QPI Morning Note - 10/22/24: Stocks Lower As Earnings Season Ramps Up Activity

Overnight Summary: The S&P 500 closed Monday lower by -0.18% at 5853.98 from Friday higher by 0.40% at 5864.67. The overnight high was hit at 5901 at 4:35 p.m. EDT and the low was hit at 5863.75 at 5:45 a.m. EDT. The overnight range is 38 points. The current price is 5866 at 7:05 a.m. EDT lower by -30.25 points lower by -0.51%.

Executive Summary: Earnings are prolific this week.

Article of Note: “The S&P 500 is On Its Own Eras Tour” by Jessica Karl (Bloomberg)

Key Events of Note Today:

Richmond Fed Manufacturing Index out at 10:00 a.m. EDT.

Earnings Out After The Close

Beats: RLI +0.35, MEDP +0.24, BOKF +0.20, ZION +0.19, CADE +0.08, HSTM +0.06, KREF +0.03, WRB +0.01, RBB +0.01, HXL +0.01, ELS +0.01 of note.

Flat: None of note.

Misses: SIGI -0.23, SSD -0.17, SAP -0.09, WTFC -0.02, NUE -0.01, CATY -0.01 of note.

Capital Raises:

IPOs For The Week:

New IPOs/SPACs launched/News:

IPOs Filed/Priced:

Secondaries Filed or Priced:

ASPN announces public offering of 4,250,000 shares of common stock

CERO: FORM S-1 – Up to 713,563,749 Shares of Common Stock

GLMD: FORM F-1 – Up to 1,000,000 Ordinary Shares

MRX: Form F-1.. 7,000,000 Shares

NNE: FORM S-1 – 1,398,602 Units consisting of 1,398,602 Shares of Common Stock and 2024 B

Notes Priced:

Direct Offering:

Exchangeable Subordinate Voting Shares: None of note.

Selling Shareholders of note:

BOW files for 4,000,000 shares of common stock offering by selling shareholders

Debt/Credit Filing and Notes:

Mixed Shelf Offerings:

OMC files mixed-shelf securities offering

ASPN files mixed-shelf securities offering

NCRA files a $50 million mixed-shelf offering

XBIO files a $50 million mixed-shelf offering

PIPE:

Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

Movers Up: IRTC +17.2%, FLXS +11.4%, CAKE +5.3%, ZION +5.2%, SAP +4%, IIIN +3.6%, HSTM +3.3%, RVMD +2.5%, NRIX +2%, ARE +2% of note.

Movers Down: BOOM-21.2%, MEDP -10.7%, NNE -9.7%, ASPN -5% SSD -4.6%, HXL -2.9%, NUE -2.9%, BOW -2.4% of note.

News After The Close:

TVGN reports top-line revenue forecast of nearly $1 bln in launch year and cumulative 5-year estimate between $18 bln and $22 bln.

SAP raises FY24 cloud and software revenue outlook in conference call.

NKE announces 12-year partnership extension with NBA, WNBA, and NBA G League on uniforms and apparel.

BOOM provides strategic review update; lowers Q3 sales outlook; chairman David Aldous steps down

CNA announces Q3 catastrophe losses and and Q4 Hurricane Milton losses, expects to report Q3 pretax net catastrophe losses of $143 mln.

IP to reduce its workforce by approximately 650 employees

CAKE jumping by +3% after activist urges the company to consider a spin-off of its smaller brands into a separate public company. (WSJ)

BA awarded $277 mln U.S. Air Force contract

Barron’s + Nu Holdings (NU) as both Berkshire Hathaway and Ark Investment Management own it. (Barron’s)

Buybacks or Repurchases:

Exchange/Listing/Company Reorg and Personnel News:

REXR appoints Michael Fitzmaurice as CFO and promotes Laura Clark, current CFO, to the role of COO; effective November 18

LPLA names Rich Steinmeier as CEO; was interim CEO since October 1; names Matt Audette as President and CFO, expanding previous role as CFO; both appointments effective immediately

Dividends Announcements or News:

Stocks Ex Div Today: DELL NOK APA CRS APOG GOOD GLAD

Stocks Ex Div Tomorrow: LOW CLX AM DNUT AGX LTC

What’s Happening This Morning: Futures S&P 500 -20 NASDAQ -115 +108 Dow Jones -94 Russell 2000 -3.85 (at 8:20 a.m. EDT). Asia is lower ex Australia while Europe is lower .VIX Futures are at 18.10 from 18.20 Friday while Bonds are at 41.134% from 4.108% on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher as well. Gold, Silver and Copper higher. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $68,222 from $67,751 lower by -280 at -0.41% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

Daily Positive Sectors: Technology of note.

Daily Negative Sectors: Real Estate, Healthcare, Financials and Consumer Defensive of note.

One Month Winners: Utilities, Technology, Materials, Financials and Industrials of note.

Three Month Winners: Utilities, Real Estate, Financials, Materials, Industrials and Consumer Defensive of note.

Six Month Winners: Technology, Utilities, Real Estate, Financials and Consumer Cyclical of note.

Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

Year to Date Winners: Technology, Utilities, Financials, Industrials and Communication Services of note.

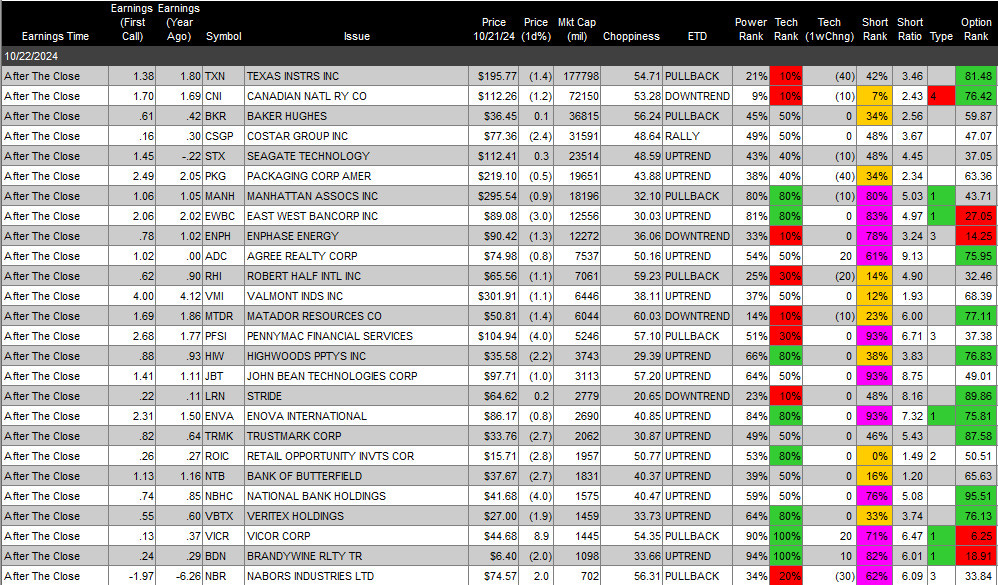

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Tuesday After the Close:

Wednesday Before The Open:

Earnings of Note This Morning:

Beats: GM +0.58, LMT +0.34, MCO +0.34, PHM +0.23, MLI +0.16, DHR +0.14, KMB +0.13, RTX +0.11, PM +0.09, MMM +0.08, BKU +0.07, PEBO +0.07, FI +0.04, DGX +0.04, GE +0.02, PNR +0.02, IVZ +0.01, VZ +0.01 of note.

Flat: None of note.

Misses: GPC -0.54, SHW -0.18, PII -0.15, BANC -0.15, HRI -0.13, DENN -0.01 of note.

Still to Report:

Company Earnings Guidance:

Positive Guidance: GM LMT MCO PM of note.

Negative or Mixed Guidance: FI GPC PII PNR DGX RTX SHW HSTM MEDP of note.

Advance/Decline Daily Update: The A/D Line fell yesterday.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

Gap Up: IRTC +18.6%, FLXS +9.2%, MOLN +8.1%, RYAM +5.7%, FUFU +5.4%, CAKE +4.8%, SAP +3%, DHR +2.9%, RLI +2.8%, ANNX +2.5%, NRIX +2%

Gap Down: BOOM -17.4%, MEDP -11.4%, LOGI -8.2%, PII -7.2%, NNE -6.5%, BOW -4.8%, SSL -4.8%, MRX -4.6%, IIIN -4.5%, SSD -4.5%, ASPN -3.4%, NUE -3.3%, HXL -2%

Insider Action: None of note that see Insider buying with dumb short selling. None of note that see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

Pre-Market Movers: CAKE SHW. (CNBC)

5 Things To Know Before The Market Opens on Tuesday. (CNBC)

Bloomberg Lead Story: Bonds slump globally as Traders rethink Fed’s Rate Path. (Bloomberg)

Markets Wrap: US Futures slide with Rate Path at risk. (Bloomberg)

The Washington Post reported Trump would keep Federal Reserve Chairman Powell but demote Vice Chair of Supervision Michael Barr.

Federal Reserve San Francisco President Mary Daly spoke last night at 6:00 p.m. EDT and expects the Fed to continue cutting rates. (Bloomberg)

GM raises guidance after an easy beat. (CNBC)

Bloomberg: Big Take – The Climate Short is here. (Podcast)

Economic:

Weekly API Crude Oil Inventories are due out at 4:30 p.m. EDT.

Richmond Fed Manufacturing Index due out at 10:00 a.m. EDT.

Geopolitical:

Federal Reserve Philadelphia President Patrick Harker speaks at 10:00 a.m. EDT.

Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

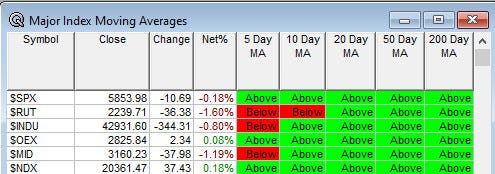

Moving Averages On Major Equity Indexes: Moves from 100% positive to 87%.

Meeting & Conferences of Note:

Sellside Conferences:

Jefferies Private Technology Conference

Leerink Partners Biopharma Private Company Connect

Fireside Chat: None of note.

Top Shareholder Meetings: AIT, BCLI, COEP, NA, NRSN, SGMA, SKYE

Top Analyst, Investor Meetings: LTM, MKC, SCPH, SKE

Update: None of note.

R&D Day: None of note.

FDA Presentation:

Company Event: None of note.

Industry Meetings or Events:

American Society of Reproductive Medicine’s (ASRM) 2024 Scientific Congress and Expo

Federal Reserve Bank of Philadelphia Fintech Conference

Gartner IT Symposium/Xpo 2024

ICS Cybersecurity Conference

NBAA Business Aviation Convention & Exhibition

Parenteral Drug Association Universe of Pre-Filled Syringes and Injection Conference

Peptide Therapeutics Symposium

QCOM Snapdragon Summit

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from QPI or its employees.

Upgrades: IAG AMCX PCTY FSLR FLR AEG

Downgrades: CSIQ