P 500 -1 NASDAQ +40 Dow Jones -74 Bonds are at 4.365% from 4.77% on the 10-Year. Crude Oil and Brent are lower with Natural Gas higher. Gold and Silver are higher with Copper lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and lower against the Yen. Bitcoin is at $91,624 from $89,844 yesterday morning higher by +$206 with Futures up +0.23% this morning.

Sector Action:

Daily Positive Sectors: Materials, Energy, Communication Services and Consumer Cyclicals of note.

Daily Negative Sectors: Healthcare of note.

One Month Winners: Communication Services, Financials, Consumer Cyclicals, Industrials and Technology and of note.

Three Month Winners: Consumer Cyclicals, Technology, Financials, Industrials and Communication Services of note.

Six Month Winners: Technology, Utilities, Real Estate, Financials, and Consumer Cyclical of note.

Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

Year to Date Winners: Technology, Communication Services, Financials and Utilities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before The Open:

Notable Earnings of Note This Morning:

Beats: GDS +1.05, KC +0.78, BERY +0.19, WB +0.09, LOW +0.07, ENR +0.05, VIK +0.05, WMT +0.05, AS +0.04, VVV +0.04, MDT +0.01 of note.

Misses: J -0.45, OCSL -0.11, VIPS -0.02 of note.

Advance/Decline Daily Update: The A/D Line hit a wall last Tuesday and rolled over having broken its monthly moving average.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

Gap Up: SYM +29.7%, SMCI +26.4%, FSUN +8.3%, KC +6.7%, WB +5.8%, FINV +5.5%, TCOM +4.7%, BERY +4.1%, VIR +3.7%, XPEV +3.7%, PLL +2.9%, ERII +2.7%, MARA +2.7%, ATAT +2.6%, BWLP +2.3%,

Gap Down: INCY -12.3%, FFIC -12.2%, HMST -7.1%, DJT -6%, J -3.8%, BTM -3.6%, PTGX -3.4%, LEU -3.3%, ACM -3.3%, OCSL -2.9%, SYRE -2.3%, AVAV -2.1%, IIIN -2%

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Stocks making the biggest move in pre-market Check back for today's listing. (CNBC)

Walmart (WMT) hikes outlook. (CNBC)

Lowes (LOW) beats but offers lower guidance. (CNBC)

Druckenmiller piles into regional bank stocks and health care bet. (CNBC)

Economic:

October Housing Starts are due out at 8:30 a.m. EDT and came in last month at 1.354,000 and are expected to drop to 1,340,000.

API Crude Oil Data is due out at 4:30 p.m. EDT.

Geopolitical:

Several Federal Reserve speakers today.

Federal Reserve Kansas City Fed President Jeffrey Schmid speaks at 1:10 p.m. EDT.

President Biden received the Daily Briefing at 8:00 a.m. EDT from Rio de Janeiro, Brazil.

President Biden is in Brazil for day two of the G-20 Summit.

President Biden holds a working lunch with President Lula da Silva of Brazil at 8:15 a.m. EDT.

The president returns to the White House at 10:45 p.m. EDT.

Watch our Twitter feed, Bullet86, for an impromptu appearances.

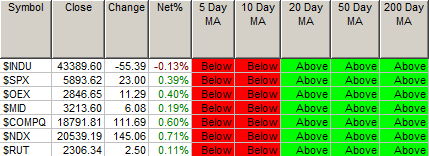

Moving Averages On Major Equity Indexes: Move from 57% to 60%.

Meeting & Conferences of Note:

Sellside Conferences:

Bernstein Industrials Forum

Craig-Hallum Alpha Select Conference

Jefferies London Healthcare Conference

Jefferies Miami Consumer Conference

J.P. Morgan Global TMT Conference

Needham Security Networking & Communications Conference

RBC's TIMT Conference

ROTH Technology Conference

Stifel Healthcare Conference

Seaport Digital Media & Advertising Conference

Stephens Investment Conference

TD Securities Energy Conference

Wolfe Healthcare Conference

Fireside Chat: None of note.

Top Analyst, Investor Meetings: CPB, CNTM, COSM, KSPI. TOMZ

Shareholder Meetings: AEIS, BL, CTVA, ENLT, GLRE, KAR, LMND, QCOM, TRP, VIR

Industry Meetings or Events:

AASLD Conference

American Heart Association Scientific

College of Rheumatology Convergence

Nareit's REITworld Annual Conference

New York Stock Exchange Investor Access

REITworld: Investor Conference

Top Tier Sell-side Upgrades & Downgrades:

Upgrades: PRDSY FIX BNS BNS AWK ACRS (2)

Downgrades: SABR ERJ