QPI Morning Note - 11/13/24: CPI Comes In At 0.2%, Stocks Bounce Back To Positive

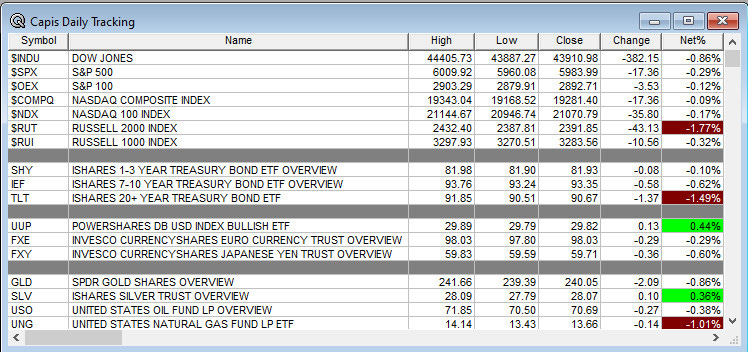

Overnight Summary: The S&P 500 closed Tuesday lower by -0.29% at 5983.99 from Monday higher by 0.10% at 6001.35. The overnight high was hit at 6017 at 4:10 p.m. EDT and the low was hit at 5993 at 1:35 a.m. EDT. The overnight range is 24 points. The current price is 5997.75 at 6:55 a.m. EDT lower by -15.25 points which is -0.25%.

Executive Summary: Key for today will be the latest CPI report due out at 8:30 a.m. EDT.

Articles of Note: “The Trump Economic Awakening” by Glenn Hubbard. (WSJ Opinion) Hubbard was the Chairman of the Council of Economic Advisors Under President George W. Bush.

Key Events of Note Today:

CPI out today along with Weekly Crude Oil Inventories. Comes in at 0.2%.

Notable Earnings Out After The Close

Beats: SU +0.67, SDRL +0.40, ICUI +0.34, NTRA +0.31, OXY +0.26, CART +0.20, MODG +0.19, CAE +0.10, ZI +0.06, CAVA +0.04, SWKS +0.03, RXT +0.03, CHGG +0.02, SOUN +0.01, FNA +0.01 of note.

Flat: None of note.

Misses: LNW -0.37, SPOT -0.24, MARA -0.08, CRNX -0.05, RKLB -0.01 of note.

Capital Raises:

IPOs For The Week: AGH, JUNS, LHAI, MSW, NAMI, PRB, ZSPC

New IPOs/SPACs launched/News:

IPOs Filed/Priced:

Secondaries Filed or Priced:

ETNB commences an underwritten public offering of $100 million of shares of its common stock

VVX announces proposed secondary offering of 2.5 mln shares of common stock

GDYN files for common stock offering

OS files for 15,000,000 shares of Class A common stock

Notes Priced:

MGY Pricing of Offering of $400 Million Senior Notes

XHR Upsizing and Pricing of Senior Notes Offering

Direct Offering:

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

EBS files for a 3,613,338 shares of common stock offering by selling shareholders

Mixed Shelf Offerings:

EXP files mixed shelf securities offering

LTC files mixed shelf securities offering

MIST files a $250 million mixed shelf securities offering

SGMO files $500 mixed shelf securities offering

SHOP files mixed shelf securities offering

CLYM files a $250 million mixed shelf securities offering.

PIPE: GRPN entered into privately-negotiated agreements with holders of 1.125% Convertible Senior Notes due 2026

Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: DAVE +32.4%, PAY +26%, CAVA +16.2%, NTRA +14%, DNA +11.2%, HNST +10.6%, AMBC +10.4%, RPAY +7.5%, PRDO +7.4%, ICUI +6.7%, SPOT +6.4%, MODG +6.1%, SDRL +6%, CAE +5.1%, RXT +4.9%, FNA +3.5%, BHVN +3.3%, DHT +2.9%, PUBM +2.6% of note.

Movers Down: SAVE -39.1%, SIBN -22.5%, GRPN -20.7%, CHGG -14.4%, ZI -12.8%, RUM -12.2%, RKT -10.9%, SGMO -9%, GDYN -8.5%, SOUN -7%, PGNY -6.9%, PLUS -6.3%, MARA -6%, CART -5.3%, IAS -5%, PRTA -5%, LNW -4.4%, SWKS -2.6% of note.

News After The Close:

Johnson & Johnson MedTech (JNJ) receives IDE approval for OTTAVA robotic surgical system which is competition for ISRG.

AllianceBernstein (AB) announces that preliminary assets under management decreased to $793 billion during October 2024 from $806 billion at the end of last month.

Amazon (AMZN) Exec Chair/Founder Jeff Bezos sold another 5,992,724 shares worth approx. $1.25 bln pursuant to a Rule 10b5-1 trading plan.

Rivian Automotive (RIVN) and Volkswagen Group (VWAGY) enter into an agreement to launch their Joint Venture with a total deal size of up to $5.8 billion, which is expected to start today.

Rocket Lab USA (RKLB) signs a multi-launch agreement with a confidential commercial satellite constellation operator for its new medium-lift rocket Neutron

GD awarded a ceiling $5.57 bln U.S. Air Force contract

Spirit Airlines (SAVE) moves towards bankruptcy after talks with Frontier Airlines (ULCC) broke down. (WSJ)

10-K Delays – ADM RGEN MOND LAZR

Barron’s: Is today’s CPI report a bump in the road? (Barron’s)

Buybacks or Repurchases:

GPI approves a new share repurchase authorization of $500 million

Exchange/Listing/Company Reorg and Personnel News:

HQY announces retirement of CEO Jon Kessler; Scott Cutler appointed successor, effective Jan 6, 2025

CAE announces that CEO Marc Parent will be leaving the company at next year’s Annual General Meeting in August.

JACK announces the return of Lance Tucker as CFO, effective January 13.

Dividends Announcements or News:

Stocks Ex Div Today: EQIX WELL PCAR URI KVUE WAB ED ETR WST CMS AER POOL HOMB SEM MSM ST PBF HTGC CAKE

Stocks Ex Div Tomorrow: XOM TJX COF FANG URI IR WEC TPG LPLA SBAC EXE CTRA FTAI FIX PR CCK LXQ VNOM ZION IVZ CGNX KBH

What’s Happening This Morning: Futures S&P 500 +14 NASDAQ +40 Dow Jones +85 Russell 2000 +4.75 (at 8:20 a.m. EDT). Asia is lower and Europe is lower. VIX Futures are at 15.95 from 15.85 yesterday while Bonds are at 4.42% from 4.365% on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold and Silver higher with Copper lower. The U.S. Dollar is lower versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $87,847 from $86,349 lower by -95 by -0.22% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Communication Services and Technology of note.

Daily Negative Sectors: Materials, Utilities, Real Estate and Healthcare of note.

One Month Winners: Communication Services, Financials, Consumer Cyclicals, Industrials and Technology and of note.

Three Month Winners: Consumer Cyclicals, Technology, Financials, Industrials and Communication Services of note.

Six Month Winners: Technology, Utilities, Real Estate, Financials, and Consumer Cyclical of note.

Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

Year to Date Winners: Technology, Communication Services, Financials and Utilities of note.

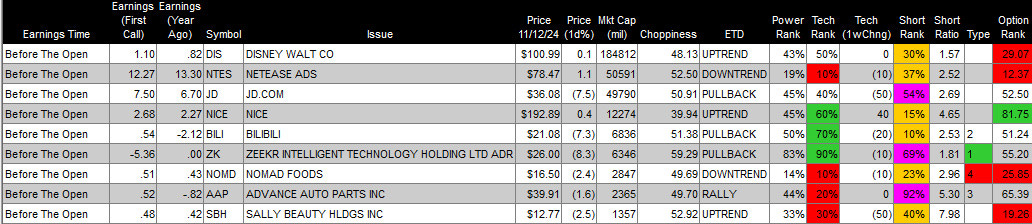

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Wednesday After the Close:

Thursday Before The Open:

Notable Earnings of Note This Morning:

Beats: CYBR +0.48, GFF +0.29, RSKD +0.10, HBM +0.09, MRSN +0.08, ENLT +0.05, SSYS +0.05, TSEM +0.03, ARCO +0.01 of note.

Flat: None of note.

Misses: PSFE -0.10, DOLE -0.01 of note.

Still to Report:

Company Earnings Guidance:

Positive Guidance: AHR ICUI NTRA FNA PAY PRDO RKLB SDRL CYBR ENLT RSKD TSEM of note.

Negative or Mixed Guidance: IAS PGNY SWKS MODG of note.

Advance/Decline Daily Update: The A/D Line hit a wall yesterday and rolled over.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

Gap Up: DAVE +48.1%, RKLB +30.2%, PAY +24%, HNRG +16.7%, HNST +16.7%, NTRA +14.7%, DSP +14.6%, CAVA +14.5%, MLR +13.3%, RIVN +12.1%, FNA +12%, DNA +12%, MRVI +11.2%, AMBC +7.7%, SPOT +7.5%, RPAY +7.5%, MESO +7.4%, CAE +7.4%, FIHL +6.7%, HUT +6.2%, NPCE +4.9%, SDRL +4.8%, PRDO +4.6%, ICUI +4.5%, IMUX +4.3%, PUBM +3.3%, IONQ +3.2%, SSYS +3.1%, DHT +3%, AMGN +2.8%, LAZR +2.7%, RXT +2.4%, SU +2.2%

GapDown: SAVE -64.6%, GRPN -20.5%, SIBN -17.5%, CHGG -15.8%, ZI -14.7%, RKT -13.7%, PGNY -13%, SGMO -11.1%, OABI -11.1%, CART -9.1%, RUM -8.6%, IAS -7.6%, GDYN -7.2%, MARA -7.2%, SWKS -6.4%, LIF -6.4%, PLUS -6.3%, SOUN -6%, VVX -5.5%, DOX -5.1%, SMCI -4.6%, OS -4.4%, DOLE -3.9%, LNW -3.7%, PRTA -3.5%, AB -2.6%, ETNB -2.2%

Insider Action: No names see Insider buying with dumb short selling. HPK HASI see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Pre-Market Movers: yet to post, check back. (CNBC)

5 Things To Know Before The Market Opens. (CNBC)

Bloomberg Lead Story: Trump Picks Musk and Ramaswamy for Government Efficiency Effort. (Bloomberg)

Markets Wrap: US Futures slip in front of CPI. (Bloomberg)

Weekly Mortgage Applications rose 0.5%.

Elon becomes the First Friend. (Bloomberg)

Klarna readies US IPO after a plunge. (Bloomberg)

Amgen (AMGN) falls over weight loss drug’s bone density data. (CNBC)

The Big Take: Elon Musk has a new project to run: Trump’s Government. (Podcast)

Wealthion: The Fed is wrong as economic and market risks loom. (Podcast)

Economic:

October CPI is due out at 8:30 a.m. EDT and is expected to remain at 0.2%.

Weekly API Crude Oil Inventories are due out at 4:30 p.m. EDT.

Geopolitical:

Several Federal Reserve speakers today.

Federal Reserve Dallas President Lorrie Logan speaks at 9:35 a.m. EDT.

Federal Reserve St, Louis President Alberto Musalem speaks at 12:30 p.m. EDT

Federal Reserve Knasas City President Jeffrey Schmid speaks at 1:30 p.m. EDT.

President Biden receives the Daily Briefing at 1:15 p.m. EDT

President Biden meets with the President Elect Trump at 11:00 a.m. EDT.

Press Briefing at 12:30 p.m. EDT by Press Secretary Karine Jean-Pierre.

Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

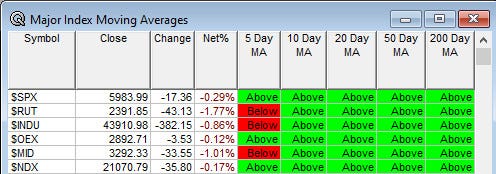

Moving Averages On Major Equity Indexes: Move from 100% to 90%. Other asset classes continue to struggle.

Meeting & Conferences of Note:

Sellside Conferences:

Baird Global Industrial Conference

Bank of America Global Energy Conference

Cantor Crypto Digital Assets & AI Conference

Citizens JMP Financial Services Conference

Evercore ISI Insurance Conference

Goldman Sachs Carbonomics Conference

Guggenheim Healthcare Innovation Conf

JMP Securities Financial Services Conference

JPM Global Luxury & Brands Conference

Piper East Coast Financial Services Conference

Scotiabank Transportation & Industrials Conference

Sidoti Micro-Cap Virtual Conference

UBS Global Healthcare Conference

Wolfe Wealth Symposium

Fireside Chat: None of note.

Top Analyst, Investor Meetings: BRNS, DAVA, LUCD, LYV, MA, OVID, SLF

Shareholder Meetings: CDXS, MNTS, PALT

Update: None of note.

R&D Day: None of note.

FDA Presentation: PTCT: Approval Decision on Upstaza

Company Event: None of note.

Industry Meetings or Events:

American Conference on Pharmacometrics

Dermatology Drug Development Summit

Milken Institute Future of Health

ORS PSRS 7th International Spine Research Symposium

SpiceWorld Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: ONON MMM EQR BASFY

Downgrades: SBUX ITW IP ESAB CAT